Legal Aspects of Cross-Border Insolvency

Legal Aspects of Cross-Border Insolvency

Cross-Border Insolvency under the IBC Code: UNCITRAL model law and implications, legal framework, significant aspects and international perspective

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

An Overview

To seek international exposure India seeks to attract foreign companies to set up manufacturing facilities in India. However, only foreign investment alone is not enough. When any company gets insolvent, India has to take all the necessary steps to protect the shareholder’s investments. Insolvency refers to a state where an organization or an individual is unable to fulfil its financial burdens. They are due against the lenders as debts.

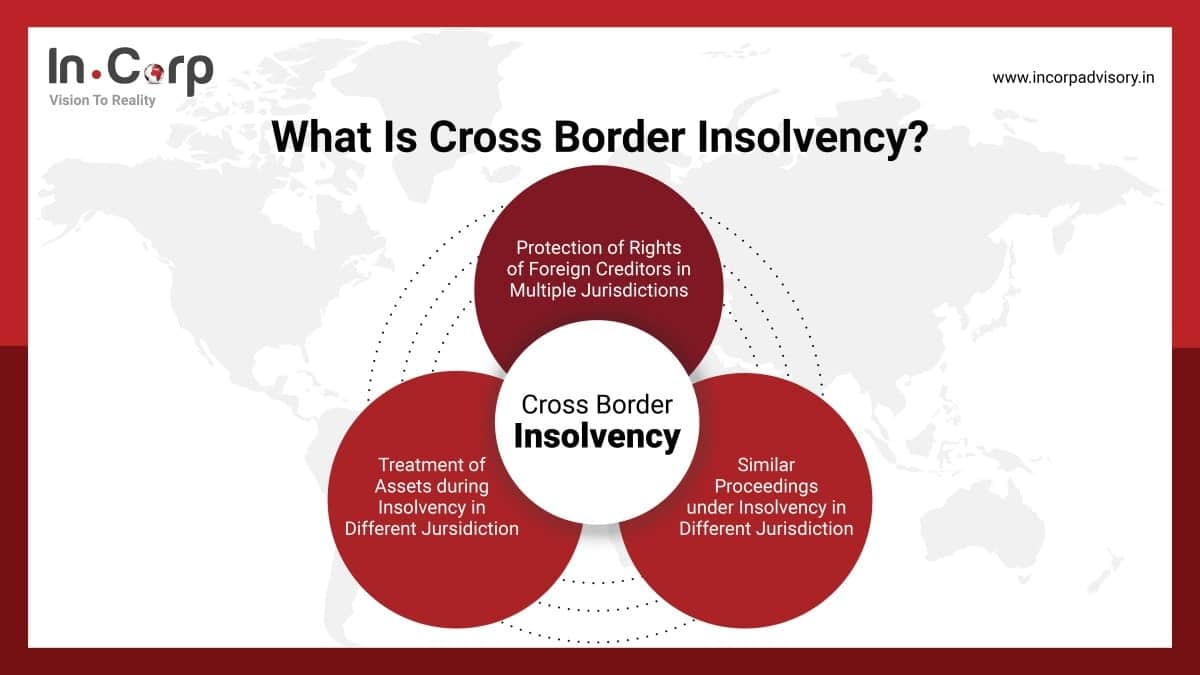

Cross-Border insolvency denotes the treatment of financially burdened debtors where:

- Their assets are in more than one country, or

- The creditors are in more than one country.

In order to assure foreign investors and to protect their rights, you need proper cross-border insolvency laws. This will ensure the foreign investors that their investments are safe in India. The Insolvency Law Committee, on the adoption of the United Nations Commission on International Trade Law Model Law (UNCITRAL Model Law) on Cross-Border Insolvency, was proposed to be added as part of the Insolvency Bankruptcy Code (IBC).

What Is Cross-Border Insolvency?

For example – Jet Airways (India) was one such case wherein Insolvency proceedings were initiated in the Netherlands and India simultaneously.

Importance of Cross-Border Insolvency

Indian law does not recognize foreign proceedings related to insolvency, such as re-organizations. Mutual (reciprocal) agreements require individual long-drawn-out negotiations with each country. Different agreements with different countries will complicate insolvency proceedings. Also, such agreements do not address issues relating to co-ordination or recognition of insolvency proceedings that have commenced in multiple jurisdictions involving various branches of a single company. In the absence of such joint agreements, there is no guidance for an Insolvency Resolution Professional to avail evidence or act concerning foreign assets.

Legal Framework for Cross-Border Insolvency Under the IBC Code?

- Currently, cross-border insolvency can be dealt with under the Insolvency Bankruptcy Code (IBC). It empowers the Central Government to enter into bilateral agreements with other countries to resolve situations about cross-border insolvency. Further, a letter of request can be issued to a court in a country where an agreement has been entered. It shall specify how one can deal with the assets situated in that country.

- The agreements under IBC will apply both when proceedings in India would require recognition, assistance, etc., abroad and vice-a-versa.

- The Civil Procedure Code and English common law principles in India will be applicable for recognising foreign proceedings. Similarly, for Indian proceedings to be recognised abroad, the procedural rules of that foreign jurisdiction will be applicable.

- Most industrialised countries have adopted the UNCITRAL Model Law. They are required to provide recognition, assistance, co-operation, and appropriate relief concerning insolvency proceedings commenced in India (except where that country has otherwise required reciprocity).

Uncitral Model and its Implications

United Nations Commission on International Trade Law (UNCITRAL) received the consent of Model Law on Cross Border Insolvency issues on May 30, 1997. It thereby was passed by the United Nations General Assembly on December 15, 1997. Countries such as the USA, Japan, UK, Australia, Canada, Mexico, and South Africa have implemented the model law into their domestic legislation.

In case of international insolvency, you need to be aware of 2 concepts:

- Main proceedings – They are initiated where the debtor has its Centre of Main Interest (COMI).

- Non-main proceedings – These proceedings may be initiated in any place where the debtor has a commercial establishment.

There is no longer a bias between local creditors over foreign creditors. It enables countries to assist insolvency officials from other countries.

Significant Aspects of UNCITRAL Model?

India will become a prime destination for foreign creditors for investment after the enactment of this model law. The three main economic benefits of the Model Law are as follows:

- Faster exchange of necessary information between countries

- Assistance and co-operation in preserving the organisation’s assets leading to successful reorganisation and

- Efficient credit recovery mechanism

- Regarding procedures followed for foreign entities, this law is much more precise than the IBC. This law is flexible as a country can change the model law according to the conditions and the local insolvency laws.

- Further, if the foreign proceedings are against the country’s public policy, then a country could refuse the validity of such proceedings.

- The UNCITRAL Model law helps coordinate between courts and insolvency professionals in both domestic and foreign jurisdictions.

What are the International Perspectives?

United States America

The USA recognizes the principle of dual citizenship for corporations. The ‘place of incorporation’ plays a vital role in determining which law has to be applied. Thus, if the branch of a company is in one place and the company is carrying out its core business operations in another place, the corporation shall be deemed a citizen of both states. For cross-border insolvency, US bankruptcy courts will recognize foreign proceedings when the conditions laid down in the Bankruptcy Code of the US are satisfied.

The code allows concurrent proceedings against the debtor once foreign proceedings are recognized.

United Kingdom

When the English Law is read with EC Regulations, the ‘Centre of Main Interest (COMI)’ plays a vital role in the proceedings. The ‘place of incorporation’ will not be a determining factor for determining jurisdiction. It has to be read conjointly with COMI. The interpretation depends upon common sense and commercial perception of judges.

UAE

UAE has not incorporated national law with UNCITRAL Model Law on Cross-Border Insolvency. Also, there are no provisions for co-operation and coordination with the courts of other jurisdictions. UAE has the civil law system and the common law systems. The UAE civil law regime does not recognize a foreign insolvency order or proceeding. Instead, they are treated as foreign judgments under the provisions of the Civil Procedures Law.

The Dubai International Financial Centre (DIFC) and Abu Dhabi Global Markets (ADGM), by contrast, have embraced the UNCITRAL Model Law on Cross-Broder Insolvency. It is incorporated with certain modifications into each of the DIFC’s and ADGM’s Insolvency Law.

Singapore

In 2013, the Insolvency Law Review Committee recommended the adoption of the model law. In three years, the model law was implemented in Singapore. Under the model law, a foreign representative can apply to the Singapore High Court to recognize foreign insolvency proceedings.

The application must be accompanied by:

- A certified copy of the decision commencing the foreign insolvency proceedings and appointing the foreign representative; and

-

- A statement identifying all insolvency proceedings in respect of the debtor known to the foreign representative.

Why Choose InCorp Global?

Cross-Border insolvency involves multiple jurisdictions and hence laws, rules, and regulations of all the jurisdictions involved need to be taken care of. We at InCorp have presence across various parts of the world including offices in Singapore, Hong Kong, Indonesia, the Philippines, and Vietnam and have domain expertise in the field of Insolvency Laws and hence are in the best possible position to guide you and support you in cases where the Corporate Debtor has a presence in multiple countries. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

InCorp Advisory | IBC

FAQs

Cross-border insolvency refers to insolvency cases that involve businesses with assets, creditors, or operations in multiple countries. It complicates the resolution process due to differing legal frameworks, requiring coordination between jurisdictions to resolve debts and assets efficiently.

Cross-border insolvency cases can be resolved under the IBC by recognizing foreign insolvency proceedings, facilitating cooperation between Indian courts and foreign jurisdictions, and ensuring that assets are managed and distributed fairly across borders.

Insolvency professionals manage cross-border insolvency cases by coordinating between different jurisdictions, helping resolve disputes, ensuring compliance with both domestic and international laws, and facilitating asset liquidation or restructuring.

Businesses can manage liabilities by negotiating with creditors across different jurisdictions, adhering to international legal agreements, and working with insolvency professionals to ensure fair treatment of creditors and an efficient resolution of the insolvency process.

The UNCITRAL Model Law on Cross-Border Insolvency provides a framework for international cooperation in insolvency cases, allowing for the recognition of foreign insolvency proceedings and the efficient resolution of cross-border disputes.

Share

Share