Legal Requirements for Setting Up a Finance Company in GIFT City

Legal Requirements for Setting Up a Finance Company in GIFT City

Legal framework for setting up a finance company in GIFT City, covering structure, services, and compliance needs

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

GIFT City is a global financial and IT services hub, a first of its kind in India. It is designed to compete with globally benchmarked business districts. More than 200 companies have setup in GIFT city, key occupants include major banks, mainstream insurance firms, and info-tech. The finance industry works together with banking to offer financial services and innovative products, contributing significantly to the growth of a financial center. In GIFT City, businesses involved in financing activities like lending, factoring, forfeiting, and leasing of aircraft and ships are allowed to operate under a license as a finance company or unit.

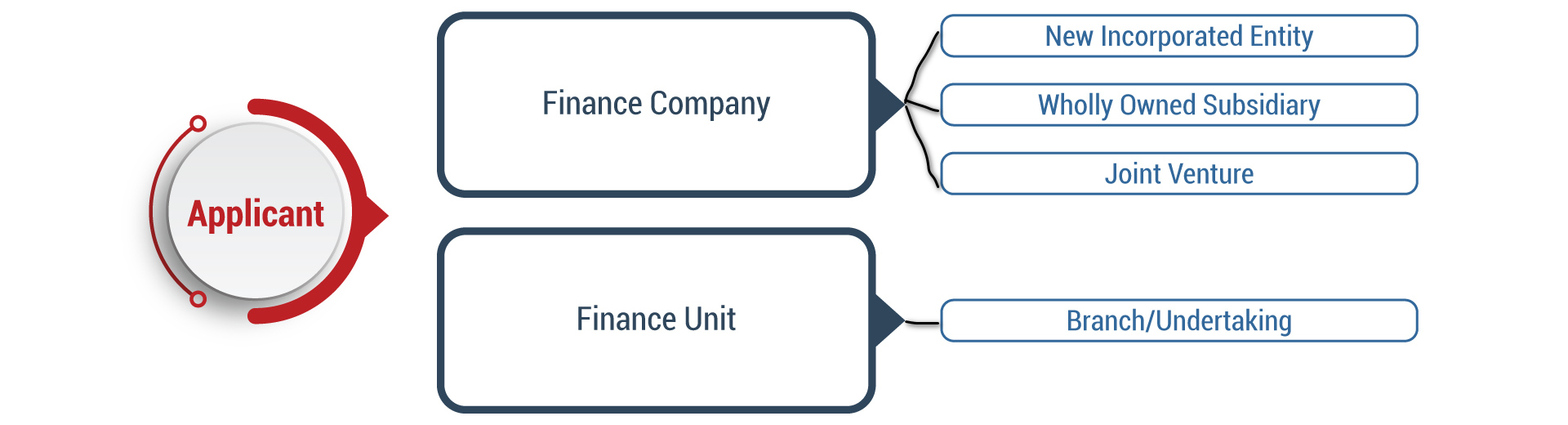

Structure

To better understand how a Finance Company/unit can be formed, let’s have a look at the following standard structures in GIFT City – IFSC.

Permissible Services

A finance company or a finance unit may undertake the following activities:

i. Core Activities

- Lending in the form of loans, commitments and guarantees, credit enhancement, securitisation, financial lease, and sale and purchase of portfolios;

- Factoring and forfaiting of receivables;

- Undertaking investments, including subscribing, acquiring, holding, or transferring securities or such other instruments, as may be permitted by the Authority;

- Buy or Sell derivatives;

- Global/Regional Corporate Treasury Centres in GIFT City.

- Any other core activity as notified by the Authority.

ii. Non-Core Activities

- Merchant Banking;

- Authorised person;

- Registrar and Share Transfer Agent;

- Trusteeship Services;

- Investment Advisory Services

- Portfolio Management Services

- Operating lease of any products, including aircraft lease, and ship lease.

- International Trade Financing Services Platform;

- Distribution of financial products

- Function as trading and clearing members or professional clearing member of exchanges and clearing corporations set up in IFSCs;

- to act as facilitators of permissible activities

- Any other activity without involving a customer interface

- any other activity, as may be permitted and classified as a non-core activity by the IFSCA Authority in GIFT City.

Net Worth Requirement

| Sr. No. | Activity | Minimum Owned Fund Required |

|---|---|---|

| 1. | Undertaking one or more of the non-core activities only | USD 0.2 million |

| 2. | Undertaking one or more core activities with or without non-core activities (except for Global / Regional Corporate Treasury Centres) | USD 3 million |

| 3. | Undertaking activities of Global / Regional Corporate Treasury Centres. | USD 0.2 million |

Other Financial Requirements

A Finance Company or a Finance Unit is required to maintain the following ratios:

- Capital Ratio (CR) – Minimum capital ratio at eight percent of its regulatory capital to its risk-weighted assets.

- Liquidity Coverage Ratio (LCR) – A Finance Company or a Finance Unit as the case may be, shall maintain LCR on a stand-alone basis.

- Exposure Ceiling (EC) – The sum of all the exposures of a Finance Company or a Finance Unit, as the case may be to a single or group of counterparties must not be more than 25% of the available eligible capital base.

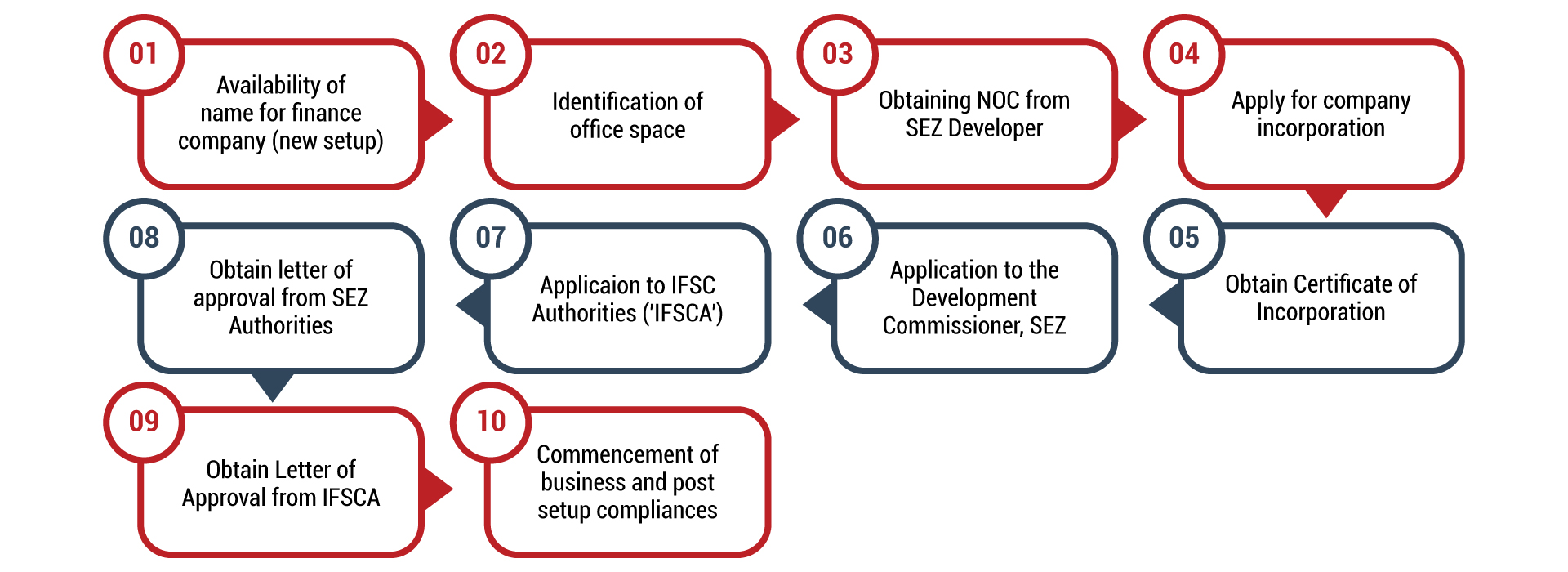

Process for Setting Up of Finance Company/Unit:

Step 1: Availability of name for finance company (new setup)

Step 2: Identification of office space

Step 3: Obtaining NOC from SEZ Developer

Step 4: Apply for company incorporation

Step 5: Obtain Certificate of Incorporation

Step 6: Application to the Development Commissioner, SEZ.

Step 7: Application to IFSC Authorities (‘IFSCA’)

Step 8: Obtain letter of approval from SEZ Authorities

Step 9: Obtain Letter of Approval from IFSCA

Step 10: Commencement of business and post setup compliances

Benefits for Finance company / Unit registered in GIFT City

| Particulars | Benefits |

|---|---|

| Income Tax Act | – 100% tax exemption for 10 consecutive years out of 15 years

– MAT / AMT @ 9% of book profits applies to Company/others set up as a unit in IFSC (MAT not applicable to companies in IFSC opting for new tax regime). – Dividend paid to shareholders of the company in IFSC (Taxable in the hands of recipient, Exemption not relevant due to withdrawal of DDT regime). – Interest income paid to non-residents on monies lent to IFSC units is not taxable. – Withholding tax chargeable at the reduced rate of 4%. |

| Goods and Service Tax | – No GST on services: a. Received by unit in IFSC b. Provided by IFSC / SEZ units to offshore clients- GST applicable on services provided to DTA |

| Customs Duty | – Exemption from customs duty for all goods imported into the SEZ used for authorized operations. However, any removal of goods from SEZ into the Domestic Tariff Area (“DTA”) would attract customs duty. |

Related Read: A Complete Overview of IFSC Gift City and Tax Benefits in Gift City

Regulatory Fees

IFSCA Fees for Finance Company / Unit:

| Particulars | Amount |

|---|---|

| Application Fees (One-time) | $1,000 |

| Registration fees (One-time) | $12,500 |

| Recurring Fees* (Annual) | $12,500 |

* Fees will be reduced to $ 5,000 in case of Aircraft operating lessors and Ship operating lessors.

SEZ Fees for Finance Company / Unit:

| Particulars | Amount (in INR) |

|---|---|

| Application Fees (One-time) | INR 5,000 |

| Recurring fees (Annual) | INR 5,000 |

FAQs

In an International Financial Services Centre (IFSC), a Finance Unit can be setup and conduct financial activities without needing a no-objection certificate-NOC, as long as it is regulated by a financial sector regulator in its home jurisdiction. However, If the parent company of the Finance Unit is involved in regulated financial activities, it must obtain an NOC from its home country regulator before setting up a Finance Unit in the IFSC.

As of the current regulations, the specific mention of cryptocurrency-related activities is not provided. However, the Authority has the power to issue clarifications or guidelines.

Angel Funds cater to investors committing at least USD 40,000, whereas Venture Capital Schemes may include investors with different investment levels upto USD 150,000.

No, every Finance Company or Finance Unit is required to maintain its balance sheet only in United States Dollars (USD). However, they may be permitted to conduct business transactions denominated in INR, subject to settlement in a freely convertible foreign currency.

No, Finance Companies or Finance Units are explicitly prohibited from accepting public deposits from residents, both within and outside IFSCs. They are also not allowed to register with the Authority as Banking Units.

Share

Share