IFRS S1 and S2: Scope, and Reporting Requirements – Indian and Global Perspective

IFRS S1 and S2: Scope, and Reporting Requirements – Indian and Global Perspective

Overview of IFRS S1 & S2: Understanding Key disclosure Standards Shaping Sustainability and Climate Reporting

Globally, sustainability reporting is being recognised as a fundamental business practice. Investors, regulators, and a broad range of stakeholders are insisting on a clear picture of the environmental, climate, and related financial risks, and how they shape performance and strategy over the long term.

In pursuit of this goal, the International Sustainability Standards Board (ISSB) was established by the IFRS Foundation in 2021. Later in 2023, ISSB issued two sustainability reporting standards, IFRS S1: General Requirements for Sustainability-Related Financial Disclosures and IFRS S2: Climate Related Disclosures. In this blog, we explore the purpose, scope, and reporting requirements from India and global perspective.

Purpose IFRS S1 and S2

Previously, there was no standardized reporting of sustainability practises, and such reporting was fragmented, inconsistent, and in most cases, completely optional. This made it challenging for investors to ‘read between the lines’ of risk and performance disclosures of companies in different countries. Overlapping reporting frameworks and expectations lead to reporting inefficiency and a lot of noise.

The purpose of IFRS S1 and IFRS S2 is to address these challenges by defining a clear and consistent global set of requirements for the IFRS Reporting of sustainability matters and climate risks that are material. The adoption of S1 & S2 aims to complement the financial reports and allow businesses to transparently disclose the effects of sustainability matters on the enterprise value. Together, IFRS S1 and IFRS S2 are becoming the global baseline for sustainability-related IFRS Reporting.

Scope

Global Perspective on IFRS S1 & IFRS S2

Globally, IFRS S1 & IFRS S2 are receiving strong support from governments, regulators, and capital market participants as a baseline for sustainability related financial disclosures under IFRS Reporting.

Effective from mid 2025, over 20 jurisdictions which contribute greater than 50% of global GDP have either adopted or are in the process of adoption of the ISSB Standards, although the IFRS Applicability varies by country and jurisdiction. These countries include the UK, Canada, Nigeria, Brazil, California and Singapore and other European countries which have committed to adopting IFRS S1 and IFRS S2 either fully or partially, over the next few years.

Source: https://www.earth-scan.com/blog/meaning-issb

India’s Perspective on IFRS S1 & S2

India has not officially adopted IFRS S1 and S2. Instead, the regulatory focus remains on evolving Business Responsibility & Sustainability Report (BRSR) framework which is mandated by SEBI for top 1,000 listed companies.

BRSR aligns with global ESG Frameworks such as GRI and SASB but not fully with IFRS Reporting under S1 and S2 yet. The ISSB standards are currently viewed as voluntary options for Indian companies. In 2024, the RBI proposed climate related risk disclosure rules which aligns with IFRS S2, for banks and financial institutions.

Reporting Requirements under IFRS S1 and IFRS S2

The core content of the ISSB Standards detail what information companies are required to report. Companies need to disclose information across four key pillars under these Sustainability Standards (based on TCFD structure):

Governance

How sustainability and climate issues are overseen by leadership as per IFRS S1 and IFRS S2.

Strategy

Impact of risks and opportunities on business plans and financial performance.

Risk Management

How sustainability and climate risks are identified and managed under S1 and S2.

Metrics and Targets

Quantitative and qualitative data on performance and targets related to sustainability and climate issues, in line with IFRS Reporting.

Overview of IFRS S1 and IFRS S2: General Requirements for Sustainability-Related Financial Disclosures and Climate-Related Disclosures

A. Objectives

| IFSR S1

(General Requirements for Disclosure of Sustainability-Related Financial Information) |

IFRS S2

(Disclosure of Climate-Related Financial Information) |

|---|---|

| To require an entity to disclose information about its sustainability related risks and opportunities that is useful to primary users of general purpose financial reports in making decision relating to investment in entity. | To require an entity to disclose information about its climate related risks and opportunities that is useful to primary users of general purpose financial reports in making decision relating to investment in entity. |

B. Using IFRS S1 with IFRS S2

IFRS S1 establishes key concepts and sets out general requirements (such as the reporting entity, and timing and location of reporting) for the disclosure of all sustainability-related risks and opportunities. IFRS S2 must be applied alongside S1 to include climate-related disclosures thus ensuring complete IFRS Reporting.

C. Conceptual Foundations of Reporting

The conceptual foundations define the parameters for the type of information a company must provide to ensure it is decision-useful to investors. The conceptual foundations are as below:

Combined, these concepts provide a coherent basis for preparing sustainability-related financial disclosures within IFRS Reporting.

D. Deciding What Sustainability Information to Report

Useful sustainability-related financial information under S1 and S2 is characterised by two fundamental and four secondary traits. The two fundamental characteristics are as follows:

- Relevant: Sustainability-related financial information is relevant if it can influence the decisions of investors.

- Represented Faithfully: To faithfully represent a sustainability-related risk or opportunity, a disclosure must represent that risk or opportunity (using qualitative and/or quantitative information) completely, neutrally, and accurately.

Four secondary characteristics are as follows:

- Verifiability

- Timeliness

- Comparability

- Understandability

E. General Requirements for Disclosure

| Particulars | Requirements of Disclosure |

|---|---|

|

Source of Guidance |

IFRS S1 and IFRS S2 includes both required and optional sources of guidance that companies can refer to outside of ISSB Standards. These sources of guidance support companies in identifying relevant risks and opportunities and material information. |

| Location of Disclosures | A company can choose the location depending on the company’s practices and its jurisdictional reporting regime. The disclosures could be in Management Discussion and Analysis (MD&A) or in other reports as required by regulation. |

| Timing of Reporting | The entity’s sustainability-related financial disclosures shall cover the same reporting period as the related financial statements. |

| Comparative Information | IFRS S1 and IFRS S2 requires companies to disclose comparative information in respect to the preceding reporting period. It includes quantitative information, such as metrics and targets and current and anticipated financial effects. It might also relate to qualitative information, such as narratives or descriptions used to help investors understand sustainability disclosures. |

| Statement of Compliance |

Companies that comply with all the requirements of the ISSB Standards provide an ‘explicit and unreserved’ statement of compliance to enhance credibility & trust. |

F. Understanding Climate Risk and Opportunities

Risks refers to a potential negative effect of climate change on an entity’s business model, operations, financial performance or enterprise value. Opportunity refers to the potential positive effects arising from efforts to mitigate or adapt to climate change, which may enhance an entity’s value or performance.

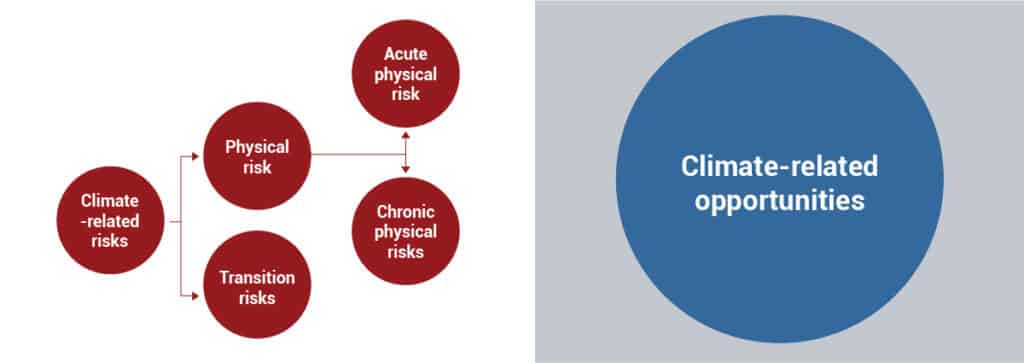

IFRS S2 classifies climate-related issues into two main categories of risk and one for opportunities:

1. Climate-related risks

These are divided into:

- Physical Risks

a) Acute Physical Risks: These are short-term, event-based impacts like floods, heatwaves, or wildfires. Such events can lead to extreme weather that disrupts operations or damages assets.

b) Chronic Physical Risks: These are long-term shifts in climate patterns such as rising sea levels, sustained temperature increases, or desertification. They can impact long-term resource availability, productivity, and infrastructure.

- Transition Risks

These are linked to the low-carbon shift of the global economy.

Other factors include:

a) Policy and regulatory changes (e.g., emission limits, carbon taxes)

b) Technological changes (e.g., clean tech replacing outdated high-emission processes)

2. Climate-related opportunities

Climate change has strategic opportunities such as:

- Resource efficiency (e.g., lower energy or water use)

- New products and services (e.g., green finance, renewable energy solutions)

- Access to new markets

G. Transition Reliefs

A company is exempted from providing comparative data in its first annual reporting period under IFRS S1. This is because the metrics companies are expected to report under IFRS S1 are most likely to be new to them. Additionally, companies have been granted some flexibility in how they adopt the new sustainability reporting standards.

For their first year of reporting, they can publish their sustainability-related disclosures separately from their financial statements. They’re also allowed to focus solely on climate-related risks and opportunities under IFRS S2, without needing to cover other sustainability issues. Additionally, if they lack the necessary expertise or resources, they can provide qualitative descriptions of the financial impacts of sustainability risks and opportunities instead of detailed numbers. These reliefs make the shift to IFRS reporting smoother.

Conclusion

IFRS S1 and S2 signify a major change in how companies inform the public of sustainability and climate-related risks. In addition to meeting the requirements, the standards provide a competitive edge allowing companies to tailor disclosures to strategic objectives, strengthen investor trust, and encourage changes within the organization that really matter. As the world changes, being prepared and adopting these standards early will differentiate the leaders in the sustainable economy of the future.

Why Choose InCorp Global?

At InCorp, we undertake the services of ESG and Risk Management solutions under one roof. Our trained multi-disciplinary team makes deep assessments to identify possible ESG risks as well as opportunities. With customized solutions, you can attain the sustainability you want. For more information about our services, you could write to us at info@incorpadvisory.in or reach out to (+91) 77380 66622.

Authored by:

Aayushi Jagwani | Sustainability & ESG

FAQ

No, IFRS S1 and S2 are not globally mandatory. Their applicability depends on whether a local jurisdiction or regulator chooses to adopt them. However, companies may choose to adopt the standards voluntarily, especially if they want to enhance transparency and meet investor expectations. In many regions, large and publicly accountable entities are likely to be the first to adopt them.

Formal scores are given to companies requested by investors or customers, while voluntary disclosures offer visibility without scoring. Strategically, scores act as a benchmark, highlighting strengths and areas for improvement in governance, risk management, and climate performance. They influence investment decisions, supplier evaluations, and overall market credibility.

Companies need to disclose information across four key pillars (based on TCFD structure):

- Governance - How sustainability and climate issues are overseen by leadership.

- Strategy - Impact of risks and opportunities on business plans and financial performance.

- Risk Management - How sustainability and climate risks are identified and managed.

- Metrics & Targets - Quantitative and qualitative data on performance and targets related to sustainability and climate issues.

The primary users are investors, lenders, and other capital market participants who rely on general-purpose financial reports. The goal of IFRS S1 and S2 is to provide them with decision-useful information about sustainability and climate-related risks and opportunities that can affect a company’s enterprise value.

‘Enterprise value’ refers to the total value of a business including its market capitalization and debt from the perspective of investors and capital providers. IFRS S1 and S2 focus on disclosing sustainability and climate information that could influence enterprise value, ensuring relevance to financial decision-making.

Share

Share