FinTech in GIFT IFSC: Guide to Establishing an Entity

FinTech in GIFT IFSC: Guide to Establishing an Entity

A complete guide on establishing a dynamic fintech entity in GIFT City's IFSC, understanding its pre-requisites, and growth opportunities.

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

The main purpose of FinTech framework is to promote innovation in the financial industry by encouraging the development of new and advanced financial products and services in various sectors such as banking, insurance, securities, and fund management. FinTech Framework offers access to players who have innovative technological solutions, including customer data such as preferences and activities, which can help in the marketing of financial products and services in any ecosystem. The goal is to create a more innovative ecosystem in the Gujarat International Finance Tec-City (GIFT City). In this blog, we delve into the vibrant fintech ecosystem of GIFT City IFSCA, examining its regulatory framework, growing startups, and transformative technologies reshaping the financial landscape.

Understanding Financial Technology (FinTech) At GIFT City

Fintech is derived from the combination of two words – Financial (Fin) Technology (Tech). Fintech refers to cutting-edge technology designed to enhance and streamline the provision and utilization of financial services. It encompasses any application, software, or technological solution enabling individuals or businesses to digitally oversee, access, or conduct financial transactions, as well as gain insights into their financial matters.

The main objective of Fintech is to simplify and streamline financial processes for individuals, businesses, and corporations alike. Fintech entities are enablers of services that utilizes specialized software and algorithms that are designed to run on computers and smartphones. Fintech integration in GIFT IFSC is crucial for its transformative impact. By using automation and artificial intelligence, fintech improves conventional financial processes, making them more efficient and cost-effective.

International Financial Services Centres Authority (IFSCA) has launched a framework called the Fintech Framework for Fintech entities. The focus on user-friendly experiences through digital banking and online platforms ensures customer loyalty and satisfaction. In a highly competitive global market, fintech equips companies in IFSCs to meet or exceed international standards. Features such as regulatory compliance, data analytics, financial inclusion, and strategic cost reduction further strengthen fintech’s role. Additionally, its ability to facilitate seamless cross-border transactions and adapt to emerging trends makes fintech an essential asset for the future of financial services in GIFT IFSC.

Legal Structure of Setting up a FinTech Entity in GIFT IFSC

Pre-requisites for Fintech in GIFT IFSC

Setting up a Fintech entity in the GIFT IFSC involves certain prerequisites which includes making some applications to the authority. They are as follows:

- Entity using any technology in the core product or service, business model, distribution model, or methodology

- Entity with presence of deployable solution/working product

- Entity must have revenue earning track record in at least 1 of the last 3 financial years

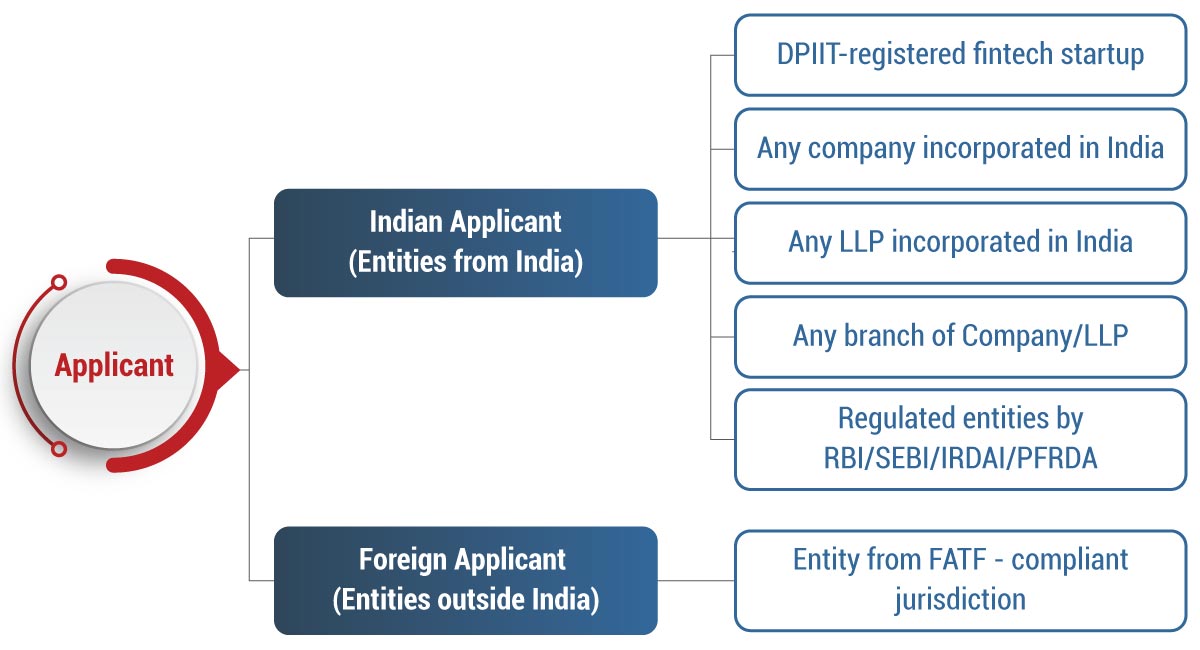

How Can Any Fintech Entity Register With IFSCA?

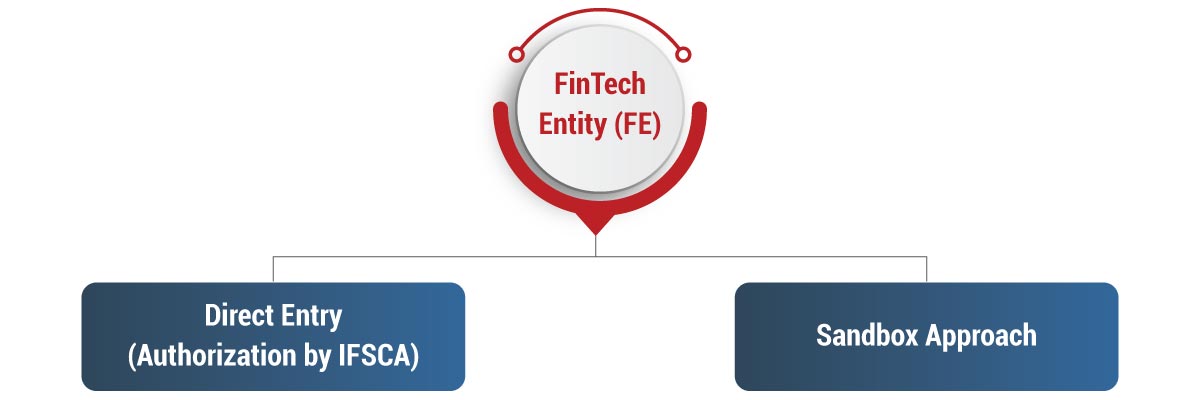

IFSCA prescribes the following two types for FinTech(s) to register with the IFSCA as a Fintech Entity (FE):

1. Direct Entry (Authorization by IFSCA)

The IFSCA allows certain class/categories of technology entities to obtain direct entry having:

- A deployable advanced/innovative technology solution that aids and assists activities about financial products, financial services, and financial institutions

- A revenue-earning track record in at least 1 of the last 3 financial years

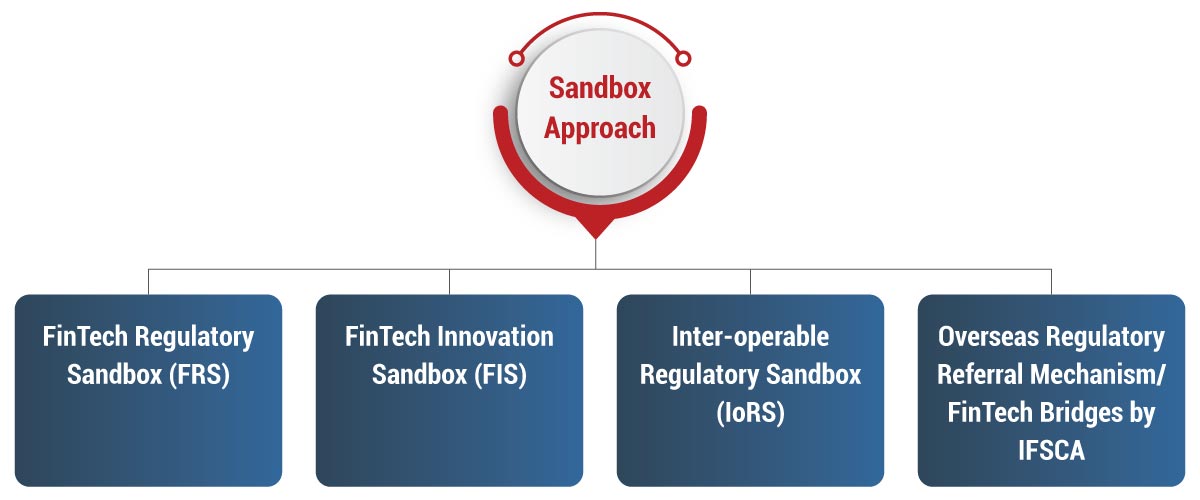

2. Sandbox Approach

Sandbox framework allows financial entities to test Fintech solutions in a live environment for a limited time with a small group of real customers. IFSCA sandbox allows applicants to undertake the following activities:

- FinTech Regulatory Sandbox (FRS) offers a confined live testing space, granting exemptions for entities to experiment with FinTech innovations in capital markets, banking, insurance, and other financial services.

- Fintech Innovation Sandbox (FIS) is an isolated testing environment for Fintech entities in IFSC allowing them to experiment with ideas and solutions using market data from financial institutions.

- Inter-operable Regulatory Sandbox (IORS) caters to hybrid financial products falling under multiple domestic regulators.

- The Overseas Regulatory Referral Mechanism facilitates cooperation between the IFSC Authority and overseas regulators for Fintech operations in each other’s jurisdictions.

Activities That Fintech Entities are Eligible to Perform in IFSCA

- Entity can provide a Fintech solution that results in new business models, applications, processes, or products in financial services regulated by the IFSCA.

- Entity can provide an advanced or emerging technology solution in allied areas/activities that aid and assist activities in relation to financial products, financial services and financial institutions (TechFin).

Below is a list of permissible areas and activities that fall under the Fintech license in varying sectors:

| Banking Sector | Capital Markets & Funds Management | Insurance Sector |

|---|---|---|

|

|

|

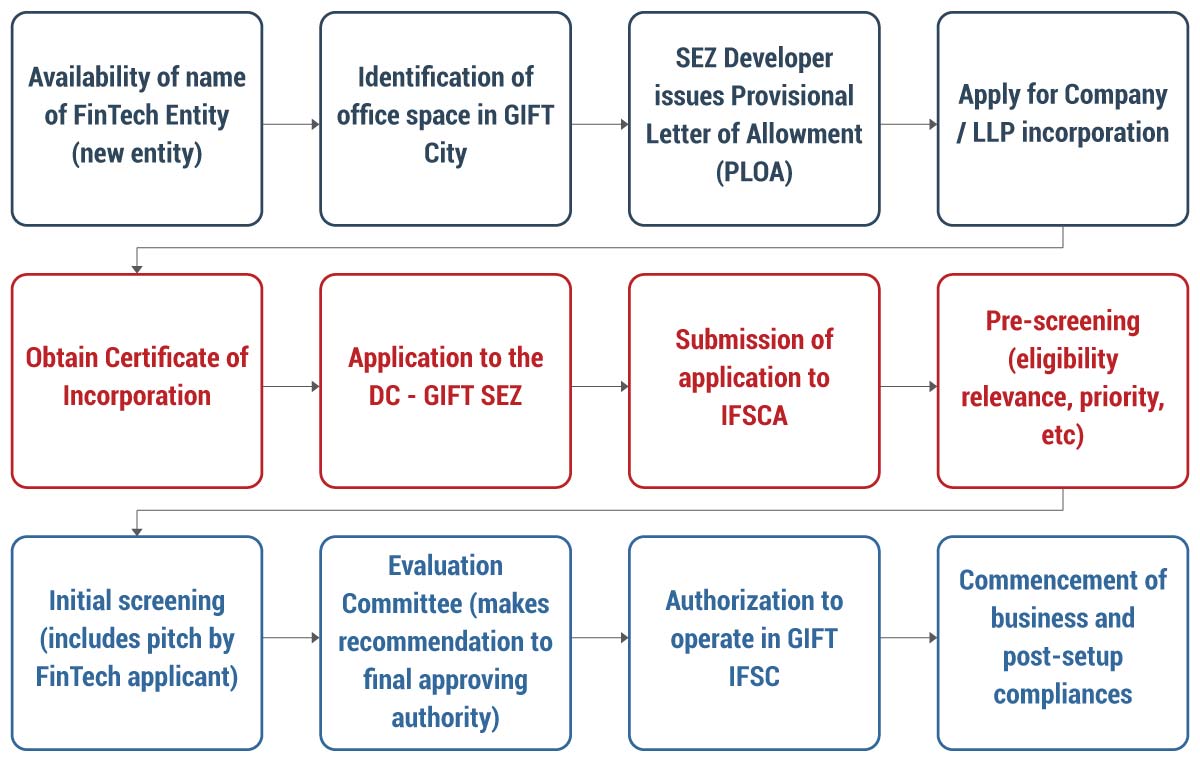

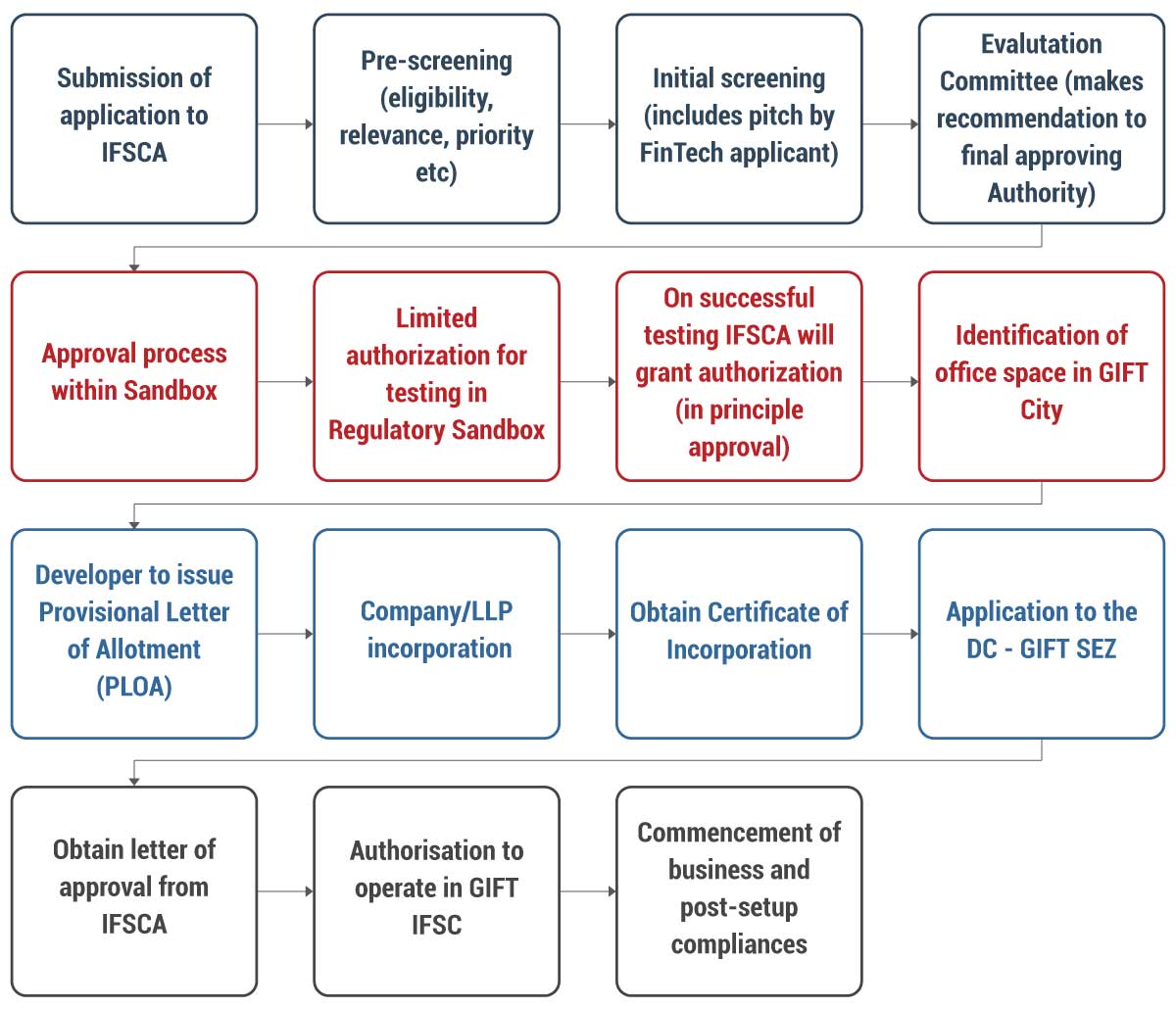

Process Flow Set-up Fintech Entities in GIFT IFSC

1. Direct Authorization Process

2. Sandbox Process

Types of Incentives

These incentives aim to foster a conducive environment for Fintech firms to thrive and contribute to the development of the financial ecosystem within the IFSC.

1. Fintech Start-up grant

An eligible FEs may receive up to Rs. 15 lakhs under this scheme, which is expected to cover expenses related to product development, manpower costs, IT expenses, and so on.

2. Proof of Concept (PoC)

FEs can receive up to Rs. 50 lakhs for conducting a PoC in India or overseas. Funds cover expenses like IT, marketing, prototyping, etc.

3. Sand-box Grant

FEs can experiment with new products or services using Rs. 30 lakhs grant for software development, prototyping, manpower, consulting, tech, IT, and admin costs.

4. Green FinTech Grant

Eligible sustainable finance FEs can receive up to Rs. 75 lakhs for ESG investments.

5. Accelerator Grant

Accelerator applicants can receive up to Rs. 10 lakhs for capacity building, mentorship, investor relations, and project development.

6. Listing Support Grant

Grant for Domestic FEs seeking listing on recognized stock exchanges. Up to Rs. 15 lacs available for eligible FEs’ road shows, travel, and listing expenses.

Regulatory Fees for Fintech Entities in GIFT IFSC

1. IFSCA Fees

| Particulars | Amount (Full Authorization) | Amount (Limited Use Authorization) |

|---|---|---|

| Application fees (One-Time) | USD 500 | USD 100 |

| Authorization Fees (Annually) | USD 1,500 | USD 500 |

| Re-registration Fees/Extension Fees (Post 12 Months) | USD 1,500 | USD 500 |

*Fees prescribed in respect of Limited Use Authorisation not applicable in respect of Indian FinTech entities

2. SEZ authorities’ Fees

| Particulars | Amount (in INR) |

|---|---|

| Application Fees (one-time) | 5,000 |

| Registration fees (one-time) | 25,000 |

| Recurring fees (Annual) | 5,000 |

Conclusion

The International Financial Services Centre (IFSC) has emerged as a major hub for businesses, particularly in the Fintech industry. The IFSC currently houses more than 35 Fintech companies, which has generated a lot of interest and highlights the lucrative opportunities offered by the IFSCA. Entities licensed by IFSCA includes JPMorgan Chase Bank National Association, Wipro Limited, Yotta Data Services Private Limited, etc.

Major tech player, Google, has setup a global Fintech operation center in GIFT City. Other companies such as IBM, Oracle, Maxim Integrated, TCS, and Cybage have already established their presence here in GIFT City. This is expected to inspire other FinTech players to follow suit, solidifying GIFT City’s status as a financial hub for technological innovation and advancement.

Why Choose InCorp Advisory?

Our team at InCorp has the expertise to offer comprehensive assistance throughout the entire process of listing companies on international exchanges in GIFT City IFSC. Below listed are the services we offer:

- Assistance in structuring the Fintech as per the requirement

- Providing advisory services on regulation and taxation to ensure compliance and optimal structuring

- Assistance in preparing necessary documentation required for incorporation of FinTech entities in GIFT City.

. Assistance in setting up Fintech entities and post setup requirements and compliance if any required.

To learn more about our GIFT City services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions (FAQs) on FinTech Applications

The processing time for FinTech applications varies based on the type of authorization:

- Authorization: Applications are typically disposed of within 60 days from the date we receive all required documents and fees.

- Limited Use Authorization: For Limited Use Authorization, the processing time is 120 days from the date of receiving the complete application and applicable fees.

IFSCA will maintain a delicate balance between fostering innovation and ensuring the protection of customers and the financial system. Points where IFSCA will not allow any relaxation are Confidentiality of customer information, Net worth standards, Fit and proper criteria, emphasizing honesty and integrity, Track record evaluation, Secure handling of customer funds and assets by intermediaries, Adherence to registration fees, Measures against money laundering and terrorism financing.

Some suggested changes for the regulatory pre-requirements that IFSCA may consider relaxing for FinTech entities during sandbox testing financial soundness criteria, Principles of Know Your Customer (KYC), Board composition standards, Management experience prerequisites, Asset maintenance requirements, Risk mitigation and its controls.

FinTech entities are required to transact in freely convertible foreign currency only. However, administrative expenses may be defrayed in INR through a specified account.

FinTech Entities are required to ensure that users acknowledge the associated risks before signing up. Additionally, they must disclose whether users will be compensated for any losses incurred during the sandbox testing phase.

Share

Share