Complete Overview of the Carbon Border Adjustment Mechanism

Complete Overview of the Carbon Border Adjustment Mechanism

Discover how CBAM transforms compliance into opportunities for sustainable business growth: Know more about the roadmap and impact on Indian companies.

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

Regulatory frameworks have evolved over the years to be incorporative of environmental and sustainability practices. Among these, one such development is the Carbon Border Adjustment Mechanism (CBAM) Regulation. This article will serve as a guide for exporters and importers, majorly decision-makers, to grow their businesses responsibly while adhering to the new and updated CBAM Regulations. Along with discussing the specificities of Carbon Border Adjustment Mechanism Regulations, this blog will also talk about the CBAM Reporting requirements to ensure compliance and advantages for companies.

What is CBAM?

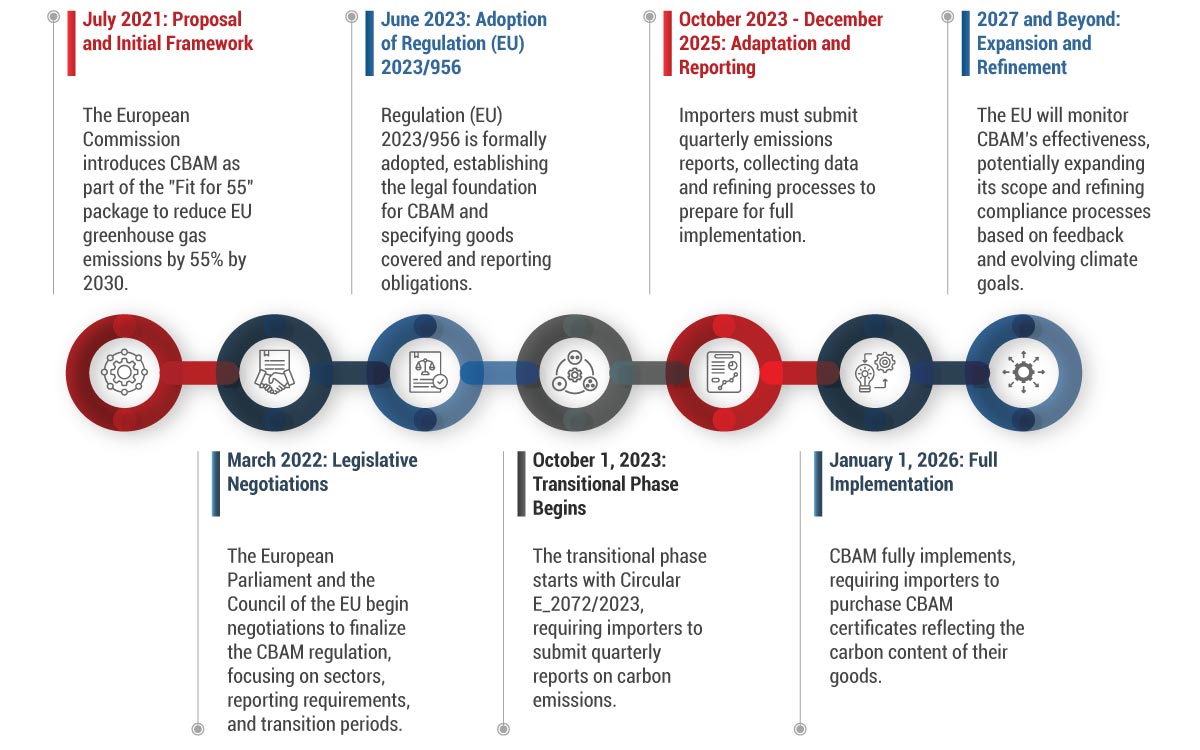

Carbon Border Adjustment Mechanism (CBAM) is a part of the European Union’s (EU) ‘fit for 55’ package, which aims to reduce carbon emissions by 55% by the year 2030 when compared to carbon emissions from the 1990s. Carbon emissions are one of the main causes of global warming with industrialized carbon emissions being one of the major contributors. In October 2023, the European Union issued a circular, E_2072/2023, under regulation 2023/956 introducing CBAM. The circular specifies what CBAM would overlook while providing a detailed roadmap for the implementation of this regulation. CBAM was put in place to cut down practices where businesses relocate their production units to countries without stringent environmental regulations. Alongside this will only further degrade the environmental conditions of underdeveloped or developing countries.

CBAM targets global producers to produce a sustainability certificate where they can declare what sustainability interventions have been utilized. The CBAM regulations came into effect on 1st October 2023, however, this is the transitional phase decided by the EU. From 1st October 2023 to 31st December 2025, reporting obligations are applicable only for importers and exporters. From 1st January 2026, only registered businesses will be allowed to import CBAM goods. EU partner states are required to monitor the movements of these goods. The businesses required to register under CBAM regulations may register their business on 1st January 2025.

Significance

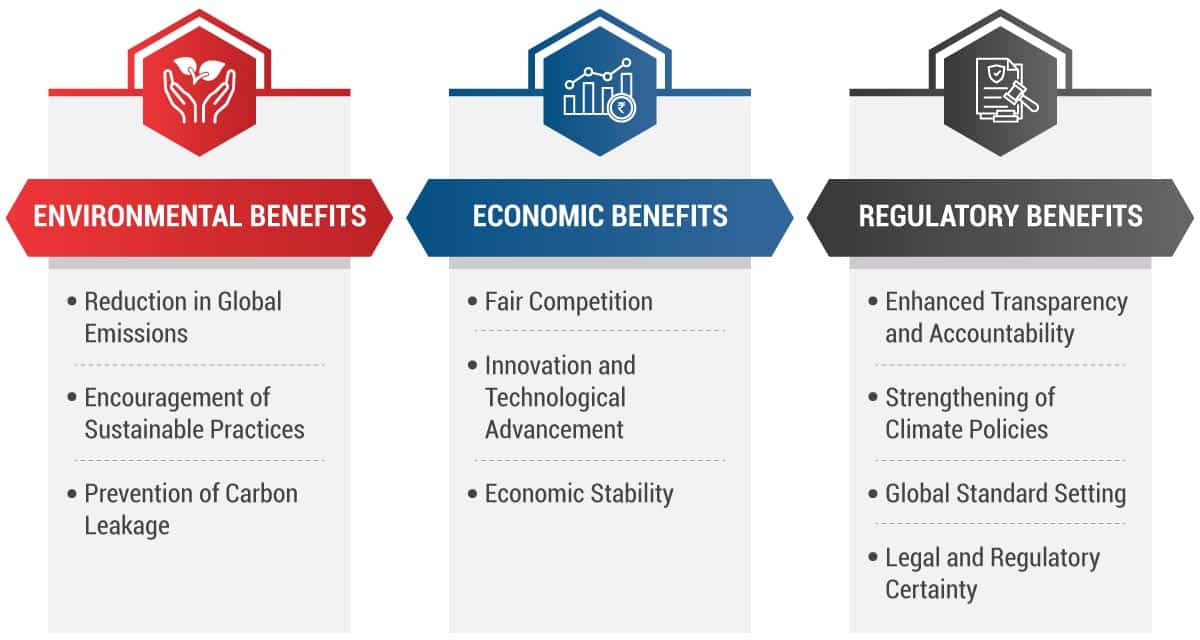

The primary goal of the Carbon Border Adjustment Mechanism Regulation is to equalize the cost of carbon between domestic products and imports, thereby preventing companies from relocating production to countries with laxer carbon regulations. This ensures that the EU’s climate objectives are met without putting its industries at a competitive disadvantage. CBAM requirements ensure that EU exporters are not in a disadvantageous position as compared to importers of the same goods.

As CBAM targets carbon-intensive sectors, it increases the cost of these imports, pushing global producers towards the adoption of greener technologies. This could lead to a 10-20% reduction in CO2 emissions from these sectors by 2030 (European Commission, 2021).

By integrating climate policy and trade regulation, Carbon Border Adjustment Mechanism establishes a model for future regulations. Implementing ESG frameworks like CBAM can ensure sustainable economic growth where nobody is at a loss. CBAM establishes a global harmony for environmental standards by mandating the parameter for exporters beyond the lines of the EU.

CBAM Implementation Roadmap

Timeline and Key Milestones

Structure of CBAM

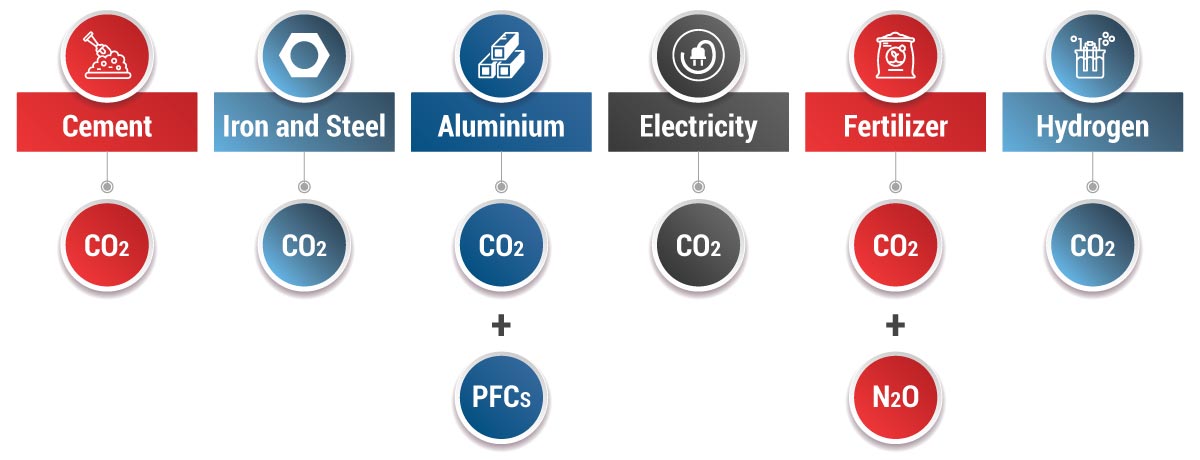

Application: Affected Sectors and Regulated Emissions

The Carbon Border Adjustment Mechanism (CBAM) targets carbon-intensive sectors to ensure that the environmental costs of production for those are accounted for. Initially, CBAM covers imports of the six carbon- intensive sectors. The goods covered are listed in Annex 1 of the CBAM regulations and are identified by their Combined Nomenclature (CN) codes. The covered goods and their related emissions to be reported are as below:

These products are chosen due to their high risk of carbon leakage. The current scope of covered goods will not change before 2026; however, it is intended to include all sectors covered by the EU ETS by 2030.

Cement, fertilizer, and electricity will be covered – and in the future taxed- for both direct and indirect emissions, while iron and steel, aluminum, and hydrogen will be covered only for direct emissions.

Who is Obliged to Submit CBAM Reports?

Compliance with CBAM reporting falls primarily on importers bringing goods into the EU from the covered goods categories. These entities, referred to as ‘reporting declarant’ in the regulation, must submit detailed quarterly reports during the transitional phase and then purchase CBAM certificates once the mechanism is fully implemented.

Carbon Border Adjustment Mechanism reports must detail the quantity of CBAM goods, indirect emissions (if required) and, the carbon emissions embedded with the carbon price for embedded emissions in the country of origin. These reports must be verified by independent third parties to ensure accuracy and compliance. The reporting framework increases transparency and makes it easier for regulatory bodies to ensure compliance with decided standards.

CBAM Exemptions

While CBAM comprises of stringent measure, it includes some exemptions to level the playing field. These exemptions are given based on specific criteria, designed to encourage global cooperation by promoting fair competition. These exceptions are as mentioned below:

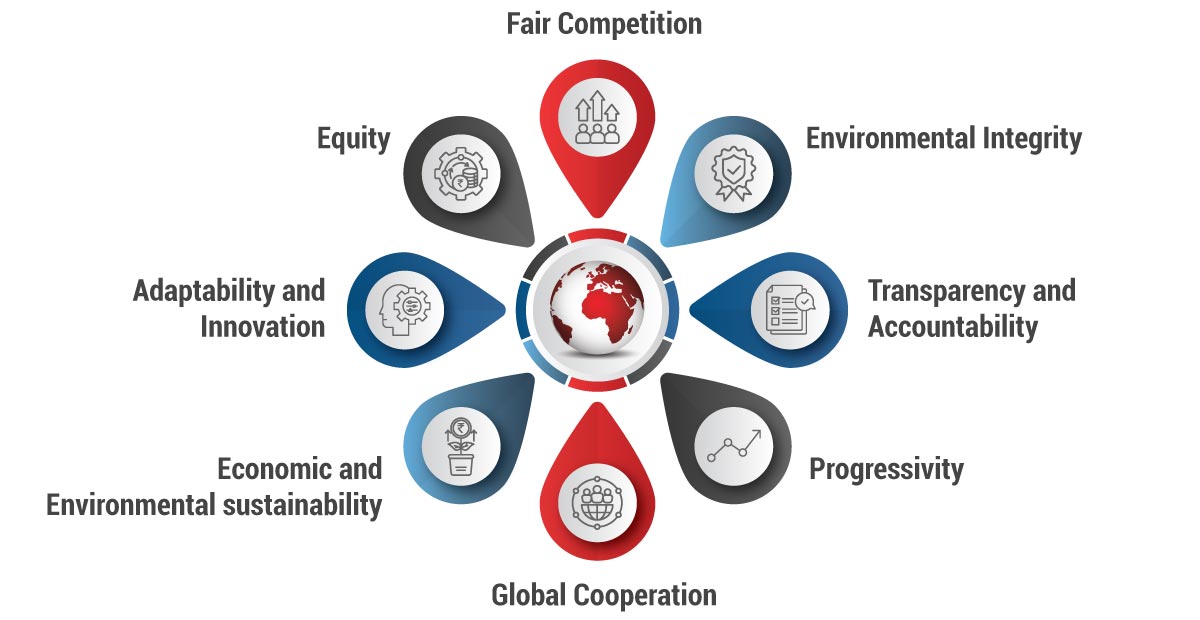

Principles of CBAM

The Carbon Border Adjustment Mechanism is guided by several fundamental principles designed to ensure its effectiveness in combating climate change. These principles are essential for understanding how CBAM operates and why it is structured in a particular way.

Advantages of CBAM

How is CBAM Impacting Indian Companies?

The implementation of Carbon Border Adjustment Mechanism would impact Indian companies drastically. The exports affected by CBAM regulations are estimated to be over $37 billion. CBAM is expected to impose a 20-35% tax on the products mentioned above. Also, Indian exporters need to produce CBAM certificates to trade in the European Economic Area (EEA).

Strategic Implications

1. Investment in Green Technologies

To mitigate the impact of CBAM, Indian companies are compelled to invest in cleaner production technologies. Such investments may seem expensive initially but are crucial for maintaining long-term competitiveness of Indian businesses in the European market.

2. Supply chain Adjustments

Indian companies need to reassess their supply chains to reduce the carbon footprint of their products as Scope 3 is also included in the calculation for CBAM reports. In this, Life Cycle Assessment (LCA) comes into play. Supply chain adjustments involve sourcing raw materials from suppliers with lower emissions and optimizing logistics to minimize the carbon emissions of the downstream operations.

3. Compliance and Reporting

Indian exporters must establish robust reporting mechanisms to comply with CBAM’s stringent documentation requirements. This includes accurate measurement and independent verification of carbon emissions embedded in their products. The cost associated with compliance, including third-party verifiers and setting up reporting systems, adds to the operational burden on Indian companies.

4. Market Diversification

CBAM regulations will increase the cost of production of the above-mentioned goods.

Economic Implications

1. Cost Pass-Through

The additional costs imposed by CBAM are likely to be passed on to consumers at higher prices. This could, in turn, affect the demand for Indian products in the EU and may potentially reduce export volumes. For instance, a 15% rise in steel prices due to CBAM could lead to approximately a 5-10% reduction in demand from EU importers (Economic Times).

2. Competitiveness

The increased costs associated with CBAM could, therefore, make Indian products less competitive in the EU market, compared to those from countries with lower carbon footprints or those with similar carbon pricing mechanisms. Indian exporters need to enhance their environmental performance to retain their market share in the EU.

To remain competitive in the EU market, companies associated with the high-emission sectors have to take steps towards reducing carbon footprints. To pass through CBAM, companies need to invest sustainably. Adopting and reporting these procedures can cause financial burdens on organizations. However, by incorporating necessary sustainability practices, Indian companies can navigate through standards like CBAM and access the EU market.

Alignment with BRSR and LCA Guidelines

BRSR is a mandated framework for reporting ESG practices in India. BRSR was introduced by the Securities and Exchange Board of India (SEBI) in 2019. This framework having its roots in India can assist companies in following the Carbon Border Adjustment Mechanism regulations with ease. By incorporating BRSR, Indian companies gain advantage in getting CBAM certificates.

Life Cycle Assessment (LCA) is a one-stop solution for assessing the environmental impacts of produced goods over a complete life cycle. For example, the manufacturing of a metal nut would be considered from the extraction of metal to the final deliverable product i.e. a nut. This detailed analysis aligns seamlessly with CBAM’s focus on the carbon content of imported goods. Data from LCA can be utilized to meet CBAM’s stringent reporting requirements, ensuring that emissions are accurately measured and reported. Furthermore, LCA encourages innovation in techniques to reduce environmental impacts through the supply chain, which can incentivize CBAM’s costs on carbon emissions, driving companies towards greener technologies and more sustainable practices.

The interrelationship between CBAM, BRSR, and LCA centers on their shared emphasis on sustainability, transparency, and accountability. By integrating data from these frameworks, companies can maintain a consistent position on their environmental performance by addressing sustainability at both strategic and operational levels. Moreover, it also reduces regulatory risks and enhances market share for exports in the EU.

Now that is quite apparent, for Indian companies, aligning with these frameworks brings both challenges and opportunities. While ESG reporting is set to increase costs for companies, BRSR and LCA data will streamline this process by complementing each other. The concurrence of such mechanisms will catalyze standardized reporting and practices adopted by the companies.

Adopting and mastering these ESG reporting strategies be beneficial for Indian companies. The interlinked international regulations would serve as a nexus for promoting standardized and informative reporting from all the organizations. The regulatory paradigm embodies sustainability and hence makes organizations more socially responsible.

Way forward

The primary goal of the Carbon Border Adjustment Mechanism Regulation is to equalize the cost of carbon between domestic products and imports, thereby preventing companies from relocating production to countries with laxer carbon regulations. This ensures that the EU’s climate objectives are met without putting its industries at a competitive disadvantage. CBAM requirements ensure that EU exporters are not in a disadvantageous position as compared to importers of the same goods. By 2030, CBAM is set to inculcate all the sectors mentioned under EU ETS.

Soon, we might see more regulations coming in, to cut down carbon emissions. Benchmarks are also expected to inculcate more parameters to provide complete analysis. Companies might need to adopt technological interventions to calculate ESG parameters. AI-driven analytics are part of many such ESG Rating Frameworks. One such scoring mechanism is the Morgan Stanley Capital International (MSCI) ESG Rating Framework. The framework uses AI to analyze data points for ESG reporting.

Why Choose InCorp Advisory?

We know that navigating Carbon Border Adjustment Mechanism compliance with its complexities can be a challenging task. Our team has extensive experience in managing CBAM reporting and compliance for businesses across various sectors and domains. Our professionals understand the nuances of the requirements that are equipped to streamline your compliance process, ensuring you meet all regulatory obligations while unlocking new opportunities for your business. To learn more about CBAM Reporting or any other ESG services we offer, you can write to us at info@incorpadvisory.in or reach out to us at

(+91) 77380 66622.

Frequently Asked Questions

The transitional phase of CBAM began on October 1, 2023, and will continue until December 31, 2025. During this period, importers have to submit quarterly reports detailing the carbon emissions of their goods. This phase is meant to be a buffer for businesses to adapt to the new requirements without immediate financial adjustments.

Complete implementation of CBAM will begin on January 1, 2026. At that point, importers will have to purchase CBAM certificates based on the carbon content of their imports. These costs will align with those incurred by EU producers under the EU Emissions Trading System (EU ETS).

CBAM incentivizes companies to adopt greener technologies and sustainable practices by imposing carbon costs on high-emission imports. This not only helps businesses comply with regulations but also enhances their competitiveness, reputation, and appeal to environmentally conscious investors and consumers.

Annex 1 of CBAM includes high-emission goods such as cement, iron and steel, aluminum, fertilizers, electricity, and hydrogen. These goods are identified due to their significant carbon footprints and high risk of carbon leakage.

The CBAM report should include detailed information on the carbon emissions embedded in the imported goods, the methods used for calculating these emissions, and independent verification of the emissions data. Reports including all this data should be submitted quarterly during the transitional phase.

Yes, CBAM provides exemptions for imports from countries with equivalent carbon pricing mechanisms, goods produced with emissions significantly lower than the EU benchmark, and in some cases, imports from Least Developed Countries (LDCs) to avoid placing undue economic burdens on these nations.

Share

Share