Transfer Pricing: Meaning, Objective, Benefits, and Applicability

Transfer Pricing: Meaning, Objective, Benefits, and Applicability

All about Transfer Pricing methods: Know different approaches used with illustration and examples

- Last Updated

A transfer price arises for accounting and taxation purposes when related parties, such as divisions within a company or a company and its subsidiary, report their own profits. When these related parties are required to transact with each other, a transfer price is used to determine costs. Transfer prices generally do not differ much from the market price.

Transfer price is a price that represents the value of goods or services between independently operating units of an organization whereas transfer pricing refers to prices of transactions between associated enterprises that may take place under conditions differing from those taking place between independent enterprises.

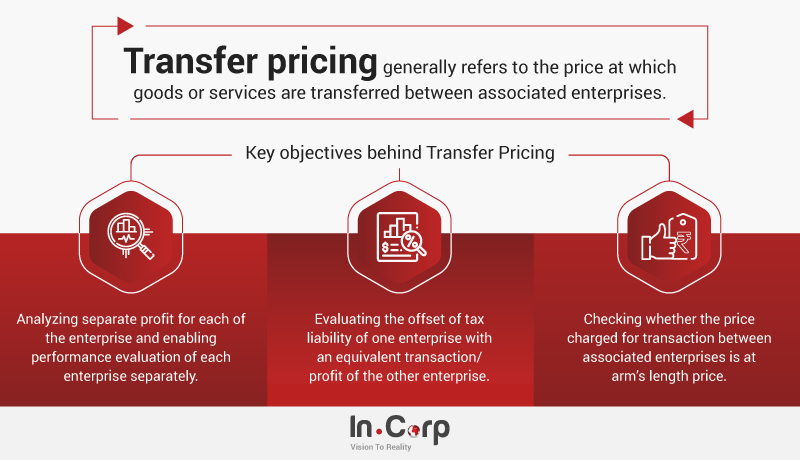

Transfer pricing generally refers to the price at which goods or services are transferred between associated enterprises. These transactions can include sales of products, provision of services, lending of money, and use of (intangible) assets. Thus, the effect of transfer pricing is that the parent company or a specific subsidiary tends to produce insufficient taxable income or excessive loss on a transaction. For instance, profits accruing to the parent can be increased by setting high transfer prices to siphon profits from subsidiaries domiciled in high-tax countries and low transfer prices to move profits to subsidiaries located in a lower-tax jurisdiction.

To simplify, the prices and conditions applied between related parties under the transfer pricing policy should be appropriate within the range of prices and conditions charged between independent companies.

What is the objective of Transfer Pricing?

Associated Enterprise is an enterprise that participates in or in respect of one or more persons who participate, directly or indirectly, or through one or more intermediaries, in the management, control, or capital of the other enterprise.

Arm’s Length Price refers to the price that should have been charged between related parties had those parties not been related to each other.

Constituent Entity can be defined as the following :

- Any entity of the international group that is included in consolidated financial statements for financial reporting purposes or included if equity share of any entity of the group were to be listed.

- Or any entity of the group which is excluded from consolidated financial statements based on size or materiality.

- Or any permanent establishment of an entity of the group if separate financial statements are prepared for financial reporting, regulatory, tax reporting, or internal management control purposes.

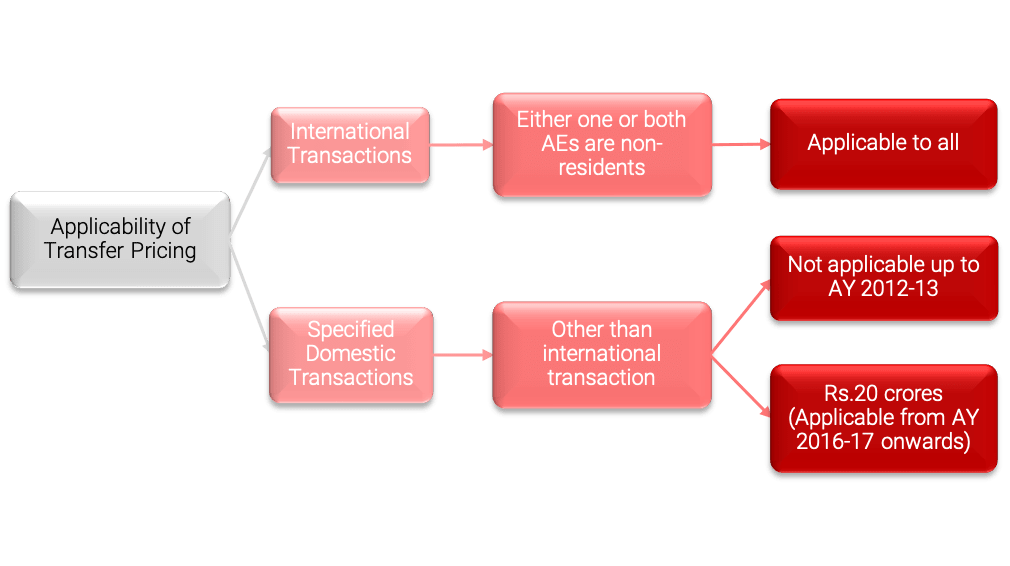

Part 1: Applicability and Scope of Transfer Pricing

1. Which transactions are subject to transfer pricing regulations?

2. Which transactions are covered under transfer pricing?

Following transactions are covered under Transfer Pricing:

| International Transactions | Specified Domestic Transactions |

|---|---|

| • Sale of finished goods | • Purchase of raw material or fixed assets |

| • Sale or purchase of machinery or intangibles | • Reimbursement of expenses paid/received |

| • IT enabled services | • Support services |

| • Software development services | • Technical service fees |

| • Management fees | • Royalty fee |

| • Corporate guarantee fees | • Loan received or paid |

| • Any expenditure with respect to which deduction is claimed while computing income like rent, interest paid, technical fees paid, etc. | • Any transaction related to businesses eligible for profit-linked tax incentives, for example, infrastructure facilities and SEZ units |

| • Transfer of goods from the eligible business of assessee to the non-eligible business of assessee or to a person related to assessee |

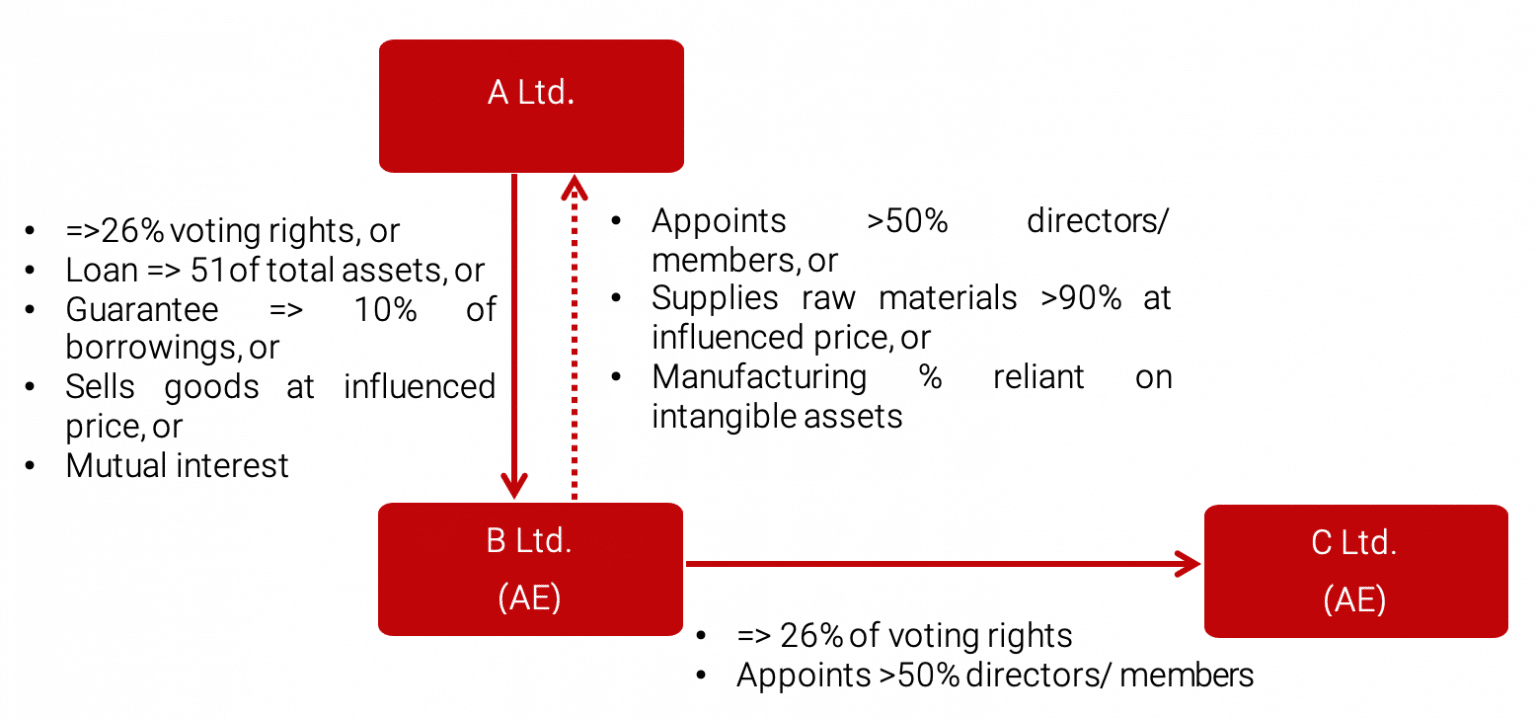

3. What are the various types of deemed Associated Enterprise (AE)?

In the case of A Ltd., the following will be associated enterprise if:

- A Ltd. holds => 26% voting power in B Ltd. Further, B Ltd. holds => 26% voting power in C Ltd.

- A Ltd. gives loan to B Ltd. => 51% of the book value of total assets of B Ltd.

- A Ltd. guarantees => 10% of the total borrowings of B Ltd.

- B Ltd. appoints > 50% of directors/members of the governing board or one or more executive directors of A Ltd.

Further, C Ltd. appoints > 50% of directors/ members of the governing board or one or more executive directors of B Ltd.

- Manufacturing of goods of A Ltd. is wholly reliant on intangible assets of B Ltd.

- B Ltd. supplies > 90% of raw materials to A Ltd. for manufacturing where the price is influenced by B Ltd.

- A Ltd. sells goods to B Ltd. at the price decided by B Ltd.

- A Ltd. and B Ltd have a mutual interest.

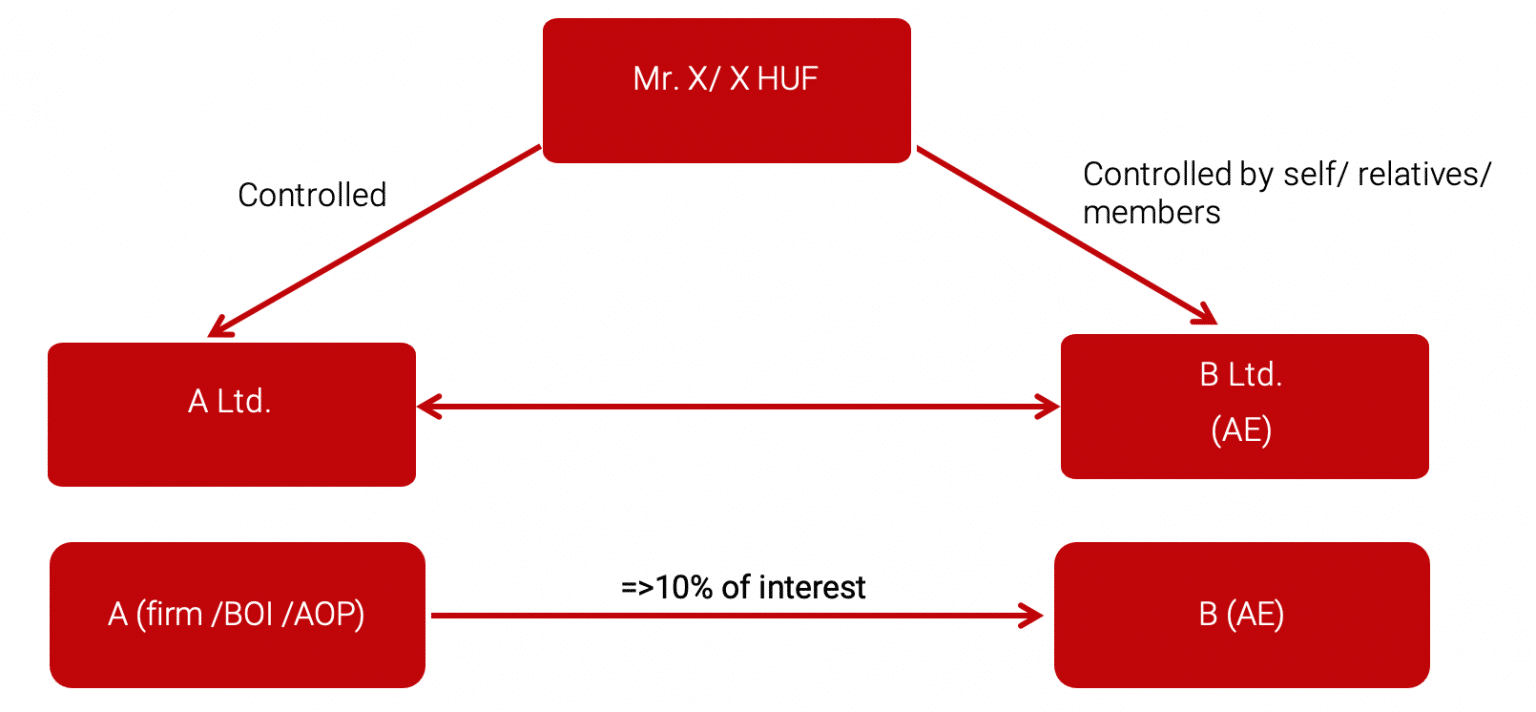

- A Ltd. is controlled by Mr. X/HUF and B Ltd. Is controlled by Mr. X/HUF or relatives of Mr. X/HUF.

- A (firm/AOP/BOI) =>10% of interest in B

For example,

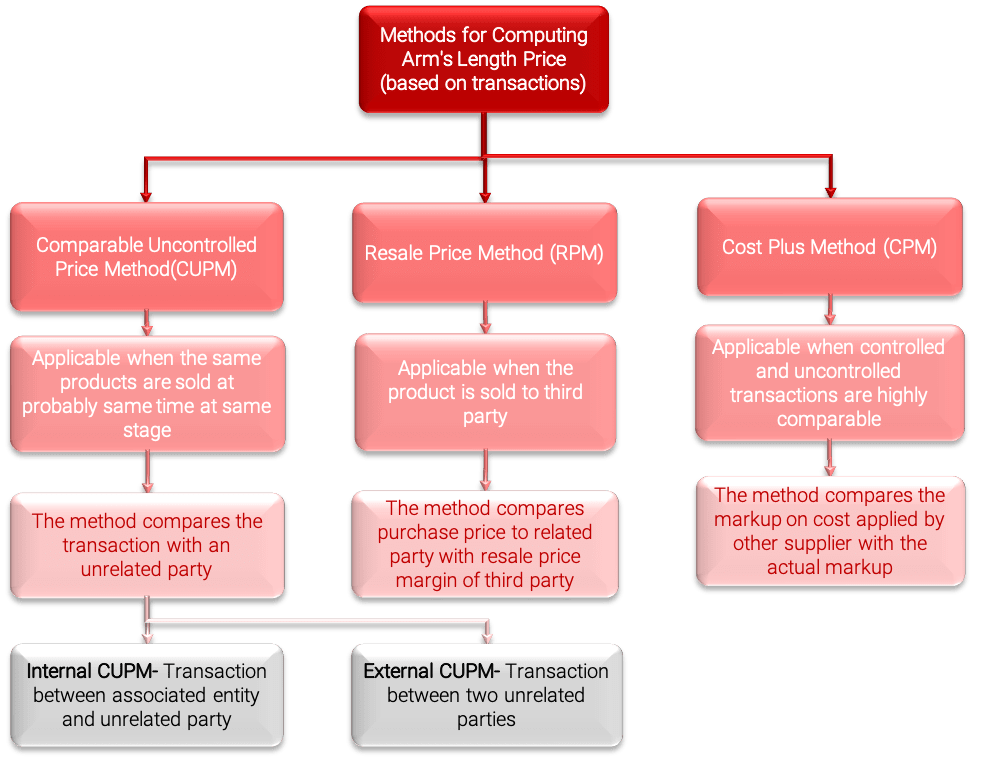

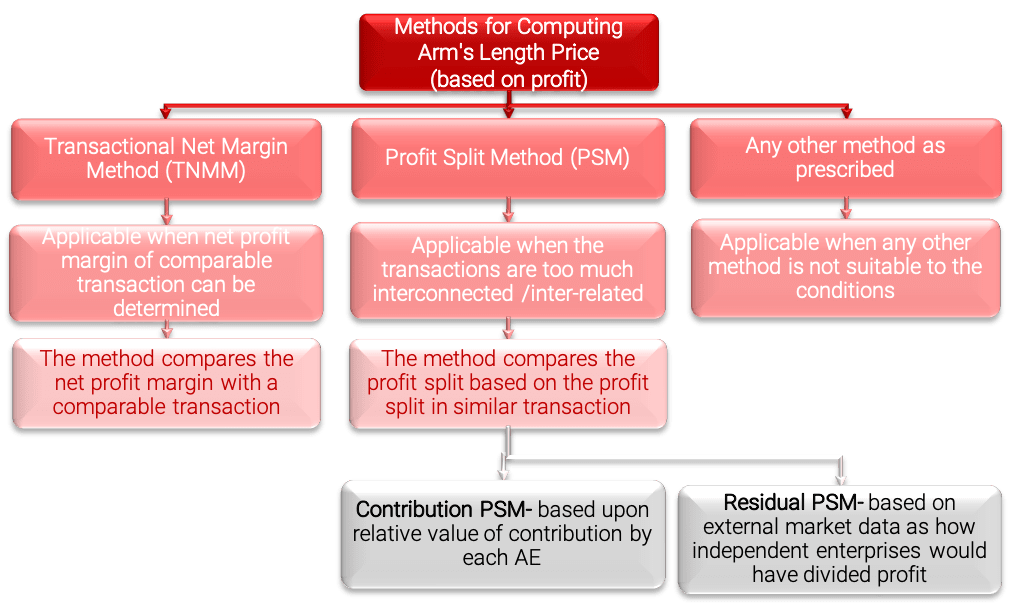

Part 2: Methods for Computing Arm’s Length Price

1. What are the methods to compute Arm’s Length Price?

The various methods for computing Arm’s Length Price are as follows:

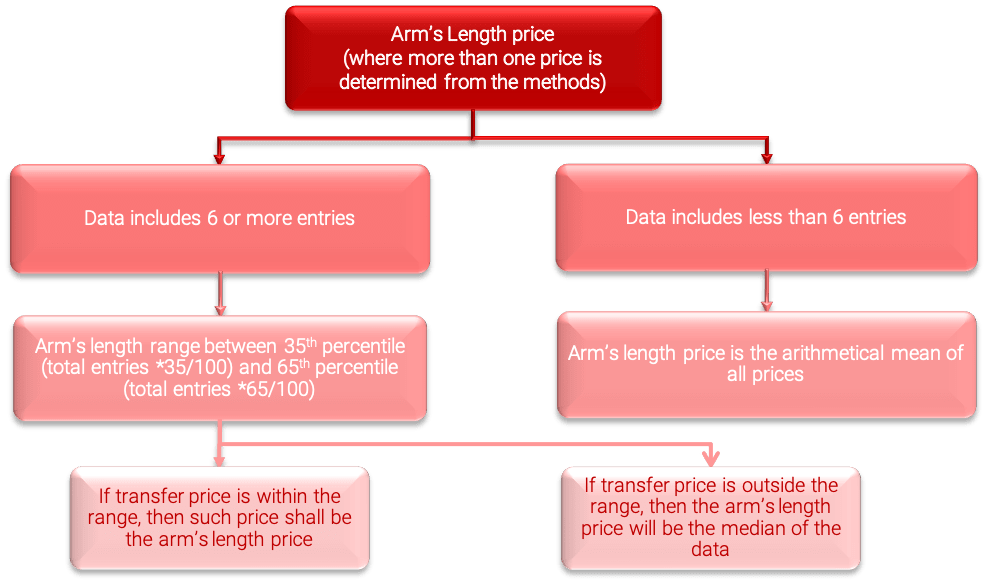

2. What will be the ALP when more than one price is determined from the methods?

Note: If the variation of arm’s length price does not exceed 1% in case of wholesale trading and 3% in other cases, such transfer price will be deemed to be arm’s length price as per Rule 10CA of Income Tax Rules.

Wholesale trading means the transaction of trading in goods where purchase cost is 80% or more of the total cost and average monthly closing inventory is 10% or less of the sale of such goods.

Illustration:

X Ltd. manufactures engineering goods, Y Ltd. (unrelated party) also manufactures similar grader as compared to that of X Ltd. Z Ltd. is the associated enterprise of X Ltd.

Determine the best suitable method and the arm’s length price of X Ltd for the following transactions.

| Sr. No. | Nature of Transaction | Method Applicable | Arm’s Length Price |

|---|---|---|---|

| 1 | X Ltd. sold the grader to Z Ltd. and either X Ltd. or Y Ltd. sold the grader to a third party. | CUPM | • Internal CUPM- Price charged by X Ltd. to the third party

• External CUPM- Price charged by Y Ltd. to the third party |

| 2 | X Ltd. had purchased the grader from Z Ltd. and sold the grader to the third party. | RPM | The purchase price derived after considering the resale price margin of the transaction with the third party |

| 3 | X Ltd. sold grader to Z Ltd. and mark-up on the cost charged by Y Ltd. on the transaction with a third party is determined. | CPM | The price after adding the markup percentage applied by Y Ltd. on the cost base. |

| 4 | X Ltd. sold grader to Z Ltd. and the net profit margin charged by Y Ltd. is available. | TNMM | The price after applying the same net profit margin applied by Y Ltd. |

| 5 | X Ltd. and Z Ltd. are into a joint venture for manufacturing graders. | PSM | Split the profit on the basis of profit divided between Y Ltd. and the third party. |

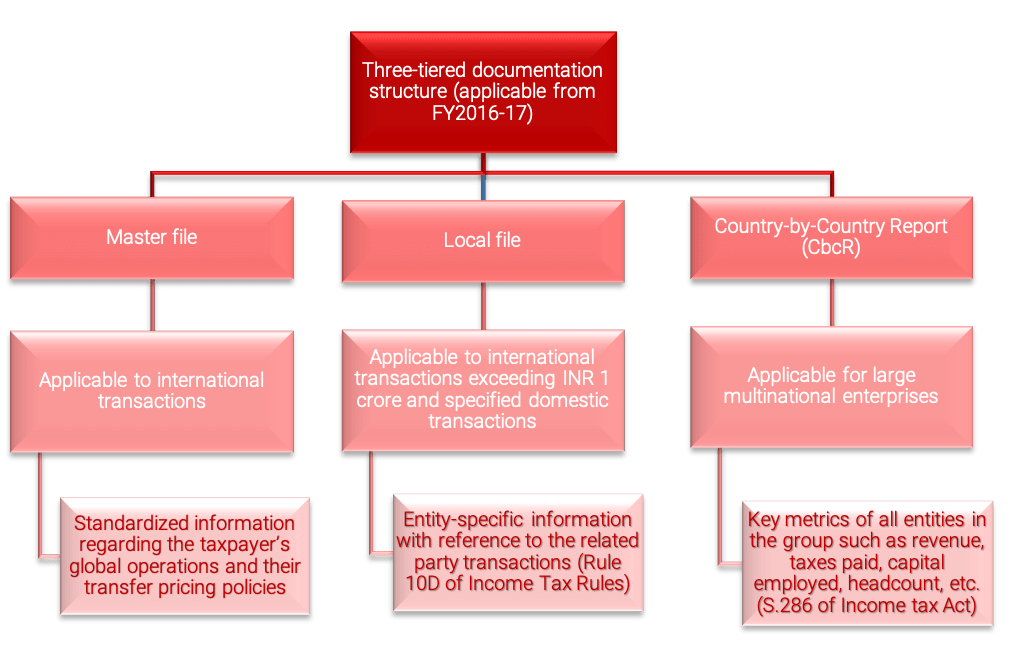

Part 3: Documentation and Compliance

1. What is the documentation structure under transfer pricing?

2. What are the documents required to be maintained?

Information and documents to be maintained as per Rule 10D of Income Tax Rules

| Basic Documents | Supporting Documents |

|---|---|

| • Details of ownership structure of the enterprise

• Profile of the group in which the enterprise is a part • Business overview of the taxpayer and associated enterprises • Details of the transaction (name of the associated enterprise, nature, terms, quantity, value) • Description of functions performed, risk assumed, assets employed • Record of relevant financial forecasts/ estimates made, economic analysis and budgets • Details of the uncontrolled transaction (nature, terms, conditions, analysis to evaluate comparability) • Details of the method selected for determining the arm’s length price • Record of actual working, assumptions, policies for determining arm’s length price • Details of adjustments, if any, made to the transfer price |

• Government’s publications, reports, databases and studies

• Reports of market research studies and technical publications • Price publications including stock exchange and commodity market quotations • Published accounts and financial statements of the associated enterprises • Agreements and contracts entered into with associated enterprises or with unrelated enterprises • Letters and other correspondence documenting any terms negotiated with the associated enterprise • Documents normally issued in connection with various transactions under the accounting practices followed |

3. What is Safe Harbour and its applicability?

- “Safe Harbour” means circumstances under which the Income Tax Authorities shall accept the transfer pricing declared by the assessee.

- Safe Harbour Rules were applicable from AY 2013-14 and the rules were revised from AY 2017-18.

- Eligible transactions to apply under safe harbour rules are:

| International Transactions | Specified Domestic Transactions |

|---|---|

| • Provision of software development services

• IT services • Knowledge process outsourcing services • Provision of intragroup loans • Provision of corporate guarantees • Manufacture and export of auto components • Receipt of low-value intragroup services • Provision of contract R&D services relating to software development or generic pharmaceutical drugs |

• Supply of electricity

• Transmission of electricity • Wheeling of electricity • Purchase of milk or milk products by a co-operative society from its members |

4. Which forms are required to be filed under transfer pricing?

| Forms | Particulars | Applicability | Timeline |

|---|---|---|---|

| Local file | |||

| 3CEB | Report from the accountant relating to the transaction | Every entity having international or specified domestic transaction | By 31st October of the assessment year |

| – | Transfer Pricing Study Report | Every entity having international transaction where the value exceeds INR 1 crore and eligible specified domestic transactions | By 31st October of the assessment year |

| Master file | |||

| 3CEAA

(Part A) |

Basic details of the international group and constituent entity by constituent entity | Every constituent entity having international transaction | By 30th November of the assessment year |

| 3CEAA

(Part B) |

Master file information that provides an overview of the international group’s business operations and transfers pricing policies by constituent entity | Consolidated revenue of international group exceeds INR 500 crores; and

The aggregate value of the international transaction exceeds INR 50 crores, or Aggregate value of international transaction pertaining to intangible property exceeds INR 10 crores |

By 30th November of the assessment year |

| 3CEAB (Intimation) | Intimation for filing Form 3CEAA by constituent entity | In case, multiple constituent entities resident in India. | By 31st October of the assessment year |

| Country by Country reporting | |||

| 3CEAC | Intimation of details of parent entity/alternate reporting entity not resident in India by Constituent entity | Consolidated revenue of international group exceeds INR 5,500 crores | By 31st January of the assessment year |

| 3CEAD | Report by a parent entity or the alternate reporting entity resident in India | 12 months from the end of the reporting accounting period | |

| 3CEAE | Intimation on behalf of the international group – no agreement for the exchange of CbCR by Constituent entity | By 31st January of the assessment year | |

| Safe Harbour rules | |||

| 3CEFA/ 3CEFB | Application for opting for safe harbour in respect of international transaction/ specified domestic transaction | Every entity having eligible international transaction under safe harbour rules | By 30th November of the assessment year |

5. What are the penalties in case of non-compliance?

| Particulars | Section | Penalty |

|---|---|---|

| Under-reporting of income | 270A(7) | 50% of the tax payable on under-reported income |

| Misreporting of Income | 270A(8) | 200% of the tax payable on misreported income |

| Failure to maintain transfer pricing documents or furnishing incorrect information or document | 271AA(1) | 2% of the value of the transaction |

| Failure to furnish master file

(Form 3CEAA, 3CEAB) |

271AA(2) | INR 5,00,000 |

| Failure to furnish the Accountant’s Report

(Form 3CEB) |

271BA | INR 1,00,000 |

| Failure to furnish transfer pricing documentation to the Transfer Pricing Officer | 271G | 2% of the value of the transaction |

| Failure to furnish CbCR report (Form 3CEAC, 3CEAD, 3CEAE) | 271GB | Up to 1 month- INR 5,000 per day |

| > 1 month- INR 15,000 per day |

Why choose InCorp Global?

At InCorp, our team provides seamless support with advisory services. Our experts will assist you in complying with all the applicable laws and framework thereafter. Explore all our tax services and feel free to get in touch with our experts today. To learn more about services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

FAQs

Our View: Since A Ltd. holds more than 26% of voting rights in B Pte.Ltd. (i.e. 49%), B Pte. Ltd. will be considered as an associated enterprise of A Ltd. Since C Ltd. appointed more than one executive director of A Ltd., A Ltd. and C Ltd. are associated enterprises.

Our View: A Ltd. and B Pte. Ltd. are associated enterprises and B Pte. Ltd is a foreign company providing IT services that are covered under the scope of transfer pricing. Therefore, the transaction between A Ltd. and B Pte. Ltd. is an international transaction. A Ltd. pays interest to C Ltd. which is an expense deductible under Income Tax Act,1961. Therefore, the interest on advancement of loan by C Ltd. to A Ltd. is a specified domestic transaction.

Our View: A Ltd. and B Pte. Ltd. entered into an inter-related agreement for providing IT services and therefore profit split method (PSM) can be used to determine arm’s length price. Since C Ltd. advanced loan to XY Ltd.(unrelated party). The transaction with A Ltd. is highly comparable to the transaction with XY Ltd. Therefore, the internal comparable uncontrolled price method (Internal CUPM) can be used

Our View: The Arm’s Length Price of the transaction between A Ltd. and B Pte. Ltd. will be the ratio in which price is deducted in a similar agreement between P Ltd. and Q Ltd. i.e. on basis of amount invested. Therefore, the profit of A Ltd. will be INR 4.1 crores (8 crores*41/80) and that of B Pte. Ltd. will be INR 3.9 crores. The transfer price (i.e. 50% of 8 crores=INR 4 crores) is within the range of 3% of arm’s length price(INR 3.977 crores to INR 4.1 crores). C Ltd. should charge interest @ 12% per annum on loan advanced to A Ltd. Therefore, the interest at arm’s length price will be INR 26.4 crores (220 crores *12% per annum). The transfer price (i.e. 11.90% of 220 crores=INR 26.18 crores) is within the range of 3% of arm’s length price (INR 25.608 crores to INR 26.4 crores).

Our View: The list of forms required to file under Transfer Pricing rules is as follows:

| Forms | Timeline |

|---|---|

| 3CEAA (Part A) | 30th November 2020 |

| 3CEAA (Part B)* | 30th November 2020 |

| 3CEAB | 30 days prior to filing Form 3CEAA |

| 3CEB (to be filed by Chartered Accountant) | 31st October 2020 |

| 3CEFA (option to apply for safe harbor rules) | 30th November 2020 |

*Since the consolidated revenue of ACE Pte. Ltd. exceeds INR 500 crores and value of transaction exceeds INR 50 crores. Therefore, A Ltd. is required to file Form 3CEAA (Part B).

Our View: Every entity having international transactions where the value exceeds INR 1 crore is required to maintain documents. Since the value of transaction providing IT services is INR 80 crores, A Ltd. is required to maintain the supporting documents which are as follows:

- Reports of market research studies relating to such transactions.

- Published accounts and financial statements of the B Pte. Ltd.

- Agreement for providing IT service entered with B Pte. Ltd.

- Invoice of the services rendered.

Entity having specified domestic transactions where the value exceeds INR 20 crores is required to maintain documents. Since the value of specified domestic transaction of interest expenses between A Ltd. and C Ltd. exceeds INR 20 crores, A Ltd. is required to maintain the following supporting documents:

- Published accounts and financial statements of C Ltd.

- The loan agreement between A Ltd and C Ltd.

- The loan agreement between C Ltd. and XY Ltd.

- Loan statement of the loan advanced and interest accrued to A Ltd.

Our View: Every entity having international transactions greater than INR 1 crore or specified domestic transaction greater than INR 20 crores will have to maintain the transfer pricing study report. Therefore, A Ltd. will have to maintain a transfer pricing study report for both international and specified domestic transactions on or before 31st October 2020.

Our View: The following penalty shall be imposed if A Ltd. fails to file:

| Form | Penalty |

|---|---|

| 3CEAA, 3CEAB | INR 5,00,000 |

| 3CEB | INR 1,00,000 |

A Ltd., B Pte. Ltd., and C Ltd. are companies under the group of ACE Pte. Ltd. A Ltd. and C Ltd. are domestic companies and B Pte. Ltd. is a foreign company. The consolidated revenue of ACE Pte. Ltd. is INR 950 crores for AY 2020-21. A Ltd. holds 49% of voting rights in B Pte. Ltd. and also C Ltd. appointed three executive directors of A Ltd.

A Ltd. and B Pte. Ltd. had an agreement to provide an IT service worth INR 80 crores to an entity, where A Ltd. invested INR 41 crores and B Pte. Ltd. invested INR 39 crores and the profit earned would be distributed on an equal basis. The profit earned from the transaction is INR 8 crores. A similar agreement exists between P Ltd. and Q Ltd.(unrelated parties) where profit is split on the basis of the amount of investment made.

C Ltd. advanced a loan of INR 220 crores to A Ltd @ 11.9% per annum and also advanced loan of INR 220 crores to XY Ltd.(unrelated party) @12% per annum.

Share

Share