Impact of Reverse Flipping on Indian Businesses

Impact of Reverse Flipping on Indian Businesses

Reverse flipping: Know the strategic advantages of Indian-founded overseas-based start-ups returning to India.

- Last Updated

The great migration has begun in the country. Indian-founded but overseas-headquartered start-ups are mapping their way to India. These may be attributed to a favorable environment created by government initiatives, the maturity of Indian markets, and recent regulatory changes on round-tripping. Companies like Pepperfry, PhonePe and Groww recently moved their headquarters to India. Similarly, fintech companies like Pine Labs, Meesho, Flipkart, KreditBee, Zepto, and many other companies are looking to move their headquarters to India. In this blog, we explore the Indian ecosystem to trace potential reasons for an increase in reverse flipping, also referred to as internalization by entities. We will also look at the reasons why entities are considering a reverse flip to India.

‘Flipping’ refers to the process of transferring entire ownership of an Indian entity to an entity incorporated abroad along with the transfer of key assets, like intellectual property, to a foreign entity despite having most of their market, personnel, and founders in India. This results in the Indian company becoming a wholly owned subsidiary of the foreign company, with its day-to-day operations in India.

In the past decade, the popularity of flip strategy surged among Indian startups seeking support from foreign investors in some selective fields like SaaS, blockchain technology, AI, InsureTech and health tech where the Indian ecosystem is either not matured enough or growing at a slower pace. Some of the main reasons for flipping include access to global investors, easier listing on foreign exchanges, higher valuations abroad, a wider customer base in new markets, favorable regulatory regimes, founder preferences, and taxation benefits cited by international investors in their home countries. Singapore, the Cayman Islands, the United Kingdom, and the United States of America are some of the common examples of countries where Indian entities have ‘flipped’.

What is Reverse Flipping?

- In reverse flipping, Indian start-ups, especially in the e-commerce marketplace, fintech, and edtech space, which had shifted their headquarters overseas, moved back to India. Reverse flipping is a counter-narrative to the flipping trend.

- Many Indian startups are evaluating reverse flipping in India, based on India’s good economic policies, growing local market, and rising investor trust in its startup ecosystem.

- One of the main reasons for reverse flipping is to list the company on Indian stock exchanges, which attracts many retail individual investors ready to buy shares of startup companies.

How is Reverse Flipping Done?

To reverse flip the headquarters to India, and the office outside India of the foreign company may be deemed to be the branch/office outside India of the resultant company in accordance with the FEMA Regulations. The company then moves its assets, operations, and intellectual property rights to the new entity in India. This refers to moving both tangible and intangible assets like trademarks, patents, and exclusive technology licenses/rights to the new entity in India. Reverse flipping of a foreign entity back to India can be achieved by any of the following methods:

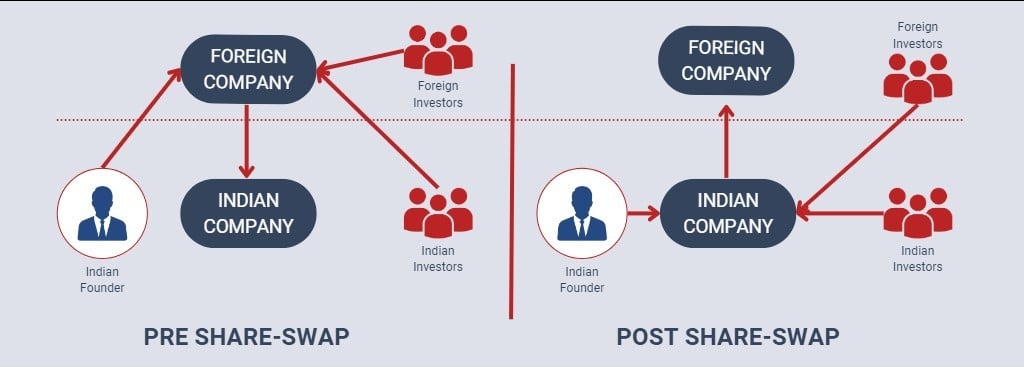

1. Share Swap Arrangement

The company may use share swaps or mergers as a method for executing the reverse flip. In this arrangement, shareholders of the foreign headquarters entity swap their shares in the foreign entity with the shares of the Indian entity. The transfer of shares in the foreign entity would be subject to capital gain tax in the hands of shareholders in India as the same would fall under the term transfer as per the Income Tax Act, 1961. As an example, the capital gains taxes paid by the shareholders of PhonePe (in case of swap of shares) during its shift to domicile in India was as high as almost INR 8,000 crores.

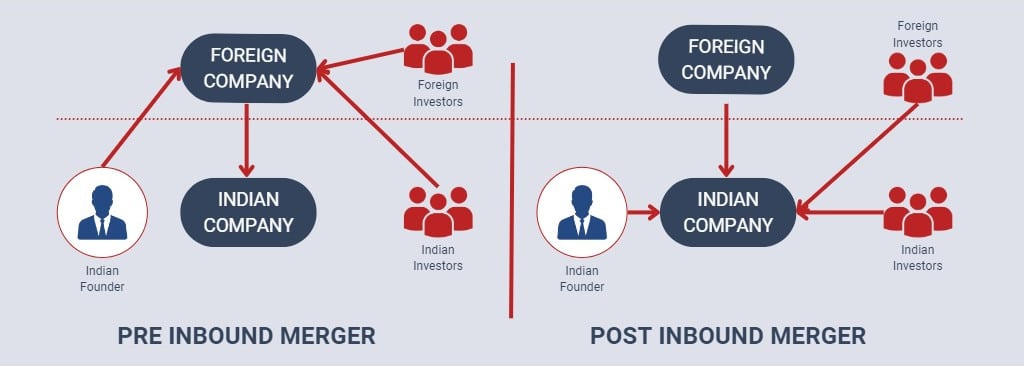

2. Inbound Merger

The other approach for reverse flipping is an inbound/cross-border merger of the HoldCo with its Indian subsidiary, wherein the Indian entity becomes the surviving company. This involves the foreign entity merging into the Indian entity, with the assets and operations eventually owned and controlled by the Indian entity. This arrangement would be tax-neutral in India under the Income Tax Act, 1961 provided all the conditions of an amalgamation/merger are satisfied. Inbound mergers must comply with the Foreign Exchange Management Act, 1999 (FEMA), and its regulations, including the Foreign Exchange Management (Non-Debt Instruments) Rules, 2019, and the Foreign Exchange Management (Cross-Border Merger) Regulations, 2018 (cross-border regulations). Mergers must also follow the Companies Act, 2013, and the rules thereunder. An inbound merger must be approved by the National Company Law Tribunal (NCLT). Fintech start-up Groww has chosen reverse flipping (from the USA to India) through this route.

Why Reverse Flipping is Gaining Traction

1. Regulatory Influences

Apart from an attractive investment pool, many startups had previously relocated their headquarters overseas to take advantage of better tax and regulatory conditions. However, with changes and improvements in global tax rules and India’s compliance procedures, the benefits of staying overseas have significantly dropped.

2. Market Dynamics

The Indian market is experiencing remarkable expansion, making it a lucrative place for businesses. The possibility of high valuations and strong market demand are convincing reasons for startups to return to India.

3. Strategic Advantages

Relocating to India helps startups align their operations to the primary market, using local skills, assets, and market knowledge more efficiently. Additionally, listing on Indian stock markets can enhance their value, as the investor trust in the Indian economy is rising. Global factors like the non-renewal of Petrodollor deal may reduce demand for the US Dollar significantly, paving the way for other currencies of developing countries to rise against USD, RBI repatriating sovereign gold from the Bank of England to India and NY Fed may shift interest of investors from western countries to upcoming economies like India.

4. Government Assistance

The Indian government offers a conducive atmosphere for startups and a strong economic growth story, even though returning startups have to pay taxes. Programs like the National Initiative for Developing and Harnessing Innovations and the Atal Innovation Mission foster innovation among startups. Fund of Funds for startups, and the Gujarat International Finance Tech-City International Financial Services Centre (GIFT IFSC) regime are initiatives taken by the government for fostering financial growth in India.

5. Facilitating the listing process for microcap shares in India

The Indian government has taken various steps to make it easier for microcap shares to be listed in India. These include easing the listing criteria, simplifying the approval process for Initial Public Offers (IPO) and Follow-on Public Offers (FPOs) by reducing the time and paperwork needed for listing, setting up a separate trading platform to meet the specific needs of microcap and startup companies, enabling better access to capital by launching Startup India program and various funding schemes.

6. Key tax law changes promoting foreign investments

Reduction in Corporate tax rate from 30% to 22%, abolition of Dividend Distribution Tax (DDT) shifting the tax burden from companies to shareholders, streamlining of taxation for Foreign Portfolio Investors (FPIs), Tax holiday for startups, exemption from Minimum Alternate Tax (MAT), the introduction of Advance Pricing Agreements (APAs) etc. have played a significant role in attracting the companies to India.

7. Regulatory Reforms

Improved ease of doing business and liberalized regulations boost investor confidence. Reforms such as the introduction of Goods and Services Tax (GST), liberalization of Foreign Direct Investment (FDI) policies and measures to streamline regulatory processes have made India a more attractive destination for foreign companies seeking to establish or expand their presence in the country.

Key Considerations

1. Legal & Regulatory Compliance

Companies that want to move their domicile to India must obtain approvals from regulatory bodies such as the National Company Law Tribunal (NCLT) and local courts. Also, compliance with financial services regulators, including the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), creates another layer of approvals, requiring a thorough knowledge of the relevant regulations. The company is to understand registration processes, corporate laws, tax regulations, employment laws, and any other applicable laws of India for their type of industry/company before internalization.

2. Tax Implications: Navigating the intricacies

Understanding tax implications is one of the main factors that startups need to understand before internalization back to India. Challenges may arise with cross-border mergers and the taxation of ESOPs granted at foreign levels. Also, they will have to understand the tax applicable in the current jurisdiction for internalization which may further complicate the situation.

3. Compliance with the Foreign Exchange Management Cross Border Regulation, 2018

Foreign Exchange Management (Non-debt Instruments) Rules, 2019 (FEMA NDI Rules) and Foreign Exchange Management (Overseas Investment) Rules, 2022 and Foreign Exchange Management (Cross Border Merger) Regulations, 2018 are the Cross Border Regulations that be followed. The Indian Company shall not require any prior approval of the Reserve Bank of India as any transaction on account of a cross-border merger undertaken in accordance with Cross Border Regulations shall be deemed to have prior approval of the Reserve Bank.

Securities given to non-residents and share transfers to foreign investors need to meet the standards for pricing, entry routes, sectoral caps, and reporting requirements. Guarantees and outstanding borrowings/loans of the foreign company have to be in alignment with external commercial borrowing/trade credit rules within a period of two years from the date of sanction of merger by NCLT.

If the asset or security outside India is not permitted to be acquired or held by the Indian company as per Indian Law, the Indian company shall sell such asset or security within a period of two years from the date of sanction of Merger by NCLT and the sale proceeds shall be repatriated to India immediately through banking channels. Where any liability outside India is not permitted to be held by the Indian company, the same may be extinguished from the sale proceeds of such overseas assets within the period of two years.

4. Competition Commission of India (CCI) compliance

An entity may also have to see if the CCI needs to approve the internalization based on the deal value / asset size and turnover of the entities involved and if the structure gives them control. Parties will have to assess if they get control of the structure and the details of the deal value / asset size and turnover of the entities involved.

5. Other regulatory approvals

Additional regulatory and sectoral approvals may be required depending on the sector of the entity. For example, the RBI may need to approve an entity in a sector under the ‘approval route’ in the FDI policy of India. The internalization may also trigger approvals based on the type of business or licenses of the entities involved. For example, the RBI needs to approve any change in control of the Non-Banking Financial Companies (NBFC) and Housing Finance Companies (HFC). Since the foreign entity will dissolve and the shareholders will move to the Indian entity, there is a change in control, ownership, shareholding, and possibly management of the entity, so all relevant approvals related to these aspects must be obtained.

6. Employee Stock Option Plans (ESOPs)

Foreign Holding Company founders and promoters usually are entitled to employee stock options (ESOP) or similar benefits. However, as per the Indian law, promoters of Indian Company are not allowed to have ESOPs, unless they are DPIIT-recognized startups. Inbound merged promoters of Indian Company are not allowed to have ESOPs, unless they are DPIIT-SOPs. Further, as per the Indian law, ESOP must provide that there shall be a gap of one year between the grant of options and its vesting. Promoters’ ESOPs may need to change in the structure for an inbound merger to follow legal and tax rules in India.

7. Business Transition

Once internalization is complete, the foreign company shifts its operations to India i.e. the new location. The Indian company may need to hire local talent, build partnerships with suppliers and vendors, and adapt its business strategy to the local market situation.

8. Successful IPO

For existing institutional investors, a timely exit is essential to the realization of the value of their investment. While IPOs remain a preferred exit option, the overall market sentiment and reaction towards a to-be-listed company’s products/services and sector at the time of exit cannot be predicted.

With direct listings on the GIFT IFSC exchange, it will offer Indian companies the opportunity to list on the IFSC Exchange, irrespective of their presence on domestic exchanges, thus enabling access to global capital and potentially enhancing their valuations. At the same time, trading in dollars will eliminate the need for currency conversion and reduce hedging costs, enhancing investor returns.

How is the Government Responding?

The International Financial Services Centres Authority (IFSCA). had set up an expert Padmanabhan committee to develop a plan to ‘Onshore the Indian innovation to GIFT IFSC’. IFSCA aims to make GIFT City, India’s first IFSC, the preferred destination for startups to internalize. This expert committee presented its Report on 25 August 2023 with proposed measures to be taken by various stakeholders, such as ministries and regulatory bodies, in implementing the concept of bringing Indian innovation to GIFT IFSC. If these efforts succeed, it will pave the way for more startups and their investors to reverse flip or re-domicile into India and list their securities in India.

Recommendation of some reforms

1. An amendment in the Companies Act to carve out some more exemptions from stringent compliance and governance for such Indian companies formed under reverse flipping, recognizing the issue of SAFE Instruments and SPAC Companies (Sole Purpose is Acquisition of Company) and invest IPO Proceeds therein. Such instruments and companies are popular in foreign jurisdictions.

2. Provide additional limits of Liberal Remittance Scheme (LRS) for resident start-ups to invest in such companies

3. Provide exemption from the stamp duty for transfer of assets and shares

4. Fast and single track window for formation, registrations, approval for merger from NCLT, Tax and regulatory bodies and post-merger compliances.

5. Simpler, faster, and efficient dispute resolution process

6. Establishing advanced ruling authorities.

7. Establishing a smooth exchange of information and reduction in duplication of compliances between Ministry of Corporate Affairs (MCA) and Securities and Exchange Board of India (SEBI) for faster listing.

Conclusion

India is rising globally and in its new avatar it is young, entrepreneurial, digital, and hungry for scale. In the last few years, we have seen unicorns from India transforming the global landscape. The Prime Minister’s vision for 2047 is Amirt Kaal for ‘New India’, a new dawn for the country that will bring with it the chance to fulfil the nation’s aspirations.

The recent trend of reverse flipping is driven by India’s appeal as an emerging powerhouse. The change in rules regarding round-tripping fosters a more business-friendly environment, aiding companies in leveraging global profits for growth within India. This is further supported by the country’s current start-up ecosystem, which benefits from abundant venture capital, favorable tax policies, strong intellectual property protection frameworks, and a vast, educated workforce. Additionally, increasingly supportive government policies favor entrepreneurship. By reverse flipping to India, these companies are positioning themselves to capitalize on the nation’s dynamic economic environment and growth opportunities.

Authored by:

Megha Gala | Direct Tax

Frequently Asked Questions

Reverse flipping is when an Indian parent company transfers ownership to its foreign subsidiary, making the foreign entity the listed or controlling company.

Companies use reverse flipping to access global capital markets, enhance valuation, and improve investor reach.

It introduces foreign jurisdiction compliance requirements while Indian regulators monitor tax, corporate governance, and disclosure obligations.

Tax implications include capital gains tax, cross-border transaction taxes, and potential withholding tax obligations.

It can boost valuation due to better access to foreign investors, improved liquidity, and global market perception.

Share

Share