Designing Stock Appreciation Rights in India: A Strategic Guide

Designing Stock Appreciation Rights in India: A Strategic Guide

SARs should motivate employees to contribute towards company’s growth: Know about designing the compensation plan

- Last Updated

In today’s fiercely competitive business landscape, where building a successful company is just the beginning, the race to attract and retain top-tier talent has become a global strategic imperative. Stock Appreciation Rights (SARs) have emerged as a popular instrument for employee/contractual employee compensation in India, especially within the growing startup ecosystem. SARs offer employees, etc., the potential for financial gain tied to the company’s stock value without actual equity transfer. This blog delves into the critical aspects companies should consider when structuring SARs in India.

Companies should design Stock Appreciation Rights that allow them to tailor their compensation plans to incentivize employees (including contractual ones) and motivate them to contribute to the company’s growth.

Factors that Contribute to Increasing Popularity of SARs in India

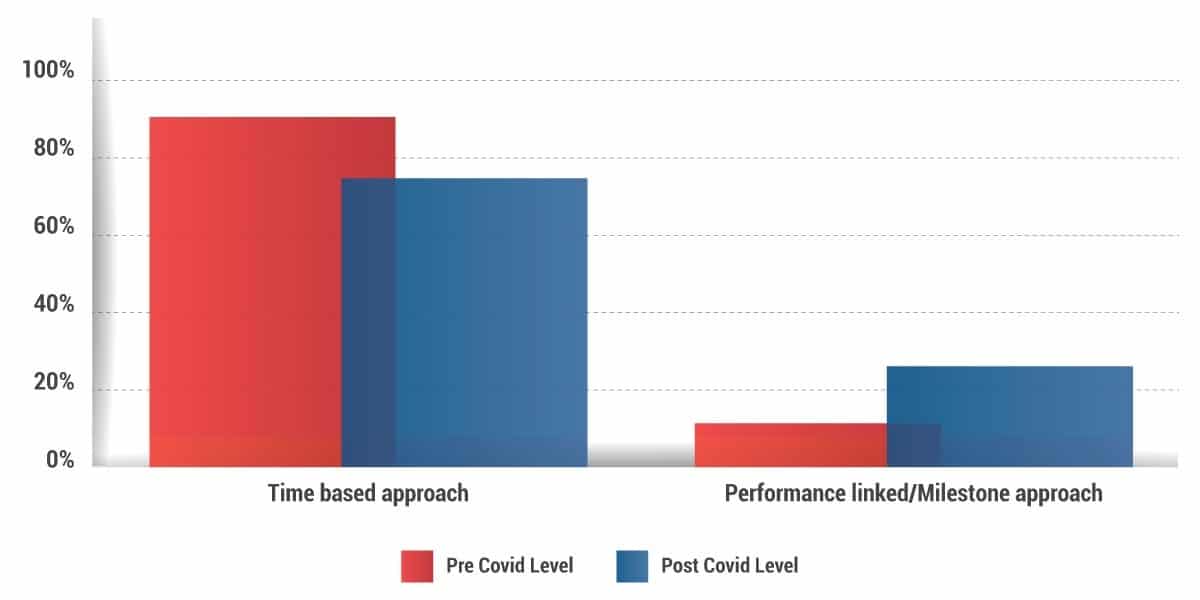

In 2023, over 85% of the unlisted companies that issued incentive plans followed the structured process of issuing annual grants, keeping in mind either retention, longevity or performance parameters. The trend is explained based on pre-Covid and post-Covid analysis as under-

In corporate India, the shift from a traditional incentive model of annual incremental package to innovative incentive tools like Stock Appreciation Rights is driving strategic shifts, aligning employee/key managerial person and corporate interests amid intense talent competition. SARs which is quite adaptable to economic shifts, play a crucial role in attracting and retaining top talent while fostering a culture of mutual growth.

Factors That Could Lead a Company to opt for Stock Appreciation Rights

| Factors | Description |

|---|---|

| Equity Preservation | SARs offer a share in the company’s growth in value without dilution of equity at the time of grant. |

| Customizable Conditions | SARs may have time or performance-based conditions that can be tailored for various service providers including employee levels based on their timing of involvement in growth trajectory and their contribution vis a vis exit strategy. |

| Retention and Value Growth | Encourage employee retention and contribution to company’s value growth. |

| Financial Ease | SARs eliminate the need for cash outlay (exercise price) upon exercise, reducing the financial burden on employees compared to stock options. Similarly, companies issuing SARs to key employees or contractors/consultants can postpone the cash outflow during the initial phase of a cash-strapped situation. |

| Flexible Settlement Options | SARs offer the choice of cash or equivalent shares settlement, allowing companies to align incentives with their financial strategies and stakeholder interests in medium to long run. |

Factors Companies Should Weigh When Choosing Between Equity-settled and Cash-settled SARs for Employee Incentive Plans

The choice depends on factors such as ownership goals, financial benefits, employee motivation, and long-term alignment with company objectives.

| Sr. no. | Particulars | Equity-Settled SARs | Cash-Settled SARs |

|---|---|---|---|

| 1 | Financial Outflow | Equity-settled SARs do not require beneficiaries to pay any cash outflow at the time of exercise. The financial benefit is realized in the form of potential stock value appreciation. | Cash-settled SARs involve immediate payout to beneficiaries against the exercise of their rights. They result in a direct financial burden on the management of the company if appropriate exit strategy is not in place. |

| 2 | Financial Benefit | Equity settled SARs offer beneficiaries the potential for long term financial gain as they benefit from the appreciation in the company’s stock value over time. | Cash settled SARs provide beneficiaries with an immediate financial benefit upon exercise, offering a quick and tangible incentive. |

| 3. | Taxation of Employees | Equity-settled SARs incur perquisite tax on exercise date for employees. Further on sale of shares they incur capital gain (long term/short term) depending on period of holding. | Cash settled SARs incur perquisite tax on exercise date for beneficiary. |

| 4. | Dilution of Equity | Equity-settled SARs will lead to dilution of the company at the time of exercise and will dilute ownership structure of the company. | Equity settled SARs do not lead to additional dilution of the company |

Factors a Company Should Consider When Designing and Implementing SARs

Selection of Employees/Contractors/Consultants

Identify which employees/level of employees/contractors/consultants within the company should receive Stock Appreciation Rights based on their role, responsibilities and effective contribution. Companies should consider these parameters significant in achieving the company’s objectives.

Define the Milestone of Grants

Define the timing for Stock Appreciation Rights grants, deciding whether they will occur annually, quarterly, or upon the achievement of specific company milestones.

Tailored Vesting Conditions

The company should customize the vesting conditions after evaluating whether time-based vesting, performance-based vesting, or a combination will provide the best incentive for employees and advisors whose immense support is needed for a company’s growth. Also, the company should consider employee’s aspiration, risk taking abilities and industry opportunities which employee has forgone to take up the employment with the company while designing the vesting schedule.

Special Vesting Rules

Establish special vesting rules for exceptional circumstances, such as death, disability, or other events where employee has to leave due to circumstances beyond his control. Define criteria for ‘good leaver’ and ‘bad leaver’. Determine its impact on Stock Appreciation Rights under different circumstances.

Communication Plan

Stock Appreciation Rights terms shall be well drafted, articulated with illustration and shall be communicated to eligible employees including its benefits, terms, and how it aligns with the enterprise objectives.

Legal and Regulatory Compliance

From a company perspective, designing and implementing SARs shall be aligned with ESOP guidelines under the Companies Act, 2013 and Companies Rules, 2014, and considering SEBI’s SBEB regulations for best industry practices.

Tax Implications in the Hands of Company

1. In the case of employees, as at the time of exercise of equity/cash-settled SARs are taxable as salary (perquisite), the company is liable for tax deduction at source under Section 192 of the Income Tax Act. Similarly, in the case of non-employees like contractors or professionals, tax deduction shall be in alignment of provisions related to tax on contractors (194C) or professionals (194J). In the case of payout to non-resident non-employees, provision of Section 195 and double tax avoidance treaties with respective countries shall be referred to.

2. Stock Appreciation Rights expenses (i.e. perquisite earned by the employee) = FMV of SAR on date of exercise – FMV of the SAR on the date of grant.

3. The law does not clearly mention the allowance of SAR expenses incurred by the company, but they can claim the SAR expenses under Section 37 of the Income Tax Act, 1961, as revenue expenses in the year of exercise of SAR. This is because the company pays those expenses in cash/shares on the exercise dates relying on ITAT ruling to support this claim.

Accounting Implications

- Accounting for SARs involves recognizing the compensation expense over the vesting period. Also, the fair value of SARs should be expensed against the income statement and recorded as a liability on the balance sheet.

- Ind AS 102 does not mandate any specific method of valuation. However, Black Scholes method is the most popular method.

Benefits of SARs to Companies

- Under Stock Appreciation Rights, the companies can pay employees equity-linked remuneration without diluting the shares carrying voting rights. This means that the existing shareholders do not lose their voting rights or control over the company.

- Since there is no mandate of minimum vesting period for Stock Appreciation Rights issued by unlisted companies under companies act, certain selected employees may be granted Stock Appreciation Rights upfront (i.e., with no vesting requirement) while other employees may be granted SARs in accordance with a vesting schedule.

- Stock Appreciation Rights offer more flexibility to the company in terms of the settlement mode, the vesting period and the exercise period. The choice to pay SARs in cash or shares.

- Stock Appreciation Rights can be issued to third party contractors, consultants and advisors unlike ESOPs.

- Cash-settled SARS is suitable for organizations that do not want to comply with many regulations linked to issue of shares but wish to share benefits reaping from growth with employees.

- Cash-settled SARs are easier to administer and account for than ESOPs, as they do not involve the actual transfer of shares or the valuation of the shares.

Conclusion

Stock Appreciation Rights are implemented globally as a means of incentivizing employees as well as non-employees. Performance-linked SARs are steadily recognized as an effective mechanism of stock-based compensation in post COVID era. Notably, it is also a viable alternative to ESOPs, as well as well-regulated for listed enterprises due to SEBI’s intention to regulate SARs under the SEBI (SBEB) Regulations in structured form.

While ESOPs may have been embedded in the ethos of companies in India hitherto, it may soon be widely adopted by Indian companies as the modus operandi for employee incentivization due to their empirically evident benefits.

Why Choose InCorp Advisory?

Our team of professionals has expertise in managing the complexities of Indian corporates, foreign exchange, and taxation laws of different countries, including structuring of stock plans for companies ensuring optimized tax solutions for MNCs, startups, and investors. To learn more about our Taxation services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions (FAQs)

What happens to Stock Appreciation Rights when a company is bought out?

This varies depending on the company and the terms of the deal. For example, a company can change the SAR plan's design or provide a different way to own equity after a merger or acquisition. The same will be part of re-organization scheme.

Can SARs be transferred or sold?

SARs are generally non-transferable and cannot be sold to third parties. Unless specified otherwise, they are typically granted solely to the employee and are not transferable by assignment.

What is the difference between stock options and appreciation rights?

A SAR works much like a stock option, but there's one big difference. You must pay the grant price to get the actual stock when you exercise a stock option. But with appreciation rights, you don't have to pay anything to get the stock. Instead, you get the extra value that the stock gained, which is the current market price minus the grant price.

Can a company withdraw SARS if an employee switches to a competitor?

Stock Appreciation Rights often come with clawback clauses. These clauses outline specific circumstances under which the company may reclaim all or a portion of the compensation granted under the SAR plan. For instance, if an employee joins a competitor company before a certain deadline, the company might have the right to cancel or withdraw SARs.

How are Stock Appreciation Rights typically granted?

SARs are often granted as part of an employee/contractor/consultant's compensation package or as a performance incentive. They are generally subject to a vesting schedule, which may be based on the passage of time or the achievement of performance targets.

This varies depending on the company and the terms of the deal. For example, a company can change the SAR plan's design or provide a different way to own equity after a merger or acquisition. The same will be part of re-organization scheme.

SARs are generally non-transferable and cannot be sold to third parties. Unless specified otherwise, they are typically granted solely to the employee and are not transferable by assignment.

A SAR works much like a stock option, but there's one big difference. You must pay the grant price to get the actual stock when you exercise a stock option. But with appreciation rights, you don't have to pay anything to get the stock. Instead, you get the extra value that the stock gained, which is the current market price minus the grant price.

Stock Appreciation Rights often come with clawback clauses. These clauses outline specific circumstances under which the company may reclaim all or a portion of the compensation granted under the SAR plan. For instance, if an employee joins a competitor company before a certain deadline, the company might have the right to cancel or withdraw SARs.

SARs are often granted as part of an employee/contractor/consultant's compensation package or as a performance incentive. They are generally subject to a vesting schedule, which may be based on the passage of time or the achievement of performance targets.

Share

Share