Portfolio Management Services in GIFT: Structure and Compliance

Portfolio Management Services in GIFT: Structure and Compliance

PMS in GIFT IFSC: Legal setup, client types, investment rules, compliance needs, tax benefits, fees and registration steps

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

GIFT City is designed to be India’s first international financial hub, providing regulatory benefits like a streamlined setup process, tax incentives, and access to international markets. Any financial business operating out of GIFT IFSC enjoys several tax benefits with world class infrastructure. The government gives these tax incentives in the form of reduced taxes, simplified compliance requirements, and lower withholding rates. With these tax exemptions, Indian enterprises can expand internationally while potentially lowering their domestic tax obligations. At InCorp, we help clients to establish their offices in GIFT City IFSC under various regulatory frameworks and structures. One of the key licenses in GIFT IFSC is Portfolio Management Services under Fund Management Regulations, 2022. In this blog, we take you through important aspects of Portfolio Management Services (PMS).

Portfolio Management Services (PMS) means investment advisory services where portfolios are managed based on the client’s specific needs, risk tolerance and investment goal. Like most managed services, PMS is provided by professional portfolio managers or financial institutions with the sole objective of systematically managing portfolios to achieve clear investment objectives. PMS offers several key benefits including diversification, risk mitigation, transparency, and regulation compliance.

Legal Structure

Portfolio managers who offer PMS needs to be present at GIFT IFSC by incorporating a registered FME under the Fund Management Regulation, 2022. FME can be set in the following legal structures:

- Company

- Limited Liability Partnership (LLP)

- Branch of an existing entity

Note – A branch structure is only allowed for an FME already registered and regulated by a financial sector regulator in India or a foreign jurisdiction for similar activities. Also, registered FME (retail) shall not be permitted though LLP mode or its branch.

Client Categories

Portfolio managers (FME) may offer services to the following client categories:

- Persons residing outside India

- Non-Resident Indians (NRIs)

- Non-individual residents in India, eligible under FEMA to invest offshore

- Individual residents in India eligible to invest offshore under the Liberalized Remittance Scheme (LRS) of RBI.

Net Worth Requirements

| Sr. No. | Category | Net Worth (USD) |

|---|---|---|

| 1. | Registered FME (Non-retail) | 5,00,000 |

| 2. | Registered FME (Retail) | 1,000,000 |

Permissible Investments

- A FME operating as a portfolio manager in an IFSC shall be permitted to invest in securities and financial products in an IFSC, India or foreign jurisdiction.

- Discretionary portfolio management services may invest in securities listed or to be listed on stock exchanges, money market instruments, units of investment schemes, and other financial products as specified by the authority.

Other Compliance Requirements

Other requirements for setting up of FME providing Portfolio Management Services includes the following:

Appointment of Principal Officers and Key Managerial Personnel(s) (KMP)

- A FME must appoint a Principal Officer who shall be responsible for overall activities.

- One KMP shall be appointed as Compliance and Risk Manager.

- In case of Registered FME (Retail), in addition to the above, a KMP shall be appointed for fund management.

- A FME shall appoint other personnel as required in keeping with the size of its operations.

Fit and proper requirements

- The entity and its principal officers, directors/partners/designated partners, key managerial personnel and controlling shareholders shall be fit and proper persons.

- A person is considered fit and proper if such person shows record of fairness, financial integrity, good reputation and honesty.

- A Principal officer should be professionally qualified in finance, law, accountancy, business management, commerce, economics, capital market from a recognized institution with experience of at least five years in the securities market or financial products.

Portfolio Management Agreement and Dealing with Client Funds

- A portfolio manager must sign a formal written agreement with the portfolio management client that include key aspects, including investment objectives, risk factors, fee structure, contract duration, and any other relevant terms related to the management of the portfolio.

- In case of a portfolio management agreement, entity is not permitted to accept funds or securities worth less than USD 150,000 from the client.

- The funds of a client availing portfolio management services shall be maintained in a separate bank account.

- A FME shall maintain a separate bank account for each portfolio management client holding securities.

- The FME shall not borrow funds or securities on behalf of the client.

Taxation Benefits

- 100% tax exemption for any 10 years in a row out of the first 15 years of operations.

- Supplies to an IFSC entity shall be regarded as ’zero-rated supply’ and accordingly, no GST shall be levied.

- MAT/AMT at 9% of book profits applies to company/others setup as a unit in IFSC – MAT may not be applicable to companies in IFSC who are opting for new tax regime.

- Specific exemptions have been defined for retail funds and Exchange Traded Funds (ETFs) as per the Finance Act 2024.

Regulatory Fees

1. IFSCA Fees for Incorporating an PMS

| Particulars | Registered FME (Non-retail) USD ($) | Registered FME (Retail) USD ($) |

|---|---|---|

| Application fees (one-time) | 2,500 | 2,500 |

| Registration fees (one-time) | 7,500 | 10,000 |

| Annual fees (recurring fee) | 5,000 | 5,000 |

2. SEZ Authorities (IFSCA Admin) Fees

| Particulars | INR (₹) |

|---|---|

| Application fees (one-time) | 5,000 |

| Registration fees (one-time) | 25,000 |

| Recurring fees (annual) | 5,000 |

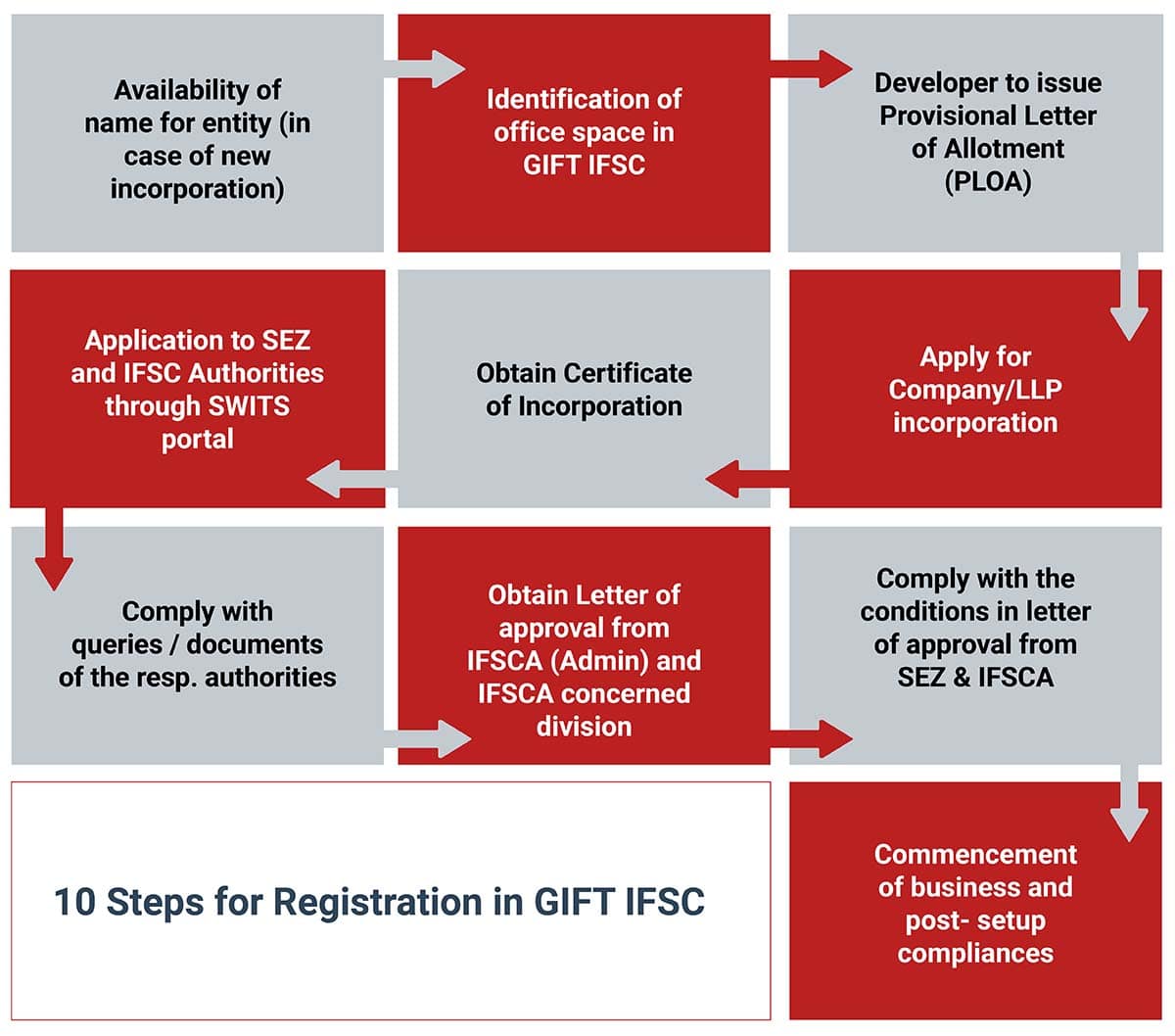

Process Flow for Registration in GIFT IFSC

Conclusion

In conclusion, Portfolio Management Services (PMS) offer professional investment solutions to investors and act as an asset to those looking forward to investing or diversifying their existing investments by offering them solutions that will cater to their needs. Through GIFT City, PMS can leverage the benefits and offer customized strategies to meet the needs of different types of investors, making it easier for them to achieve their financial goals.

Why Choose InCorp Advisory?

Our team at InCorp is dedicated to supporting clients with the incorporation of Portfolio Management Services (PMS) entities and managing their post set up compliances. Our comprehensive services include:

- Providing advisory services on Fund Management Regulation and respective taxation to ensure compliance with all applicable laws.

- Assistance in structuring the entity as per the requirements under Fund Management Regulations in GIFT City IFSC.

- Assistance in preparing necessary documentation required for incorporation of PMS entity.

- Assist clients in post-setup requirements and compliances, if required.

To learn more about our Portfolio Management Services in GIFT City IFSC, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Rajveer Singh | GIFT CITY

Frequently Asked Questions (FAQs)

IFSCA regulations provide PMS providers with direct access to international financial market through which investors can create well diversified global portfolio. This increases the diversification of assets, currencies, and sectors and delivers better results by accessing more potential growth segments in global markets than locally possible. Additionally, it provides a hedge against a country specific risk, offering potentially higher risk adjusted returns.

IFSCA regulatory framework provides a globally competitive business environment with more operational freedom, improved cross-border investment procedures. Unlike domestic markets, it permits the equity investment overseas without the overlays found domestically; and encourage the development of asset management, in support of other investment strategies and structures.

The tax strategy of the IFSCA enhances the attractiveness of PMS services in GIFT City by offering a highly competitive tax structure. NRIs benefit from zero tax on capital gain and dividend income. Additionally, the IFSC is also tax efficient due to incentives given to the offshore tax and the DTAA that India has with several countries which allows investors to efficiently plan their taxes while having equal access to world portfolio.

Share

Share