BRSR 2.0: What Changed for 2024 Compared to 2023

BRSR 2.0: What Changed for 2024 Compared to 2023

Understanding BRSR 2.0 and the Latest Developments: What has Changed from 2023 to 2024?

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

SEBI is proactively spearheading the refinement of ESG reporting standards in India and has already mandated the top 1000 listed companies to submit BRSR reports as a part of their listing disclosure requirements. Previously, there were two formats of BRSR, ‘BRSR Lite’ and ‘BRSR Comprehensive’ and now BRSR 2024 requirements have been changed. SEBI brought about a significant change in the reporting landscape by amending the SEBI Listing Obligations and Disclosure Requirements (LODR) Regulations, 2015. This amendment, communicated through a notification on June 14, 2023, brings forth the ‘BRSR Core’ framework for companies and their associated value chain.

On July 12, 2023, SEBI released the ‘BRSR Core’ framework and concurrently the assurance and disclosure requirements for BRSR Core, along with ESG disclosures for the value chain and its corresponding assurance requirements. The framework for ‘BRSR Core’ can be accessed here

Read on to know more about the BRSR 2024 requirements and the latest developments from the previous year.

Decoding Key Performance Indicators (KPIs) in BRSR Core

The BRSR Core framework includes pertinent KPIs across 9 ESG attributes. These KPIs are tailored to the unique context of Indian/Emerging markets and facilitates improved global comparability with international reporting standards. Considering that emerging markets like India pose a unique array of environmental and social challenges, the introduction of new metrics becomes imperative to depict an exhaustive portrayal of the company and its sustainability standing.

The table presented below showcases the linkage between BRSR Core Key Performance Indicators (KPIs) and the corresponding ESG attributes.

| Attributes | KPIs Introduced |

|---|---|

| Fairness in Engaging with Customers and Suppliers | Number of days of accounts payables |

| Open–ness of Business | Concentration of purchases and sales with trading houses, dealers, and related parties along-with loans and advances & investments, with related parties |

| Enhancing Employee Wellbeing and Safety | Spending on measures towards well-being of employees and workers (including permanent and other than permanent) |

| Enabling Gender Diversity in Business | Gross wages paid to females as % of total wages paid by the company for the current and previous financial year |

| Complaints filed under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 | |

| Water Footprint | Water intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and water intensity in terms of physical output |

| Greenhouse Gas Footprint and Water Footprint | With respect to the disclosure of greenhouse gas emissions (Scope 1 and Scope 2 emissions) & its intensity, the listed company is also required to disclose the total Scope 1 and Scope 2 emission intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and in terms of physical output |

| Embracing Circularity – details related to waste management | Waste intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and waste intensity in terms of physical output |

| Enabling Inclusive Development

|

Percentage of input material (inputs to total inputs by value) sourced from suppliers – directly from within India (the change is made from input materials sourced from within the district and neighbouring districts) |

| Job creation in smaller towns – Disclosure of wages paid to people employed (including employees or workers employed on a permanent or non-permanent/on contract basis) in the rural, semi-urban, urban and metropolitan locations, as % of total wage cost for current and previous financial year |

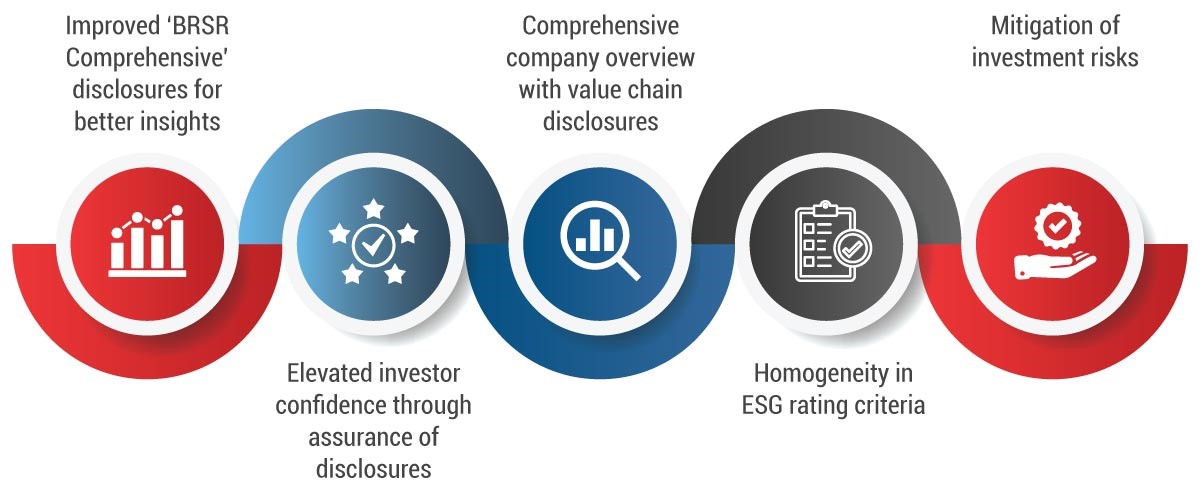

Overall, the BRSR Core is aimed to present a holistic and transparent status quo of the companies for investors.

The Enabling Impact of ‘BRSR Core’

Changes in Comprehensive BRSR Framework

With the introduction of ‘BRSR Core’, in Section A, it is mandatory for the listed company to furnish details about the assurance provider’s name and explicitly state the type of assurance obtained.

In Section C, the ‘Essential indicators’ have undergone updates to incorporate new KPIs from the BRSR Core framework while certain KPIs have been transposed from Leadership to Essential Indicators. The transition of parameters from ‘leadership’ to ‘essential’ is described below.

| BRSR Principles | Indicators that Transitioned from ‘Leadership’ to ‘Essential’ |

|---|---|

| Principle 6 Businesses should respect and make efforts to protect and restore the environment |

Details of total energy consumed (in joules or multiples) from renewable and non-renewable sources, Energy intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and energy intensity in terms of physical output |

| Details related to water discharge for the current and previous financial year | |

| Principle 9 Businesses should engage with and provide value to their consumers in a responsible manner |

Information related to data breaches |

The top 1000 listed companies are now required to publish BRSR reports in the updated format. The updated BRSR format with the newly incorporated KPIs of the BRSR Core can be accessed here.

BRSR Core Assurance Requirements

Typically, the data disclosed in BRSR is the company’s self-disclosed data. The assurance requirements are intended to enhance the reliability of this data. Companies will now be required to undertake reasonable assurance on the most critical disclosures under ‘BRSR Core’ and not the entire BRSR disclosures. SEBI has released the guidance for assurance provider. The assurance provider should possess the necessary expertise and the listed company must verify that there is no conflict of interest with the assurance provider selected to assure BRSR Core disclosures.

The responsibility for ensuring that the assurance provider of the ‘BRSR Core’ possesses the necessary expertise to conduct reasonable assurance lies with the Board of the listed company. The listed companies are obligated to ensure the absence of any conflict of interest with the selected assurance provider tasked with evaluating the BRSR Core. Specifically, the company must verify that the assurance provider and its associates refrain from involvement in the sale of their products or the provision of non-audit/non-assurance services, including consulting services, to the listed company or its group companies. This precautionary measure is crucial in maintaining independence and impartiality throughout the assurance process, thereby bolstering the credibility and reliability of the assessment.

BRSR Core: Timelines for Disclosure and Assurance

The reporting of BRSR Core KPIs is mandatory for the top 1000 companies from 2023-24. Also, a defined glide path has been outlined for undertaking reasonable assurance for the BRSR Core.

| Financial Year | Reporting of BRSR Core KPIs | Applicability of BRSR Core Reasonable Assurance) |

|---|---|---|

| 2023-24 | Top 1000 | Top 150 listed companies |

| 2024-25 | Top 1000 | Top 250 listed companies |

| 2025-26 | Top 1000 | Top 500 listed companies |

| 2026-27 | Top 1000 | Top 1000 listed companies |

Inclusion of Value Chain Disclosures for Comprehensive Insights

The disclosure of a company’s value chain metrics is imperative for conducting a comprehensive sustainability analysis. For certain companies, notable greenhouse gas (GHG) emissions may be inherent in the supply chain, making it crucial for them to report such emissions.

With the introduction of ‘BRSR Core,’ value chain disclosures, previously categorized under ‘leadership indicators,’ will now be comprehensively covered and reported. Recognizing the challenges associated with obtaining relevant data for companies in the initial year, the disclosure will be implemented on a “comply or explain basis” and will be gradually rolled out in phases.

The top 250 listed companies must meticulously report parameters aligned with the BRSR Core for their value chain, to the extent that it is attributable to their business with value chain partners. These disclosures are to be seamlessly integrated into the listed company’s annual report.

According to the SEBI’s circular, the value chain should encompass the principal upstream and downstream partners of a listed company, cumulatively representing 75% of its purchases/sales (by value) respectively. This reporting may be presented in a segmented manner, distinguishing between upstream and downstream partners, or reported holistically on an aggregate basis. The scope of reporting and any assumptions or estimates, if any, should be clearly disclosed.

The details of ESG disclosures and assurance for the value chain is described below:

| Financial Year | Reporting of BRSR Core KPIs | Applicability of Limited Assurance for Value Chain Disclosures |

|---|---|---|

| 2024-25 | Top 250 | – |

| 2025-26 | Top 250 | Top 250 |

For a comprehensive understanding of the measurement, data, and assurance approach, please refer to Annexure-I of the SEBI Circular by visiting the link.

Homogeneity in ESG Rating Criteria

In response to challenges like greenwashing and the absence of standardized criteria for ESG ratings, SEBI has introduced a set of regulations. These measures aim to address the dynamic nature of these issues and elevate the credibility and transparency of financial markets.

SEBI has introduced a regulatory framework to oversee ESG rating providers through a master circular dated July 12, 2023. ESG rating providers are now mandated to seek registration with SEBI to continue offering ESG rating services. Furthermore, foreign ESG rating providers must adhere to the same procedure if they intend to provide ESG rating services.

The introduction of ‘BRSR Core’ marks a significant stride in standardizing ESG rating criteria to ensure equity. Previously, companies that excelled in specific aspects could still secure favourable ESG ratings, potentially obscuring a comprehensive understanding for investors.

To enable better comparability, the ERPs will now be required to furnish ‘Core ESG ratings’ based on assured BRSR Core parameters, while additional commentary or outlook on unverified or unassured data may be included. This will enable investors to effectively compare and benchmark the performance of companies.

Mitigation of Investment Risks

Presently, investors exhibit a pronounced interest in aligning their investments with sustainable practices and initiatives. Responding to investor concerns, SEBI has mandated the clear disclosure of the name of the ESG strategy, names of ERPs, along with the corresponding ESG scores.

SEBI has also mandated ESG schemes to invest at least 65% of its AUM in companies that are reporting the BRSR comprehensive version and providing assurance on BRSR Core disclosures. The same shall come into effect on Oct 01, 2024.

In summary, the developments in BRSR 2024 are poised to mitigate investment risks through informed decision-making.

Our Opinion

As BRSR reports mainly consist of self-disclosed data from companies, third-party assurance of ‘BRSR Core’ parameters will enhance the reliability of these disclosures and informed decision-making for investors. ERPs will now be required to develop a new rating criteria to provide a Core ESG rating, which shall be based on assured BRSR Core parameters. While BRSR covers a broad spectrum of disclosures, the assurance is specifically targeted at critical disclosures as ‘BRSR Core’, limiting the compliance costs for companies. The inclusion of value chain disclosures, which were previously categorized under leadership indicators, improves accuracy.

Amid evolving compliance requirements and BRSR latest developments, it is imperative for companies to implement effective data collection systems. Recording data that was not previously tracked is essential to prevent inaccuracies in reported data and mitigate last-minute challenges. To facilitate a seamless assurance process for BRSR Core KPIs, companies must institute policies, protocols, internal checks, and a governance framework akin to those implemented for the collection and disclosure of financial information.

Why Should You Choose Us?

Our team has in-depth experience and knowledge of the latest developments in BRSR reporting, required for handling projects of companies across various sectors and stages. We offer comprehensive guidance, helping companies understand and navigate the complexities of BRSR 2.0 with confidence. Our services ensure not only compliance but also the creation of long-term value through responsible and transparent business practices. Connect with us today to elevate your BRSR reporting process with our team of BRSR experts.

FAQs

BRSR 2024 requires more detailed reporting on environmental impacts, supply chain transparency, and board diversity, with stronger emphasis on governance and climate-related disclosures.

Businesses will need to update their data collection systems and processes to meet stricter reporting standards, requiring additional resources and improved ESG data management.

Improvements include expanded disclosures on climate risks, supply chain practices, and human rights, as well as greater emphasis on alignment with global sustainability frameworks.

Companies should conduct a gap analysis, enhance data collection capabilities, and ensure their teams are trained on the new reporting requirements for BRSR 2.0.

BRSR 2.0 requires additional disclosures on carbon footprint, net-zero targets, board diversity, and alignment with the UN Sustainable Development Goals (SDGs).

Share

Share