Linking MSCI ESG Ratings with BRSR Framework

Linking MSCI ESG Ratings with BRSR Framework

Market Influence on ESG Ratings: Know about conceptualization, key issue framework, methodology to enhance BRSR reports for MSCI ratings

- Last Updated

In the growing phase of sustainable investment, there is a greater need for a standard framework to analyze a company’s environmental, social, and governance (ESG) performance across its operational activities. These factors not only play a vital role in determining a company’s exposure to ESG risks and opportunities but also help investors and companies guide their decisions. With SEBI at the forefront of developing ESG reporting standards in India, adopting transparent reporting practices, such as the Business Responsibility and Sustainability Reporting (BRSR), is gaining momentum. Also, SEBI has made it mandatory for the top 1000 listed companies to publish BRSR reports as part of their listing disclosure obligations.

Sustainable investment is not a new concept. It has now become an approach that investors use worldwide. This ensures that their portfolios represent values and that companies are not involved in controversial activities. In context, ESG ratings are essential according to Credit Rating Agency (CRA) Regulations. These ratings provide information about a company’s ESG performance, helping investors to evaluate risk exposures, mitigations, and opportunities related to sustainability. However, what raised the widespread adoption of ESG ratings was the introduction of Principles for Responsible Initiative (PRI) by the United Nations in 2010, advising investors to consider ESG factors in their decision-making processes. This initiative was, therefore, a landmark, propelling ESG considerations into the mainstream of financial discourse.

Furthermore, SEBI has implemented a set of regulations vide circular no. SEBI/HO/DDHS/POD3/P/CIR/2024/45 dated May 16, 2024, to streamline the process. This is aimed at tracking ESG Rating Providers (ERPs) to address the uncertainties surrounding the standards for ESG ratings to improve the credibility and transparency of the dynamic nature of such concerns.

Market Influence on ESG Ratings

Today, ESG ratings are fundamentally crucial from the perspective of the investment landscape. Also, ESG ratings help in shaping market behavior and company valuations. Investors not only use these ratings to drive their decisions, but also help companies in mitigating risks and make the most of opportunities associated with sustainable practices.

In addition, SEBI has registered around six entities to become ESG rating providers (ERPs) in the past few weeks, including credit agencies like ICRA, CRISIL, etc. and proxy advisory firms such as Stakeholders Empowerment Services (SES) ESG and Institutional Investor Advisory Services (IIAS). Also, Morgan Stanley Capital International (MSCI) and London Stock Exchange Group divisions, are awaiting the nod of SEBI to become ERPs. SEBI’s decision to regulate entities that provide ESG ratings will make these rating scores more consistent, comparable, and transparent, instilling higher confidence among investors.

Over the last decade, the ESG rating system has developed rapidly. Many specialized agencies have increased the demand for transparent and comparable ESG data. Prominent agencies such as Sustainalytics, ISS ESG, MSCI, etc., have developed a wide variety of methodologies to assess companies across different ESG variables. To better understand one such rigorous assessment of ESG performance, the MSCI ESG Rating framework has been conceptualized to offer a comprehensive evaluation of a company’s ESG strengths and weaknesses, enabling investors to make more informed and responsible investment decisions.

Conceptualizing MSCI ESG Ratings

The MSCI Rating Framework is a sustainable tool for investors that navigates the complexity of ESG factors. This framework assesses thousands of companies worldwide based on diverse ESG variables and provides insight into the companies’ management of financially relevant ESG risks and opportunities.

Each rating is an industry-relative measure and is determined at the company level. Also, MSCI ESG Ratings consider a company’s management measures that are aggregated relative to companies’ governance structures, policies and targets, quantitative performance metrics, and relevant controversies. The top-level assessment is the overall company ESG rating, an industry-relative seven-point scale from AAA to CCC. These assessments are not absolute but are explicitly relative to a company’s industry peers.

The company ESG rating is then derived from the industry-adjusted company score based on assessing the underlying data available at the last ESG rating action date.

| Rating | Leader/Laggard | Industry-Adjusted Score |

|---|---|---|

| AAA | Leader | 8.571* – 10.0 |

| AA | Leader | 7.143 – 8.571 |

| A | Average | 5.714 – 7.143 |

| BBB | Average | 4.286 – 5.714 |

| BB | Average | 2.857 – 4.286 |

| B | Laggard | 1.429 – 2.857 |

| CCC | Laggard | 0.0 – 1.429 |

*The appearance of overlap in the score ranges is due to rounding errors. The 0-to-10 scale is divided into seven equal parts, each corresponding to a letter rating.

MSCI ESG Ratings Key Issues Framework

MSCI key issues have a more diverse spectrum of ESG variables comprising around 33 key issues that are further classified into 10 themes, focusing on the intersection between a company’s core business and the industry-specific issues that may provide substantial risks and opportunities corresponding to them. These key issues are weighted according to the impact and time horizon of the risk or opportunity, like how material topics are identified for materiality assessment in Sustainability Reporting.

Framework for setting Key Issues weights

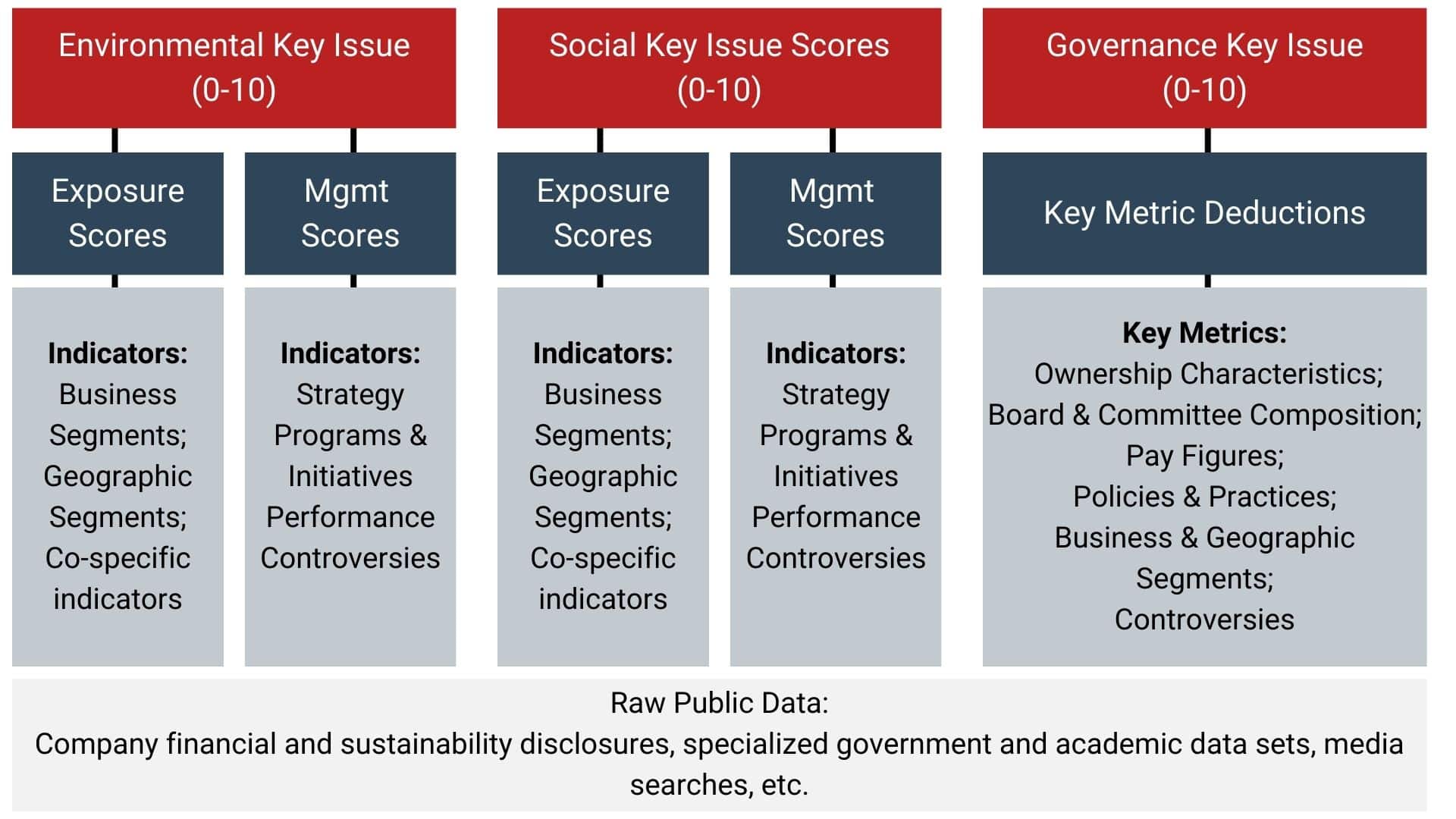

In addition, each company is evaluated on a selection of two to seven environmental and social key issues (out of 33 total) relevant based on the company’s exposure to material ESG risks identified by industry and market-specific factors. All companies are evaluated for the Governance pillar, which comprises six key issues under Corporate Governance and Corporate Behavior, as they are classified as Universal key issues to all industries.

Methodology of MSCI ESG Rating and Scores

As per the methodology, the MSCI has classified scoring into two types: Industry-Adjusted Company Score and Weighted Average Key Issue Score (WAKIS), which can be described as follows:

- Industry-Adjusted Company Score: This score is calculated by normalizing the WAKIS relative to the benchmark scores set by the industry peer group for ESG rating.

- Weighted Average Key Issue Score (WAKIS): This is calculated for each company based on the weighted average scores for all the individual Environmental and Social Key Issues and the Governance pillar score.

- The Governance pillar score is a type of deduction-based scoring model that uses a universally applied 0-10 scale derived from key metrics included in the Corporate Governance (comprising Ownership & Control, Board, Pay, and Accounting) and Corporate Behavior (comprising Business Ethics and Tax Transparency) Themes.

- Key Issue Scores (Environmental and Social themes) are derived from the weighted average of underlying key issues ranging from 0-10. Generally, these key issues scores are evaluated based on the company’s exposure to risks or opportunities and its ability to manage that exposure. These are calculated using the Key Issue Exposure Score and Key Issue Management Score.

Interpreting Key Issue Scores and Supplemental scores

- Key Issue Scores

| Key Issue Scores | Risk-Based | Opportunity-Based |

|---|---|---|

| 10 | Companies with a score of 10 on risk-based key issues have very strong measures relative to their exposure to ESG risk. Although, companies with a score of 10 do not have very high exposure to the risks. | Companies with a score of 10 on opportunity-based ESG key issues have very strong positioning to meet market demand for their provisions that have a positive impact. |

| 5 | Companies with a score of 5 on risk-based have moderate management measures relative to their exposure. | Companies with a score of 5 on opportunity-based have moderate positioning to meet the market demand for their provisions that have a positive impact. |

| 0 | Companies with a score of 0 on risk-based ESG key issues have very poor management measures relative to their exposure. | Companies with a score of 0 on opportunity-based do not have the initiative to meet the market demand for their provisions that have a positive impact. |

- Supplemental Scores

Supplemental scores are the other scores considered under the MSCI ESG Rating Framework that do not directly contribute to the overall ESG rating but provide additional insights to the issuers of ESG ratings. These are sub-divided into four parameters:

- Pillar Scores: These scores across the Environmental and Social Pillars are calculated based on the weighted average of Key Issue Scores (WAKIS), normalized by the total sum of weights underlying each pillar.

- Theme Scores: These scores across the Environmental and Social Pillars (8 out of 10 Themes) are calculated based on the WAKIS, normalized by the total sum of weights underlying each theme- generally, these range from 0 to 10, with lower scores indicating more severe risk.

- Governance Key Issue Scores: Each Key Issue represents a broad area of governance risk, and the Governance pillar is calculated for both themes.

- Governance Theme and Key Issue percentiles: To complement the 0-10 Theme and Key Issue Scores, percentile rankings are calculated. These assess a company’s relative performance against its peers, with percentile rankings ranging from 0-100. Further, they are evaluated using two types of percentile rankings: Home market and Global market percentiles.

| Percentile Rankings | Description |

|---|---|

| 96-100 | Best in Class |

| 76-95 | Above Average |

| 26-75 | Average |

| 6-25 | Below Average |

| 0-5 | Worst in Class |

The Interconnection: MSCI Key Issues and BRSR Principles

As companies adopt BRSR guidelines to increase openness and accountability in various ESG variables, MSCI’s standardized ESG assessments provide valuable insights into their alignment with sustainability goals. The concurrence between these two facilitates unified integration, increasing consistency and comparability in sustainability reporting. In contribution to this, the relationship between the MSCI key issues and BRSR principles can be described as:

| BRSR Principles | Linkage with MSCI |

|---|---|

| Principle 1 | It is linked to the following key issues of MSCI-

It varies by company but ultimately influences scores based on the disclosure quality. |

| Principle 2 | It is connected to the social pillar of the MSCI rating mechanism. It includes-

With higher scores for ethical practices and lower scores for controversial sourcing. |

| Principle 3 | It aligns with a key issue of human health and safety, highlighting the importance of respecting and promoting employee welfare. |

| Principle 4 | This is intertwined with the social theme of MSCI, which defines stakeholder opposition with metrics focusing on community relations and getting higher scores for their performance disclosure. |

| Principle 5 | It includes-

It stresses the protection and promotion of human rights, with scores based on detailed narratives and continuous improvement efforts. |

| Principle 6 | Aligned with the environmental pillar of the MSCI rating framework, which covers a broad spectrum from climate change to natural capital to environmental opportunities, it assesses the entities’ scoring based on their management and exposures defined in the methodology. |

| Principle 7 | It is the only principle with no direct interconnection with the MSCI Framework. |

| Principle 8 | It connects to the sub-theme under the social pillar of MSCI, which is key issues such as raw material sourcing and community relations. This also examines how companies shall manage and abide by social commitments and goals. |

| Principle 9 | Connected to the sub-theme defined by the MSCI as privacy and data security to ensure consumer beliefs, satisfaction, and high measures corresponding to their integrity. |

To sum up, out of the 33 key issues defined under the MSCI ESG ratings framework, it covers approximately 58% of the narratives reported in the BRSR Framework. Moreover, there can be a more significant step that companies could adopt toward standardized BRSR reporting in India; it just requires them to disclose more on the leadership indicators to narrow the gap between their holistic ESG assessment.

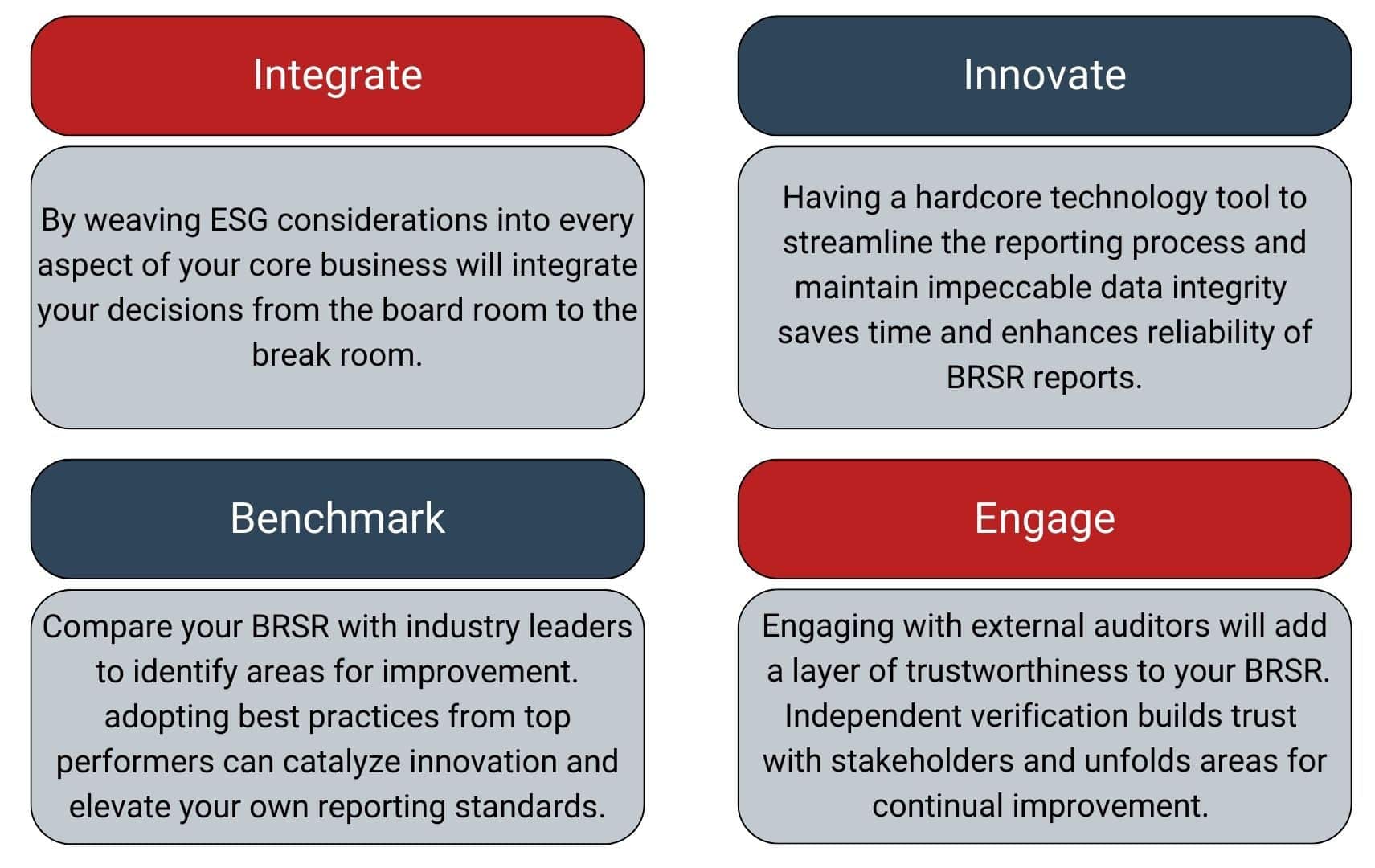

Enhancing BRSR Reports for Better MSCI ESG Ratings

For those companies aiming to build high scores on MSCI ESG ratings, refining their BRSR narratives is a crucial step. The high-quality BRSR reports serve as media for a company’s ESG efforts. In addition, this will attract socially conscious investors and reinforce the company’s reputation and competitive edge.

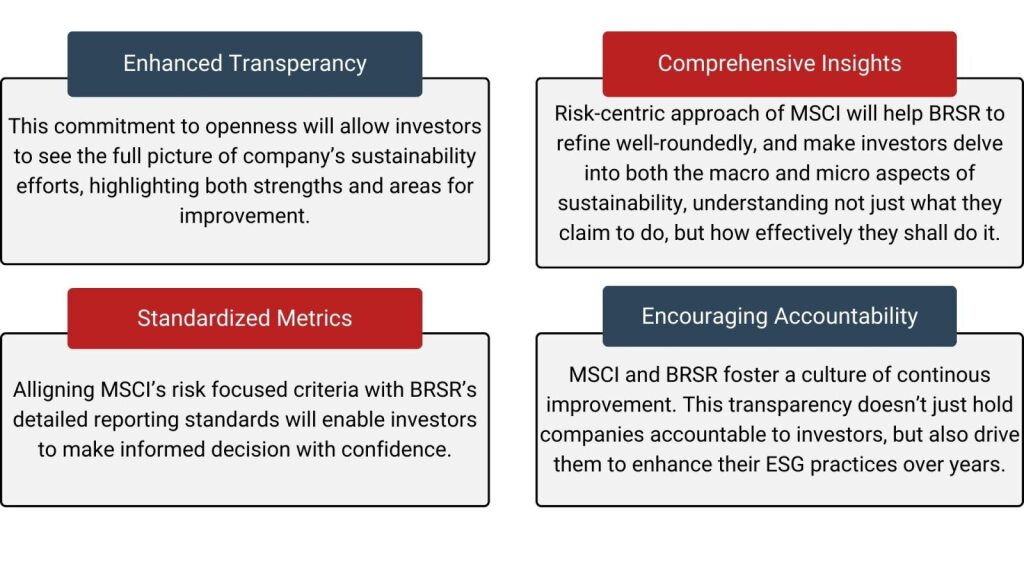

Benefits of Aligning BRSR with MSCI

Conclusion

The market for sustainable investment has no limits and will tend to accelerate soon. The synergy between the MSCI Rating Framework and BRSR will represent a significant advancement. Investors, companies, and stakeholders stand alike to benefit from this collaborative approach, driving the global shift toward responsible and impactful investing. This alignment fosters transparency and accountability and encourages companies to adopt more sustainable practices, ultimately contributing to a more sustainable future.

Why Choose InCorp?

InCorp Advisory offers a diversified ecosystem and support for your BRSR and ESG needs. Our team of experts conducts an in-depth assessment to identify and highlight potential risks and opportunities associated with BRSR reporting. Serving a diverse clientele, from listed companies to investors, we enhance ESG reports and create valuable investment opportunities. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Share

Share