Why Listed Companies Need ESG Consultants for BRSR Reporting

Why Listed Companies Need ESG Consultants for BRSR Reporting

Understanding the crucial role of ESG consultants in BRSR reporting for listed companies

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

Introduction

Today, organizations across the world are recognizing the value of incorporating Environmental, Social, and Governance (ESG) criteria into their business operations. This not only increases their credibility but also ensures that they follow sustainable practices. The Securities and Exchange Board of India (SEBI) has introduced Business Responsibility and Sustainability Reporting (BRSR) as a mandatory reporting requirement for the top 1000 listed companies to report their performance on ESG aspects. This makes it essential for listed companies to integrate ESG principles into their reporting processes. But this movement, for a more sustainable and responsible business model comes with its challenges. Here comes the critical role of ESG consultants, who bridge the gap between the current corporate practices and the ideal sustainable practices as suggested by BRSR guidelines. This blog explores why listed companies require ESG consultants for effective BRSR reporting.

Importance of BRSR Reporting for Listed Companies

Companies that want to disclose their sustainability performance and impact use BRSR reporting as a framework. It aims to provide a complete view to stakeholders about the efforts being taken by the company to achieve its sustainability goals. This transparency is essential for investors, regulators, customers, and other stakeholders who prioritize sustainability in their decision-making process.

Related Read: How to Choose Right ESG Reporting Framework for Business

In today’s world, companies are scrutinized not only based on their financial performance but also based on the impact they create on society and the environment. Companies complying with BRSR reporting guidelines showcase greater accountability thus enhancing stakeholders’ confidence. One of the advantages of BRSR reporting is that a company disclosing its sustainability performance, gains a competitive edge in the market, contributing to long-term value creation. Positive ESG practices give a boost to a company’s reputation and brand value. Further, let us look at the structure of a BRSR report.

BRSR Reporting Format

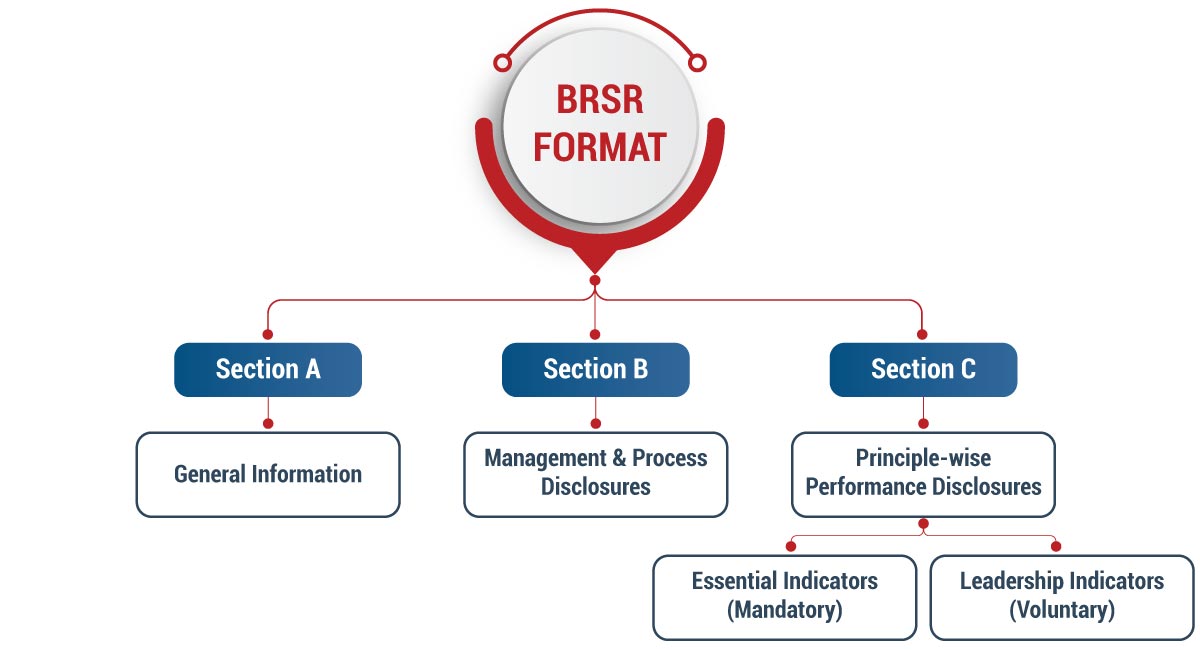

BRSR Reporting framework uses a unified and transparent reporting format. The BRSR Report comprises of about 140 questions across 3 sections.

Below is the structure of BRSR:

Section A: General Information

This section aims to obtain basic information about the entity as below:

- Corporate Identity Number (CIN), name of the entity, year of establishment, and registered office address.

- Products sold and services offered that are contributing to 90% of their total revenue.

- Total number of employees and workers with gender-wise break-up and employment type (whether permanent/other than permanent), number of differently abled workers, inclusion of women employees, etc.

- Overview of the entity’s material responsible business conduct and sustainability issues about environmental and social matters that present a risk or an opportunity for the business.

- Number of sites where factories and offices are located, markets served, stakeholders, and the contribution of exports as a percentage of total revenue.

- Information about holding, subsidiary, associate companies, and joint ventures.

Section B: Management and Process Disclosures

In this section, the entity is required to disclose information related to governance, leadership, and oversight as below:

Related Read: The Ultimate Guide to EcoVadis Certification

- Any specific commitments, goals, or targets related to the principles, including basic information, context, entities covered (such as subsidiaries, associates, etc.), expected outcomes, timelines, and whether goals are mandatory or voluntary. The entity must also disclose performance against each goal or target, including any changes or delays.

- The listed entity’s director responsible for the report should highlight sustainability’s relevance. The statement should include the organization’s vision, strategy, priorities, trends, achievements, and views on performance related to environmental and social impacts.

Section C: Principle-wise Performance Disclosures

In this section, the entity needs to display how well they have aligned their processes with NGRBC’s 9 principles of business conduct and the core elements of sustainability.

For each principle, they are required to report on two parameters as below:

1. Essential Indicators (Mandatory)

Under this, companies are required to disclose data related to energy usage, emissions, water consumption, and waste generation. This section also includes details of training programs conducted for employees. These indicators are mandatory for a company to report.

2. Leadership Indicators (Voluntary)

This section includes details about the company’s efforts beyond mandatory requirements to demonstrate leadership in business responsibility and sustainability. This includes information about adoption of technology or business models to improve its sustainability performance. The company can also include details about initiatives undertaken to support economic development in underserved communities, and diversity and inclusion within the company.

What does an ESG Consultant do?

An ESG consultant supports businesses with an analysis of the impact that their products and day-to-day operations have on the environment and society. Their role is to demonstrate the organization’s honesty, integrity, and transparency through effective BRSR reporting. ESG consultants enable organizations to understand their sustainability performance and identify areas of improvement to align their business practices with Sustainable Development Goals (SDGs).

How ESG consultants enhance organizations’ BRSR reporting capabilities

1. Novel and Diverse data streams

ESG consultants have an expert understanding of ESG data sources. They can extract relevant datasets from various sources such as external systems, third-party data sources and sustainability surveys. They have expertize in designing data management frameworks, transforming information into meaningful insights.

2. Undeveloped Systems and Non-Digitized Data

ESG consultants assist organizations in bridging the gap between outdated, non-digitized systems and today’s data-driven requirements of BRSR reporting. They implement strategies to digitize comparable information, streamline data collection processes, and integrate obsolete systems, ensuring relevant data is standardized and compatible with reporting frameworks.

3. Data Inconsistency

Related Read: The Rise of BRSR Reporting in India: Key Challenges, Implications and Strategies for Businesses

To maintain the integrity of data, ESG consultants implement data validation process to identify discrepancies in data and resolve any inconsistencies present. By standardizing data collection and streamlining the process, they effectively mitigate risks associated with inconsistent data.

4. Lack of Expertise in understanding the Data

ESG consultants understand complex datasets and know how to extract actionable insights from it. They have expertize in translating technical data into meaningful narratives. Through training programs and knowledge-sharing sessions, consultants enable informed decision-making.

5. Missing Initiatives and Data

One of the key roles of ESG consultants is to identify gaps in existing initiatives, ensuring that BRSR report reflects a complete view of the organization’s sustainability performance. They specialize in conducting gap analysis and determining areas where additional data collection efforts or strategic intervention is required. ESG consultants drive continuous improvement in ESG practices by recommending the adoption of new initiatives and expanding data sources.

6. Adherence to Regulatory Changes

ESG consultants conduct thorough regulatory assessments to identify compliance requirements and reporting obligations. They provide strategic guidance and proactive compliance strategies enabling companies to stay ahead of regulatory changes, minimizing risks, and ensuring alignment with evolving standards.

7. Lack of Management Intent

ESG consultants translate the intent of the organization into tangible actions and measurable outcomes. They work closely with senior management to define clear sustainability objectives and develop implementation plans accordingly.

8. Lack of Governance Mechanisms and Responsibilities

ESG consultants work with boards of directors and executive teams to define governance principles which is a crucial aspect of ESG. This includes determining mechanisms, reporting protocols, and performance metrics. They aim to identify an organization’s sustainability goals and integrate them into decision-making processes.

Conclusion

With the constant changes in BRSR reporting, the role of an ESG consultant is becoming vital in guiding companies to identify relevant sustainability metrics and implement those in their business practices. ESG Consultants offer significant insights into performance improvement, stakeholder expectations, and global standards in terms of sustainability. Listed companies can leverage the specialized knowledge being offered by ESG consultants to enhance their effectiveness, credibility, and long-term value creation through BRSR Reporting.

Why Choose InCorp Advisory?

We understand that BRSR Reporting can be a challenging task given its dynamic nature. Our team has in-depth experience in handling BRSR reporting requirements and projects for businesses across various sectors and stages. To learn more about BRSR Reporting or ESG services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions on ESG Consultants in India

ESG consultants assess the sustainability performance of the company and provide insights into process improvement. They are specialists who can determine the ESG framework and reporting requirements applicable to your business.

ESG consultants assist companies in identifying risks and develop a plan to mitigate them. They also support organizations in identifying opportunities, enhancing performance, and ensuring compliance with guidelines listed by SEBI.

The scope of work includes assessment of current practices in terms of sustainability, managing risks, and engaging with stakeholders. They support organizations with developing ESG strategies, collecting data, and monitoring performance. ESG consultants also advise companies on sustainable practices and ensure compliance with regulations.

By integrating sustainable practices into their operations, companies can mitigate risks related to reputational damage, lower operating costs by assessing the environmental impact to reduce waste and increase efficiency. ESG reporting also gives companies a competitive edge in differentiating themselves in the marketplace and attracting customers and investors who value sustainability.

Some of the challenges with BRSR reporting include data collection, clarity on initiatives taken up by the company towards sustainability, and failure to set measurable goals. Such challenges can be arduous for companies when they are required to disclose their sustainability measures. An ESG consultant possesses the required knowledge to support organizations to effectively navigate through these challenges.

Share

Share