AIF In GIFT City IFSC: Framework and Minimum Requirements

AIF In GIFT City IFSC: Framework and Minimum Requirements

AIF In GIFT Cit IFSC: AIF Framework, Registration Process, Benefits for AIFs Registered, Taxation and Operational Benefits

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

The Gujarat International Finance Tec-City (GIFT City), located in Gandhi Nagar, Gujarat, is India’s sole certified IFSC. In April 2015, the Government of India (GoI) opened India’s first International Financial Service Centre (IFSC) at GIFT City in Gujarat. The Government of India has been working along with various regulators to make it a global financial hub. It has been planned to lure foreign investors to relocate their business in India. In this article, we discuss how to incorporate an AIF unit in IFSC Gift city and its benefits.

What Is IFSC?

- An IFSC is a special jurisdiction where global financial service providers offer financial services/products in foreign currencies to worldwide customers.

- An IFSC’s role in India is to carry out financial services transactions that are currently carried out outside of India by foreign financial institutions and Indian financial institutions’ overseas branches / subsidiaries.

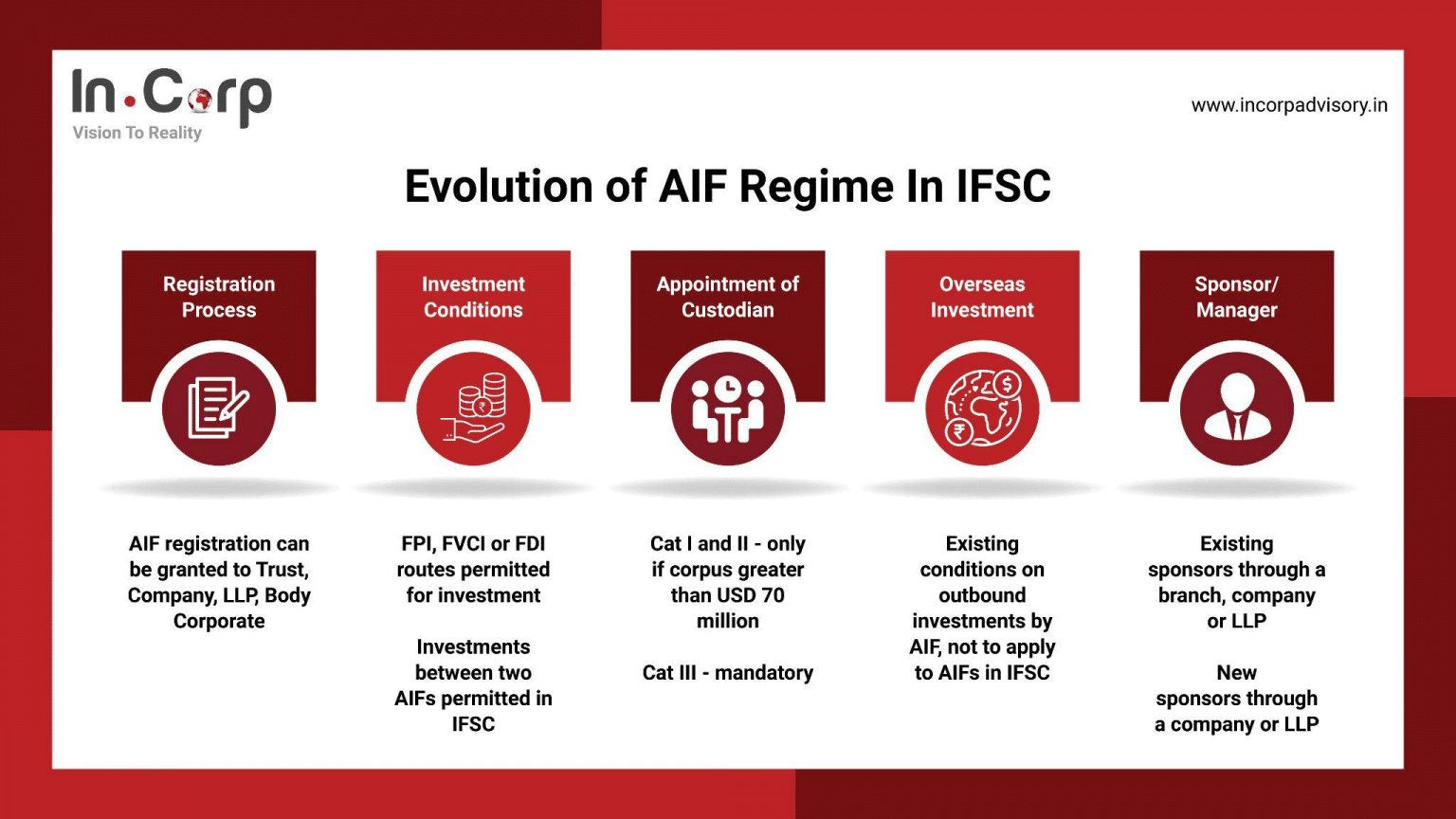

- In light of the AIF regime’s success in the domestic market, and in order to encourage the fund regime in the IFSC. Various government guidelines were released in 2015 to help enable and regulate the securities market in India’s first IFSC, GIFT City. These principles established the foundation for AIFs, including permissible investors, permissible investments, and so on.

- AIFs can be set up as a trust, corporation, limited liability partnership, or body corporate.

What is the Framework of AIF in IFSC Gift City?

What are the minimum requirements for AIF in GIFT City?

| Minimum

Requirements |

Particulars | Amount |

| Minimum corpus requirement for each scheme of the AIF | USD 3,000,000 | |

| Minimum investment by an investor in AIF:

• For employees or directors of the AIF or its Manager • For other investors |

USD 40,000

USD 150,000 |

|

| Minimum continuing interest requirement for manager or sponsor of the AIF (not through waiver of fees)

• For Category I and Category II AIF • For Category III AIF |

Lower of the following:

2.5% of corpus or USD 750,000 5% of corpus or USD 1,500,000 |

|

| Angel Funds | Minimum Corpus- USD 750,000

• Criteria for Angel Investor – Individual – Net tangible assets [excluding principal residence] > USD 3,00,000 – Body corporate – Net worth > USD 1,500,000 – Minimum investment of USD 40,000 from every investor for a maximum period of 5 years • Angel Funds can invest in VCUs which – Have turnover < USD 3,750,000 – Are not promoted by/related to any industrial group whose group turnover > USD 45,000,000 • Minimum investment in VCU – USD 40,000 subject to a cap of USD 1,500,000 • Manager/sponsor should have a continuing interest of 2.5% of the corpus or USD 80,000, whichever is lower |

|

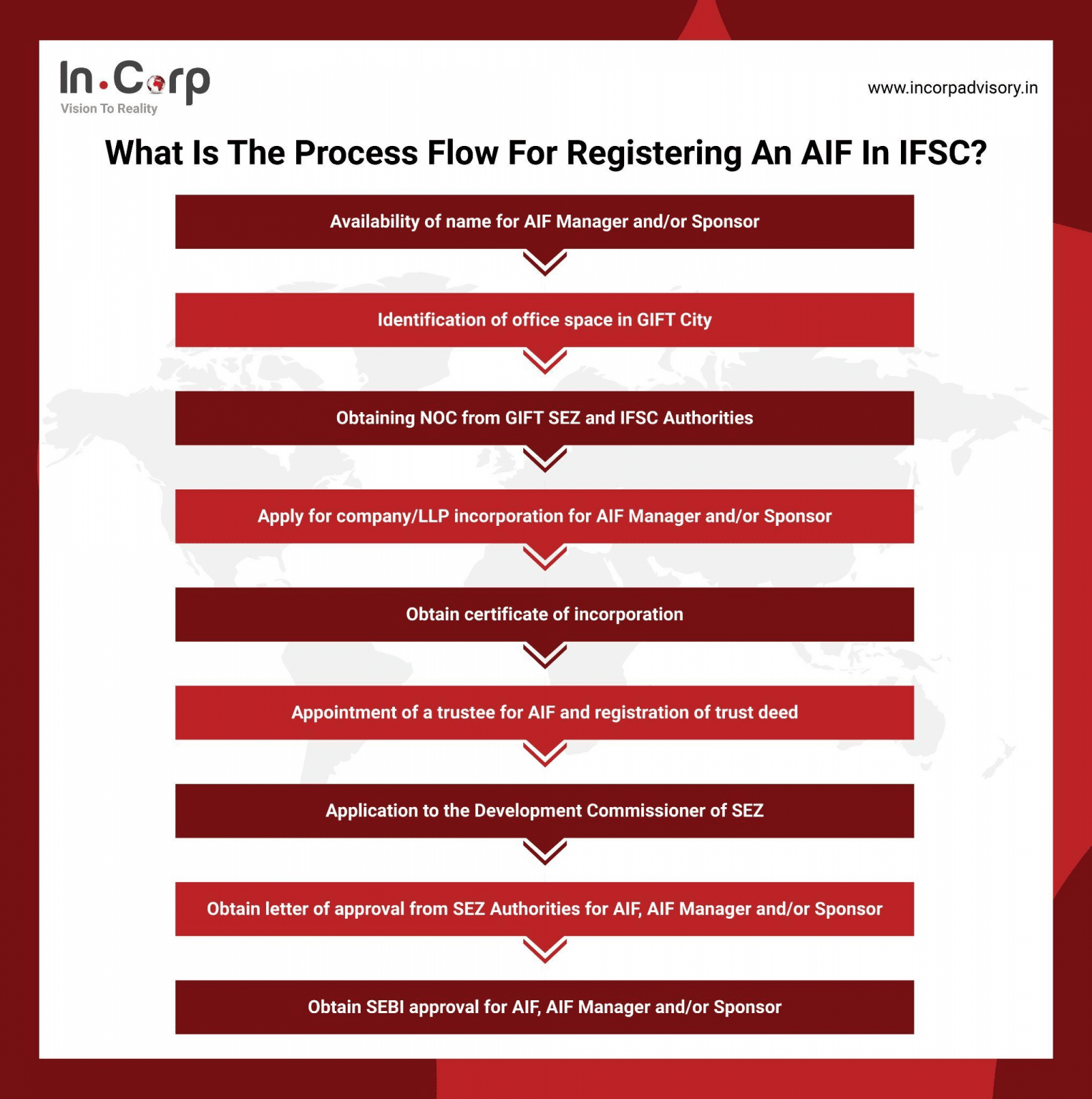

What is the process flow for registering an AIF in IFSC GIFT City?

Benefits for AIFs Registered in GIFT City IFSC

The AIFs registered under GIFT city were provided with various benefits as compared to general AIFs registered elsewhere. Few benefits are listed below:

Investment Opportunities

The investment flow of AIFs is as follows:

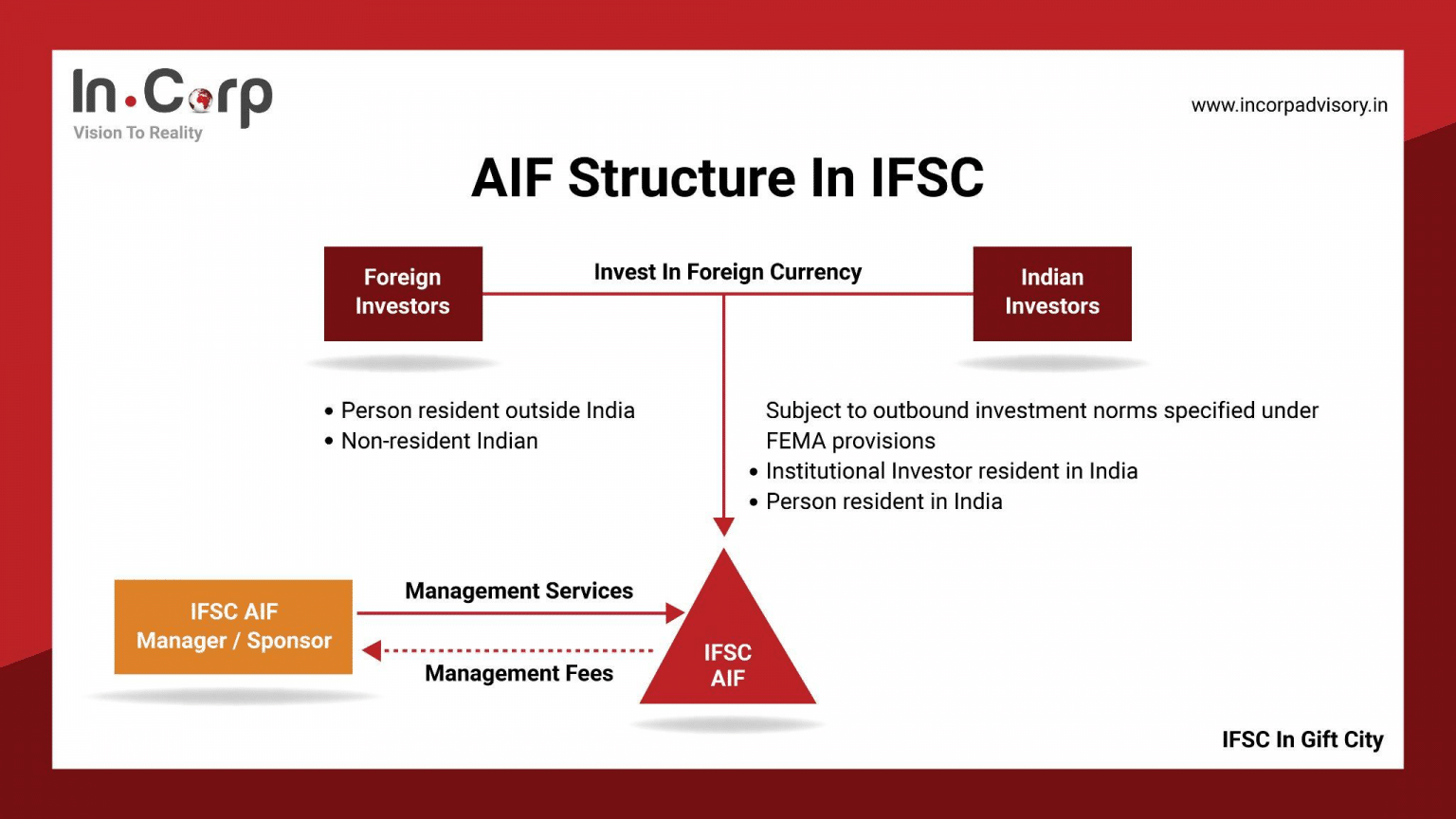

AIF incorporated in GIFT City IFSC is permitted to invest in following securities:

- Securities Listed in GIFT City- IFSC

- Securities issued by Companies incorporated in GIFT City – IFSC

- Securities issued by Companies incorporated in India or foreign jurisdiction

- Units of other AIFs

- Other permissible investments as per AIF Regulations (like LLP, REIT, InvIT, Derivatives, SPV etc.)

- Overseas entities (without adhering to restriction applicable for domestic AIFs)

AIF registered in GIFT City IFSC can invest in India through the following modes:

- Foreign venture capital investment (“FVCI”) route

- Foreign portfolio investor (“FPI”) route

- Foreign direct investment (“FDI”) route.

Taxation Benefits

- AIF – Category I and II

- Business income 10 years out of first 15 years tax holiday u/s 80LA of Income Tax Act, 1961. However, for AIF’s registered elsewhere in India, business income is taxable since no specific exemption is provided.

- Other income like capital gains, Income from other sources are exempt for AIF irrespective of their registration location. However, the same is taxable in the hands of investors.

- AIF – Category III

- Any income earned by AIF III except capital gains is taxable in the hands of AIF. Therefore, no income is taxable for the investors as AIF III has not received pass through status yet as compared to AIF I and AIF II. However, there is no clarity on taxability of dividend income.

- Minimum Alternate Tax (MAT)/ Alternate Minimum Tax (AMT) is applicable at 9% of book profits. However, the same is applicable only to companies opting for the old tax regime.

- Exemption from STT, CTT, stamp duty in respect of transactions carried out on IFSC exchanges by registered AIFs.

- Supply of services by the Manager to AIFs registered in IFSC is exempt from GST.

- Income accruing to or received by non-resident investors from offshore investments made by a GIFT City AIF would not be taxable in India.

Operational Benefits

Apart from the above tax and compliance benefits, AIFs registered in IFSC have some operational benefits too which are as under:

- Lower operating costs due to subsidies granted by the Gujarat Government,

- Availability of skilled labor,

- Proximity to the onshore market,

- World class infrastructure, unparalleled connectivity and transportation access,

- Access to multiple markets from IFSC.

Why Choose InCorp Advisory?

Our Advisory and Taxation Team at InCorp offers seamless assistance in incorporating an entity in GIFT City with related compliance and advisory services. We shall evaluate and assist in analyzing GIFT City–related operational, commercial, taxation benefits, ensuring smooth setting up and assistance in regular compliance with all applicable rules and regulations in GIFT City. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions About AIF in GIFT City

AIF’s registered in GIFT City- IFSC are regulated by both GIFT City Regulations and SEBI (AIF) Regulations 2012

Yes, AIFs registered in GIFT City -IFSC are required to comply with all the Income tax compliances as mandatory for general AIFs.

Yes, approval is required from following authorities:

- IFSC authorities

- SEZ authorities

- SEBI (AIF) Regulations, 2012

Share

Share