ESG Risks: Role of Management and Advisory in Mitigation

ESG Risks: Role of Management and Advisory in Mitigation

Insights on emerging risks and strategic solutions: Expert advisory on navigating challenges, driving sustainability and long-term success

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

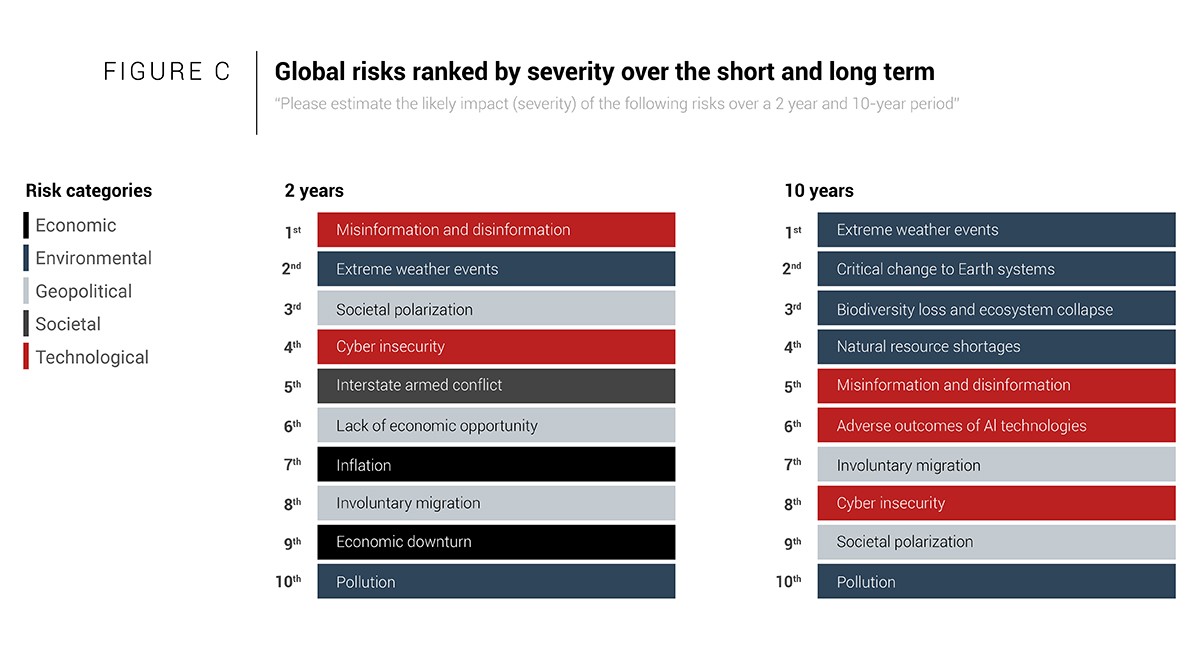

Environment, Social and Governance (ESG) factors are linked to 7 out of the top 10 global risks by impact over the next 10 years according to the World Economic Forum’s (WEF) Global Risks Report 2024. Regulatory bodies around the world are moving quickly towards a low-carbon and circular economy in light of the Paris Climate Agreement and the UN 2030 Agenda for Sustainable Development. Advancements like these have brought ESG risks to the forefront for both stakeholders and businesses. In this blog, we will explore ESG risks in detail and the step-by-step framework to mitigate ESG risks, helping you safeguard your business.

Change in Risk Map

Extreme weather events and biodiversity loss among long-term risks, highlight the global shift towards ESG risk landscape. Inflation and economic downturns are in the top 10 short term risks but interestingly none of the economic risks are in the top 10 long-term risks. This suggests that the definition and assessment of future risks may change. Based on this study, considering the global trends, we can reasonably conclude that traditional economic metrics may no longer be the only measure of future sustainability and success.

Source: World Economic Forum

Source: World Economic Forum

ESG Risks and its Types

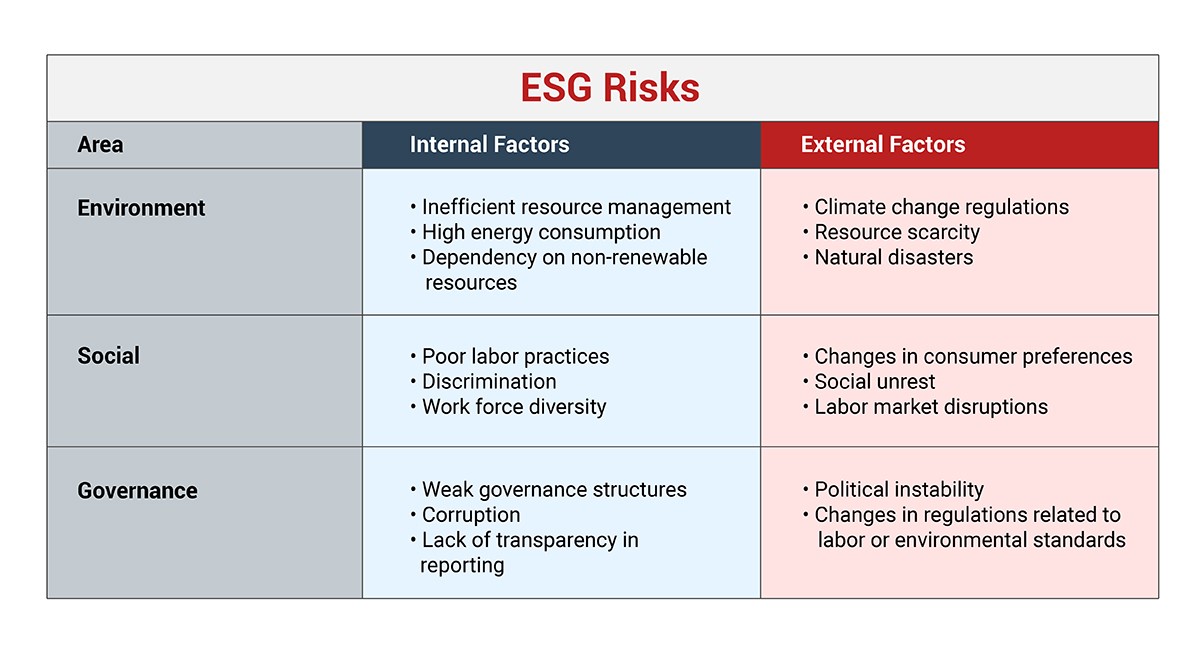

ESG risks refer to the possible negative impacts that environmental, social and governance concerns may have on an organization’s long-term viability and overall performance. ESG is no longer a standalone concern, but a tool used by investors, regulators, and other stakeholders to assess businesses. This shift in perspective has led to a new type of risk called ESG risk. It is important to note that today, these risks are driving major investment decisions of stakeholders globally.

Where do ESG Risks Arise?

ESG risks can arise from both the internal and external environments of the business. Some of the internal and external factors contributing to ESG risks are tabulated below:

Double Materiality: A Holistic view of ESG Risks and Impact

Double materiality considers a broader and dual perspective on ESG impacts. It considers that ESG risks not only affects the business’ financial performance but also the broader environmental and social well-being. In the past, entities only focused on the financial aspect of ESG and how it would impact their bottom line. Double materiality goes beyond that. It recognises that these factors not only affect the entity’s financial health but also have wider implications for stakeholders and the global ecosystem. This means decision makers need to consider both financial and non-financial perspectives in decision making and stakeholder engagement. By adopting double materiality, entities can get a comprehensive view of ESG risks and opportunities.

Mitigating ESG Risks

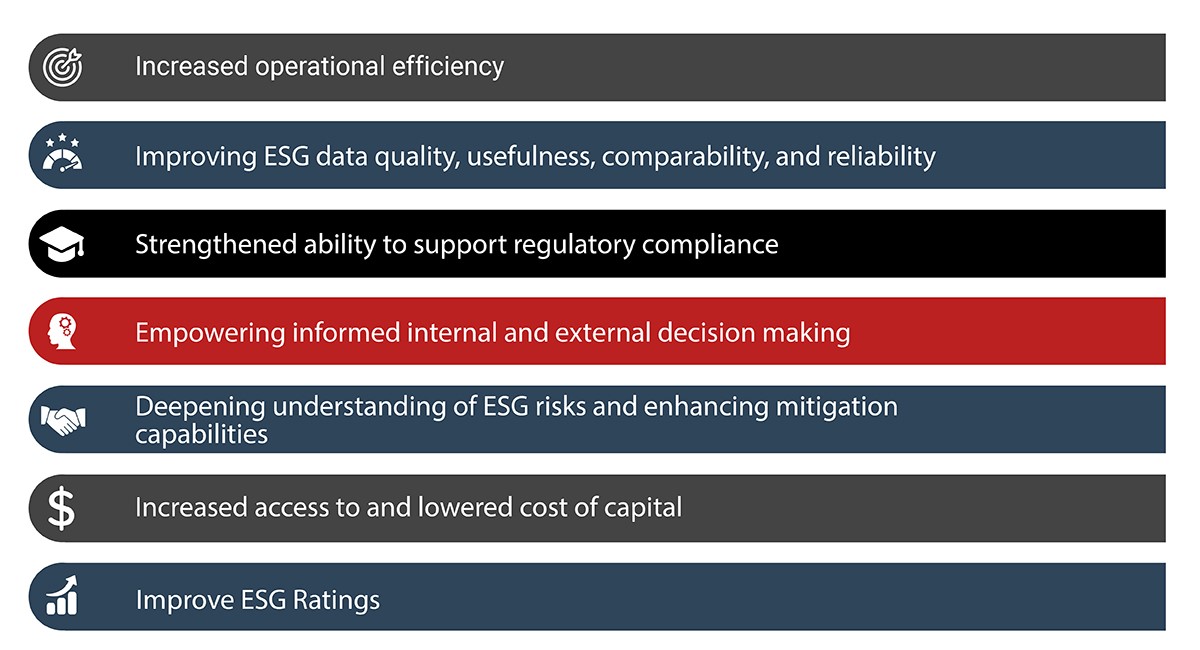

Companies will need to identify and manage their ESG risks to protect their long-term existence, financial performance and reputation. Having robust internal controls for material sustainability data is the key. A company needs to implement internal processes to manage ESG risks so it can harvest the benefits that follow.

Benefits of Implementing Internal Processes to Manage ESG Risks

Steps to Mitigate ESG Risks

The mitigation process entails the following:

- Risk Assessment: Accurately identify the actual and potential ESG risks that apply to your industry, operations, and stakeholders. This involves examination of the environmental footprint, social dynamics, and governance structures of your business activities.

- Stakeholder Engagement: Engage internal and external investors, employees, customers, suppliers, communities, regulators to take cognizance of their ESG expectations and concerns. Clearly outline communication channels to address them effectively.

- ESG Integration: Inculcate considerations of ESG into corporate strategy and risk management frameworks across various levels in the organization.

- Design and Implement Internal Controls

- Data Collection and Reporting: Develop Standard Operating Procedures (SOPs) for data collection and reporting of ESG Key Performance Indicators (KPIs). Track KPIs relating to carbon footprint, diversity and inclusion, employee well-being and policy readiness, among other applicable measures.

- Risk Mitigation Strategies: Formulate and implement mitigation strategies to address identified ESG risks by adopting business practices in a manner that ensures sustainability and integration into the company-wide risk management framework.

- Internal Assurance Mechanisms: Institute internal assurance through audits, management reviews, and ESG-specific assessments on the effectiveness of your ESG risk management to identify breaches, strengthen controls, and assure overall performance enhancement.

- Target setting and Monitoring: Set ESG goals and targets that align with your organization’s vision. Ensure the targets are SMART – Specific, Measurable, Achievable, Relevant, and Time-bound. Regularly monitor performance against these targets and benchmark it against industry peers. Continuous improvement should be a core mantra.

- External Assurance and Certification: Avail external assurance from reputed third-party providers on ESG performance and practices. It instils a sense of trust and credibility amongst stakeholders.

Role of Advisory in Managing ESG Risks

The emerging trends of using technology and data analytical platforms have brought a revolution in risk management. Indeed, today businesses can track the ESG risks and performance in real-time through the support of the data platforms and different high-tech solutions. Among these revolutions and innovations, modern advisory services stand at the frontline. Advisors not only bring subject matter acumen but also help businesses leverage technology to manage ESG risks effectively. The future of risk management lies in adopting balanced and holistic risk management strategies that address both financial and non-financial well-being of business. This will ensure long term sustainability of business.

However, according to the 2023 ESG Maturity Benchmarking report by Audit Board, two-thirds of organizations worldwide have not yet established ESG controls and 60% do not perform internal ESG audits. This proves that the road ahead will indeed be tough if ESG risks are not managed appropriately.

Conclusion

Considering the present global scenario, ESG risks have now become an integral part of an entity’s Risk Management Framework. Like any risk, their management calls for foresight and professional advice. Their knowledge can be used as a means of prioritizing material ESG risks, identifying KPIs, helpful in value creation and sustainable growth. ESG Risk Management is a journey. Partnerships with experts and the use of a flexible yet comprehensive approach go a long way toward mitigating ESG risks while remaining agile for evolving expectations. This proactive strategy is a long-term value generator that unleashes the full potential of ESG – risk management.

Why Choose InCorp Global?

We at InCorp provide services relating to ESG and risk management all under one roof. Our experienced team undertakes comprehensive assessments to identify potential ESG-related risks and opportunities. With our customized solutions we can help you achieve your sustainability goals. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Muskaan Jain | ESG & Sustainability

Frequently Asked Questions

ESG risks refer to the possible negative impacts that environmental, social and governance concerns may have on an organisation’s long-term viability and overall performance.

ESG risks typically address non-financial factors that can still have financial implications, such as climate change, resource scarcity, and unethical governance. Traditional business risks, on the other hand, focus primarily on financial aspects and operations, such as market competition, cost management, and supply chain disruptions.

- Conduct risk assessment to identify actual and potential ESG risks

- Engage stakeholders to take cognizance of their expectations and concerns

- Integration of ESG considerations into corporate strategy.

- Develop standard procedures for ESG data collection and reporting

- Formulate and implement risk mitigation strategies for identified risks

- Conduct Internal audit and reviews

- Set SMART ESG goals and targets. Regular monitoring

- Obtain external assurance and certification as needed

In addition to reputational value, ESG risks are also relevant from a financial standpoint for investors. Investors consider ESG performance in their decision making because subpar practices in these areas could indicate potential economic losses.

Regulatory and legal actions, damaged stakeholder trust, higher capital costs, operational disruptions, and loss of business or foreign market share are some of the real consequences businesses face if they ignore ESG risks. In the long term, neglecting ESG risks can reduce a company’s competitiveness and hinder its ability to attract investors.

Share

Share