Best Practices for Integrating BRSR with Financial Reporting

Best Practices for Integrating BRSR with Financial Reporting

Overlapping of BRSR and financial disclosures: All about integration, strategies, challenges and role of advisors

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

The growing need for companies to be accountable and transparent has an implicit influence on the convergence of financial and non-financial reporting. In India, SEBI has mandated the top 1,000 listed entities to report on sustainability through BRSR and has also encouraged them to voluntarily adopt Integrated Reporting. Integrating financial and non-financial performance enables businesses to show that they are financially stable while still committed to sustainability and sound governance. This helps various stakeholders gain understanding of the company’s overall performance allowing cross-verification and harmonization to determine real business value.

Evolution of BRSR Reporting

In the recent past, the economic and financial impact of climate change and ESG risks has been well recognized. From FY 2022-23, SEBI made it mandatory for the top 1000 listed entities to provide ESG-related information under the BRSR. The earlier version was Business Responsibility Report (BRR) based on the NVG 2011 framework. Further, in July 2023, BRSR framework added new KPIs for BRSR Core. To the extent possible, these KPIs are made quantifiable for comparison of disclosures. With this change, the updated BRSR enables companies to report on certain financial parameters in addition to non-financial ones, thus making the framework more holistic in decision making. This enhancement will facilitate the assurance of BRSR, including BRSR Core, as envisaged by SEBI in its glide path.

The BRSR report, published alongside a company’s annual report, includes three sections of disclosures as mentioned below:

- General disclosures: Basic company information, including size, location, products, and number of employees.

- Management disclosures: Information on policies and processes related to leadership, governance, and stakeholder engagement.

- Principle-wise disclosures: Responses to nine principles of the National Guidelines for Responsible Business Conduct (NGRBC).

As the updated BRSR format connects financial performance with ESG performance, it helps stakeholders evaluate stability, growth, and sustainability of a company. It therefore enables companies to disclose the risk-related and opportunity aspects of sustainability for understanding how these issues impact value creation and their long-term viability. The standardized format is also easy and direct to compare with companies, sectors, and timeframes.

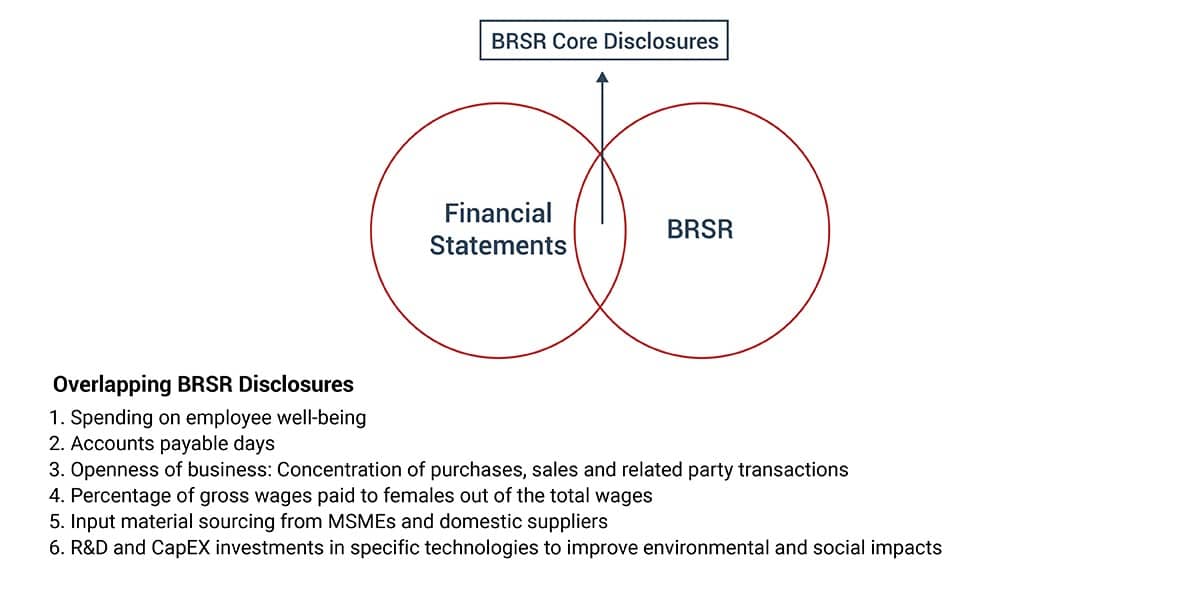

Overlapping of BRSR and Financial Disclosures

Most of the disclosures in the BRSR correlate with financial reports. Examples include turnover, net worth, accounts payable, spending on employee well-being, gross wages paid to females and RPT disclosures. As BRSR is part of the annual report, it is crucial that this data is harmonized with the financials to avoid inconsistencies and ensure the narrative is consistent across reports. For example, if a manufacturing company is actively trying to boost gender diversity in the workplace, when the male-to-female ratio is increased from 3:1 to 3:2, the gross wages paid to female employees (a financial parameter) will also show an increase.

Harmonizing corporate reporting (financial and non-financial disclosures) helps companies avoid potential fines and regulatory actions. Global trends, such as the International Sustainability Standards Board’s IFRS S1 and S2, aim to establish a unified global baseline for sustainability reporting to promote consistency. These standards seek to provide stakeholders with a broader view of a company’s performance and future prospects.

Why Integration matters?

The integration of BRSR with financial disclosures is more than just a regulatory compliance, it helps to rationalize the overall information disclosed to stakeholders. Indeed, while aligning financial performance to BRSR, companies have to present economic as well as ESG impacts in cohesive and transparent manner.

Integrating BRSR with financial reporting offers several key benefits as listed below:

Strategies for Integration

To integrate BRSR and financial reporting perfectly, following is the necessary strategic approach:

- Cross-Verification of Data: All financial and non-financial information disclosed through BRSR reports must be verified with financial statements. Every variation must be resolved through coordinated efforts between the finance, accounting, compliance, and sustainability teams.

- Integration of reporting processes: Financial and non-financial reporting should be integrated using technology and automation. Single-entry documentation process will be effective if the quantity, consumption, and cost can be linked to each other. For example, electricity consumption units, along with their associated costs, can be recorded during data entry into the ERP system. This will streamline the processes, optimize efficiency and accuracy of reporting. This will help reduce the team’s workload while maintaining consistency in the reporting process.

- Improvement of Disclosure Quality: Non-financial disclosures must be benchmarked against financial disclosures in terms of clarity, explanation and providing contextual information to support transparency and comparability.

- Strategic Objectives Alignment: Goals and vision agreed upon by financial and BRSR reports must be in alignment with the overall strategic objectives of the company. Such an alignment will reinforce consistent reporting and bring forth effective long-term vision of the company.

- Continuous Improvement and Feedback: Provide a loop of continuous review and feedback on the integration process. This will help identify specific areas that need improvement in terms of adaptation to changes in standards and expectations from stakeholders.

Challenges in Integration

Financial reporting follows well-defined standards and procedures like GAAP or IFRS, to ensure consistency. Sustainability disclosures are varied, mostly sector-specific, hence inconsistent. This varied reporting practice makes it complex to integrate the sustainability metrics with the financial reports.

The other challenge is the information being reported. Sustainability disclosures usually address mixed qualitative and quantitative information, whereas financial reports are mostly based only on quantitative information. This creates a significant difference between both reporting styles, which makes it challenging to align them.

The lack of standard metrics for sustainability reporting presents another challenge towards integration. When compared to financial reporting, the practice is rooted on common principles that everyone accepts and uses. The scope and the magnitude of sustainability metrics might be quite different. This makes it nearly impossible to make comparisons on performance and even cross compare results between companies. Secondly, full-scale integration may involve more resources and specialized expertise for data gathering and analysis which many organizations are not equipped with; hence the potential gaps in their reporting.

These challenges should be addressed to have a coherent reporting framework that can report an entity’s comprehensive performance. An organization’s strengths to articulate value and long-run viability to its stakeholders will be enhanced by recognizing the importance of both financial metrics and sustainability metrics.

The Role of Advisors

Advisers can be very important to understand complex business issues related to the integration of BRSR disclosures into financial reports. Advisers, who are aware of financial reporting as well as sustainability standards, assist businesses in ensuring that they comply with requirements of regulatory bodies while adopting industry best practices. The business cooperates with advisers in crafting strategies to align BRSR with financial reporting. As an outcome of this cooperation, the integration of these two processes will ultimately be supportive of long-term value creation but simultaneously conform to the increasingly evolved regulatory requirements. They also help in verifying all the financial and non-financial data for accuracy and consistencies between both sets of disclosures.

Conclusion

Integrating BRSR with financial reporting aims to harmonize disclosures enabling stakeholders to attain a comprehensive, reliable, and transparent view of company performance. The integration will promote transparency, accountability, and informed decision-making as companies work to adapt to the evolving landscape of corporate reporting and rising stakeholder expectations. Advisers will play a very important role in this integration process by advising businesses on all intricacies involved in blending financial and non-financial disclosures, ensuring alignment with global best practices to foster long-term sustainable growth.

Why Choose InCorp Global?

We at InCorp provides services relating to ESG and risk management all under one roof. Our experienced multi-disciplinary team undertakes comprehensive assessments to identify potential ESG risks and opportunities. With our customized solutions we can help achieve your sustainability goals. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Muskaan Jain | Sustainability & ESG

Frequently Asked Questions

Integrating BRSR and financial disclosures ensures transparency, provides a holistic view of a company’s performance, and aligns with regulatory requirements, helping stakeholders make informed decisions.

Key steps include identifying ESG metrics, collecting relevant data, aligning financial statements with BRSR guidelines, and ensuring regular reporting and auditing of both financial and ESG disclosures.

Businesses can use financial reporting tools to streamline data collection, automate compliance checks, ensure accurate ESG reporting, and track progress toward sustainability goals in real-time.

Challenges include lack of standardized ESG data, difficulty in measuring intangible ESG factors, and aligning ESG data with financial reporting systems, requiring significant system updates and staff training.

Integrated data offers a more complete view of a company’s performance, showcasing its commitment to sustainability and financial health, which builds credibility and enhances investor confidence.

Share

Share