Setting Up Business in GIFT City: Tax Advantages

Setting Up Business in GIFT City: Tax Advantages

Fostering financial growth: a brief guide to leverage tax advantages in GIFT City for your business expansion.

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

Gujarat International Finance Tec-City (GIFT City) is a new financial center located in Gandhinagar, India that serves as the financial center for managing financial transactions outside India. GIFT City is built in a tri-city approach, near Ahmedabad and Gandhinagar to create a sustainable and profitable environment for businesses. GIFT City enjoys the benefits of being a Special Economic Zone (SEZ) designated by the International Financial Services Centres Authority (IFSCA). Recently, the government authorized individuals to open foreign currency bank accounts in GIFT City.

Apart from maximizing tax benefits by setting up business in GIFT City, the regulated area is built to compete with other international financial centers like Singapore and Dubai. GIFT City attempts to lure foreign investors to set up funds in GIFT City. In return, entities can maximize tax benefits by setting up businesses in the GIFT City. The superior infrastructure and strategic location of the financial center makes it a comprehensive one-stop solution for all businesses looking to expand in the Indian market. This blog highlights the tax benefits and overall advantages of setting up a business in GIFT City.

Reasons to Choose GIFT City for Business Setup

1. Internationally benchmarked regulatory environment

GIFT City features an internationally benchmarked regulatory environment designed to cater to businesses’ needs. The regulatory framework also eases the bureaucratic challenges that may arise while maintaining compliance with all norms.

2. Tax incentives

Being an SEZ under the Special Economic Zones (SEZs) Act of 2005, GIFT City has various tax incentives associated to it. Entities can avail these tax benefits by setting up business in GIFT City. This removes the tax burden from organizations and helps yield higher returns on investments.

3. Ease of doing business

There are several benefits for entities setting up businesses in GIFT City, of which tax benefits are just one aspect of a vast landscape. Setting up a business in GIFT City is beneficial due to favorable regulatory frameworks and support processes to aid businesses.

4. State-of-the-art infrastructure

GIFT City was established in 2015, equipped with the latest technology and infrastructure which was one of the major attractions for setting up a business at GIFT City. Modern office spaces, high-speed connectivity, and modern utilities together build up GIFT City as a successful IFSC.

5. Strategic location

GIFT City is built on the idea of a tri-city. The government envisaged GIFT City as a place easily accessible from Ahmedabad and Gandhinagar to build a comprehensive location that is both strategically situated and economically vibrant.

Tax Benefits for Setting up Business in GIFT City

Income Tax Benefits

- Fund managers at GIFT can avail 100% tax exemption for 10 consecutive years in a span of 15 years. They do not have to pay tax on the profits earned by managing funds during the initial years of operation after setting up business at GIFT City.

- In case where Minimum Alternate Tax (MAT) is applicable, businesses can enjoy a reduced rate of MAT if they fulfill criteria under Section 115JB of the Income Tax Act. These criteria are mostly related to profits made under SEZ operations.

GST and Custom Duties

- Since GIFT City is a SEZ, all the goods and services provided to locations outside the SEZ are considered exports attracting a 0% GST rate.

- Moreover, transactions intra-GIFT is considered zero-rated supplies removing the burden of GST taxation.

- Imports are subjected to custom duties and tax as per standard regulations at GIFT. However, if these imports are to be exported outside the SEZ, they are treated as zero-rated supplies and no GST is levied on such components.

- By setting up business at GIFT City, organizations can enjoy warehousing facilities available to them. They can be exempted from customs duty deferral or exemptions until the imports are cleared for the Indian market.

| Particulars | Units in IFSC |

|---|---|

| Income Tax |

|

| Goods & Services Tax |

|

| Other Taxes Duties |

|

Special Economic Zone (SEZ) Advantages

A Special Economic Zone (SEZ) is a specified area under a nation’s territory that enjoys financial relaxations when compared to other areas in that country. These regions are generally designed to foster a fruitful environment to attract businesses and increase the investments made. SEZs can be crucial for a developing nation like India. Setting up your business at GIFT City is a perfect example of taking advantage of SEZ benefits. Businesses set up under the SEZ section of the GIFT can enjoy duty-free export and import of goods and services.

Tax exemptions and financial benefits are only one side of the coin of GIFT City. Businesses can enjoy several more benefits that are very specific to GIFT. Firstly, GIFT is specially designed for finance. Other SEZs in India are more manufacturing-oriented while GIFT focusses on financial and other related services. Due to the strategic location and extreme focus on international coherence, GIFT ensures global connectivity to other financial markets which is absent from many other SEZs.

Regulatory Framework and Compliance in GIFT City

The International Financial Services Centres Authority (IFSCA) is the sole regulator that overlooks the operations in GIFT City. IFSCA was established in 2020 with headquarters in GIFT City, Gandhinagar. IFSCA develops and regulates financial products, financial services and financial institutions in IFSC India. Currently, GIFT City is the only IFSC that is operating in India. Before the establishment of IFSC, regulations in IFSC were overlooked by the RBI, SEBI, PFRDA and IRDAI. Since the functioning of an IFSC is highly interlinked, the IFSCA has been concepted to be the unified regulator, translating to increasing the ease of doing business in the area.

Ease of Doing Business

- Regulatory Environment

GIFT City features a favorable regulatory environment for setting up businesses at GIFT City. It provides concise and easy-to-navigate regulations that foster a transparent process for regulation compliance. There is less bureaucratic delay due to this streamlined process of the regulatory environment. - Strategic Location

The government promotes entities to set up business at GIFT City. For this, numerous benefits and exemptions are provided to businesses. GIFT City offers a 20% reduction in operating costs of businesses when compared to other Tier-1 cities in the nation

Fiscal Benefits at GIFT IFSC

Businesses operating within the GIFT City can avail several fiscal benefits. These benefits are sketched out to attract businesses by providing them with financial benefits that increase the safety of investments made under GIFT City. Apart from tax, GST, and custom duty exemptions, there are multiple other fiscal benefits:

- Dividend Distribution Tax (DDT) is not applicable to the distribution of dividends by businesses set up in GIFT City.

- The transactions performed on the stock exchanges are exempt from taxation under the Commodities Transaction Tax (CTT).

- The transactions performed on the stock exchanges are exempt from taxation under the Securities Transaction Tax (STT).

- Central Sales Tax (CST) and Stamp duty are exempted on transactions conducted within the GIFT City.

Key Benefits Proposed in the Finance Bill 2024 for GIFT City

- Profits and gains of business or profession to the extent attributable to units held by non-residents are exempt from retail funds and exchange-traded funds in IFSC.

- Specified income of the Core Settlement Guarantee Fund (Core SGF) set up by recognized clearing corporations in IFSC is exempt in the hands of that fund.

- Relaxation from charging of unexplained credits to Income Tax in case of venture capital funds regulated by IFSCA.

- No restriction to finance companies located in IFSC on deduction of interest in computing income under profits and gains of business or profession.

- Tax on short-term capital gain on equity shares, units of equity-oriented mutual funds and units of a business trust is increased to 20% for resident investors in IFSC.

- The rate of long-term capital gains is proposed to be 12.5% for all categories of assets listed on exchanges at IFSC. Unlisted bonds and debentures will be taxable at the respective tax rates for resident investors in IFSC, whether short-term or long term.

- Exemption from GST compensation cess leviable on imports in Specified Economic Zone (SEZ) by SEZ unit or developer.

- For finance companies located in IFSC, payment of interest to non-residents is allowable without any limit.

- Two regimes applicable to charitable entities are proposed to be merged into a single regime from October 1, 2024.

- When two registered charitable organizations merge, there would be no exit tax on satisfying prescribed conditions from April 1, 2025.

Technological and Digital Advancements in GIFT City

GIFT City is equipped with state-of-the-art and modern infrastructure that is ever so crucial in the day-to-day operations of businesses. The infrastructure is furnished with integrated systems to manage energy, waste, and transportation. Businesses set up at GIFT City can also make use of the sensors and Internet of Things (IoT) devices present to collect and analyze the data.

Technological innovations at GIFT City are focused on enabling the fintech sector. GIFT City promotes technological advancements like Blockchain, Artificial Intelligence, Agritech, Tokenization, Quantum and Spacetech. Through GIFT City’s regulatory environment, it looks to promote the use of the latest technologies in the finance sector. GIFT IFSC also supports infrastructure such as incubators and accelerators to cater to the needs of fintech entities.

GIFT City ensures data security by featuring a holistic data security framework. It adheres to the Data Protection Bill according per the Indian Law. Also, inside the GIFT SEZ, ISO 27001 is implemented to mitigate the risks of data violations.

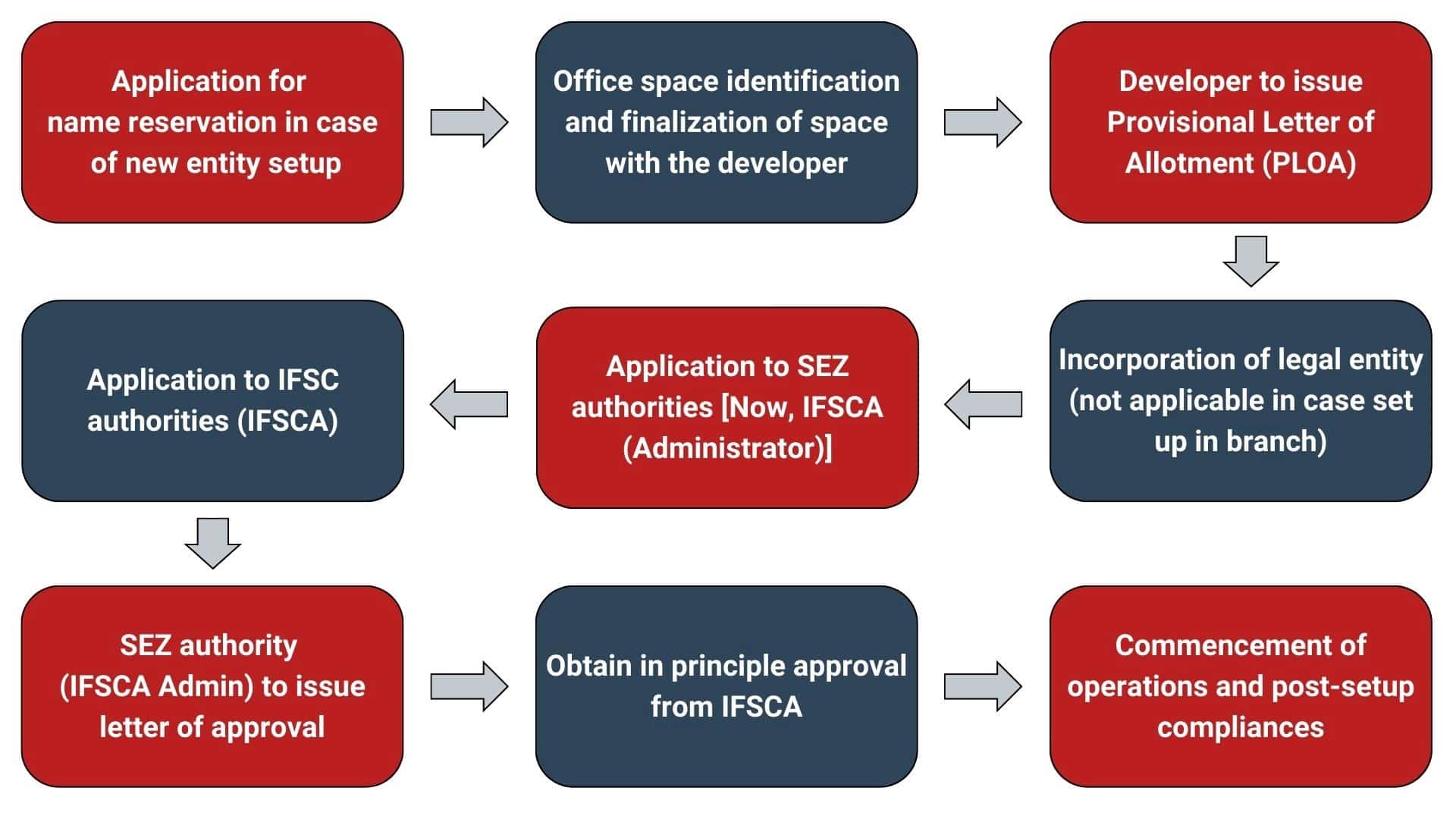

Step-by-Step Process to Set Up a Business in GIFT City

1. Office space in GIFT SEZ

For setting up businesses at GIFT City, the first and foremost step is to identify and select the office space within the SEZ. To validate this step, approval must be taken from the developer or co-developer. The office space will serve as the location for establishing business operations.

2. Provisional Letter of Allotment (PLOA)

After the entities have established communication with the developer/co-developer, it is necessary to get a PLOA. Through this document, you can initiate the establishment of your business operations confirming the chosen office space within the GIFT SEZ.

3. Form FA to SEZ Authorities

The businesses looking to set up under the GIFT SEZ are required to submit Form FA and a list of other documents.

4. Unit Approval Committee (UAC) meeting

After successful submission of Form FA to the SEZ authorities, entities will be contacted by the Development Commissioner. During the hearing, the entities will be represented by an authorized representative.

5. Letter of Approval

After the hearing, the Development Commissioner will authorize a Letter of Permission/Approval (LOA) if the Committee deems the entity fit to operate under the GIFT IFSC.

6. Letter of Acceptance

Entities looking to set up business at GIFT City are required to submit a letter of acceptance to the Development Commissioner stating they agree to the LOA’s terms and conditions within 45 days of receiving the LOA.

7. Lease Deed

A lease deed must be signed with the developer/co-developer of the GIFT SEZ and submitted to the Development Commissioner within six months of receiving the LOA.

8. SEZ License and Registration

After entities obtain a SEZ license, they need to obtain a registration with the NSDL portal.

9. Bond cum Legal Undertaking

For setting up business in GIFT City a bond cum legal undertaking must be prepared and signed by the Development Commissioner and GIFT SEZ’s specified officer.

10. Registration Certificates and Exemption Eligibility

Several certificates are to be obtained before beginning the business operations. These registration certificates include GST, RCMC, IEC, etc. The entity should also apply for eligibility certificates for exemption from taxation with respective state and central governments.

11. Registration by IFSCA

Since GIFT City is a certified IFSC, entities must obtain a Certificate of Registration by paying the fees from the International Financial Services Centres Authorities (IFSCA).

Conclusion

Businesses can avail maximized tax benefits by establishing their offices at GIFT City. The SEZ features a specially tailored business favorable regulatory environment. If you want to strategically maximize your business growth and its future, you should look the way of GIFT City. We hope this blog was able to disseminate some information on GIFT City and the availble tax benefits.

Why Choose InCorp Global?

We, at InCorp can help you set up your business at GIFT City. We feature a professional team of qualified individuals who can steer your business to a GIFT City success story. We provide holistic solutions for setting up businesses in GIFT City. Here are some of the services we offer:

- We assist in structuring and setting up the entity as per the latest requirements.

- We provide advisory services on regulation and taxation to help your business navigate freely in the GIFT IFSC domain.

- We aid in preparing the necessary documents required for incorporation at GIFT City.

- We also aid in post-setup requirements and compliance (if applicable).

To learn more about our GIFT City services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Daanish Narayan | GIFT City

Frequently Asked Questions (FAQs) on Tax Benefits at GIFT

GIFT City is India’s first operational International Financial Services Centre (IFSC), offering world-class infrastructure, regulatory ease, and global financial connectivity.

Businesses enjoy tax holidays, reduced GST, exemptions on capital gains, and lower corporate tax rates, making it financially attractive.

SEZ status provides customs duty exemptions, simplified compliance, and export-import advantages, boosting operational efficiency.

Eligible entities include IFSC-registered banks, insurance firms, mutual funds, and other financial service providers complying with SEZ and IFSC regulations.

GIFT City enables cross-border transactions, foreign currency dealings, global banking, and offshore fund management under a single regulatory framework.

Share

Share