TCS On Sale Of Goods

TCS On Sale Of Goods

Section 206C of Income Tax Act: Know the TCS on sale of goods, its applicability, TDS rate with examples

- Home

- »

- Assessment

- »

- TCS On Sale Of Goods

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

The government of India has introduced Section 206C(1H) of the Income Tax Act, 1961 with regards to Tax Collection at Source on receipt of sale consideration for sale of any other goods. It is applicable to all sellers of goods whose turnover for the preceding Financial Year exceeds INR 10 crores w.e.f. 01.10.2020. This provision is not applicable where other TCS & TDS provisions is applicable.

Key points to be noted

- Every seller who has received any amount as consideration on sale of any other goods above INR 50 lakhs are liable to collect an additional 0.1% of the bill amount, collect PAN and pay/deposit such amount as TCS every month.

- Even though the TCS amount is debited to the buyer, the liability does not arise until the time the amount is collected/received.

- TCS returns have to be filed like TDS returns and compliances like issuance of certificate etc. are to be followed.

Action point

- We advise all assessee to complete accounting for half year till 30.09.2020 and divide all parties to whom sales are made in two parts, one where receipts from April to September has exceeded Rs. 50 Lacs and other where the limit has not been breached. with parties whereas sale and corresponding receipts of Rs. 50 lakhs are made.

- In the case of first set of parties, From every sale after 01.10.2020 to such parties, assessee would be liable to levy 0.1% (0.075% till 31st March, 2021) TCS in every bill and keep record of the same, as tax is payable at the time of receipt from such sale.

- In the case of second set of parties, from every sale that takes place after the receipt of Rs. 50 Lacs is breached, TCS is to be levied in every bill.

- Accordingly, sellers will need to add 0.1% to the bill value and deposit with the government on receipt of the payment from buyers.

- Also in a case where sales were made before 01.10.2020 and TCS was not levied on such bill but receipt after 01.10.2020 exceeds Rs.50 Lacs in such a case debit note will have to be raised for collecting TCS On receipt exceeding Rs. 50 Lacs.

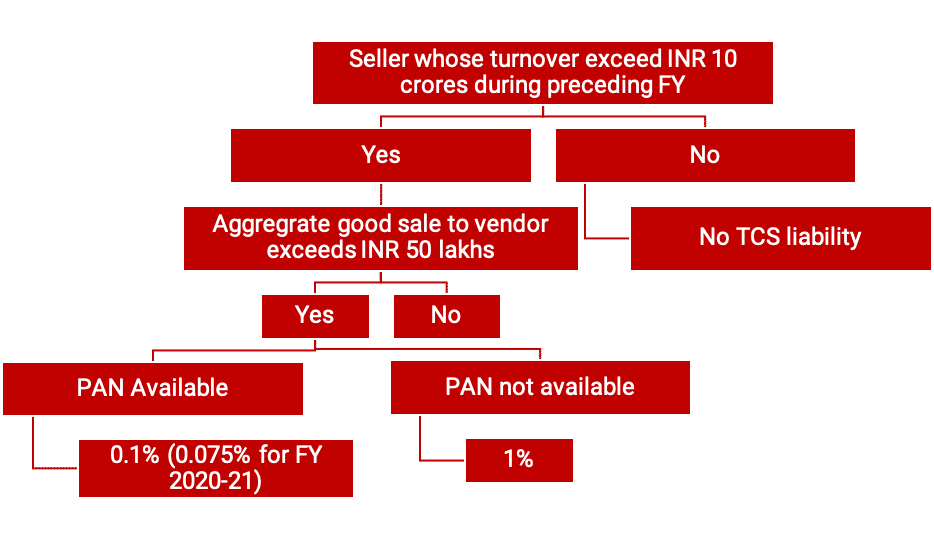

Flow Chart of TCS applicability

Due date* for TCS Payment, Return filing, and issue of TCS certificate

| Collection Month | Quarter Ending | Due date of Payment | Due Date of filing return (in Form 27EQ) | The date for generating TCS certificates (in Form 27D) |

|---|---|---|---|---|

| April | 30th June | 7th May | 15th July | 31st July |

| May | 7th June | |||

| June | 7th July | |||

| July | 30th September | 7th August | 15th October | 31st October |

| August | 7th September | |||

| September | 7th October | |||

| October | 31st December | 7th November | 15th January | 31st January |

| November | 7th December | |||

| December | 7th January | |||

| January | 31st March | 7th February | 15th May | 31st May |

| February | 7th March | |||

| March | 7th April |

*subject to extensions as provided by CBDT due to COVID19.

Illustrations

1. If Sales consideration is INR 80 lakhs, and since the threshold limit for applicability of TCS u/s 206C(1H) is INR 50 lakhs per customer, whether TCS u/s 206C(1H) has to be collected on INR 80 lakhs or on INR 30 lakhs?

ANS: TCS must be collected on INR 30 lakhs.

2. Goods are sold to a customer viz. AMO Pvt Ltd. for INR 65 Lakhs in September 2020 and sales consideration received upto 30th September 2020 is INR 45 Lakhs. For the period beginning from 1st October 2020, the receipt of outstanding consideration is INR 20 lakhs. Whether the seller is liable for collecting TCS u/s 206C(1H)?

ANS: The provisions of section 206C(1H) came into effect on and from 1st October 2020. For sales billed in September 2020 and consideration is received on or after 1st October 2020, TCS would be applicable (as per clarification issued by CBDT). TCS would be applicable on amount of Rs. 15 Lacs (Rs. 65 Lacs (Total Receipts) – Rs. 50 Lacs (Exemption Limit))

3. If goods are sold to a customer viz. AMO Pvt Ltd for INR 65 Lakhs in September 2020 and sales consideration received on 5th October 2020 is INR 65 lakhs, whether the seller is liable for collecting TCS u/s 206C(1H)?

ANS: Liability to collect TCS on sales consideration of INR 15 lakhs (65 lakhs – 50 lakhs) which is received on or after 1st October 2020.

4. If goods are sold to a customer viz. MAB Pvt Ltd for INR 90 lakhs in September 2020 and for INR 45 lakhs in October 2020, on what amount is the seller liable to collect TCS u/s 206C(1H) if full amount is received in October 2020?

ANS: The applicability of Section 206C(1H) is triggered when sales consideration received to a customer where it exceeds INR 50 lakhs in aggregate during a financial year. Sale consideration received before 1st October 2020 has also to be considered for computing INR 50 lakhs. In the given example, amount received in a financial year is INR 125 lakhs which is above INR 50 lakhs, hence the applicability of Section 206C(1H) is triggered.

| Sales up to September 2020 | INR 90 Lakhs |

| Sales in October 2020 | INR 45 Lakhs |

| Total sales for FY 2020-21 | INR 125 Lakhs |

| Amount received on or after 01st Oct 2020 | INR 125 Lakhs |

| Amount liable to TCS u/s 206C(1H) | INR 75 Lakhs (INR 125 Lakhs – 50 lakhs) |

5. If goods are sold to a customer viz. AMO Pvt Ltd for INR 35 lakhs in September 2020 and for INR 25 lakhs in October 2020, on what amount is the seller liable to collect TCS u/s 206C(1H)?

ANS: The seller will be liable to collect TCS on INR 10 Lakhs (as and when the amount is received from the customer) which is the sales in the period from which the provisions of section 206C(1H) have become applicable i.e. from 1st October 2020.

| Sales up to September 2020 | INR 25 Lakhs |

| Sales in October 2020 | INR 35 Lakhs |

| Total Sales in FY 2020-21 | INR 60 Lakhs |

| Less: Threshold Limit u/s 206C(1H) | INR 50 Lakhs |

| Amount liable to TCS u/s 206C(1H) @ 0.075% | INR 10 Lakhs [INR 60 Lakhs-50 Lakhs] |

Clarification required from CBDT

- What is export as per the provision of TCS? Does that include High sea sales, sale to deemed exports like SEZ/ EOU etc.?

- What is the applicability of TCS on barter transactions?

- What is the definition of Goods?

- What is TCS liability on Bad debts recovery?

- How to resolve the mismatch between books and Form 26AS?

How can Incorp help?

Our team of professionals have expertise in managing the complexities of Indian corporates, foreign exchange, and taxation laws of different countries. This includes structuring stock plans for companies and ensuring optimized tax solutions for MNCs, startups, and investors.

Our experts can help you in the following:

- Obtain Lower TCS certificates for the assessee

- Determination of parties to which TCS provision is applicable as of 30 September 2020.

- Assistance on monthly TCS compliance assistance.

To learn more about our taxation services, you can write to us at info@incorpadvisory.in or call us at (+91) 77380 66622.

Authored by:

InCorp Advisory | Direct Tax

FAQs

The Section provides a trigger point at the time of receiving any amounts as consideration for the sale of any goods.

Whenever the amount collected from the customer is lumpsum or ad hoc amount, the seller would be required to gross it up and remit the TCS accordingly.

Every time, the seller receives part of the sale consideration in advance, he is required to remit TCS under Section 206C(1H). The difficulty arises in the calculation of the amount required to be remitted as the seller needs to calculate GST first and then calculate TCS later, both on grossing up basis requiring tedious calculations.

Practical difficulties arise where advance is collected for the sale of goods and TCS is remitted and subsequently, the contract is canceled, and the amount is refundable. In such cases, the seller is required to refund only the primary sale consideration received but not the TCS amount since such TCS amount is already credited as prepaid taxes and will appear in Form 26AS and the buyer cannot insist for a refund of the TCS amount as there is no specific provision for the same.

TCS is to be collected at the time of receipt of an amount of consideration. As in the instant case, though the amount is not received in cash/cheque / electronic mode a genuine debt (receivable and payable is adjusted) is received by any other mode and hence, the provisions for TCS will be applicable.

Section 206C(1H) is not applicable if the buyer is liable to TDS / deduct tax at source under any other provision of the Act on the goods purchased by him from the seller under the said contract.

Need a consultation with an expert?

Share

Share