- Home

- »

- Reporting & Assurance

- »

- ESG Due Diligence

ESG Due Diligence

InCorp supports you in assessing your investment stability

Enquiry Form

ESG

Professionals

Due Diligence Reports

Workshops Conducted

Sectors

Covered

Due Diligence Reports

ESG Professionals

Workshops Conducted

Sectors Covered

InCorp's team of 30+ ESG professionals ensure compliance, enabling clients to make informed decisions on environmental impacts in potential investments

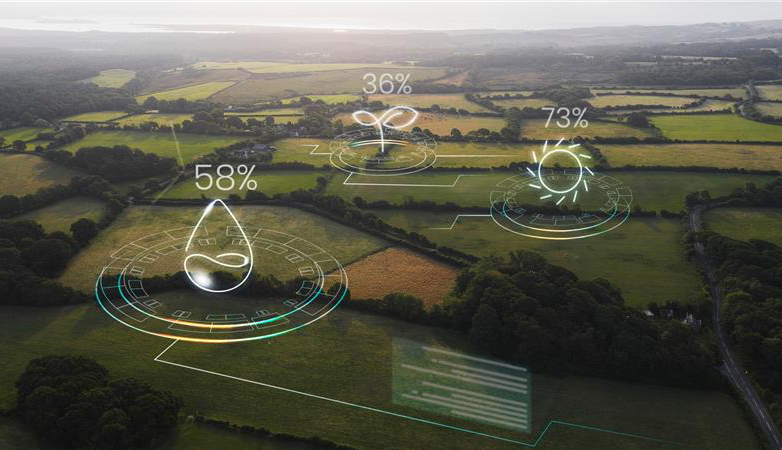

ESG issues now constitute a crucial part of the investment decision-making process and portfolio management. InCorp supports the rising trend of impact investing, aiding impact funds and their companies in fair and transparent reporting. We conduct workshops in invested companies to raise awareness of ESG, impact calculation and data requirements. We have delivered xx ESG due diligence reports, delivering insights into company’s ESG policies, performance and track record. We have extensive experience in offering detailed due diligence across 20+ sectors including Automotive, Infrastructure, Insurance and IT services amongst others.

Service Areas Within ESG Due Diligence

Impact Assessment

We assist you in considering the impact of a target company’s ESG strategy, approach and performance on investor’s current ESG performance and goals.

Site Vists

Conducting site visits to identify non-compliances with respect to environment, health and safety issues.

Readiness Assessment

Assessing performance and readiness against specific ESG regulatory compliance, such as the mandatory sustainability disclosure requirements introduced by the CSRD.

InCorp Insights

How to Choose Right ESG Reporting Framework for Business

UNGC defines corporate sustainability as “Corporate sustainability is a company’s delivery of long-term value in financial,…

The Ultimate Guide to EcoVadis Certification

Sustainability performance has become an essential component of a company’s business value. Businesses of all sizes…

The Rise of BRSR Reporting in India: Key Challenges, Implications and Strategies for Businesses

ESG reporting originated in India as a part of CSR guidelines introduced into India in 2009…

BRSR Reporting and Its Influence on Investor Decisions in India

A whole new Environment, Sustainability & Governance (ESG) verticals have been created by businesses across the…

Benefits of Hiring an ESG Consultant in India for ESG Reporting Needs

For decades, more profit margins have been generated by businesses for their stakeholders without a care…

ISSA 5000 – A New Era in Sustainability Assurance Standards

The IAASB approved the exposure draft of the International Standard on Sustainability Assurance, or ISSA 5000,…

Integrating BRSR with Financial Reporting and Disclosures

The growing need for companies to be accountable and transparent has an implicit influence on the…

ESG Risks: Role of Management and Advisory in Mitigation

Environment, Social and Governance (ESG) factors are linked to 7 out of the top 10 global…

EU CSRD – What Should Businesses Know About the Framework?

Many countries across the world have made it mandatory to have ESG compliance as per the…

Complete Overview of the Carbon Border Adjustment Mechanism

Regulatory frameworks have evolved over the years to be incorporative of environmental and sustainability practices. Among…

clientele

Expert Team

Dhaval Shah

Chief Growth Officer

Prakhar Gupta

Lead

Direct to Your Inbox!

Stay updated with our curated newsletter content designed for you