BRSR Reporting and Its Influence on Investor Decisions in India

BRSR Reporting and Its Influence on Investor Decisions in India

BRSR Reporting: How Comprehensive Reporting Framework is Influencing Investor Decisions while Transforming the Indian ESG Landscape

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

A whole new Environment, Sustainability & Governance (ESG) verticals have been created by businesses across the globe to ensure long-term business continuity. Some level of detail on sustainability was reported by 98% of companies as mentioned in a 2024 report by the International Federation of Accountants (IFAC). It is seen that there has been a marked increase in sustainable reporting practices being adopted by companies, irrespective of the industries in which they operate. The disclosure of ESG performance has become a key parameter that customers, investors, and stakeholders take into consideration before being associated with organizations.

Business Responsibility and Sustainability Reporting (BRSR) has been mandated for top 1000 listed entities in India by SEBI, considering the need of the hour. The BRSR framework and its influence on investor decisions in India are explored in this blog.

Understanding BRSR Reporting

The BRSR is ESG reporting of the SEBI framework that began in 2021. All the top listed companies with 1000 ranked market capitalizations are required to report their ESG performance in the marketplace. It serves as a central guiding framework for public companies to report their ESGs, aligning them with international standards. BRSR has replaced Business Responsibility Reporting, which has been part of the business landscape since 2012.

BRSR Reporting focuses on providing ease of adopting an ESG reporting practice that adheres to various national and international sustainability reporting frameworks. BRSR sets the gold standard for reporting ESG performance disclosures in India. BRSR aligns with popular international frameworks like the United Nations Sustainable Development Goals (UN SDGs), Global Reporting Initiative (GRI), and Task Force on Climate-Related Financial Disclosures (TCFD)

Nine core principles laid out in the National Guidelines on Responsible Business Conduct (NGRBC) are aligned with by the BRSR. The following focus areas are covered by these nine principles:

- Ethical Business Practices

- Product Stewardship

- Employee Wellbeing and Engagement

- Stakeholder Engagement

- Human Rights

- Environmental Stewardship

- Public Policy Advocacy

- Inclusive and Equitable Growth

- Customer Focus

Nine Core Focus Areas of NGRBC

Moreover, a tool is provided for businesses that want to align with the NGRBC by BRSR Reporting. The BRSR Reporting structure is divided into three sections.:

Section A: General Disclosures

Section B: Management and Process Disclosures

Section C: Principle-wise Performance Disclosures

Essential Indicators (Mandatory)

Leadership Indicators (Voluntary)

The Growing Importance of ESG Criteria

There are intrinsic benefits for businesses that adopt sustainability throughout their value chains. With the world becoming more and more environmentally conscious, companies that wholly embrace eco-friendly practices outperform their peers in the long run by earning stakeholder trust. Responsible investors invest only in businesses that periodically demonstrate positive ESG performance. Consumers are also increasingly demanding to associate themselves only with brands that have a positive ESG outlook.

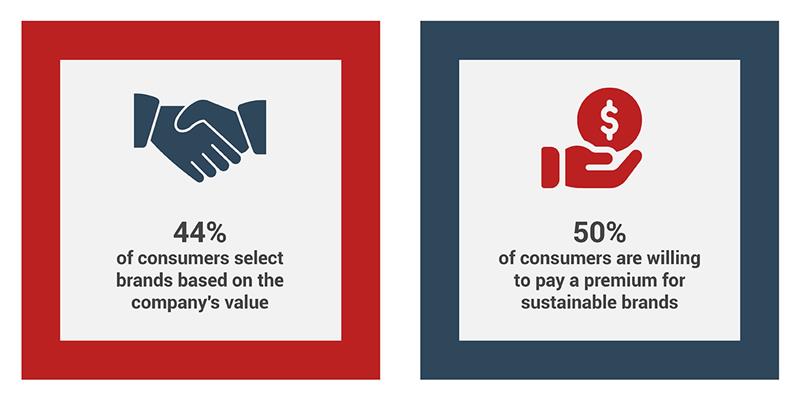

A McKinsey analysis discovered that ESG strategies result in higher equity returns 63% of the time in a sample size of over 2000. A survey by IBM in 2022 discovers that 50% of consumers are comfortable paying an average premium of 70% for ESG-conscious brands. We could list here thousands of even more studies on that subject, but the studies described below, hopefully should help to outline growing importance for the focus on ESG from the enterprises.

Changing consumer choices (IBM)

BRSR Reporting: Enhancing Corporate Transparency

The BRSR framework that helps improve corporate transparency in businesses was launched by SEBI. The full gamut, from leadership initiatives to environmental impact, is covered by the 140 detailed questions in the BRSR. Companies that are built around integrating sustainability into their core are well placed to deal with upcoming regulatory changes and expectations from consumers. BRSR can be termed as the poster child for unlocking future value through responsible practices for businesses.

InCorp consistently encourages organizations to adopt more responsible practices in response to BRSR reporting requirements. ESG reporting practices are often adopted by smaller companies looking to follow larger companies, thus enhancing corporate transparency across multiple value chains.

Impact on Investor Confidence and Decision-Making

Investors today look to invest in businesses that perform well on ESG parameters. BRSR gives a comparable reporting standard against which investors can make more responsible decisions. Sustainable investing in India has witnessed rapid growth over the past few years and is projected to be around 34% of the total domestic AUM by 2051. In fact, BRSR has been very crucial in enhancing investor confidence since investors are willing to invest in companies that place their core in line with sustainability.

Additionally, the concept of BRSR Core Assurance was introduced by SEBI in July 2023 to boost investor confidence. The information displayed in a BRSR report is examined and verified by an independent party through the BRSR Assurance. It is made easier for the investor to make an investment decision since the BRSR Assurance confirms that an ESG report does not contain false data and visualizations. Investor trust is improved by the BRSR Assurance, and an organization’s ESG ratings are also helped to be improved by providing confirmation and validation of disclosures to rating agencies.

Attracting ESG-Focused Investments

The integration of ESG into enterprises is facilitated by reporting frameworks like BRSR, providing them with a competitive edge and enhancing their ability to attract investments. For instance, companies that are positively rated by ESG rating agencies like Bloomberg and MSCI are expected to attract more investments. The sustainable investment pie is growing rapidly – global ESG assets were analyzed and reported by Bloomberg Intelligence to be worth over $30 trillion in 2022 and are set to cross the $40 trillion mark by 2030.

Pools of capital from private investors and other finance institutions can be accessed by companies based on their ESG performance. ESG schemes of Asset Management Companies (AMCs) have also been mandated by SEBI to ensure that at least 65% of their AUM is invested into companies adopting the wider BRSR reporting format along with its core principles.

Challenges and Limitations of BRSR Reporting

In India, where ESG awareness is still very much in its growing phase, a unified and structured reporting standard is provided for companies by BRSR. A roadmap for entities to align their operations as per the National Guidelines on Responsible Business Conduct (NGRBC), which promotes transparency and sustainable business operations, is provided by BRSR.

However, despite a standardized reporting format being provided, there are many challenges and limitations to the BRSR reporting framework like:

1. Data Aggregation and Utilization

One of the biggest challenges with any kind of ESG reporting, including BRSR, is the aggregation and utilization of relevant data. Many organizations find it difficult to collect the required data for KPI reporting due to lack of awareness and data extraction tools. Even after the data consolidation phase is completed, the data faces challenges in being presented in a usable format for BRSR reporting by companies.

2. Changes in Reporting Requirements

Over time, the number of questions in the BRSR report has increased to 140 questions from the former 59, and detailed information is required more than earlier in the KPIs on a quantitative level. This implies that there is a complexity in hierarchies associated with the organizations.

3. Compliance with Regulations

It can be difficult for changing regulations with respect to BRSR Reporting and environmental regulations to be up to date by companies with limited internal resources.

The Indian business landscape is being transformed by BRSR Reporting, making it more responsible and transparent.

Future Trends in BRSR Reporting and Investor Relations

With the advent of technology and other utility tools, ESG reporting methodologies are likely to become standardized and cross-referenced across the world. Innovations like Machine Learning and AI are likely to play a very significant role in the process of ESG reporting going forward. They are great data storage tools but also pretty handy in giving preliminary insights into ESG performance. Such innovation should become a vital contributor to BRSR reports as India progresses toward a larger technology-led economy.

Since ESG was introduced just very recently as the new vertical into many Indian organizations, lack of awareness pervades the value chain. The phenomenon is noticed at the stage in which investors as well as various stakeholders now look for questions surrounding the responsible behaviors of the respective organizations. With mandatory BRSR reporting being legislated and made applicable to more organizations, it would be an essential step toward forming a network of ESG reporting specialists who serve these investors in searching for responsible companies to invest in.

With global frameworks evolving to include more responsible guidelines and constant at BRSR Reporting to upgrade itself. Just as how the BRR was transformed into BRSR, BRSR might eventually transform into an even more evolved framework. It is set to reel in much more investment towards sustainable organizations-more than it is already doing through strengthening investor-company relations. The future of ESG in India is bright with many more avenues to be introduced and explored.

Conclusion

A prominent piece of ESG scenario for India would be BRSR, whose reporting framework serves as an imperative component to be led with regard to adopting the ESG space in India. BRSR is enriched questionnaires with structured updates so as to present as a mark standard framework of attractive responsible investment among domestic as well as international investors. With Focused investment by BRSR, value to sustainable companies has been unlocked with maximum efficiency. Though, as of now, the ESG future of India is anchored by BRSR, it might evolve with time into another reporting format that can represent even more genuine and holistic principles.

The long-term vision of an organization is seen by investors through BRSR. If there are any risks to long-term profitability and sustainability of an organization, they are ascertained by multiple non-financial metrics disclosed in the ESG reports. As a result, there is a rise in the number of investors looking to invest in ESG-focused entities. In fact, businesses which have a positive risk-management strategy are predominantly invested in by some investors. Investor confidence is also improved and larger pools of funding for ESG-centric businesses are eventually unlocked by the BRSR Assurance provision.

Why Choose InCorp Global?

InCorp Global offers holistic solutions to all entities. We have a team of highly trained professionals who are leading industry experts. We provide services to clients across various industries. Choose InCorp for your business to streamline the process of ESG reporting. Our team can also help your organization improve its sustainability disclosure and rating scores while identifying gaps in your sustainability reporting. To know more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Muskaan Jain | Sustainability & ESG

FAQs:

Since FY 2022-23, BRSR Reporting is mandated for the top 1000 listed companies by market capitalization. This requirement was introduced on 5 May 2021 through an amendment to Regulation 34(2) (f) of the Listing Regulations. Other companies can disclose their ESG performance through BRSR on a voluntary basis.

Currently, unlisted companies are not covered by BRSR but are encouraged for voluntary disclosures. However, it is planned by the Ministry of Corporate Affairs (MCA) committee to roll it out to unlisted companies and recommend that the eligibility criteria should be based on specific thresholds of turnover or paid-up capital. In the future, we might see BRSR being extended to unlisted companies.

The best place to look is the fund prospectus which explains the most important metrics a fund uses to evaluate potential investment opportunities. This usually includes risk-management strategies related to sustainability metrics as well.

Responsible and ethical business practices are promoted by the Ministry of Corporate Affairs (MCA) through NGRBC. The NGRBC is also aligned with the larger Sustainable Development Goals (SDGs) set out by the United Nations. The NGRBC guidelines form the basis of BRSR in India.

The ESG performance of organizations can be assessed by investors with the help of BRSR, which assists them in making decisions on which businesses are the best to invest in. This is usually done by looking at risk management and overall sustainability practices. The steps that are being taken by the management committee to ensure the long-term success of the business can also be seen by investors.

Share

Share