FDI in India: Legal Framework and Impact on Growth

FDI in India: Legal Framework and Impact on Growth

Overview of FDI in India – FDI routes, pricing norms, FDI over the years, and recent changes

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

Introduction

Foreign Exchange Management Act (FEMA) was enacted in 1999 to develop and maintain the foreign exchange market in India. Over a period, India gradually allowed foreign investment in several sectors. Investment in India is permissible under three routes – Foreign Direct Investment (FDI), Foreign Portfolio Investment (FPI), and Foreign Venture Capital Investment (FVCI). One of the significant sources of financial resources for economic development of the country is FDI. FDI flows into India have been growing since India opened its doors to foreign investors in 1991 and, since then, has been a major contributor to foreign exchange in India. In addition to being a source of long-term sustainable capital in the economy, FDI aids in developing strategic sectors, improving collaborations with global players, and employment generation, amongst other benefits. Hence, the government of India intends to attract and promote FDI to support domestic capital, technology, and skills for accelerated development and growth of the economy.

Foreign Direct Investment Legal Framework in India

Currently, Foreign Direct Investment(FDI) in India is governed by the Foreign Exchange Management (Non-debt Instruments) Rules, 2019, the Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019, and press releases/circulars/notifications issued in connection therewith. The Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry issues the FDI Policy regularly, consolidating all the rules above/regulations, etc., after considering the regulatory changes effected in the interregnum.

What is Foreign Direct Investment?

FDI primarily means investment made by a resident outside India in an unlisted Indian company through capital instruments or in more than or equal to 10% of the post-issue paid-up equity capital on a fully diluted basis of a company listed in India. A resident outside India is also permitted in the capital of an LLP and body corporate.

Entry Routes for Investment

A person outside India can invest in equity shares, compulsorily convertible debentures, and compulsorily convertible preference shares of an Indian company. The investment can be made through the government route or the approval route. Under the government route, prior approval of the government of India is required. Proposals for foreign investment under government routes are considered by respective administrative ministries/departments. Under the automatic route, no approval is required from the government of India.

Prohibited Sectors

Though most sectors are open to foreign investment, the government has prohibited FDI in specific sectors to safeguard the interests of the stakeholders at large. The list of industries in which non-residents are not allowed to invest is as under:

- Atomic energy

- Real estate business or construction of farmhouses

- Chit funds

- Lottery business, including government/private lottery, online lotteries, etc.

- Nidhi company

- Gambling and betting, including casinos, etc.

- Railway operations (other than setup of railway infrastructure)

- Trading in Transferable Development Rights (TDR)

- Manufacturing of cheroots, cigars, cigarillos and cigarettes, tobacco or related substitutes

- Foreign technology collaboration in any form, including licensing for franchise, trademark, brand name, and management contracts, is prohibited with respect to the lottery business, gambling, and betting activities.

Sectoral Caps

In sectors other than those mentioned above, FDI is permissible to the extent of the sectoral-wise limits provided and subject to fulfillment of conditions as provided under the FDI Policy. Wherein no sector-specific limit is provided, 100% FDI under automatic route is permissible.

Pricing Norms

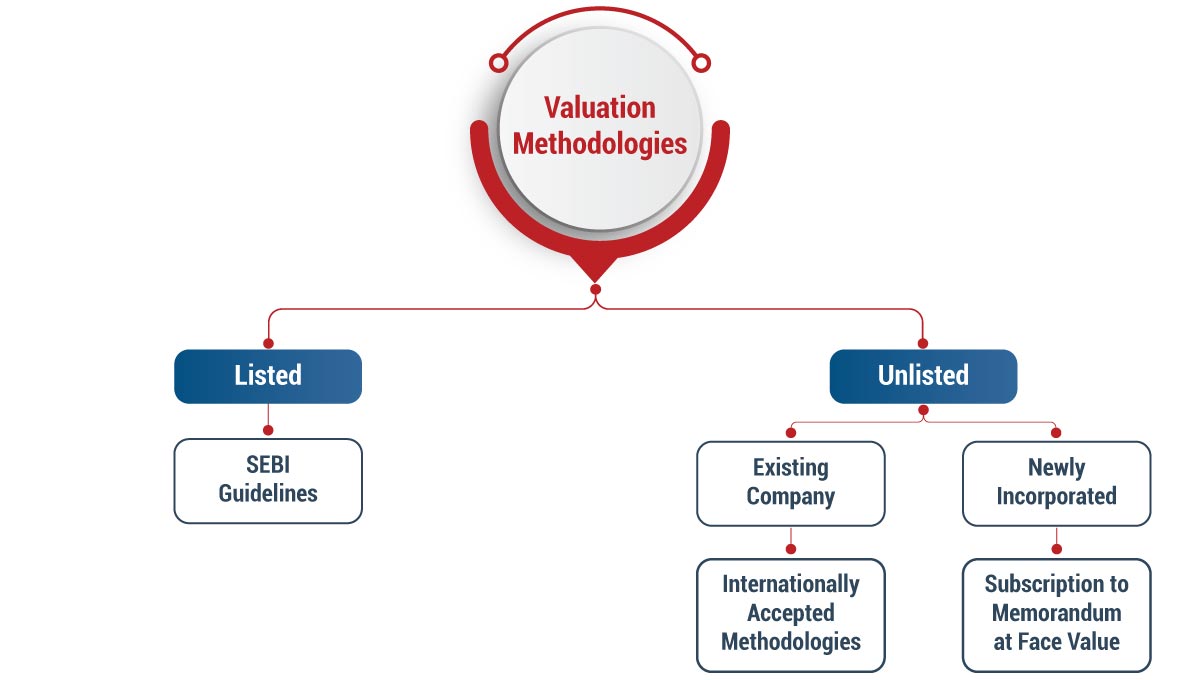

The issue or transfer of shares under FDI Policy to a resident outside India is to be at a price equal to or higher than the fair value as determined under prescribed methodologies. The prescribed methodologies are as follows:

Reporting Requirements

An entity receiving FDI must undertake necessary compliance based on the nature of the transaction. Further, the entity must file the annual return on Foreign Liabilities and Assets (FLA) with the RBI.

Interesting Facts about Foreign Direct Investment in India

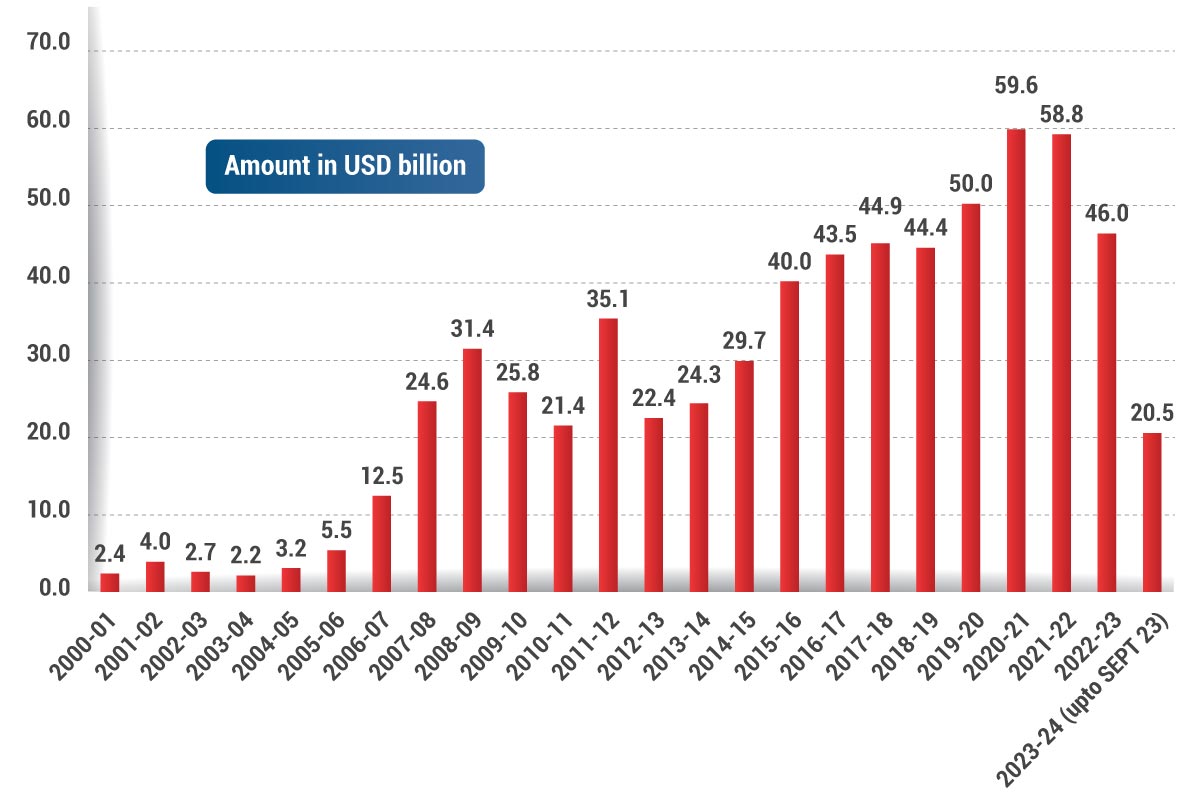

1. FDI Equity Inflow Over 23 Years

During 2022-23, led by a rise in Foreign Direct Investment in unlisted companies, the market value of FDI in India increased by 6.9% in rupee terms.

2. Share of Foreign Direct Investment (FDI) in India

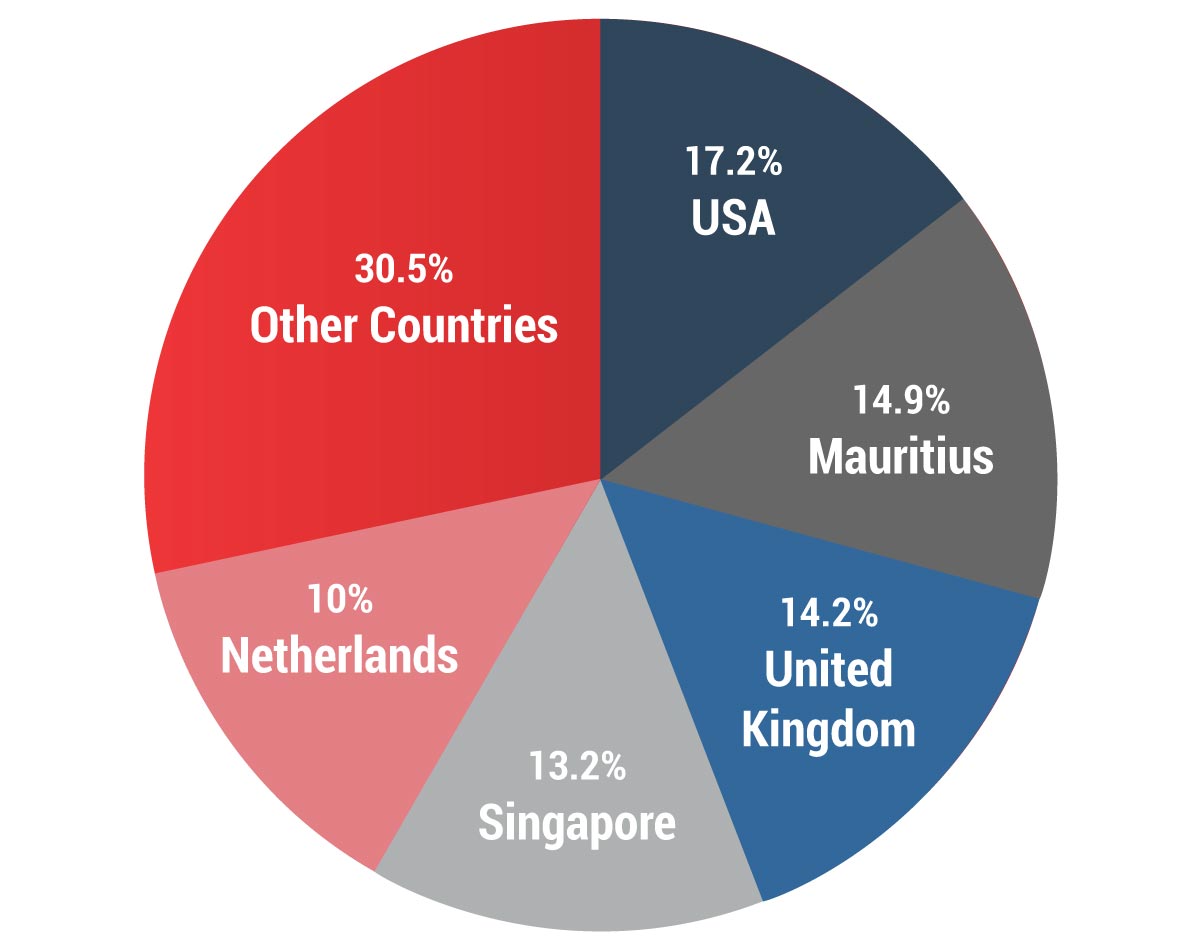

India has received the largest FDI from the USA (17.2%), followed by Mauritius (14.9%), the United Kingdom (14.2%), Singapore (13.2%) and the Netherlands (10%).

3. The manufacturing sector received the largest share of FDI equity, both at market value and face value.

4. Information, communication, financial and insurance activities were the primary FDI recipients in service sectors.

5. Foreign subsidiaries in India maintained strong external trade linkages as exports and imports accounted for more than one-third of their sales and purchases.

Recent Significant Changes

1. Consistent with the vision and strategy of the government of India as per the Indian Space Policy 2023, the Union Cabinet has facilitated the FDI in the space sector by prescribing liberalized FDI thresholds for various sub-sectors/activities, and 100% FDI is now permissible under:

- Up to 74% of FDI is under automatic routes: Satellites, manufacturing and operation, satellite data products, ground segments, and user segments. Beyond 74%, these activities fall under the government route.

- Up to 49% of FDI is through the automatic route: Launch vehicles and associated systems or subsystems and creating spaceports for launching and receiving spacecraft. Beyond 49%, these activities would fall under the government route.

- Up to 100% is under automatic route: Manufacturing components and systems/subsystems for satellites, ground segments, and user segments.

2. To curb opportunist takeovers/acquisitions of Indian companies due to the COVID-19 pandemic, the government would require prior approval of any investment by an entity of a country sharing its land border with India or where the beneficial owner of any investment is from a country sharing its land border with India.

3. Life Insurance Corporation of India, the largest public-sector insurance company in India, was permitted FDI up to 20 percent under the automatic route.

Conclusion

Given the above, the FDI landscape in India is growing and evolving rapidly. With more sectors being liberalized, FDI in India should increase significantly. However, considering the complexities surrounding the FDI regime in India, it is essential for both the foreign investor and the Indian Investee entity to analyze the permissibility of the investment and make sure that the attached terms and conditions, including pricing norms and compliance requirements, are duly adhered to.

Why Choose InCorp Advisory?

We at InCorp India have a team of experienced Chartered Accountants who can advise you on the permissibility of foreign investment, assist you with obtaining requisite approvals, and undertake the necessary compliance requirements to ensure that any foreign investment is in accordance with the Indian FDI regulations. To know more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions About Foreign Direct Investment

FDI primarily means investment made by a resident outside India in an unlisted Indian company through capital instruments or in more than or equal to 10% of the post-issue paid-up equity capital on a fully diluted basis of a company listed in India.

Under the automatic route, no prior approval is required from the government of India for making investments in India.

Under the government route, prior approval of the government of India is required. Proposals for foreign investment under government routes are considered by respective administrative ministries/departments.

FDI is permitted in LLPs subject to sectoral norms, pricing guidelines, and compliance requirements. However, it is not permitted in partnership firms.

Yes. Subject to sectoral norms, pricing guidelines, and compliance requirements, a foreign investor may set up a company or LLP in India to undertake business activities.

Share

Share