Benefits For Stock Brokers Registered in IFSC GIFT City

Benefits For Stock Brokers Registered in IFSC GIFT City

A complete overview of operational and process flow and advantages for stockbrokers functioning out of GIFT City IFSC

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

In January 2017, India’s first international exchange was launched in the International Financial Service Centre (IFSC) in Gift City. This exchange includes trading across all asset classes such as equities, currencies, commodities, and fixed-income securities. Securities can be dealt with in the exchanges operating in the IFSC with a specified trading lot size on their trading platform subject to prior approval of SEBI. Further, in December 2020, regulations have been made to set up India’s first International Bullion Spot Exchange. In this article, we discuss the registration process for stock brokers in Gift city – IFSC and its benefits.

An Overview

An International Financial Service Centre (IFSC) is a special jurisdiction where global financial service providers offer financial services/ products to global customers in foreign currencies. In India, an IFSC is to undertake financial services transactions currently carried out outside India by overseas financial institutions and overseas branches/ subsidiaries of Indian financial institutions. The key institutions permitted to set up an IFSC unit are the Banking sector, Insurance sector, and Capital Markets. A stock broker is an eligible participant in the Capital Markets of IFSC.

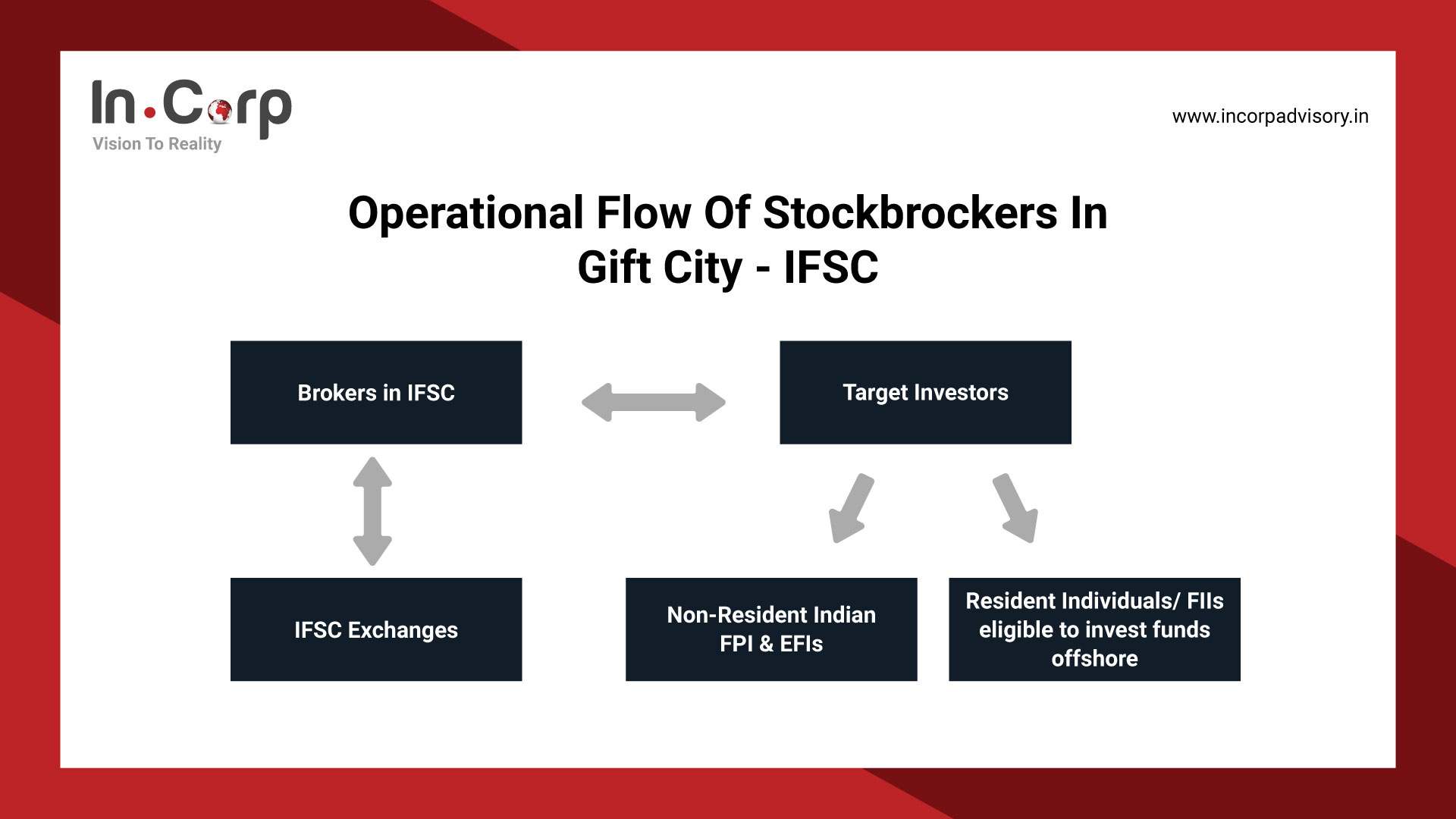

Operational Flow of Stock Brokers In Gift City – IFSC

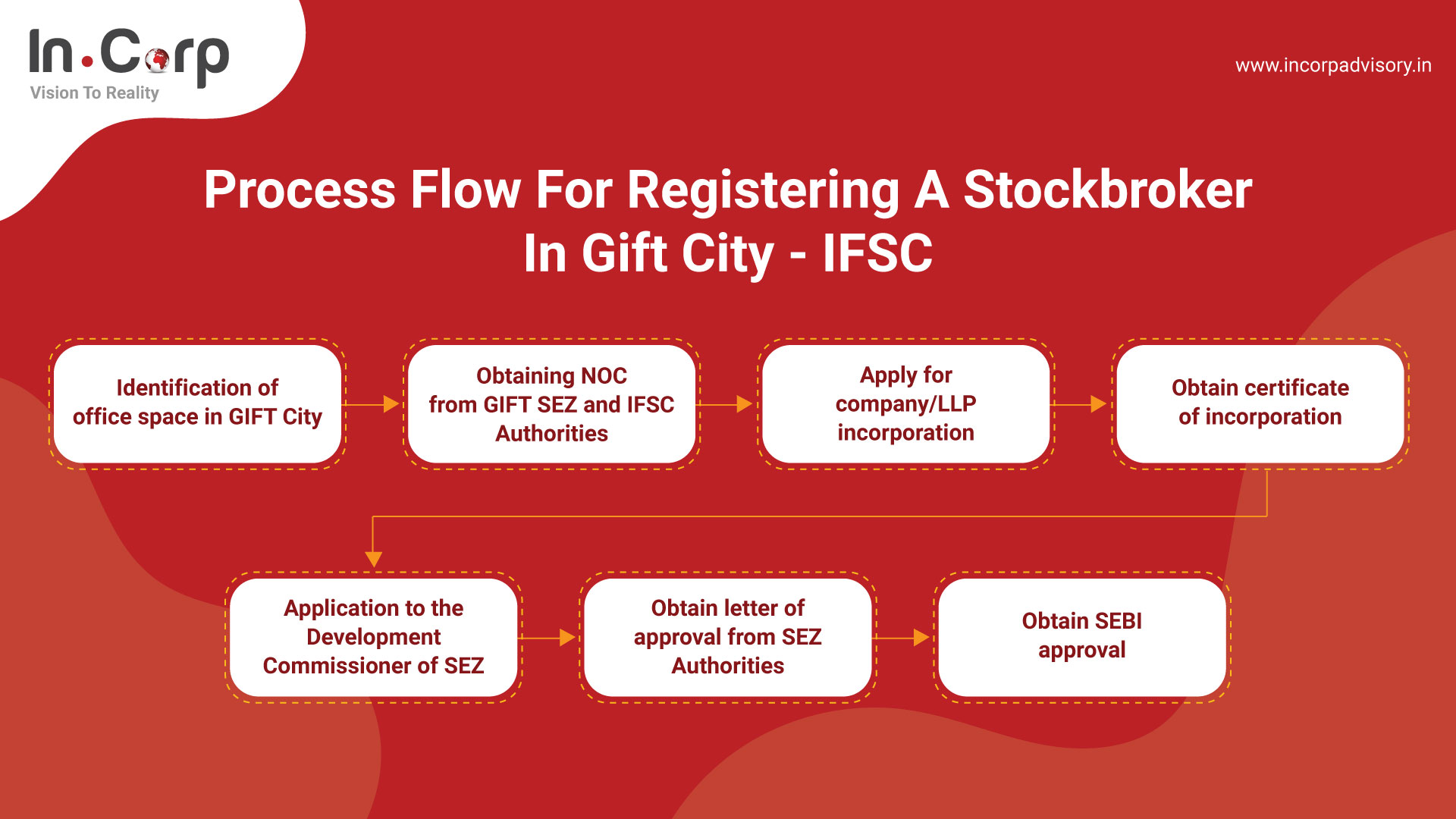

Process Flow for Registering a Stock Broker in Gift City – IFSC

Benefits for Stock Brokers Registered in GIFT City- IFSC

Stock brokers registered under GIFT city were provided with various benefits as compared to general stock brokers registered elsewhere. Few benefits are listed below:

1. Investment Opportunities

-

- India’s two largest exchanges, Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), have set up international exchanges and clearing corporations at GIFT IFSC.

- The exchanges provide more than 140 products for trading, allowing international investors and Non-Residents Indians to trade from anywhere across the globe.

- Stock brokers can target the following type of investors:-

- A person resident outside India (Mainly Foreign Portfolio Investors and Eligible Foreign Investors

- Non-Resident Indian

- Financial institution resident in India / Resident in India eligible to invest funds offshore, to the extent permitted under FEMA/RBI guidelines.

2. Taxation benefits

- Business income 10 years out of the first 15 years earn a tax holiday u/s 80LA of Income Tax Act, 1961. However, business income is taxable for brokers registered elsewhere in India since no specific exemption is provided.

- Minimum Alternate Tax (MAT)/ Alternate Minimum Tax (AMT) is applicable @9% of book profits. However, the same applies only to companies opting for the old tax regime.

- Exemption from STT, CTT, stamp duty in respect of transactions carried out on IFSC exchanges by registered brokers.

- No GST on services received by a unit in IFSC or provided to IFSC units, offshore clients.

3. Operational Benefits:

- Lower operating costs due to subsidies granted by the Gujarat Government,

- Availability of skilled labor,

- Proximity to the onshore market,

- World-class infrastructure, unparalleled connectivity, and transportation access,

- Access to multiple markets from IFSC.

Related Read: How To Incorporate AIF In GIFT City- IFSC?

Conclusion

While worldwide financial hubs such as London, New York, Hong Kong, Singapore, and Dubai have grown in popularity, the moment has come to enhance capital flows through India’s GIFT City. Compared to other major IFCs, the Indian government and its regulatory authorities have enabled GIFT City to provide a commercial and regulatory environment. The IFSC strengthens India’s strategic position as a global financial services business hub. The city benefits from several economic and financial advantages.

Why Choose InCorp Advisory?

Our Advisory and Taxation Team at InCorp offers seamless assistance in the incorporation of entity in GIFT City with related compliance and advisory services. We shall evaluate and assist in analyzing GIFT City related operational, commercial, taxation benefits, ensuring smooth setting up and assistance in regular compliance with all applicable rules and regulations in GIFT City.

Authored by:

InCorp Advisory

FAQs on Stock Brokers Registered in GIFT City – IFSC

Stockbrokers registered in GIFT City- IFSC are regulated by both GIFT City Regulations and SEBI (Stockbrokers) Regulations 1992.

Yes, stockbrokers registered in GIFT City -IFSC are required to comply with all the Income tax compliances as mandatory for general stockbrokers.

Yes, approval is required from following authorities:

- IFSC authorities

- SEZ authorities

- SEBI (Stockbrokers) Regulations, 1992

The process flow for registering a stock broker in gift city- ifsc are as follows:

- Identification of office space in Gift City

- Obtaining NOC

- Apply for Company/LLP Incorporation

- Obtain certificate of Incorporation

- Applying to the development commissioner

- Obtain letter of Approval

- Obtain SEBI Approval

Need help with navigating the rules and regulations in Gift City?

Share

Share