Strategic Compliance with EU Sustainability Laws and IFC Standards

Strategic Compliance with EU Sustainability Laws and IFC Standards

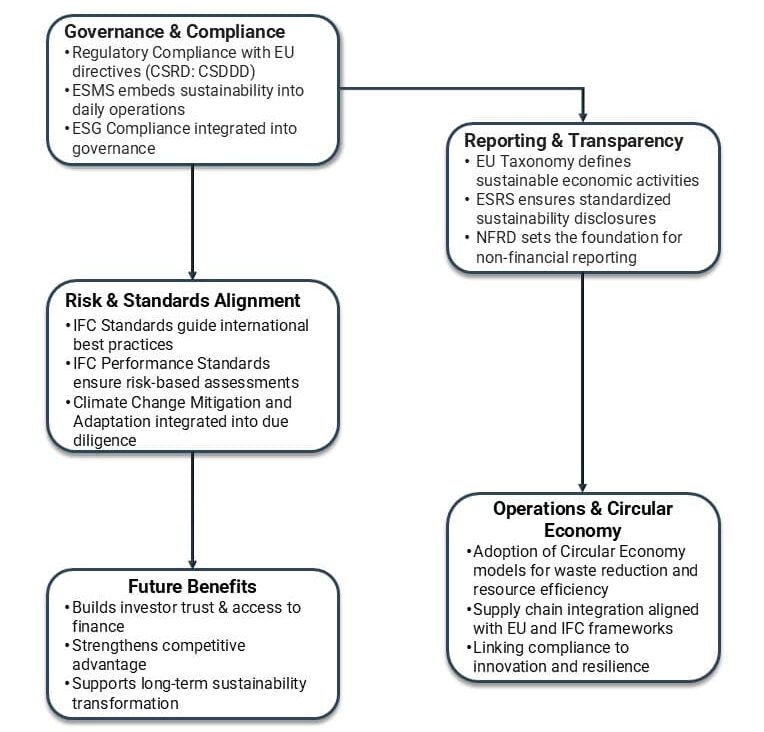

How different organizations can align with EU sustainability directives and IFC standards to enhance and build long term sustainability

- Last Updated

Global ESG compliances are undergoing a drastic change, with the European Union (EU) at the forefront through frameworks such as the Corporate Sustainability Reporting Directive (CSRD), Corporate Sustainability Due Diligence Directive (CSDDD), EU Taxonomy, and the Carbon Border Adjustment Mechanism (CBAM). At the same time, international standards like the International Finance Corporation (IFC)’s Environmental and Social Management System (ESMS) are shaping how organizations are approaching (ESG) risks and opportunities.

These developments are reshaping what it means to be a responsible business. Beyond regulatory compliance, corporations across sectors have been facing challenges and opportunities of embedding ESG into their strategic core, governance structures, and daily operations. This blog examines how companies navigate this landscape, integrating compliance with EU taxonomy and IFC performance standards into their operations for sustainable value creation, supported by real examples from several sectors.

Embedding Circular Economy principles into operations further strengthens alignment with both EU and IFC requirements. Through efficient waste management, recycling, and extended producer responsibility, companies demonstrate conformance with ESRS and NFRD while also meeting IFC Standards on resource efficiency and pollution prevention. Such actions illustrate how Regulatory Compliance, and innovation can converge to deliver competitive advantage.

IFC Performance Standards: The Global Blueprint for Responsible Project Management

From solar farms in Africa to mining projects in Mongolia, the IFC Performance Standards have become the global benchmark for managing environmental and social risks in large-scale projects. Introduced in 2006 and updated in 2012, these standards, guided by ESMS, underpin the Equator Principles, provide guidelines in navigating through corporate supply chain governance, and are increasingly aligned with international frameworks such as the UN Guiding Principles and ISSB standards.

The IFC standards operate across the entire project lifecycle. Before funding, risk profiles of projects are evaluated, with regulatory compliance obligations built into financing agreements to safeguard communities and investors. After funding, they govern implementation, monitoring, and reporting, with non-compliance triggering corrective action plans and appropriate climate change mitigation and adaptation measures. Applied across sectors like energy, infrastructure, agribusiness, and manufacturing, the IFC standards require comprehensive risk assessments, inclusive stakeholder engagement, and robust monitoring systems, ensuring that businesses not only minimize and manage the harm but also strengthen their social license to operate.

Evolving Corporate Governance and Strategic Shifts

As sustainability regulation extends its reach, boardrooms are moving from viewing ESG as a peripheral risk management concern to treating ESG Compliance as a core governance challenge. Under the CSRD, which builds on the Non-Financial Reporting Directive (NFRD), EU-regulated companies face rigorous sustainability disclosure requirements. This directive, alongside ESRS and EU Taxonomy alignment, mandates double materiality, requiring disclosure on how ESG factors affect these organizations and how their activities impact society, the environment, and the circular economy.

In this context, boards and CFOs have direct accountability for the quality of sustainability disclosures. They must ensure the integration of ESG into financials, risk management, and strategic decision-making. Meanwhile, the CSDDD amplifies this by necessitating company-wide due diligence systems capable of identifying, mitigating, and remedying adverse impacts throughout the value chain.

Such regulatory shift reflects the principles embedded within the IFC ESMS, which has always required enterprises to establish systematic policies, risk mapping, and performance tracking mechanisms for environmental and social matters. This international approach promotes continuous improvement, documentation, and climate change mitigation and adaptation strategies through stakeholder engagement which is now being mirrored in the EU’s binding frameworks.

Case: Financial Services

A leading pan-European bank illustrates how board committees increasingly oversee ESG Compliance disclosure quality, alignment with ESRS, EU Taxonomy, and adherence to IFC Standards. The CFO leads integration of financial and sustainability data, ensuring both withstand independent audit verification, which is a recent EU requirement. Beyond Regulatory Compliance, this strategic move unlocks access to green finance and enhances investor confidence, as risk and impact reporting become transparent. Integration of ESMS frameworks ensures that Climate Change Mitigation and Adaptation measures and Circular Economy principles are embedded into operations.

Integration of ESG into Operations and Business Strategy

The next wave of ESG compliances, especially through the CSRD and CSDDD, requires a shift from standalone reporting toward ESG integration by embedding sustainability considerations into the daily conduct of business across functions. This transformation is sector-dependent, with energy, transport, manufacturing, agriculture, and financial services facing both shared and unique sectoral expectations. Embedding circular economy initiatives is also becoming increasingly crucial for businesses to manage waste streams efficiently. The ESRS and NFRD focus on efficient and effective management of both hazardous and non-hazardous waste by ensuring EPR compliance.

Operationalizing mandatory requirements means companies must develop data management capabilities and cross-functional working groups. The EU Taxonomy, which defines sustainable economic activities, requires investment and business decisions to be aligned with science-based criteria governing climate change mitigation and adaptation, and broader sustainability objectives.

Meanwhile, CBAM specifically targets carbon-intensive sectors, forcing operational transparency and alignment of carbon reporting with both voluntary and legislated standards. Aligning CBAM disclosures with EU Taxonomy, ESRS, NFRD, and IFC Standards allows companies to demonstrate proactive Regulatory Compliance, embed ESMS into core processes, and strengthen long-term competitiveness while contributing to Circular Economy outcomes and Climate Change Mitigation and Adaptation.

Practical Application: Manufacturing and Automotive

Europe’s automotive giants, exposed to both the CBAM and future EU Taxonomy alignment, have fundamentally restructured their value chains. To track scope 1, 2 and 3 emissions, companies use digital ESG platforms and real-time data collection tools, extending them to their primary suppliers as well. Sustainability officers and compliance teams coordinate onboarding and capacity-building for suppliers, while cross-departmental sustainability committees embed relevant KPIs into purchasing, R&D, and product design.

Notably, these changes build on IFC-aligned management system principles which are, risk-based assessment, monitoring, and continuous improvement. By matching IFC due diligence processes with CSRD reporting, manufacturers are not just managing exposure, but also enabling transformative, low-carbon business models that anticipate future tightening of standards.

Due Diligence and Supply Chain Governance

A defining feature of CSDDD and ESMS, guided by IFC Performance Standards are turning of value chain due diligence from best practice to legal obligation, especially for high-impact sectors such as apparel, agriculture, and extractives. The CSDDD mandates enterprises to use robust risk identification, assessment, and remediation measures, focusing first on direct (“tier 1”) business partners but with increasing obligations where material downstream or upstream risks are evident.

This approach draws directly from the IFC model, long recognized for supply chain mapping, stakeholder engagement, grievance mechanisms, and regular re-assessment. What’s new is the codification and enforceability of these measures via EU law, complete with potential penalties for shortcomings.

Illustrative Example: Global Apparel Brand

An EU-headquartered apparel company, sourcing globally, employs IFC-inspired risk mapping tools and participatory stakeholder engagement forums to identify, report, and mitigate adverse impacts beyond its immediate suppliers. In anticipation of the CSRD’s double materiality lens, the company publicly discloses material risks and mitigation outcomes, winning recognition as an industry leader not just for compliance, but for responsible stewardship. This transparency is valued by investors, protects brand reputation, and prevents legal exposure under both current and forthcoming legislative regimes.

Performance Tracking, Reporting, and Technology Enablement

Effectively answering the demands of the CSRD, EU Taxonomy, and CSDDD requires companies to establish integrated, technology-enabled data ecosystems. Financial, environmental, and social metrics must converge, producing harmonized reports that are auditable and useful for strategic decision making.

The proliferation of digital ESG management platforms which are capable of real-time emissions tracking, automated supply chain due diligence, and performance benchmarking, empowers organizations to meet both EU-mandated and IFC-recommended reporting thresholds. For internal governance, this enhances risk oversight and management accountability; externally, it sends signals to regulators, investors, and other stakeholders.

Sector Implementation: Packaging Industry

A multinational packaging manufacturer, subject to EU reporting and taxation standards, invests in blockchain-based waste tracking alongside design for recyclability, directly addressing requirements for responsible product lifecycle management aligned with ESRS and IFC performance standards. This integration positions the company as a frontrunner in circular economy innovation, above and beyond regulatory compliance obligations.

ESG Assurance and the Expanded Role of Corporate Functions

A significant consequence of recent EU regulations, particularly the CSRD, is the mandated assurance over sustainability disclosures. This brings sustainability data under similar levels of scrutiny as financial reporting, a leap that triggers the need for robust internal controls, clear chain-of-custody for qualitative and quantitative information, and formal sign-off by company leadership.

The expansion of ESG into core audit and assurance functions amplifies collaboration among compliance teams, finance, sustainability officers, and independent assurance providers. It also places a premium on continuous upskilling, not only for sustainability professionals but for entire executive and board teams.

Role Evolution: Board, CFO, and Sustainability Officers

- Boards now bear formal responsibility for ESG oversight, engaging deeply in strategy-setting, monitoring, and stakeholder communications.

- CFOs must guarantee that sustainability and financial reporting are mutually reinforcing and auditable.

- Sustainability Officers orchestrate complex, cross-border compliance obligations and synchronize global standards with evolving local legislation.

- Internal Audit and Compliance bridge legal, operational, and strategy teams, promoting a culture of ESG risk awareness and proactive disclosure.

Sectoral Strategies for Future-Proofing Sustainability Performance

Leading corporations recognize that strategic ESG integration is not just about compliance, but about future-proofing competitiveness and value creation. Adaptive companies embed scenario analysis, horizon scanning, and innovation into their core strategy, anticipating sustainability regulation will evolve, with tightening thresholds and new clarity on greenwashing and materiality.

Sector Case Comparison

| Sector | Regulatory Focus | Strategic Response |

|---|---|---|

| Financial Services | CSRD, EU Taxonomy | ESG risk overlays; sustainability-linked products |

| Automotive | CBAM, CSRD, EU Taxonomy | Supplier engagement; low-emission product innovation |

| Apparel | CSDDD, CSRD, Supply Chain Law | End-to-end mapping; impact disclosure and remediation |

| Packaging | CSRD, Circular Economy Targets | Design innovation; traceable materials and waste |

| Agriculture | CSDDD, CSRD, Land Use Regulations | Farm traceability; labor rights management |

Across these sectors, the convergence of EU law and the IFC ESMS underpins investments in renewable energy, waste reduction, traceability, and circular economy models.

Navigating Ongoing Regulatory Uncertainty

Despite this trend toward harmonization, companies must grapple with ongoing regulatory flux. Recent ‘Stop-the-Clock’ amendments and Omnibus packages have deferred deadlines, narrowed reporting scopes, and layered newer ESG compliance complexities. These tactical regulatory adjustments, while reducing near-term burden for some firms, reinforce the need for:

- Dynamic Regulatory Horizon Scanning: Companies must monitor and anticipate further legislative adjustments around ESG and circular economy, ensuring agility and readiness for phased expansions in disclosure or due diligence.

- Materiality Assessments: Ongoing double materiality and sector-specific risk assessments are necessary for prioritizing disclosure and risk mitigation efforts.

- Stakeholder Engagement: Transparent communication with investors, regulators, and affected communities builds trust and provides early warning of material ESG issues. The alignment of EU sustainability legislation with the IFC ESMS framework signals a decisive pivot from voluntary corporate social responsibility to mandatory, strategic ESG integration. Regulatory compliance now requires more than isolated reporting or reactive risk management. It demands board-led governance, integrated management systems, technological enablement, and a culture of continuous improvement.

Strategic Compliance with EU Sustainability Laws and IFC Standards

Organizations leading this transition are embedding ESG into core business decision-making, leveraging best-in-class frameworks, and investing in transparent, traceable, and auditable sustainability practices. In doing so, they mitigate legal exposure, strengthen investor trust, and secure competitive advantage as the sustainable economy takes shape. As regulatory simplification and revision continue across the EU, agility, preparedness, and strategic vision will separate leaders from laggards in the era of mandatory ESG.

Why Choose InCorp Global?

InCorp Global offers comprehensive guidance, helping companies understand and navigate the complexities of BRSR and Sustainability Reporting. Our services not only ensure compliance but also the creation of long-term value through responsible and transparent business practices. To learn more about BRSR Reporting or ESG services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Shreya Kalra | Sustainability & ESG

FAQs

EU laws such as CSRD and CSDDD impose mandatory and enforceable compliance requirements, which includes sustainability reporting and due diligence across the value chains. The IFC ESMS, while voluntary, sets out a structured management system framework for identification, monitoring and managing environmental and social risk. Together, they reinforce governance, accountability, and stakeholder engagement.

Carbon-intensive and high-impact industries such as automotive, manufacturing, apparel, agriculture, packaging, and financial services face the highest regulatory scrutiny due to requirements like CBAM, CSRD, EU Taxonomy, and supply chain due diligence.

Constant amendments, such as phased CSRD rollouts or CBAM transition periods, create uncertainty for strategic ESG planning. Firms risk over-investing too early or under-preparing until enforcement tightens. Leading businesses mitigate this through scenario planning, regulatory horizon scanning, and adopting IFC’s ‘continuous improvement’ model, treating ESG compliance as a journey rather than a ‘tick-mark’ for reporting obligation.

Financial institutions face the challenge of integrating ESG (non-financial) into credit risk models while still offering competitive lending products. Many organizations are addressing this by embedding sustainability-linked loan structures, applying IFC-style risk categorization, and using EU Taxonomy criteria to design and offer green finance instruments. The challenge is ensuring consistency in ESG data quality across borrowers, especially in emerging markets.

Manufacturers, particularly in automotive, must reconcile CBAM’s carbon reporting with supplier engagement. Their biggest hurdles include limited supplier data transparency, inconsistent emissions tracking in developing markets, and resistance from micro and smaller suppliers due to compliance costs. Companies are tackling this with digital ESG platforms, supplier training, and ESG disclosures linked to procurement contracts and Supplier Code of Conducts.

Share

Share