Setting Up Your Business in GIFT City IFSC

Setting Up Your Business in GIFT City IFSC

A complete guide to capitalize on India’s potential in the international financial sector for incorporating business in GIFT City IFSC

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

With the rise of globalization and the growing importance of international finance, setting up a business in a well-established and business-friendly environment has become crucial. The Gujarat International Finance Tec-City (GIFT City), located in Gujarat, India, has emerged as a prime destination for businesses looking to tap into the country’s financial markets.

In order to capitalise on India’s potential in the international financial services sector, the entity may undertake following steps to incorporate their business in GIFT City.

Brief Process

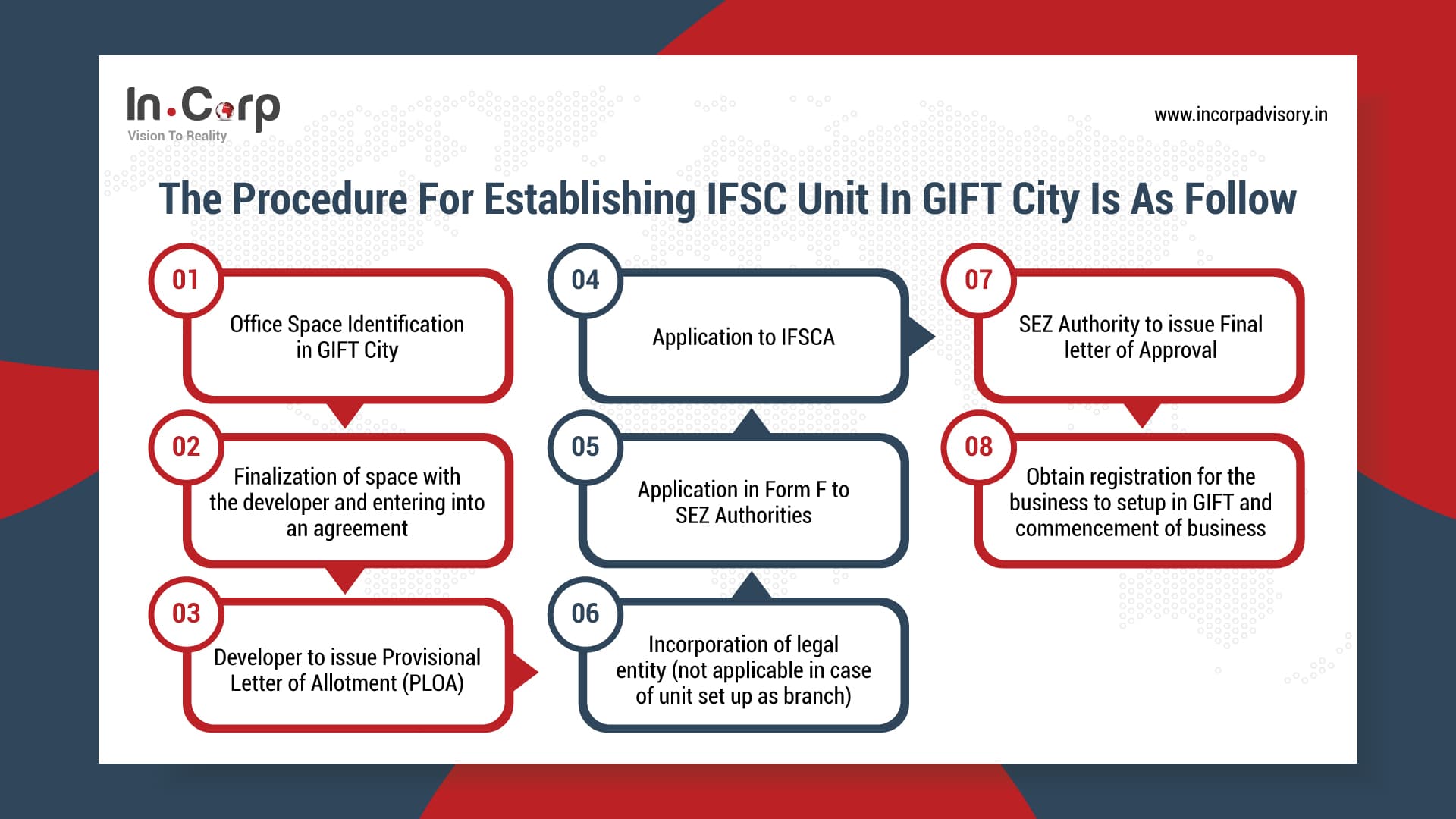

The procedure for establishing IFSC Unit in GIFT City is as follow:

Steps To Incorporate Your Business In GIFT City IFSC

If you are considering establishing an IFSC unit in GIFT City, this guide will walk you through the process step-by-step.

Step 1: Identification Of Suitable Office Space In GIFT SEZ

The initial step involves identifying and selecting office space within the GIFT SEZ. This includes entering into an agreement with the developer or co-developer of GIFT SEZ. The chosen office space will serve as the location for establishing your business operations within the SEZ.

Step 2: Obtain Provisional Letter of Allotment (PLOA)

After finalizing the agreement with the developer, it is necessary to obtain a Provisional Letter of Allotment (PLOA). This letter officially confirms the allocation of the chosen office space within the GIFT SEZ for your entity. The PLOA serves as a crucial document for initiating the establishment of your business operations in the SEZ.

Step 3: Application In FORM F To SEZ Authorities

The entity needs to prepare and submit FORM F along with the following annexures:

- Demand Draft of Rs 5,000/-

- Provisional Letter of Allotment issued by the Co-Developer.

- Detailed Project Report, including projections for the next five years.

- Entity ID documents such as License, PAN Card, IEC Code, etc.

- Self-certified copies of Memorandum of Association and Articles of Association.

- Self-certified copies of Board Resolution for setting up an office in GIFT IFSC.

- Certificate of Incorporation.

- List of Directors with their identity proofs.

- Last 3 years’ audited financial statements and IT returns of the entity or directors.

- Brief presentation covering the entity profile and scope of activities in GIFT IFSC.

- AFFIDAVIT

Prepare three sets of the above documents and submit them as follows:

- Original set to the Office of the Development Commissioner.

- Second set to the developer (GIFT SEZ) to facilitate the submission of NOC from the developer to the Office of the Development Commissioner.

- Third set for the entity itself.

Step 4: Unit Approval Committee (UAC) Meeting

The Development Commissioner will contact the entity for a meeting with the Unit Approval Committee (UAC) after receiving the FORM F. During the hearing, the entity’s authorised representative will present the case on their behalf.

Step 5: Letter of Permission / Approval (LOA)

The Development Commissioner will give the entity a Letter of Permission / Approval (LOA) if the UAC is pleased with the entity’s presentation.

Step 6: Letter Of Acceptance

Within 45 days of the LOA’s issuance, the entity must deliver a Letter of Acceptance to the Development Commissioner expressing acceptance of the LOA’s terms and conditions.

Step 7: Execution of Lease Deed

The entity must sign a lease deed with the co-developer of GIFT SEZ within six months of getting the LOA and submit it to the Development Commissioner.

Step 8: SEZ License and Registration with NSDL Portal

After the issuance of the SEZ License, the entity needs to obtain registration with the NSDL portal for SEZ Online Registration. This registration allows for reporting and other services related to import, procurement, and services.

Step 9: Bond Cum Legal Undertaking

The organisation must prepare and sign a Bond Cum Legal Undertaking with the Development Commissioner and GIFT SEZ’s Specified Officer before submitting it.

Step 10: Obtain Registration Certificates and Exemption Eligibility

The entity must proceed to obtain various registration certificates such as GST, RCMC, IEC, etc. Additionally, it should apply for eligibility certificates for exemption from various taxes from the Central and State Government.

Step 11: Registration with IFSCA

Before commencing business operations, the entity must obtain a Certificate of Registration from the International Financial Services Centres Authorities (IFSCA). The entity should prepare and submit an application along with the required fees to the IFSCA.

Step 12: Commencement of Business Operations

After completing all the necessary steps, the entity becomes eligible to commence its business operations (export of services). It is mandatory to inform the Office of the Development Commissioner about the date of the first export of services through an application titled “Commencement of business operations” and provide supporting evidence such as a tax invoice. A copy of the application should also be marked to the GIFT SEZ developer.

Conclusion

In conclusion, thorough adherence to the recommended measures and compliance with regulatory criteria are required when opening an office in the GIFT SEZ. Businesses may successfully navigate the procedure and take advantage of the opportunities and benefits offered within the GIFT SEZ by following this thorough guidance. This strategic step lays the way for success and development in a dynamic corporate ecosystem and aids India’s expansion in the field of international financial services.

Why Choose InCorp?

At Incorp, we understand the complexities of setting up an Insurance Intermediary Office in GIFT City IFSC. That’s why we offer specialized advisory services to guide you through the process, from initial planning to ongoing compliance. Our expertise can help your organization navigate international regulations and leverage the significant opportunities of GIFT City IFSC, such as access to global markets and a business-friendly environment.

Contact us today to learn how Incorp can assist in successfully establishing your Insurance Intermediary Office in this prestigious international financial center.

Authored by:

InCorp Global | GIFT City

FAQs

The first step is deciding the business structure and obtaining in-principle approval from IFSCA for operations within the IFSC.

Businesses apply through the GIFT SEZ developer, submit required documents, and receive the PLOA to secure office space provisionally.

Key documents include incorporation certificate, business plan, directors’ details, KYC documents, and SEZ approvals as per IFSCA guidelines.

SEZ status provides tax incentives, relaxed regulations, and ease of doing business, including exemptions from customs duties and simplified compliance.

Businesses should follow IFSCA’s regulations, maintain proper documentation, and regularly consult with SEZ and regulatory authorities to ensure full compliance.

Need help with navigating the rules and regulations in Gift City?

Share

Share