Inside GIFT City: Exploring the Insurance Office Landscape

Inside GIFT City: Exploring the Insurance Office Landscape

Discovering growth potential and regulatory advantages in GIFT City's insurance sector offices: A complete overview of legal structure and permissible activities

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

International Financial Service Centres (IFSC) was established to act as the global hub for financial activities. The regulation for operating insurance and re-insurance businesses was introduced in 2021, and this regulation facilitated insurance and reinsurance businesses to operate through IFSC, and the International Financial Services Centres Authority (IFSCA) was created as the regulator.

IFSC Insurance office regulations allow entities to conduct insurance and re-insurance business after registering with IFSCA. These offices provide a robust platform for underwriting, risk management, and compliance support, benefiting from a regulatory environment that promotes international business. IIOs leverage advanced technologies and innovations in fintech and insurtech, offering solutions to streamline operations and improve customer experiences. IIOs in GIFT IFSC can cater to a wider range of clients, including international businesses, high net-worth individuals and family offices.

Permitted Activities by an IIOs setup in GIFT IFSC

A registered IIO may carry any of the following nature of businesses:

- Life Insurance Business

- General Insurance Business

- Health Insurance Business

- Re-insurance Business

However, an IIO set up in an unincorporated form shall be permitted to transact such class of business which is permitted to the applicant by its home country regulatory or supervisory authority.

Eligibility to Apply for Registration as an IIO

The following can apply for registration as an IIO in GIFT IFSC:

- An insurer registered with IRDAI

- A foreign insurer or foreign re-insurer

- A branch office of foreign insurer or Lloyd’s India registered by the IRDAI

- A public company or a wholly owned subsidiary of an insurer or reinsurer formed under the Companies Act, 2013

- An insurance cooperative society (registered under the Co-operative Societies Act, 1912 or any other law for the time being in force)

- A body corporate incorporated under the laws of any country outside India, not being a private company

- A Managing General Agent (MGA) with a valid binding agreement with a foreign insurer or reinsurer

- A society of Lloyd’s on behalf of the members of Lloyd’s

Modes of Setting up in GIFT IFSC

There are two modes of establishment of IIOs:

- In an incorporated form

- In an un-incorporated form (i.e. place of business or branch form)

Capital Requirements for Setting up an IIOs

IIOs setting up through incorporated form or un-incorporated form shall maintain the following capital requirements:

| Category of IIOs | Minimum Capital Requirement |

|---|---|

| IIO setting up in an incorporated form | |

| For carrying on the business of life or general insurance | INR 100 crore |

| For carrying on exclusively the business of health insurance | INR 100 crore |

| For carrying on the business of re-insurance | INR 200 crore |

| Managing General Agent (MGA) or a service company incorporating in IFSC | INR 5 lacs |

| IIO setting up in an unincorporated form* | USD 1.5 million |

*For IIOs setting up in an unincorporated form minimum assigned capital in any freely convertible foreign currency equivalent to USD 1.5 million provided that such

assigned capital shall be:

- Earmarked and held by the applicant in the home country, country of its incorporation or domicile.

- Invested as per the requirements of its home country regulatory or supervisory authority.

- Always maintained by the applicant during the subsistence and validity of registration of IIO.

Scope of Business of IIOs

An IIO registered to transact direct insurance business within the IFSC from the following:

- Other SEZs

- Outside India

- DTA subject to Section 2CB of the Insurance Act

An IIO registered to transact re-insurance business may be permitted to do so from the following:

- Cedents based in the IFSC

- In relation to risk emanating from other SEZs

- Outside India

- Insurers operating in DTA subject to the IRDAI (Re-insurance) Regulations, 2018

Change in Shareholding of IIOs Setup in GIFT IFSC

A public company registered as an IIO must obtain prior approval from the authority for any change in its shareholding that exceeds five percent of its paid-up equity share capital. This applies whether the change involves transferring existing shares or issuing new shares to either new or existing shareholders.

However, changes in shareholding less than five percent of its paid-up equity share capital can proceed with prior notification to the authority.

Personnel Requirements for Setting up of IIO

| Category of IIO | Minimum Personnel Required |

|---|---|

| IIO setting up in an incorporated form | 1. Chief Executive Officer 2. Chief Finance Officer 3. Chief Underwriting Officer |

| IIO setting up in an unincorporated form | |

| An applicant of service company of Lloyd’s IFSC | 1. Principal Officer 2. An officer in-charge of underwriting risk with relevant experience |

| An applicant of Lloyd’s IFSC | 1. Principal Officer 2. An officer in-charge of finance and accounts with relevant experience |

| Other applicants | 1. Principal Officer 2. An officer in-charge of underwriting risk with relevant experience 3. An officer in-charge of finance and accounts with relevant experience |

Regulatory fees to be paid for Setup in GIFT IFSC

IFSCA Fees

| Particulars | Amount (in USD) |

|---|---|

| Application Fee | 1,000 |

| Registration Fee | 5,000 |

| Annual Fee | 11,500 or 1/20th of 1% total gross premium (whichever is higher) |

SEZ Fees

| Particulars | Amount (in INR) |

|---|---|

| Application Fees (one-time) | 5,000 |

| Registration fees (one-time) | 25,000 |

| Recurring fees (Annual) | 5,000 |

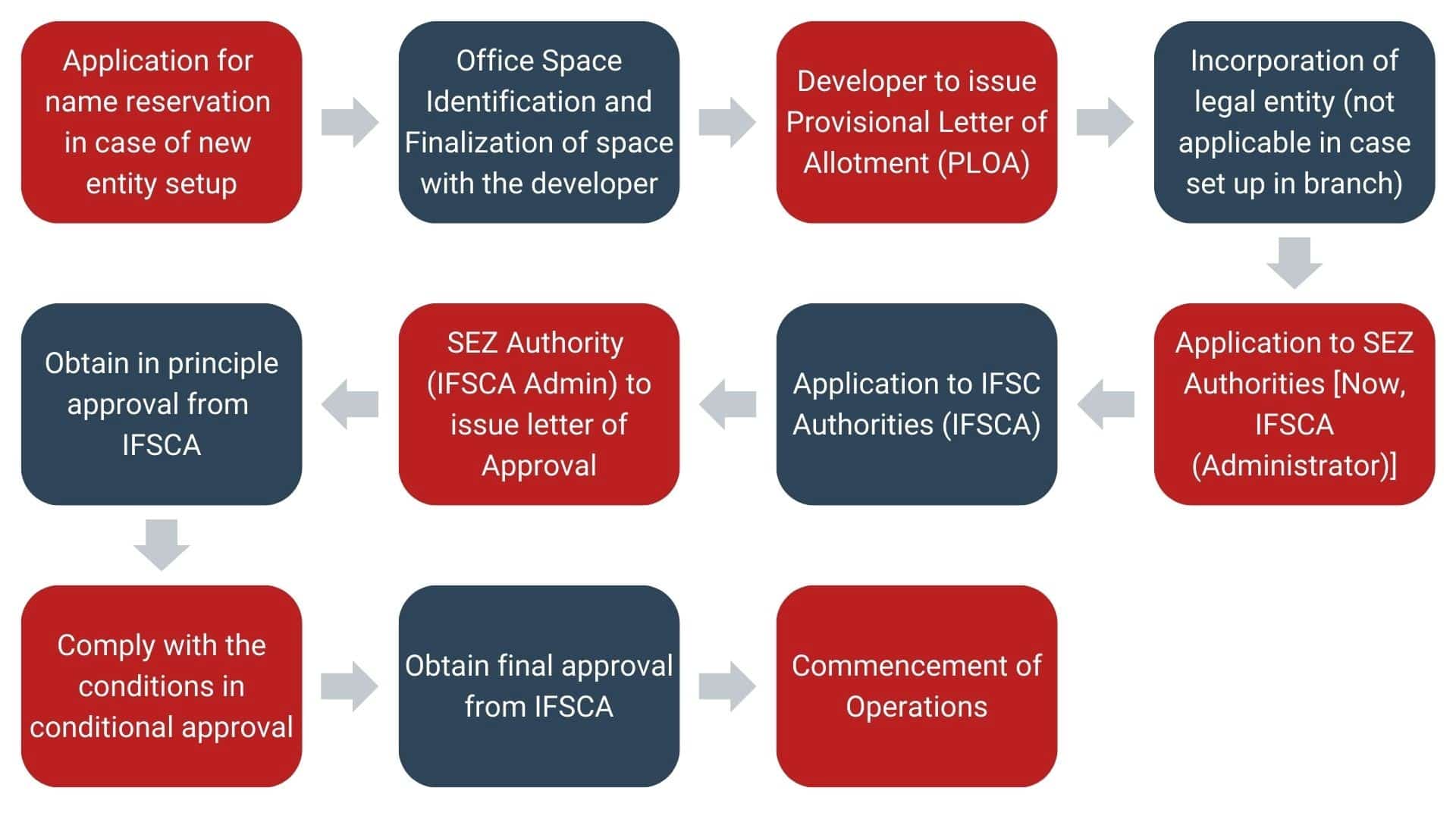

Process flow for Registration of Insurance Office in GIFT IFSC

Conclusion

In conclusion, starting an insurance office in GIFT IFSC allows insurance companies to make use of this growing financial center in India with world-class infrastructure, tax benefits and simplified regulation. By leveraging the strategic advantages of this international financial hub, the insurance offices not only aim to meet the diverse insurance needs of global clients but also to foster innovation and collaboration within the industry. These advantages make GIFT IFSC the preferred destination for local as well as international insurance companies seeking growth and competitive edge.

Frequently Asked Questions

Yes, an IIO and the prospect or insured may mutually agree to pay premiums in instalments (in foreign currency). This includes determining the payment schedule and method by incorporating a premium payment warranty clause in the insurance contract.

Securities issued by entities other than the central government, such as state governments, regional or provincial authorities, public sector entities, or municipalities, do not qualify as sovereign bonds/debt instruments, regardless of their rating status and are not eligible for investment purposes.

Yes, an Indian resident can purchase or retain a health insurance policy from an insurer located outside India, including an IIO in GIFT IFSC. This is allowed provided that the total remittance, including the premium, stays within the limit prescribed by the Liberalised Remittance Scheme (LRS) under RBI norms.

An IIO shall not market any insurance product without allotting a Unique Identification Number (UIN). In case of modification or revision of an existing insurance product, a separate UIN shall be allotted, clearly indicating that the insurance product being marketed is revised version of an earlier insurance product.

As per ‘Product Oversight and Governance Policy’ no such approval for an insurance product is required from the authority, unless specified. IIO shall submit the final policy wording to the authority before marketing an insurance product (other than a re-insurance product), including any modified or revised product.

Share

Share