- Home

- »

- ESG Advisory

- »

- Sustainability & ESG Ratings

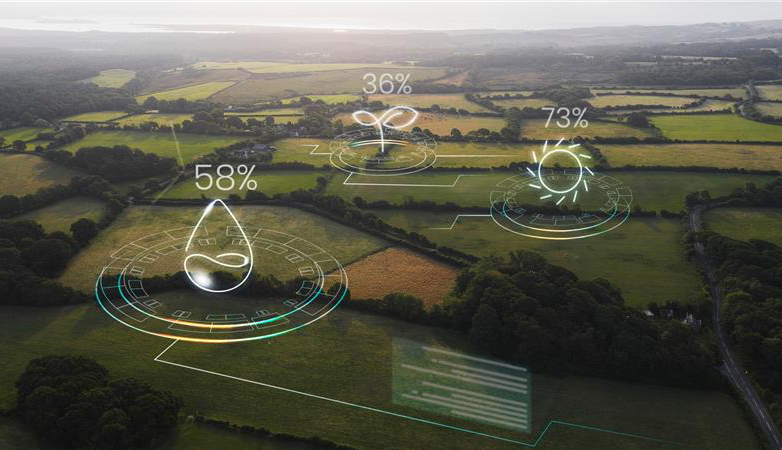

Enhance Business Value with ESG Ratings

InCorp offers specialized ESG ratings advisory services for leading agencies such as EcoVadis, CDP, GRESB, MSCI, and DJSI, assisting clients in enhancing their ESG scores.

Enquiry Form

Professionals

Rating Conversions

Strategic Advisory

Verification

Professionals

Rating Conversions

Strategic Advisory

Verification

Providing end-to-end ESG rating consultancy, with more than 40 gap analyses, 30 verifications, and 30 reporting projects completed with assured ESG rating enhancement

InCorp brings extensive expertise in working with rating agencies such as EcoVadis, CDP, GRESB, MSCI, DJSI, and others, offering clients valuable insights and support to improve their ESG scores. Our skilled team provides strategic guidance to develop actionable plans, address ESG risks, and build long-term resilience, empowering companies to lead in sustainable practices. With a sucess fee based commercial we ensure our clients, a rating improvement and support them with policy formulation, supplier engagement programs, governance advisory, trainings, and assiting the application process ESG rating , ensuring a robust and sustainable operational foundation.

Service Areas Within Sustainability & ESG Ratings

EcoVadis Ratings Consultancy

We assist businesses in enhancing EcoVadis ratings with tailored consultancy, including gap analyses, document verification and updation, training, risk assessment and alignment with standards.

CDP Disclosure and Ratings Support

Our experts offer CDP ratings consultancy to enhance environmental disclosure and improve scores, including gap analysis, CDP questionnaire preparation, GHG tracking , and setting science-based targets.

GRESB Advisory

Working with tech partners, we provide a seemless GRESB ratings support, enabling combination of consulting and automation for real asset organizations to excel in ESG assessments.

MSCI Performance Advisory

Offering MSCI consultancy to achieve higher ratings. Our team provides comprehensive guidance, aligning ESG strategies with MSCI methodology and global benchmarks.

DJSI Strategic ESG Advisory

Our team provides expert guidance to organizations in submitting the Corporate Sustainability Assessment (CSA) questionnaire for the Dow Jones Sustainability Index (DJSI).

Other Rating services

We also provide ESG rating and advisory services for a wide range of frameworks such as Sustainalytics, ISS ESG, Bloomberg ESG, FTSE Russell & much more.

InCorp Insights

How to Choose Right ESG Reporting Framework for Business

UNGC defines corporate sustainability as “Corporate sustainability is a company’s delivery of long-term value in financial,…

The Ultimate Guide to EcoVadis Certification

Sustainability performance has become an essential component of a company’s business value. Businesses of all sizes…

The Rise of BRSR Reporting in India: Key Challenges, Implications and Strategies for Businesses

ESG reporting originated in India as a part of CSR guidelines introduced into India in 2009…

BRSR Reporting and Its Influence on Investor Decisions in India

A whole new Environment, Sustainability & Governance (ESG) verticals have been created by businesses across the…

Benefits of Hiring an ESG Consultant in India for ESG Reporting Needs

For decades, more profit margins have been generated by businesses for their stakeholders without a care…

ISSA 5000 – A New Era in Sustainability Assurance Standards

The IAASB approved the exposure draft of the International Standard on Sustainability Assurance, or ISSA 5000,…

Integrating BRSR with Financial Reporting and Disclosures

The growing need for companies to be accountable and transparent has an implicit influence on the…

ESG Risks: Role of Management and Advisory in Mitigation

Environment, Social and Governance (ESG) factors are linked to 7 out of the top 10 global…

EU CSRD – What Should Businesses Know About the Framework?

Many countries across the world have made it mandatory to have ESG compliance as per the…

Complete Overview of the Carbon Border Adjustment Mechanism

Regulatory frameworks have evolved over the years to be incorporative of environmental and sustainability practices. Among…

FAQs

Sustainability and ESG Ratings assess a company’s performance in managing Environmental, Social, and Governance (ESG) factors and its long-term impact on sustainable development. These ratings evaluate how well a company addresses risks and opportunities related to climate change, labor practices, diversity, and governance, focusing on financial relevance and stakeholder impact.

CDP (formerly Carbon Disclosure Project) is a global disclosure system that enables organizations to measure, manage, and disclose their environmental impact, particularly related to climate change, water security, and forests. It is essential because it provides transparency, helps mitigate environmental risks, and improves investor and stakeholder trust.

EcoVadis evaluates companies on four themes: Environment, Labor & Human Rights, Ethics, and Sustainable Procurement. Scores are based on policies, practices, and performance. A good rating enhances credibility, strengthens supply chain relationships, and aligns with global sustainability benchmarks.

DJSI is a globally recognized benchmark for sustainability, assessing companies on economic, environmental, and social dimensions. It helps investors identify sustainable companies and provides businesses with a tool to improve their ESG performance.

MSCI ESG ratings measure a company’s exposure to ESG risks and its ability to manage them effectively. Investors use these ratings to integrate ESG considerations into their decision-making processes and portfolio management.

GRESB assesses the ESG performance of real estate and infrastructure assets. Investors and managers use GRESB scores to understand ESG risks and opportunities within their portfolios, promoting transparency and sustainability in the sector.

Yes, EcoVadis and CDP allows companies to engage suppliers for sustainability assessments to ensure alignment across the supply chain.

Yes, both EcoVadis and CDP are globally recognized and respected frameworks that enhance your reputation and credibility in international markets.

1. Develop robust ESG policies and action plans.

2. Set measurable targets for emissions, diversity, and governance.

3. Enhance transparency through detailed reporting.

4. Align with global frameworks like UNGC, GRI, or TCFD.

Third-party ratings enhance credibility, provide a benchmark against peers, and ensure alignment with investor expectations. They also highlight areas for improvement and help in attracting ESG-focused investments.

clientele

Expert Team

Dhaval Shah

Chief Growth Officer

Prakhar Gupta

Lead

Direct to Your Inbox!

Stay updated with our curated newsletter content designed for you