Fund Management Entities under GIFT IFSC – Regulations 2023

Fund Management Entities under GIFT IFSC – Regulations 2023

Fund Management Entities: Know types, benefits, regulator's fees, FME process setup, and structure

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

Gujarat International Financial Tech-City (‘GIFT’) in India is a strategic initiative aimed at promoting offshore financial services activities. It seeks to create a competitive ecosystem that enables India to compete with established global financial services jurisdictions.

A key aspect of this initiative is the development of a robust asset management industry within GIFT IFSC. To support this growth, the Indian government has introduced tax and regulatory incentives. The regulatory framework for fund management in GIFT IFSC is designed to cater to various financial intermediaries and service providers, including asset management companies, funds, banks, insurance, leasing, shared services, exchanges, broking, clearing, depository, and custody providers.

How the FME and Fund will be structured under GIFT IFSC?

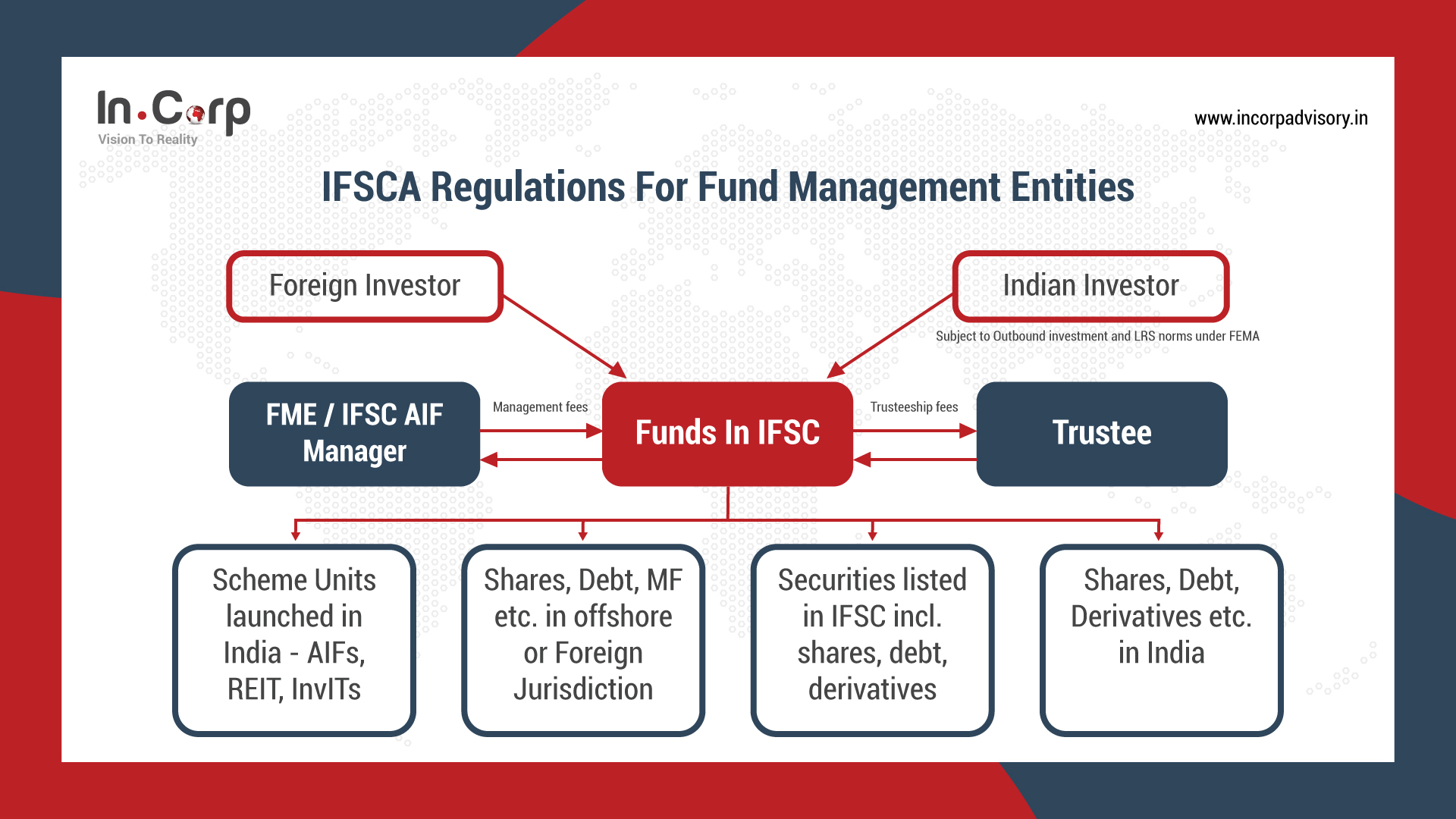

The primary objective behind the introduction of FME Regulations by IFSCA was to oversee and regulate the fund managers operating within the IFSC, rather than directly regulating the funds established within it.

FME regulations provide a comprehensive regulatory framework for Fund Managers setting up fund management entities (FME). The Fund Manager shall obtain registration from IFSCA and the conditions to be satisfied for the launching of funds/schemes shall be as per the FME Regulations.

To better understand how a fund can be formed, let’s have a look at the following standard structure:

What are the Different Types of FME under IFSC Regulations?

Key points on Structure:

| Particulars | Authorized fund Management Entity | Registered Fund Management Entity (Non-Retail Fund) | Registered Fund Management Entity (for Retail fund) |

|---|---|---|---|

| Meaning | Fund Managers that pool money from accredited investors or other large investors to make venture capital investments. | Fund Managers that pool money from accredited investors or other large investors by way of private placement and make investments in listed or unlisted. | Fund Managers that pool money from retail investors and other accredited or large investors. |

| Permissible Activities | · Investment in a startup or early-stage venture through a venture capital scheme

· Managing family Investment fund, investing in securities, financial product, and such other permitted asset classes. |

· Managing Venture Capital and Restricted schemes investing in securities, financial products, and other permitted asset classes

· Portfolio Management Services (including Multiple family offices) · Investment Manager of Investment Trust (REIT and InviTs) offered under private placement. · All activities are permitted to Authorized FMEs. |

· Managing Retail Schemes investing in securities, financial products, and other permitted asset classes.

· Investment manager of Investment trusts (REITs and InviTs) offered to the public. · Managing Exchange Traded fund · All activities as permitted to Authorized FMEs and Registered FMEs (for non-retail funds) |

| Types of schemes which can be managed | Venture Capital Scheme | Venture Capital Schemes and Restricted Schemes | All Schemes (retail as well as non-retail) |

| Launch of New Scheme | Immediately upon filing the Private Placement Memorandum (PPM) | PPM to be filed 21 working days prior to launch of the scheme | Offer document to be filed 21 working days prior to launch of scheme.

The fund can be launched only after receiving comments from IFSCA and incorporating the same in the offer document. |

| Type of investor permissible | · Accredited Investor

· Minimum investment of USD 2,50,000 except for employees /directors/designated partner of FME it is USD 60,000 |

· Accredited Investor

·Minimum investment of USD 1,50,000 except for the employees /directors/designated partner of FME it is USD 40,000 |

· Retail as well as non-retail investor |

| Legal Structure of FME | Company, LLP, Branch | Company, LLP, Branch | Company or Branch of a company |

| Minimum net worth | USD 75,000 | USD 5,00,000 | USD 1,00,000 |

Key points on Personnel requirements in FME:

| Particulars | Authorized Fund Management Entity | Registered Fund Management Entity (Non-Retail Fund) | Registered Fund Management Entity (for Retail fund) |

|---|---|---|---|

| Minimum number of directors | Not applicable | Not applicable | 4 (at least 50% to be an independent director) |

| Minimum Experience of FME | Employ such employees who have relevant experience | Employ such employees who have relevant experience | FME or its holding company shall not have less than 5 years of experience in managing Assets under Management (AUM) of at least USD 200 million with more than 25,000 investors or at least 1 person in control of the FME holding more than 25% shareholding in the FME be carrying on business in financial services for a period of not less than 5 years |

| Minimum number of KMP | One | Two | Three |

| Change of KMP | Prior approval of IFSCA required | ||

| Minimum Qualification of KMP | Professional qualification or post-graduate degree or post-graduate diploma (minimum 2 years in duration) in finance, law, accountancy, business management, commerce, economics, capital market, banking, insurance or actuarial science from a university or an institution recognised by the Central Government or any State Government or a recognised foreign university or institution or association; or a certification from any organization or institution or association or stock exchange that is recognised/accredited by an Authority or a regulator in India or a Foreign Jurisdiction. | ||

| Minimum experience of KMP | Experience of at least 5 years in related activities in the securities market or financial products including as a portfolio manager, broker-dealer, investment advisor, wealth manager, research analyst or fund management. | ||

| Substance Requirements in the IFSC | Proposal on the portfolio composition shall be initiated by a person who is based in the office of the FME in the IFSC | ||

What is the Process of FME Set-Up in IFSC?

Following are the steps for setting up FME in GIFT city- IFSC:

Step 1: Availability of name for Fund entity (new setup)

Step 2: Identification of office space in GIFT City – Notified SEZ area

Step 3: Obtaining NOC from SEZ Developer

Step 4: Apply for company / LLP/ trust incorporation

Step 5: Obtain a Certificate of Incorporation

Step 6: Application to the Development Commissioner, GIFT SEZ.

Step 7: Application to IFSC Authorities (‘IFSCA’)

Step 8: Obtain a letter of approval from SEZ Authorities

Step 9: Obtain a letter of Approval from IFSCA

Step 10: Commencement of business and post-setup compliances

What are the benefits for Funds registered in IFSC?

FMEs registered under IFSC regulations will enjoy various benefits listed below:

1. Investment Opportunities

- Funds incorporated in GIFT IFSC are permitted to invest in the following securities (which may not be allowed to Funds operating out of India):

- Securities Listed in GIFT IFSC

- Securities issued by Companies incorporated in GIFT IFSC

- Securities issued by Companies incorporated in India or foreign jurisdiction.

- Units of other funds in IFSC

- Other permissible investments as per Fund Regulations (like LLP, REIT, InvIT, Derivatives, SPV etc.)

- Overseas entities (without restriction applicable for domestic Funds)

- FME registered in GIFT City IFSC can invest in India subject to FME regulations through the following modes:

- Foreign venture capital investment (“FVCI”) route

- Foreign portfolio investor (“FPI”) route

- Foreign direct investment (“FDI”) route.

2. Taxation benefits

- Business income 10 years out of first 15 years tax holiday u/s 80LA of Income Tax Act, 1961.

- Minimum Alternate Tax (MAT)/ Alternate Minimum Tax (AMT) is applicable @9% of book profits. However, the same is applies only to companies opting for the old tax regime.

- Exemption from STT, CTT, and stamp duty in respect of transactions carried out on IFSC exchanges by registered FMEs.

- Supply of services by FME to funds registered in IFSC is exempt from GST levy.

- Income accruing to or received by non-resident investors from offshore investments made by a GIFT IFSC would not be taxable in India.

- Transfer of units of scheme, investment trust and ETF by non-residents on IFSC exchange would not be subjected to Income Tax.

3. Operational Benefits:

Apart from the above tax and compliance benefits, FMEs registered in IFSC have some operational benefits too which are as under:

- Lower operating costs due to subsidies granted by the Gujarat Government,

- Availability of skilled labor,

- Proximity to the onshore market,

- World-class infrastructure, unparalleled connectivity, and transportation access,

- Access to multiple markets from IFSC.

What is the Regulator’s Fees for Setup in IFSC?

1. IFSCA Fees would vary based on the scheme and type of FME setup in GIFT IFSC. Following are the fees structures for various FMEs:

| Particulars | Authorised FME | Registered FME

(Non-Retail) |

Retail FME |

|---|---|---|---|

| Application Fees (one-time) | $ 2,500 | $ 2,500 | $ 2,500 |

| Registration Fees (one-time) | $ 5,000 | $ 7,500 | $ 10,000 |

| Recurring Fees (Annual) | $ 2,000 | $ 2,000 | $ 2,000 |

| Modification of terms & conditions of grant of License / Registration / Authorization / Recognition | $ 1,000 | $ 1,500 | $ 2,000 |

2. All FMEs in IFSC need prior SEZ approval and hence, the SEZ authorities’ fees are as under:

| Particulars | Amount (in INR) |

|---|---|

| Application Fees (one-time) | 5,000 |

| Registration fees (one-time) | 25,000 |

| Recurring fees (Annual) | 5,000 |

Authored by:

Meet Thakkar | GIFT City

FAQs

Yes, an FME can offer both Venture Capital Schemes and Restricted Schemes simultaneously, subject to compliance with the respective regulations and filing requirements. This allows FMEs to diversify their fund management activities and cater to different investor preferences.

Angel Funds primarily target early-stage venture capital undertakings, while Venture Capital Schemes cover a broader spectrum of start-ups and emerging companies. The key difference is in the investment threshold and structure.

Angel Funds cater to investors committing at least USD 40,000, whereas Venture Capital Schemes may include investors with different investment levels upto USD 150,000.

Registered FME (Retail) is eligible to launch Mutual Funds and Exchange Traded Funds for retail investors. They must adhere to specific regulatory and compliance standards related to retail fund management, including disclosure requirements, investor protection measures, and asset allocation guidelines. These requirements differ significantly from those of other FME categories catering to accredited or high-net-worth investors.

Share

Share