Tax Benefits for Investors Setting Up AIFs in GIFT IFSC

Tax Benefits for Investors Setting Up AIFs in GIFT IFSC

A complete guide to set up Alternative Investment Funds in GIFT IFSC: Here's what investors need to know before moving to GIFT IFSC

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

What is GIFT City?

Gujarat International Finance Tec-City (GIFT City) is an International Financial Services Centre (IFSC) set up in Gandhinagar, India. It is India’s first operational greenfield smart city. GIFT IFSC is one of the most prominent emerging financial centers. The financial center aims to be a global hub for finance and business. It is built in coherence with Ahmedabad and Gandhinagar to provide a comprehensive tri-city approach to enhance the economic ecosystem of the country. GIFT IFSC also enjoys certain benefits under the Special Economic Zones (SEZs) Act of 2005. This blog will explore the tax benefits for investors setting up Alternative Investment Funds (AIFs) in GIFT IFSC. This blog shall guide readers through all the relevant information investors need to know prior to setting up AIF in GIFT IFSC.

What is IFSC in GIFT City?

The vision of GIFT City – IFSC is to become one of the leading financial centers across the world. GIFT City – IFSC is developing a thriving financial ecosystem with various banks, funds, brokers and other intermediaries itself. Infrastructure in GIFT City is one of the key advantages as it inculcates modern office spaces equipped with advanced technology. GIFT IFSC allows a range of support function service providers for the ecosystem like legal, accounting, administrators and compliance services players. These services are designed to meet each client’s needs in the GIFT IFSC. To set up an AIF (any category), GIFT IFSC can provide substantial tax and operational benefits that significantly increase returns on investments for the investors.

Setting up AIF in GIFT IFSC is also beneficial because of the regulations rationalized to promote advantages for investors and are comparable to other financial centers across the globe. GIFT IFSC is designed to be analogous to other international financial centers. This makes GIFT IFSC an ideal hub for setting up AIFs seeking to leverage international networks and optimize returns for their investors.

What are Alternative Investment Funds (AIFs)?

Alternative Investment Fund (AIF) is a privately pooled investment vehicle that invests in alternative asset classes. They are a type of investment category different from conventional investment instruments. Conventional investments include stocks, bonds, and cash, whereas AIFs include private equity funds, venture capital, hedge funds, commodities, derived contracts, managed futures, art and antiques. Investment in real estate also falls under the branch of AIF.

1. Category I: These are socially or economically desirable investments. These funds invest in Venture Capital funds, SME Funds, Social Venture funds, startups and new economically viable businesses with high growth potential.

2. Category II: These are the investments that do not fall under Category I and Category III AIFs. Category II funds cannot undertake leverage or borrowing other than to meet day-to-day operational requirements or as permitted in prevailing regulations. This may include private equity funds, debt funds, and Funds for Funds (FOF).

3. Category III: This category of AIF involves complex trading strategies. They may employ leverage/borrowing including investment in listed or unlisted derivatives. It includes Private Investment in Public Equity (PIPE) and Hedge Funds.

What is the Significance of AIFs in IFSC Landscape?

Setting up AIF in IFSC at GIFT City is significant in the financial landscape as it attracts foreign investors and allows residents a platform for investing within their limits (subject to LRS, OPI and ODI norms). AIFs allows investors to diversify their portfolios by making investments in various sectors like real estate, entity incorporated outside India (listed or unlisted) and hedge funds. These benefits become one of the major reasons why investors are lured towards investing in the GIFT IFSC. Also, the streamlined regulatory framework designed to attract investors serves as a key appeal for domestic and international investors. Setting up AIF in GIFT IFSC is extremely advantageous for businesses.

What are Key Eligibility Criteria for Entities Setting Up AIFs in IFSC?

AIF in GIFT IFSC can be launched up by Fund Management Entity (FME)/fund manager having foreign investors, Indian investors, and other entities that are regulated under International Financial Services Centre Authority (IFSCA). However, key eligibility to set up AIF are directly based on the type of scheme and category of fund. Also, IFSCA regulations have laid down its requirement for allowing AIF schemes out of GIFT IFSC. Key pre-requisites before setting up AIF in GIFT IFSC include the following:

- Scheme Corpus

- The minimum size of the corpus in case of venture capital schemes shall be USD 5 million, however, total corpus of venture capital schemes shall not exceed USD 200 million.

- The minimum size of the corpus required in the case of retail and non-retail (restricted) schemes is USD 5 million.

- Minimum Investment by FME (Skin in the game)

- In case of Venture Capital Funds and Non-Retail schemes (Restricted):

i. At least 2.5% of the target corpus and not exceeding 10% of the targeted corpus in a scheme with targeted corpus of less than USD 30 million.

ii. At least USD 7,50,000 and not exceeding 10% of the targeted corpus in a scheme with targeted corpus of more than USD 30 million (applicable only to restricted schemes – close ended)

iii. At least USD 15,00,000 and not exceeding 10% of the targeted corpus in a scheme with targeted corpus of more than USD 30 million (applicable to restricted schemes – open ended) . - In case of Retail Schemes

i. The FME shall ensure that the FME or its associate shall invest at least, lower of 1% of the AUM of the scheme or USD 2,00,000.

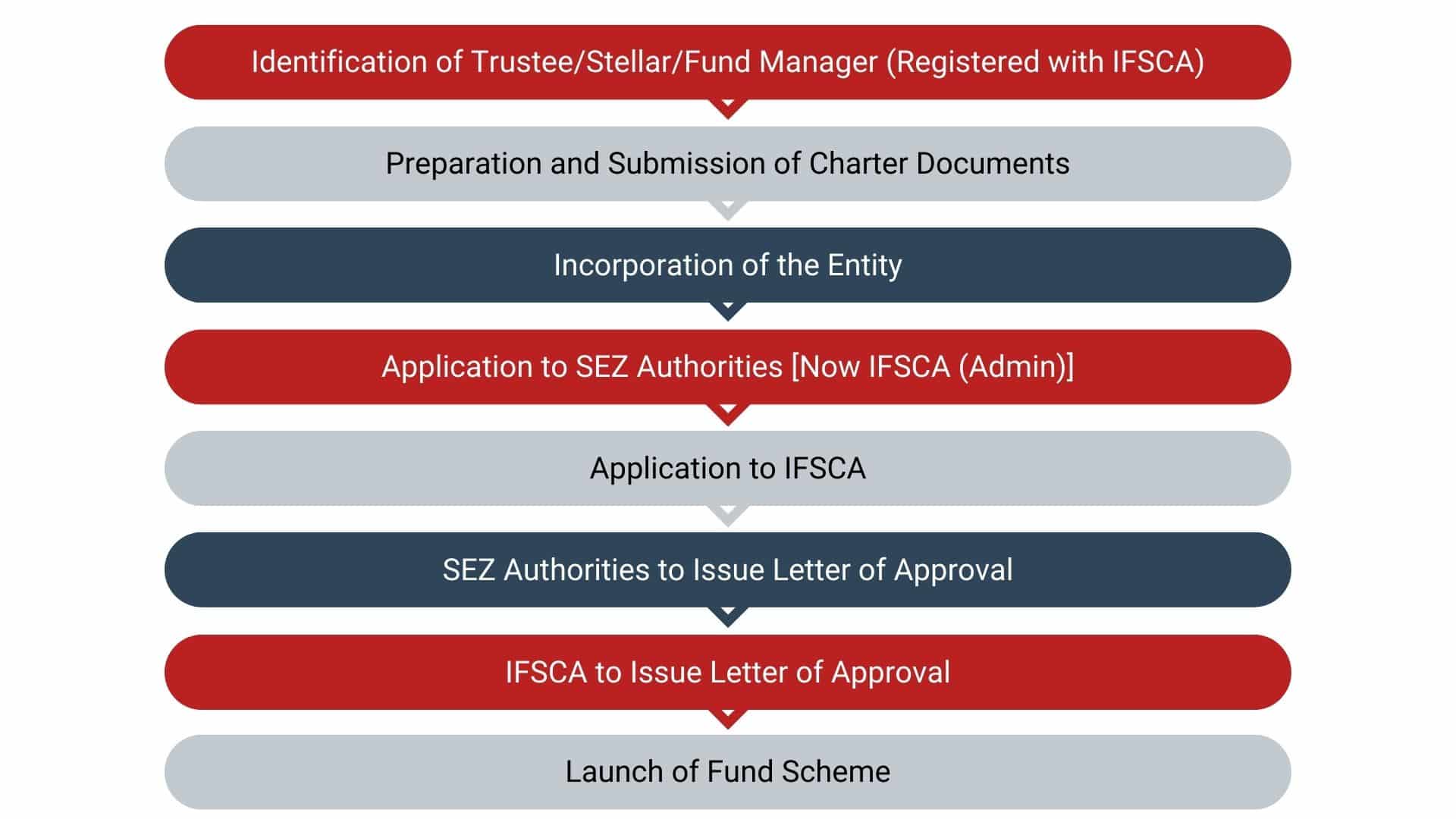

Process Flow for Setting Up AIFs in IFSC at GIFT City

Tax Benefits for Setting Up AIFs in IFSC (Investor’s Perspective)

- AIFs Category I and II in GIFT IFSC enjoy a tax pass-through status. This eliminates double taxation which is applicable in other places.

- For foreign investors in AIFs (not having income in India), any income arising out of the fund are not taxable in India.

- Non-resident investors are not required to obtain a PAN and exempted from filing income tax returns in India (this is subject to certain conditions).

- There is no levy of Goods and Services Tax (GST), Securities Transaction Tax (STT), (Commodities Transaction Tax (CTT) on transactions made under IFSC exchanges.

- Supply of services by managers (manager fees by FME) is also exempt from GST in IFSC.

- Even though Category III Alternative Investment Funds are subjected to fund-level taxation, non-resident investors are exempted from the transfer of Indian securities apart from the shares of Indian companies. Also, securities issued by non-residents apart from private equities with no accrual of income in India and transfer of offshore securities are tax exempted.

Taxation Implication in the Hands of Investors of AIF in IFSC

| Nature of income in the hands of investors | Tax rates for non-resident investors | Tax rates for resident investors |

|---|---|---|

| Dividend | 20% | Applicable slab rate |

| LTCG under 112A (STT paid equity shares, units of equity oriented mutual fund and unit of a business trust) | 12.5% | 12.5% |

| Other LTCG | 12.5% | 12.5 |

| STCG under section 111A (STT paid equity shares, units of equity oriented mutual fund and unit of a business trust) | 20% | 20% |

| Other STCG (not covered under 111A) | Applicable slab rates | Applicable slab rates |

| Business Income | Exempt | Exempt |

Note: Rates are considered subject to changes proposed in Finance Bill (No.2) 2024

Budget 2024: Key Announcements Related to AIFs in IFSC

- Profits and gains of business or profession to the extent attributable to units held by non-residents are exempt for retail funds and Exchange Traded Funds in IFSC.

- Specified income of Core Settlement Guarantee Funds set up by recognized clearing corporations in IFSC is exempt in hands of that fund.

- Relaxation from explanation and charging of ‘Source of funds’ credited in the books of the venture capital funds regulated by IFSCA, to the Income Tax.

Conclusion

GIFT City is one of the most desired financial centers to set up funds as it acts like a gateway for India market from investors perspective. Domestic and international investors are encouraged to set up funds in GIFT IFSC through various tax and regulatory ease introduced by the government from time-to-time

Why Choose InCorp Global?

InCorp has a proven track record in assisting clients with setting up their businesses.

- Regulatory Compliance: InCorp continuously updates its knowledge and practices to stay current with the latest regulations, ensuring clients remain compliant with all requirements.

- Comprehensive Services: InCorp provides a wide range of services, from business setup to ongoing support, making it a one-stop solution for many business needs. Also, InCorp experts provide guidance, which is tailor-made to your business needs, making the overall process smoother and more efficient.

You can contact us at (+91) 77380 66622 or email us at info@incorpadvisory.in to learn more about our GIFT IFSC services.

Frequently Asked Questions

Numerous benefits can be availed by setting up a fund in GIFT IFSC. Tax exemptions, Modern infrastructure, Market Access, Operational support, and SEZ benefits are a few of the direct benefits for investors.

While Category I and Category II AIFs may be launched only as close-ended schemes, the Category III AIF may be launched either as an open-ended or a close-ended scheme. In case of a close-ended scheme, the maximum tenure and amount to be raised should be decided upfront and disclosed in the placement memorandum. A close-ended scheme is required to have a minimum tenure of 1 year.

Restricted Schemes may borrow funds and engage in leveraging activities subject to the following:

- The maximum leverage by the scheme, along with the methodology for calculation of leverage, are disclosed in the placement memorandum

- The leverage is exercised in accordance with the disclosures in the placement memorandum and any deviation is subject to consent of two-thirds (2/3rd) of the investors by value

- The FME employing leverage has a comprehensive risk management framework appropriate to the size, complexity and risk profile of the scheme

Yes, the FME contribution in the Retail scheme is mandatory, except in following cases:

-

In case of relocation of schemes established/incorporated/registered outside India to IFSC

• Where the scheme is a fund of fund scheme investing in a scheme which has such similar requirements

The above contribution may be made by the FME or its associate within 45 days of the launch of the scheme and maintained on an ongoing basis.

Share

Share