BFSI Industry in GIFT IFSC: Opportunities and Road Ahead

BFSI Industry in GIFT IFSC: Opportunities and Road Ahead

A Look at the BFSI Industry: Decoding GIFT City's Rise as India's Next Financial Powerhouse And its Future

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

The BFSI sector in India is experiencing remarkable growth, driven by increasing per capita income, the introduction of innovative products, integration of technology, broader distribution channels, and increased customer awareness. In the last 15 years, bold reforms have positioned BFSI as a backbone for India’s inclusive economic development. With focus on inclusive growth, the BFSI sector emerges not as a participant but as a catalyst for shaping India’s financial landscape, ready to navigate challenges and seize opportunities, embodying the nation’s commitment to a financially inclusive society. In this blog, we take you through Gujarat International Finance Tec-City (GIFT City) IFSC’s impact on the BFSI industry.

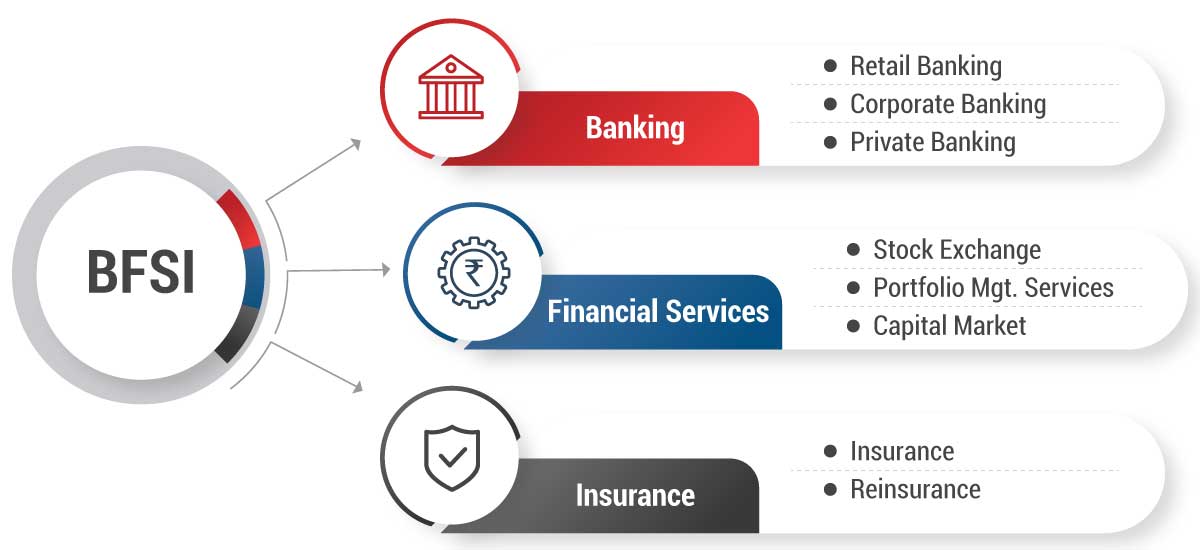

Here are the Three Essential Sectors of BFSI Industry in India

IFSC GIFT City: A Potential Game-Changer for BFSI Sector

The establishment of IFSC in India has triggered a significant transformation in the global banking, financial services, and insurance (BFSI) sector, leading to substantial developments. The regulatory structure of GIFT IFSC is designed to match internationally accepted standards, fostering flexibility and reducing the regulatory burden. IFSC in India is governed by a unified regulator named IFSC Authority (IFSCA), which encompasses the regulatory powers of other financial regulators like RBI, SBI, IRDA, etc. in India. GIFT IFSC has been designated as a foreign jurisdiction of a non-resident zone which allows easy movement of foreign capital with less restrictions. The IFSC unit’s setup in the GIFT City India also offers various tax incentives.

How is IFSC GIFT City Powering a BFSI Revolution?

The government has big plans for transforming GIFT City and thereby even accelerating the presence of BFSI industry on a global scale.

Here are some of the major announcements made in the Budget 2023:

1. Establishing IFSC Banking Units

IFSC banking units of foreign banks to engage in acquisition financing, acknowledging offshore derivative instruments as legally binding contracts. Further, the proposal involves setting up a subsidiary of EXIM Bank with the aim of improving trade refinancing capabilities.

2. NSE IFSC-SGX Connect

Its importance lies in introducing derivative trading of Nifty products, which are linked to Singapore’s index (SGX), to NSE-IFSC Gift City. This initiative aims to enhance efficiency and ease of access, enabling investors to participate in trading and clearing derivative contracts through NSE-IFSC seamlessly.

3. Data Embassies of Other Countries

Singapore’s central bank is bridging the regulatory gap for fintech. Like a grand architect, it’s building an alliance of existing sandboxes safe testing grounds for financial innovation across different countries. This lets fintech companies experiment freely, adapting their ideas to diverse markets, paving the way for a wave of revolutionary financial solutions.

4. India-Luxembourg Stock Exchange Agreement

India INX and the Luxembourg Stock Exchange have established a mutual agreement with the common objective of promoting green finance initiatives within India. This partnership between INX and LuxSE is expected to greatly boost investor interest, enabling the flow of green capital from the global financial market.

Sector wise Distribution of Active Entities and Transaction Volume in Gift City IFSCA (as on December 2023)

| Sector | Number of Active Entities in GIFT IFSC | Transaction Volume in GIFT IFSC (USD) |

|---|---|---|

| Banks (IBUs) | 23 + | 51984.75 million |

| Insurance Offices | 8 + | 57.58 million |

| Finance Companies/ Units | 34 + | 8.57 million |

| Insurance Intermediary Offices | 21 + | 57.66 million |

| Stock Exchanges | 2 | 193325.62 million |

| Funds | 95 + | 2,930.45 million |

Source: IFSCA Bulletin December 2023 edition

Benefits to BFSI Entities Operating in GIFT IFSC

BFSI sector in International Financial Services Centers (IFSCs) presents various advantages, such as tax benefits, eased regulations, and access to a diverse talent pool worldwide. Working within an IFSC allows BFSI firms to streamline regulatory procedures, facilitate smooth cross-border transactions and extend their international presence.

BFSI Entities in IFCSA have the Following Benefits:

- IFSCA regulations adhere to global standards, promoting transparency and enticing foreign investments.

- Enhance cross-border trade and investment by enabling transactions in multi foreign currencies.

- Expand the array of financial instruments beyond the domestic market, encompassing derivatives, aircraft leasing, ship leasing and global depositary receipts.

- By attracting foreign banks, asset managers, and insurance companies, GIFT City offers domestic BFSI players invaluable access to global expertise and extensive networks.

- GIFT City features cutting-edge physical and digital infrastructure, ensuring smooth operations and attracting top-tier talent.

- KYC and CDD regulations for foreign entities and individuals who want to invest or operate have been relaxed so that they can make investment and repatriate the funds with minimum regulatory hurdles.

- Taxation on various products has been exempted or charged at a lower rate so that financial products in GIFT City IFSC can be compared with the other International Financial Centres of the world.

- Unified regulators were established under the Act of Parliament liable to promotion, operation and management of activities in GIFT City.

- Favorable state policies and regulatory amendments have resulted in numerous opportunities for BFSI to expand and develop new businesses through cross-border trades.

Future of GIFT City and BFSI Industry

The future of GIFT IFSC holds promising growth for India as it continues to integrate seamlessly with global financial standards, fostering innovation and attracting diverse players. Simultaneously, the BFSI industry is poised for continual evolution, driven by technological advancements, regulatory adaptations, and the pursuit of financial inclusivity. Mentioned below are some of the steps that will contribute towards defining the future of GIFT City and BFSI industry:

- Transworld, Accenture, StoneX, Paytm and several international entities like sovereign fund to invest in GIFT City.

- The government of Gujarat unveiled a draft plan to expand the limits of GIFT City by three times to 3,430 acres adding the riverfront. GIFT City is being developed with an international-level retail, recreation and entertainment zone.

- Metro connectivity to GIFT City will be operational by mid-2024.

- More world class education campuses to be set up to provide global education on Indian soil.

- Nvidia announced its collaboration with Yotta Infrastructure to establish an Artificial Intelligence (AI) data center in GIFT City.

- Gujarat state government lifts liquor ban for restricted use in GIFT City

- Reserve Bank of India (RBI) to allocate IFSC codes to IBUs.

- Two Japanese banks set to start operations in GIFT City.

- IREDA gets RBI nod to setup in GIFT IFSC for green financing solutions.

Conclusion

In a nutshell, GIFT City and specifically IFSC epitomizes financial innovation and growth, aligning strategically with international standards and prioritizing transparency for India entry for global players and investors. GIFT City’s cutting-edge infrastructure fosters seamless operations, making it a hub for attracting and retaining top talent. GIFT City – India’s first Smart City and IFSC project is emerging as a dynamic catalyst, propelling the BFSI industry along with the other licenses issued by the regulators only point towards sustained growth and global prominence, marking its significance as more than just a financial center.

Why Choose InCorp Advisory?

Our team at InCorp has the expertise to offer comprehensive assistance throughout the entire process of listing companies on international exchanges in GIFT City IFSC. Below listed are the services we offer:

- Assistance in structuring the fintech as per the requirement

- Providing advisory services on regulation and taxation to ensure compliance and optimal structuring

- Assistance in preparing necessary documentation required for incorporation of fintech entities in GIFT City.

- Assistance in setting up fintech entities and post-setup requirements and compliance if any required.

To learn more about our GIFT City services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Meet Thakkar | GIFT City

Frequently Asked Questions (FAQs) About GIFT City

IFSCA implements robust regulatory frameworks and supervisory mechanisms to ensure investor protection and maintain market integrity within IFSCs. This includes stringent compliance requirements, monitoring of market activities, and enforcement actions against misconduct. IFSCs regulated by the IFSCA offer a unique combination of tax incentives, regulatory relaxations, and a business-friendly environment specifically tailored to cater to the needs of BFSI firms, making them attractive destinations for global financial activities. Yes, non-Indian entities can establish operations within IFSCs regulated by the IFSCA. These entities can benefit from the regulatory framework and incentives provided by the IFSCA to conduct various financial services activities within the IFSC ecosystem. The IFSCA collaborates with international regulatory bodies and adopts best practices to ensure compliance with international regulatory standards within IFSCs. It continuously monitors global developments and updates its regulatory framework accordingly to maintain alignment with international standards. IFSCA supports startups and emerging firms in the BFSI sector through initiatives like regulatory sandboxes, incubation programs, and facilitation of access for funding and mentorship. These efforts aim to nurture innovation and promote the growth of startups within IFSCs.

Share

Share