- Home

- »

- Family Office Management

Family Office Management

Empowering legacy through strategic family wealth and estate planning

Enquiry Form

Indian HNI/Promoter Family Entities Serviced

Client

Success

Rate

Private

Family Trusts

Structured

Private Clients Supported in Succession

Indian HNI/Promoter Family Entities Serviced

Client

Success

Rate

Private Family Trusts Structured

Private Clients Supported in Succession

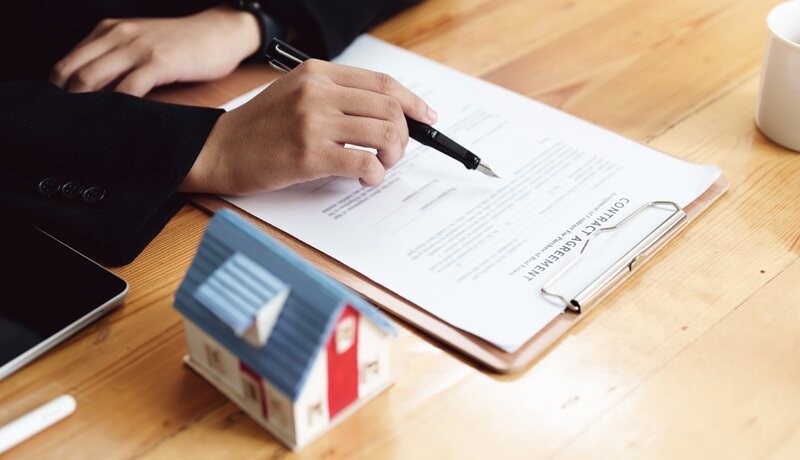

Build a lasting legacy with customized Family Office solutions designed to create value, ensure sustainability, and preserve wealth for future generations.

Our Family Office practice is tailored to meet the diverse needs of high-net-worth individuals and families. With extensive experience, we have successfully serviced and provided advisory services to over 175 Indian HNI/Promoter family entities with a more than 92% success rate. Our expertise extends to strategizing and structuring over 50 private family trusts, ensuring long-term wealth preservation. Additionally, we’ve supported over 60% of our private clients in business succession planning, helping them manage generational transitions effectively. With us, your family’s legacy is in safe hands, protected for future generations.

Family Office Management

Succession Planning

Advisory on will drafting, formation of family trusts, documentation, and execution support—ensuring smooth intergenerational transition and legal compliance.

Family Business Restructuring

End-to-end advisory for tax-efficient restructuring, M&A strategies, transaction support, and legal documentation in line with long-term wealth creation.

Family Business Management

Comprehensive business, financial, and administrative support tailored for cross-border operations, including CFO services, fund syndication, and compliance.

Services to HNI / Ultra HNI Families

Personalized wealth and lifestyle management, investment support, family office structuring and strategizing, international compliance, accounting, and tax planning—all under one trusted advisory umbrella.

NRI Services

Dedicated assistance for property management, inbound investments, tax advisory, and compliance tailored to the unique needs of non-resident families.

Philanthropy

Support in setting up and managing charitable trusts or Section 8 companies, including compliance, registration, certification, and return filings.

InCorp Insights

Anatomy of Family Business Conflicts – Bridging Generational Growth towards Legacy

Family businesses have been the oldest and historically rooted form of business across…

Succession Planning: Securing Your Legacy for Generations

Why Succession Planning? From the epic inheritance tales of the Mahabharata to the…

Registering a Will in India: Know about Securing Your Legacy

Planning for the future is essential to ensure the safety and security of…

Will vs Family Trust: What’s The Difference?

This pandemic has taught us to be better prepared for the unseen future.…

Assignment of Leasehold Rights on Land – Critical analysis

Leasehold rights on land play a crucial role in various real estate transactions…

Family Trust in India: Benefits of Setting up Private Trust

Family trusts are incredibly effective and convenient. If utilized wisely, they can be…

FAQs

Family Office Management is full-service private wealth preservation and compliance services that serve Ultra-high-net-worth (HNI/UHNI) families and Non-Resident Indians (NRIs) including Indian Citizens settled abroad. Against a backdrop of challenging legal and regulatory requirements and the need for transparent financial compliance, family offices are under increased pressure at the operational as well as management level. Family offices are increasingly operating on a global scale, whilst often having only one local presence. Individuals serviced by these offices are more demanding and expecting family offices to focus on their core. (sentence does not sound accurate) Family offices generally provide accounting, Corporate secretarial, tax advisory as well as compliance, Succession planning, Philanthropy advice, Wealth management services, custodian activities, and other comprehensive services.

With a Family Office, the family is able to directly oversee decisions about its financial matters.

The Family Office Management Services serves as a partner in the work of preserving the family’s assets along with channelising them for smooth transition to its next generation in a transparent manner. Further, many HNI/UHNI families rely on their family office to foster a sense of community and family unity over time with outsourced professionals.

To get your money’s worth, your Family Office manager should have a team of experienced and capable advisors well-versed in financial planning and tax planning within regulatory corners, which starts from managing existing wealth to planning future estate and retirement goals.

Portfolio Management Services (PMS) is a kind of wealth management service. Like mutual funds, they are managed by professionals known as portfolio managers. These experts offer a wide range of curated investment strategies to benefit from the available opportunities in the market. However, over the years, it is noticed that the professionals handling PMS are mainly associated with various securities and investment products available in Capital markets, but many times the regulatory or tax aspects are given the least of priorities. Therefore, Family Office Management plays a vital role in easing financial, regulatory as well as tax planning including compliances for avoidance of high tax cost/ litigation.

Depends on case to case.

- Expenses on Family Office Management activities supporting family business succession and administration can be claimed as Business expenses from a trade or business.

- Expenses on Family Office Management activities preserving wealth and its management can be claimed as expenses against return on Family investments. Investment expenses usually represent a large proportion of Family Office Management costs, and their deductibility generally mitigate the net costs of running such an office.

clientele

Expert Team

Samir Sanghvi

Co-Founder

Megha Gala

Lead

Direct to Your Inbox!

Stay updated with our curated newsletter content designed for you