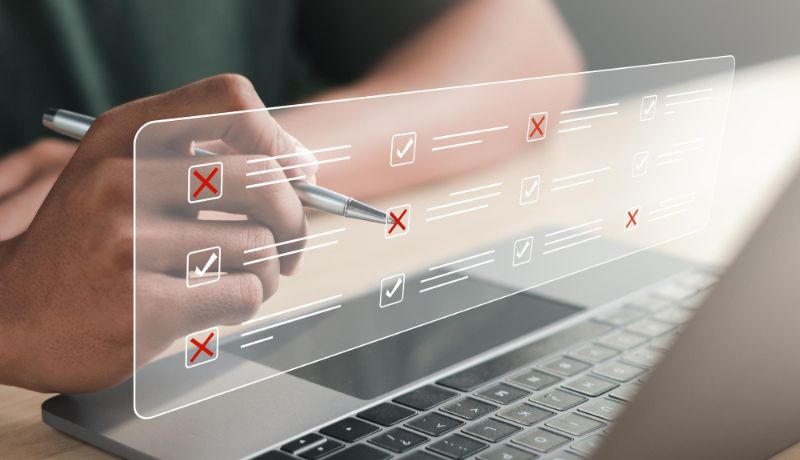

Compliance Services

Ensure accurate tax filings periodically with InCorp's tech based services

Enquiry Form

Clients

Filings

Experience

Tax Experts

Clients

Filings

Experience

Tax Experts

Serving 300+ businesses with their Direct Tax Compliance needs

Our Team provides businesses with reliable solutions to manage their Direct Tax Compliance efficiently and effectively. Incorp’s team of 15+ seasoned tax experts and 50+ consultants specialize in income tax. Our team has successfully completed 1000+ compliance filings for various individual and corporate clients annually. Our client retention is 90%. We proactively assist clients with the latest circualrs and amendments issued by the government.

Service Areas Within Compliance

Advisory on Withholding Tax Obligations

InCorp provides advisory on withholding tax obligations on payments. Our team assists in compliance with all applicable regulations.

TDS and Tax Clearance Certificates

We assist with representation before the income tax and withholding tax authorities for obtaining lower TDS certificates, tax clearance certificates.

Declarations filing

InCorp provides assistance in filing declarations for foreign participation in Indian entities and ensures that your business complies with all applicable FEMA regulations.

Assessment of Foreign Assets and Income

InCorp supports in assessing foreign assets, income and making relevant adequate disclosures to authorities.

InCorp Insights

Income Escaping Assessment / Re-assessments Under the Income-tax Act, 1961

Section 148 of the Income-tax Act, 1961 gives authority and power to the Assessing Officer to…

How Section 194T Impacts Partner Payments

Payments made by a partnership firm or LLP to its partners were not subject to TDS.…

Buyback Tax Reforms: Implications for Companies and Shareholders

A buyback of shares is a financial plan where a company repurchases its own shares from…

Finance Act 2024: Key Changes in Reopening Tax Cases

Building trust and faith in the taxation system is crucial, and a significant step to achieve…

Importance of Tools and Technologies in Audit

As businesses have evolved over the past few decades, audit and auditing techniques have also come…

Designing Stock Appreciation Rights in India: A Strategic Guide

In today’s fiercely competitive business landscape, where building a successful company is just the beginning, the…

New Re-Registration Deadline for Charitable Organizations

Income Tax offers tax relief to charitable organizations registered under the Income Tax Act. This is…

Share Reduction and Its Impact on Capital Loss Claims

The Mumbai Tribunal in the case of Tata Sons Limited (TSL) held that reduction of share…

Slump Sale: A Guide to Business Transfer and Taxation

Slump sale is an effective and maybe the quickest strategy to undertake business transfer with assets…

Tax Rule 11UACA Updates on Taxable Income

The Central Board of Direct Taxes (CBDT) vide notification no 61/2023/F. No. 370142/28/2023-TPL dated August 16,…

clientele

Expert Team

Samir Sanghvi

Co-Founder

Margav Shukla

Lead

Direct to Your Inbox!

Stay updated with our curated newsletter content designed for you