Indian Aircraft Leasing at GIFT City: Process Flow and Benefits

Indian Aircraft Leasing at GIFT City: Process Flow and Benefits

GIFT City aircraft leasing and financing: Eligibility of applicant and a complete overview of the new financial hub.

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

India is one of the fastest-growing aviation markets in the world, with the potential to become the third-largest aviation market by 2025. However, the country’s aviation industry has been facing challenges in terms of financing and leasing, hindering its growth. In response to this, the Ministry of Civil Aviation, Government of India constituted a Working Group on Development of Avenues for Aircraft Financing and Leasing Activities, known as ‘Project Rupee Raftar.’

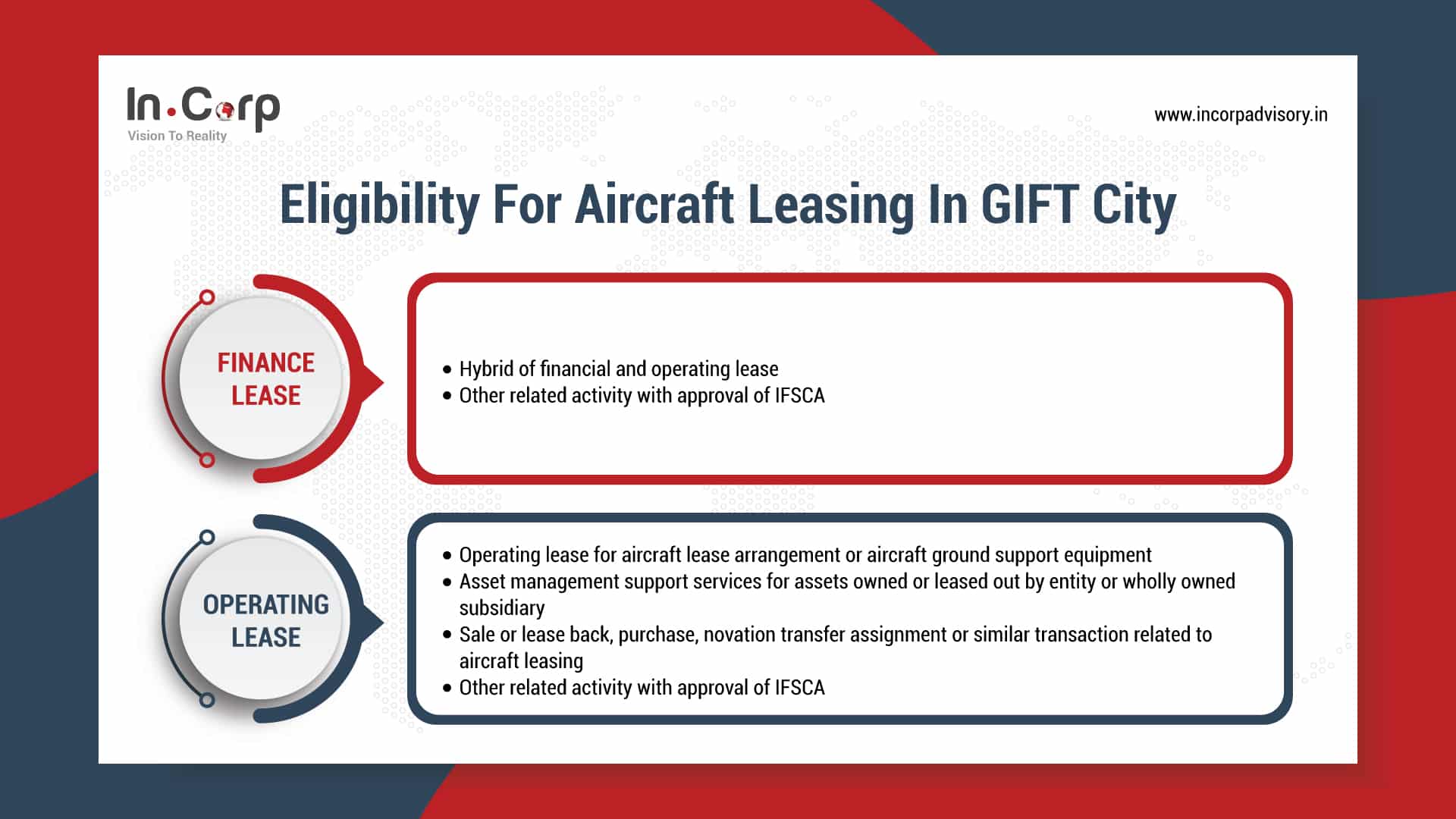

The project aims to develop a robust and indigenous leasing and financing structure in the country, with the involvement of various stakeholders, regulatory bodies, and financial institutions. Through the efforts of Project Rupee Raftar, the International Financial Services Centre Authority Act (IFSCA) notified aircraft leasing as a financial product, creating a significant opportunity for the establishment of a viable aircraft leasing market in India. The scope of aircraft leasing includes operating lease, finance lease, and a hybrid of both. Finance lease is considered a permitted core activity, while operating lease is regarded as a permitted non-core activity.

In this blog, we will explore how the IFSCA’s move to include aircraft leasing as a financial product has opened up new avenues for financing and leasing activities, unlocking the unbridled potential of the Indian aviation market. The blog comprises of the eligibility criteria, process for registering in GIFT IFSC, tax benefits for lessors and certain general conditions to follow:

Eligibility for Aircraft Leasing in GIFT City

Lessor can undertake permissible activities depending upon nature of lease:

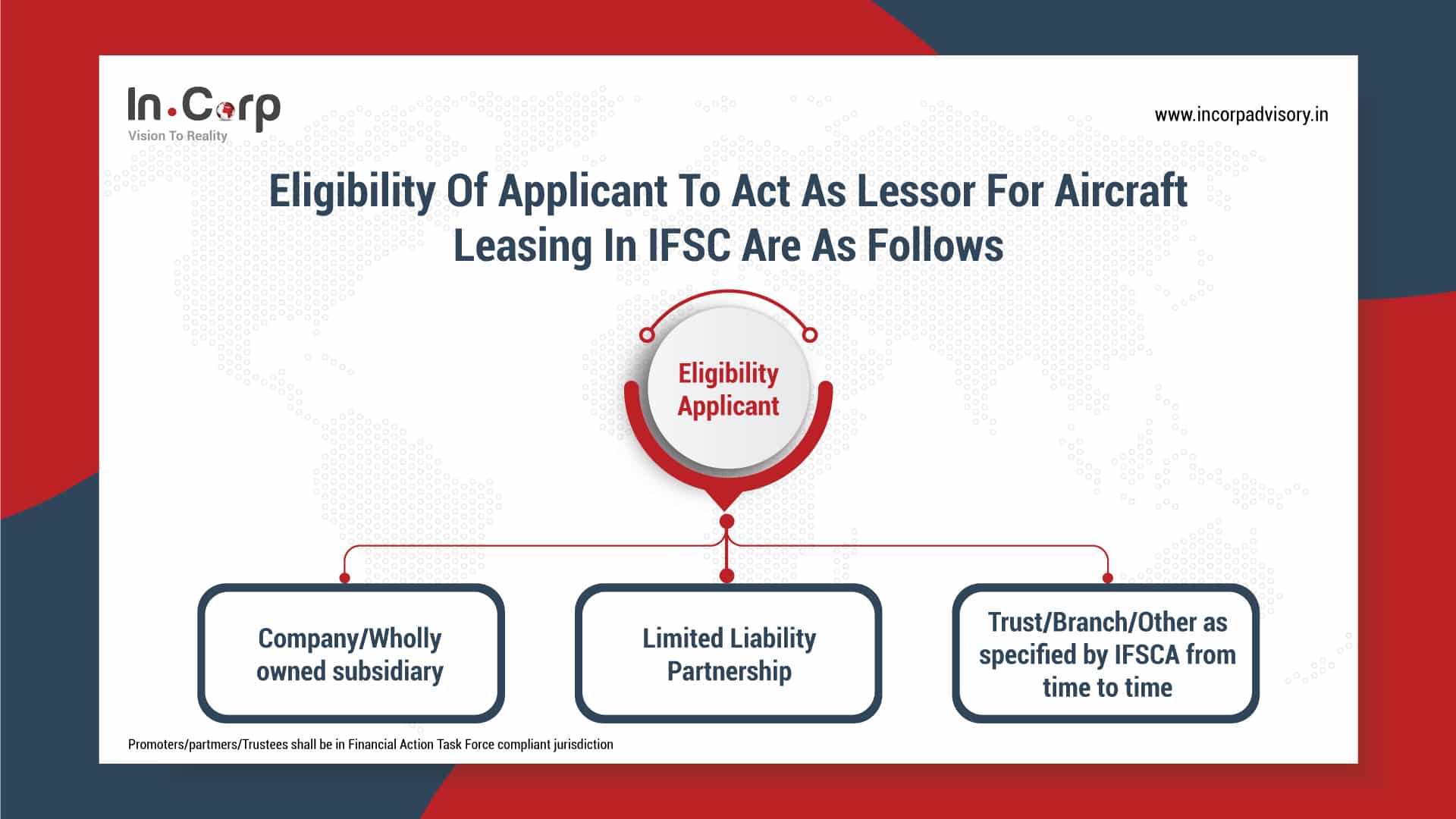

Eligibility of Applicant to act as lessor for Aircraft leasing in IFSC are as follows:

Promoters/partmers/Trustees shall be in Financial Action Task Force compliant jurisdiction

Promoters/partmers/Trustees shall be in Financial Action Task Force compliant jurisdiction

Minimum capital requirement of USD 30,00,000 for financial lease and USD 2,00,000 for operating lease.

Application fees of USD 1,000 (one time) and registration fees of USD 12,500 (one time) for finance lease, and application fees of USD 1000 (one time) and registration fees of USD 5000 (one time) for operating lease. Annual fees are USD 12,500 (2nd year onwards) for finance lease and USD 3,000 (2nd year onwards) for operating lease.

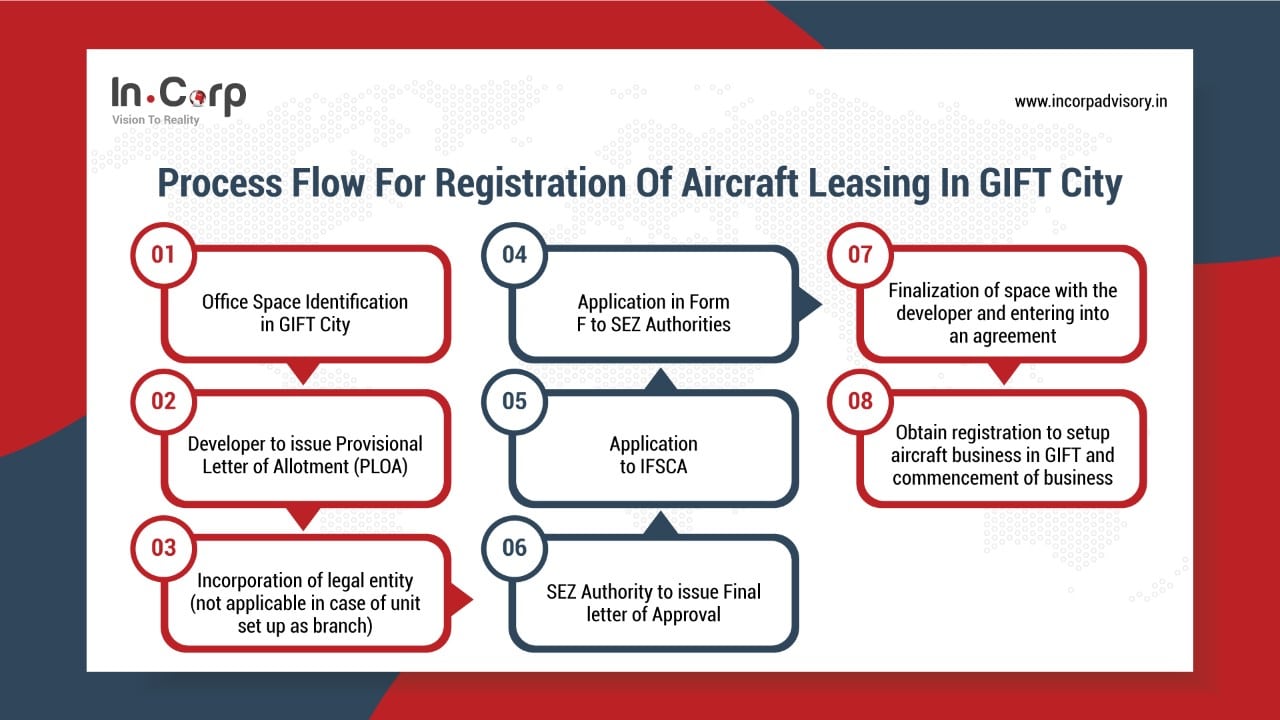

Process flow for Registration of Aircraft Leasing in GIFT City

Benefits for Aircraft Lessor registered in GIFT City- IFSC

| Particulars | Benefits |

|---|---|

| Income Tax Act |

|

| Goods and Service Tax |

|

| Customs Duty |

|

| Central Excise

Duty |

|

| Other Benefits |

|

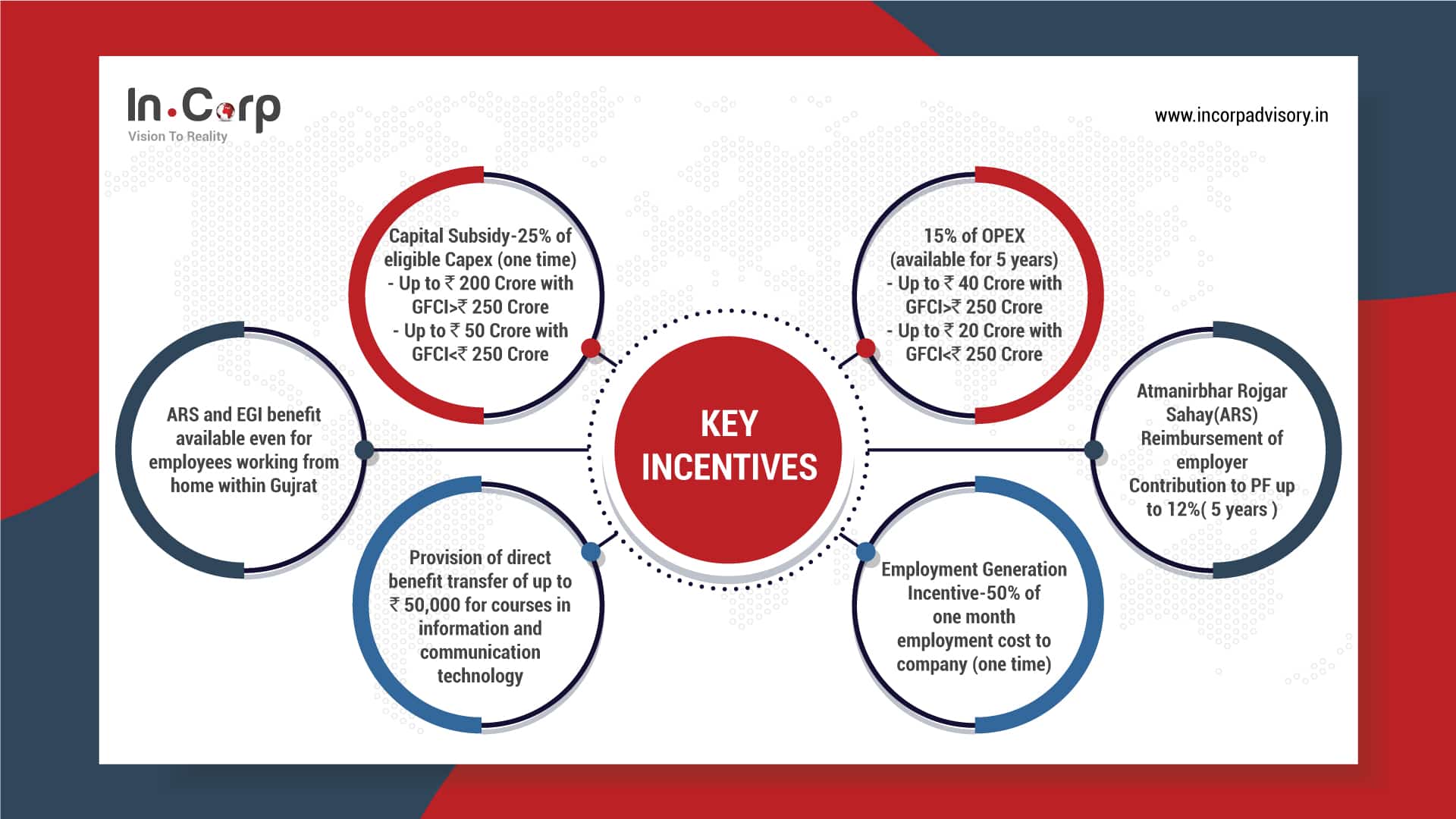

Benefits given by Gujarat Government for setting unit in GIFT City IFSC in Gujarat IT/ITeS policy (2022-27) :

General Conditions

- Lessor should undertake all transactions in freely convertible foreign currency only. Administrative expenses may be undertaken by the lessor in INR by maintaining a separate INR account.

- Books of Accounts, records, document to maintained as required by applicable law in any freely convertible currency.

- Lessor shall submit annual final statement within 15 days of finalization all financial information in USD unless otherwise specified.

- Lessor shall comply with Cape Town Convention and Protocol and other required statutory requirement, obligation, standards, policies direction and guidelines.

- In case the lessor fails to comply with the condition subject to which registration is granted, IFSCA may act after giving an opportunity of submission.

Conclusion

In conclusion, the Indian government’s initiative to develop a robust and indigenous leasing and financing structure, and the IFSCA’s decision to notify aircraft leasing as a financial product, has created a viable aircraft leasing market in India. The registration of aircraft lessors in GIFT City-IFSC offers various benefits, including tax exemptions, GST and customs duty exemptions, and other subsidies, which make it an attractive destination for aircraft leasing companies.

Why Choose InCorp?

At InCorp, we understand the importance of a robust and indigenous leasing and financing structure for the aviation industry. We recognize that setting up an aircraft leasing company can be a complex process, requiring expertise in various fields, including finance, law, and regulation. That’s why we offer specialized advisory services to assist companies in setting up aircraft leasing companies and availing the benefits of the recently created aircraft leasing market in India. Our team of experts can guide companies through the entire process, from initial planning and formation to ongoing compliance and management. With our help, companies can take advantage of the significant benefits offered by the new market, including access to affordable capital and increased flexibility in fleet management. Contact us today to learn more about how we can help your company succeed in the aircraft leasing industry in GIFT City.

FAQs

No, the above framework includes activities related to aircraft leasing including operating, finance leasing, hybrid leasing, asset management support services for assets owned or lease out and sale or lease back, purchase, novation, transfer, assignment, or similar transaction related to aircraft leasing.

The key benefits of Aircraft leasing from IFSC are as follows:

A. Regulatory Regime

- Light touch regulation in a robust framework

- Engagement with forward looking proactive and unified regulator

B. Global Opportunities

- IFSC offers an ideal platform to undertake operating as well as finance leasing activities for India as well as for global markets

C. Tax Efficient Jurisdiction

- IFSC offers a globally competitive tax regime

- Exemption from Capital Gain Tax on disposal of aircrafts

- Waiver of stamp duty

D. DTAA

- Extensive Double Tax Treaty Network with more than 90 Jurisdiction

E. Vibrant Financial Growth

- Concentration of financial institutions in IFSC including global bank, asset management companies, finance companies and professional service provider.

- Access to global financial institution and investor

Lessor is allowed to set up the operations only in the form of limited liability partnership, company, or Trust and not in form of Partnership firm.

Only Wholly owned Subsidiary of parent company are allowed to undertake aircraft lease in GIFT city.

Share

Share