Portfolio Management Services in GIFT: Framework and Benefits

Portfolio Management Services in GIFT: Framework and Benefits

IFSC provides competitive cost of operations with tax benefits, single-window clearance, and relief under various company law provisions.

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

In April 2015, the Government of India (GoI) opened India’s first International Financial Service Centre (IFSC) at GIFT City in Gujarat. An IFSC provides the very competitive cost of operations with various tax benefits, single-window clearance, and relief under various company law provisions. SEBI announced that asset managers can offer portfolio management services (PMS) in IFSC. In this article we discuss the criteria for establishing a PMS in IFSC. Continue reading to know more about the benefits of registering a PMS in IFSC.

An Overview

A portfolio manager (PM) is a legal entity that, under the terms of a contract with a client, advises, directs, or conducts the management or administration of the client’s portfolio of securities, assets, or funds (whether as a discretionary portfolio manager or otherwise). The above mentioned services are known as portfolio management services (PMS). The Indian government publishes various guidelines to promote these services and regulate the PMS in IFSC. These include permissible investors, permissible investments, and costs for IFSC registration.

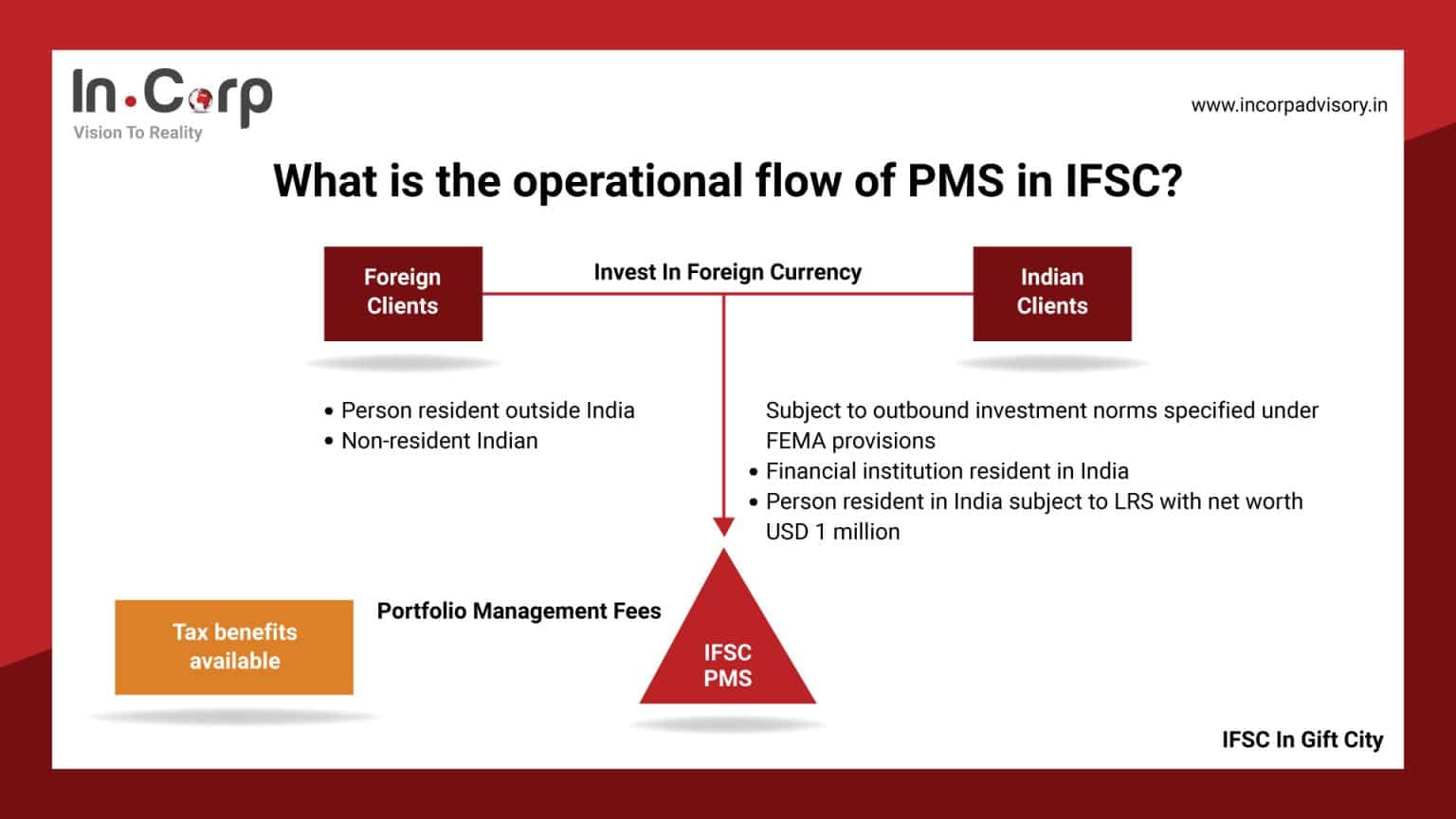

What is the Operational Flow of Portfolio Management Services in IFSC?

*LRS – Liberalised Remittance Scheme

What is the process flow for Registering an Portfolio Management Services in IFSC?

What is the Framework of Portfolio Management Services in IFSC?

We have detailed the framework of PMS below:

1. Regulatory Framework

- PMS Regulations apply as it is to all IFSC portfolio managers (IFSC PM) subject to SEBI (IFSC) Guidelines, 2015.

2. Structuring

- SEBI-registered intermediaries or international associates (by establishing a branch) may function as PM in IFSC with SEBI’s prior approval.

- If the PM is formed up as a subsidiary, the subsidiary must meet the net worth requirements.

- If the subsidiary fails to meet the standards, the parent company’s net value will be taken into account.

3. Net Worth

- In the IFSC, the minimum net worth for a PM is USD 750,000. In the case of a branch, the parent must meet the required net worth.

4. Certificate Requirement

- Non-resident principal officers and employees with decision-making capacity must be certified by organisations recognised by the Financial Markets.

5. Regulator in Foreign Jurisdiction

- In the Indian securities market, NISM (National Institute of Securities Markets) certification is required.

6. Manpower Requirement

- In case of IFSC PM, exclusive manpower shall be allocated for providing portfolio management services from an IFSC branch.

7. Ring-fencing

- Legally, financially, operationally, and technologically, the parent corporation must separate its domestic operations from its IFSC branch operations.

- The parent company is responsible for ensuring that the branch – PM entity in the IFSC complies with the applicable law.

8. Qualification requirement

- Any other organisation, institution, association, or stock exchange recognised or authorised by a financial market regulator in that foreign jurisdiction must certify principal officers and decision-making personnel who are based outside of India.

9. Certification Requirement

- A NISM certification is mandatory in case of the above deal in Indian securities markets.

10. Segregation of Funds

- PM operating in IFSC shall keep the funds of all clients in a separate account to be maintained by them in the IFSC Banking Unit (IBU) as permitted by RBI.

11. Registration Fees

- The application fee is USD 1,500, while you do have to pay an one-time registration fee of USD 15,000 for your new registration

- There is a fee of USD 10,000 every five years for post registration for all registered entities.

What are the Advantages for Portfolio Management Services Registered in GIFT City IFSC?

In comparison to regular PMS registered elsewhere, PMS registered under GIFT City received a variety of privileges. The following are a few advantages:

Investment Opportunities

PMS in IFSC can provide services only to:

- Non-resident Indian.

- Person resident outside India.

- Resident financial institution resident eligible under FEMA to invest funds offshore,

- Person resident in India, to invest funds offshore as per criteria laid down under FEMA regulations.

Note: PMS operating in the IFSC must accept funds or securities worth at least USD 70,000 from the client.

India’s two main stock exchanges, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) have established international exchange and clearing organizations at the GIFT IFSC. The exchanges offer over 140 trading goods, allowing international investors and non-resident Indians to trade from anywhere in the world.

Portfolio Management Services – PMS incorporated in GIFT City IFSC is allowed to invest in following securities:

- Securities Listed in GIFT City- IFSC

- Securities issued by Companies incorporated in GIFT City – IFSC

- Securities issued by Companies incorporated in India or foreign jurisdiction

PMS registered in IFSC of GIFT City can invest in India using the following methods:

- Foreign venture capital investment (“FVCI”) route

- Foreign portfolio investor (“FPI”) route

- Foreign direct investment (“FDI”) route.

Taxation benefits

- Business income for the first ten years of the first fifteen years of the tax vacation u/s 80LA of the Income Tax Act of 1961. Business revenue earned by PMS registered elsewhere in India, on the other hand, is taxable.

- At 9% of book earnings, the Minimum Alternate Tax (MAT) / Alternate Minimum Tax (AMT) is applied. However, only companies opting for the previous tax scheme are subject to the same rules.

- Transactions carried out on IFSC exchanges by registered PMS are exempt from STT, CTT, and stamp duty.

- There is no GST on services received by IFSC units or supplied to IFSC units, or on services provided to offshore clients.

Operational Benefits:

- Lower operational costs as a result of Gujarat government’s subsidies

- Abundance of skilled labor,

- Easy access to onshore market,

- Infrastructure of the highest quality, unmatched connection, and transportation accessibility

- IFSC provides access to a variety of markets.

Exempt from compliance under Companies act:

- For the first five years after the start of business in GIFT City IFSC, CSR (corporate social responsibility) rules are not applied.

- Resident director is required only after the first year of incorporation.

- Internal audit provisions are only applicable if they are included in the company’s AOA (Articles of Association).

- There is no need to form an Audit Committee, Nominations Committee, or Remuneration Committee.

- Managerial compensation is not subject to any restrictions.

- There is no requirement for an IFSC company to follow the same fiscal year as its holding company.

Conclusion

The Indian government and all the regulatory agencies have been working to enable GIFT City to offer a business and regulatory environment that is comparable to other leading IFCs. While the world has witnessed the growth of international financial hubs such as London, New York, Hong Kong, Singapore and Dubai, the time is now ripe to enhance capital flows through the GIFT City in India. The IFSC in GIFT City provides numerous benefits to the entities setting up operations there, some of the benefits include, a state-of-the-art infrastructure at par with other leading global financial centres, a liberal tax regime and a strong regulatory and legal environment.

Why Choose InCorp Advisory?

InCorp’s Advisory and Taxation Team provides seamless support with entity incorporation in GIFT City, and related compliance and advisory services. We shall ensure an efficient company incorporation and timely compliance with all applicable GIFT City rules and regulations. We shall provide customized solutions after analyzing applicable operational, commercial, and taxation benefits in GIFT City. To learn more about ESG services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

FAQs

Portfolio Management Services (PMS) is a professional financial service in which a portfolio of stocks is managed by qualified portfolio managers and stock market professionals with the support of a research team.

PMS registered in GIFT City- IFSC are regulated by both GIFT City Regulations and SEBI (Portfolio Managers) Regulations 2020.

Yes, PMS registered in GIFT City -IFSC are required to comply with all the Income tax compliances as mandatory for general PMS.

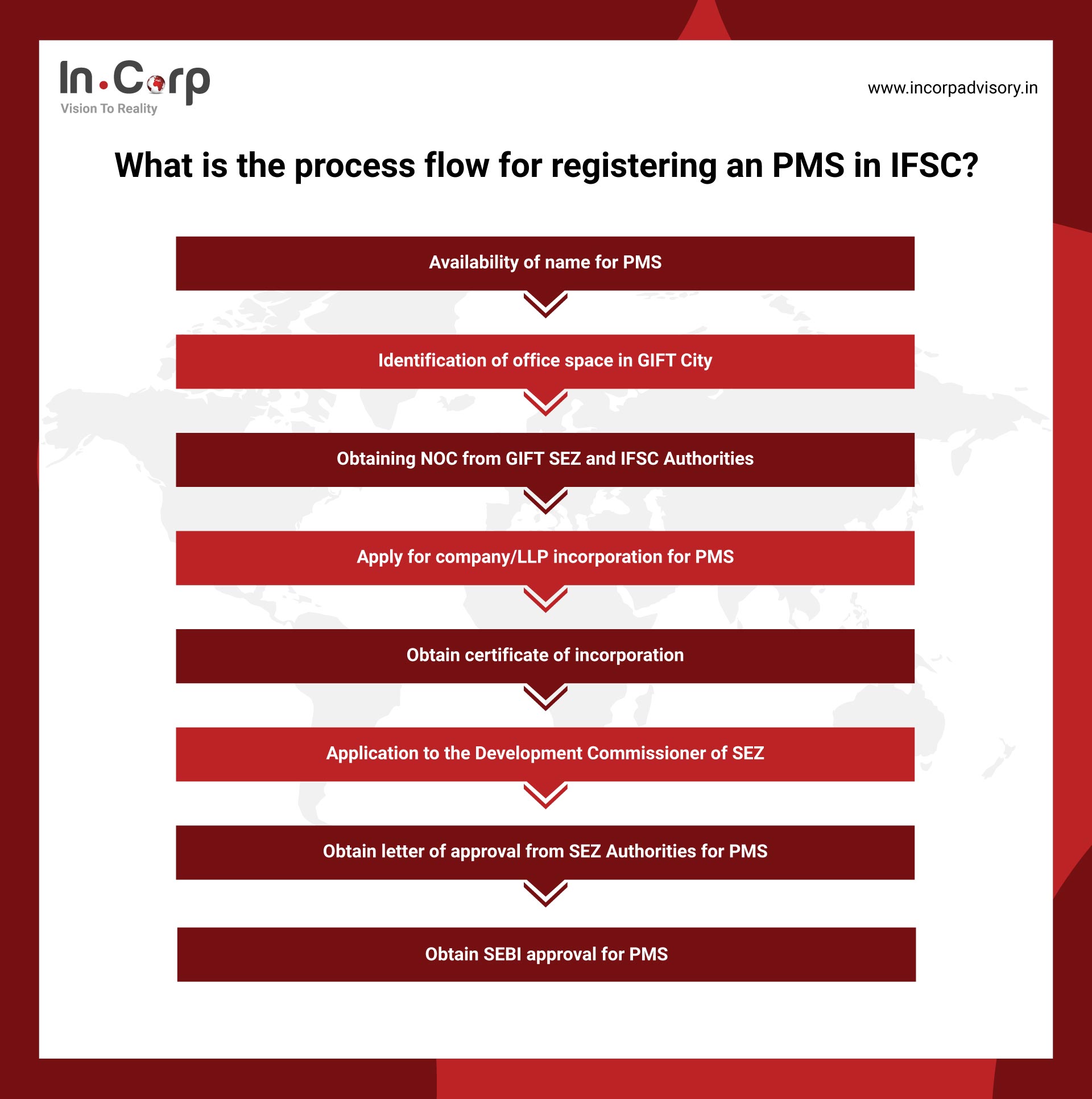

Yes, approval is required from following authorities:

- IFSC authorities

- SEZ authorities

- SEBI (PMS) Regulations, 2020

Share

Share