Indian Startups Move HQs for Expansion: Know about Flip Structure

Indian Startups Move HQs for Expansion: Know about Flip Structure

Indian startups strategically move headquarters to global hubs: Overview of foreign exchange law, tax and resources helping them grow as key players

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

What is Flip Structure?

A ‘Flip’ is a corporate inversion strategy for Indian businesses in which investment holding by Indian promoters outside India is reversed, making a foreign company a holding structure. This investment is then redirected to the Indian subsidiary through the foreign holding company. This involves a two-way flow of investment often called a ’round-trip structure’.

When a company flips, it changes its domicile status. For instance, when an Indian tech startup with roots in India flips through a holding company formed and registered in California, USA, its Indian business remains under control of the USA headquartered company.

Some prominent Indian startups with headquarters outside India

| Company | Industry Sector | Country of Incorporation (As per ROC records) | Country of Headquarter (Reference to Public domain information) |

|---|---|---|---|

| FlipKart | E-Commerce | India (2011) | Singapore (2011) |

| Grofers/Blinkit | E-commerce | India (2015) | Singapore (2015) |

| Amagi | Media Technology | India (2008) | USA (2008) |

| BrowserStack | Cloud Infrastructure | India (2011) | Ireland (2011) |

| Core.ai | IT Solutions | India (2011) | USA (2014) |

| Fractal Analytics | AI, BI, ML | India (2000) | USA (2000) |

| Hasura | Developer API and Cloud Infrastructure | India (2017) | USA (2018) |

| CommerceIQ | Retail management platform for E-commerce | India (2013) | USA (2012) |

| ChargeBee | Recurring revenue management platform (SaaS) | India (2011) | USA (2011) |

| Innovaccer | HealthTech Data Activation platform (SaaS) | India (2013) | USA (2015) |

| MindTickle | Sales Productivity Platform (SaaS) | India (2011) | USA (2011) |

| GreyOrange | AI, Robotics (SaaS) | India (2009) | USA (2011) |

| Emertius | EdTech for Skill development | India (2000) | Singapore (2015) |

| NextBillion.ai | AI backed platform for mapping, navigation, tracking. (SaaS) | India (2020) | Singapore (2019) |

| Polygon | Blockchain | India (2017) | Cayman Island (2017) |

Source: Crunchbase

Why Flip Structure?

Indian unlisted startup companies face severe challenges in raising capital from international markets where specialist funds or markets exist, hindering their growth potential. This lack of access to international capital creates an uneven playing field for Indian startups compared to foreign counterparts, limiting opportunities to compete effectively.

According to PwC UK’s Value Creation Transformation Survey, 70% of business leaders expect to use M&A to accelerate through the adoption of technology and technology-related processes. The mention of M&A transactions among multinationals highlights the dynamic nature of business environments, where companies constantly seek growth opportunities to compete globally. One of the initial steps in this direction is the flipping strategy.

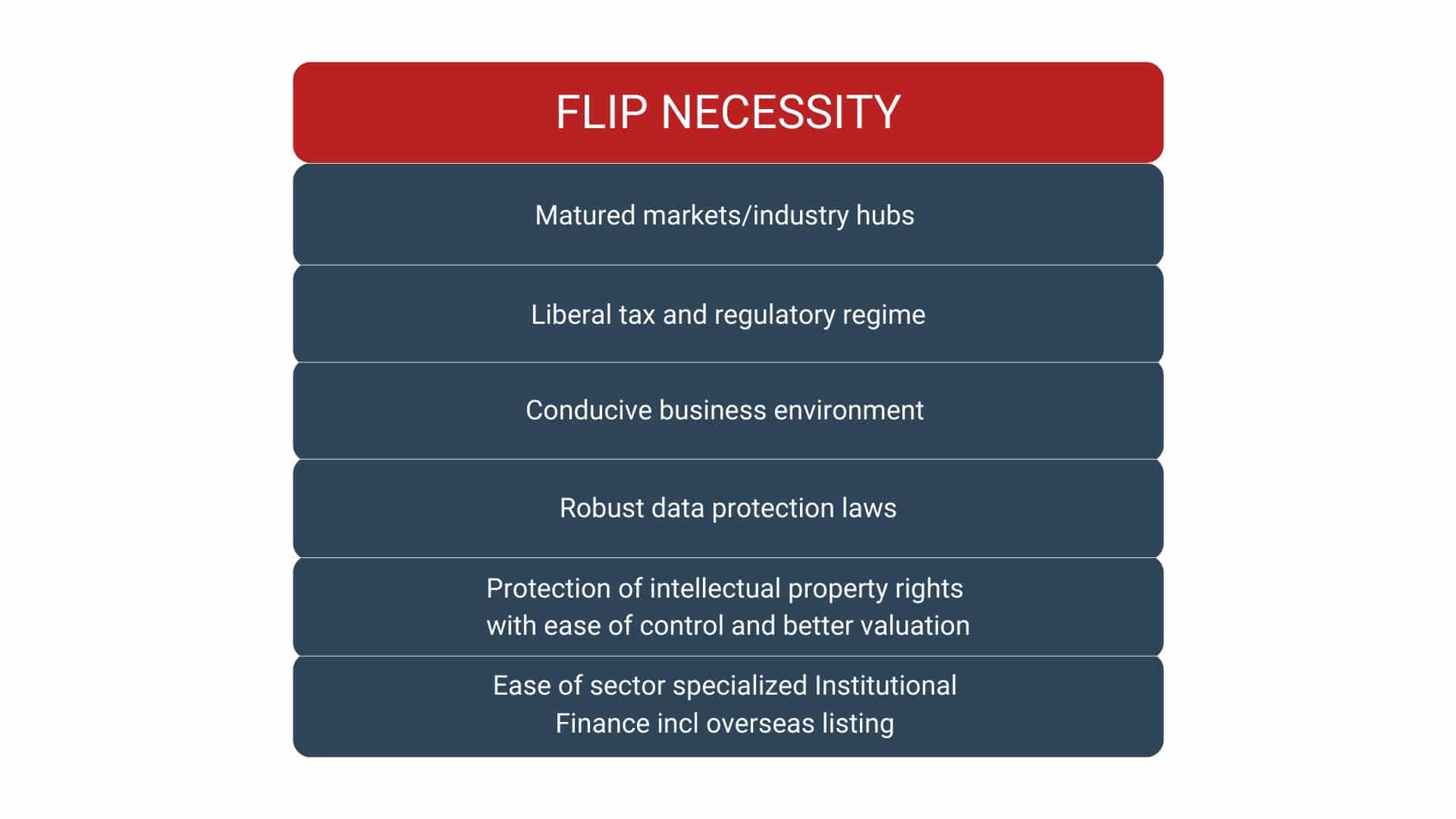

In the past decade, the flip strategy has surged in popularity among Indian startups seeking support from foreign investors in some selective fields such as SaaS, Blockchain Technology, AI, InsureTech and health tech, where the Indian ecosystem is either not mature enough or growing at a slower pace. This strategy involves incorporating a company in an investment-favorable jurisdiction like the US, UK, UAE or Singapore (where easy access to international finance is predominantly present), which becomes the holding entity for the Indian subsidiary. These jurisdictions are chosen for their investment-friendly environments and conducive legal regulations, offering Indian startups access to Intellectual Property (IP) value recognition and financial options from overseas specialized institutional investors/venture capitalists, including listing overseas. A flip helps in scaling up of operations through strategic expansion of the company’s market presence in the other jurisdiction where the flip is being carried out with purpose.

- Many tech startups seeking secured data flow often find jurisdictions like the EU, with robust data privacy and data security laws, appealing for flipping.

- The rapidly changing geopolitical landscape (rising tensions in different geographies) and increasing currency volatilities make the US listings an attractive option for international fund raise. Companies listing in the US get a natural safeguard owing to stability of the US dollar and the perceived robustness of the American financial market.

Therefore, new edge Indian startups have ample reasons to consider flipping to foreign jurisdictions. Further, developed markets also provide access to facilities such as incubators and advisors as a part of the wider business ecosystem.

Factors to be Considered while Choosing Foreign Jurisdiction

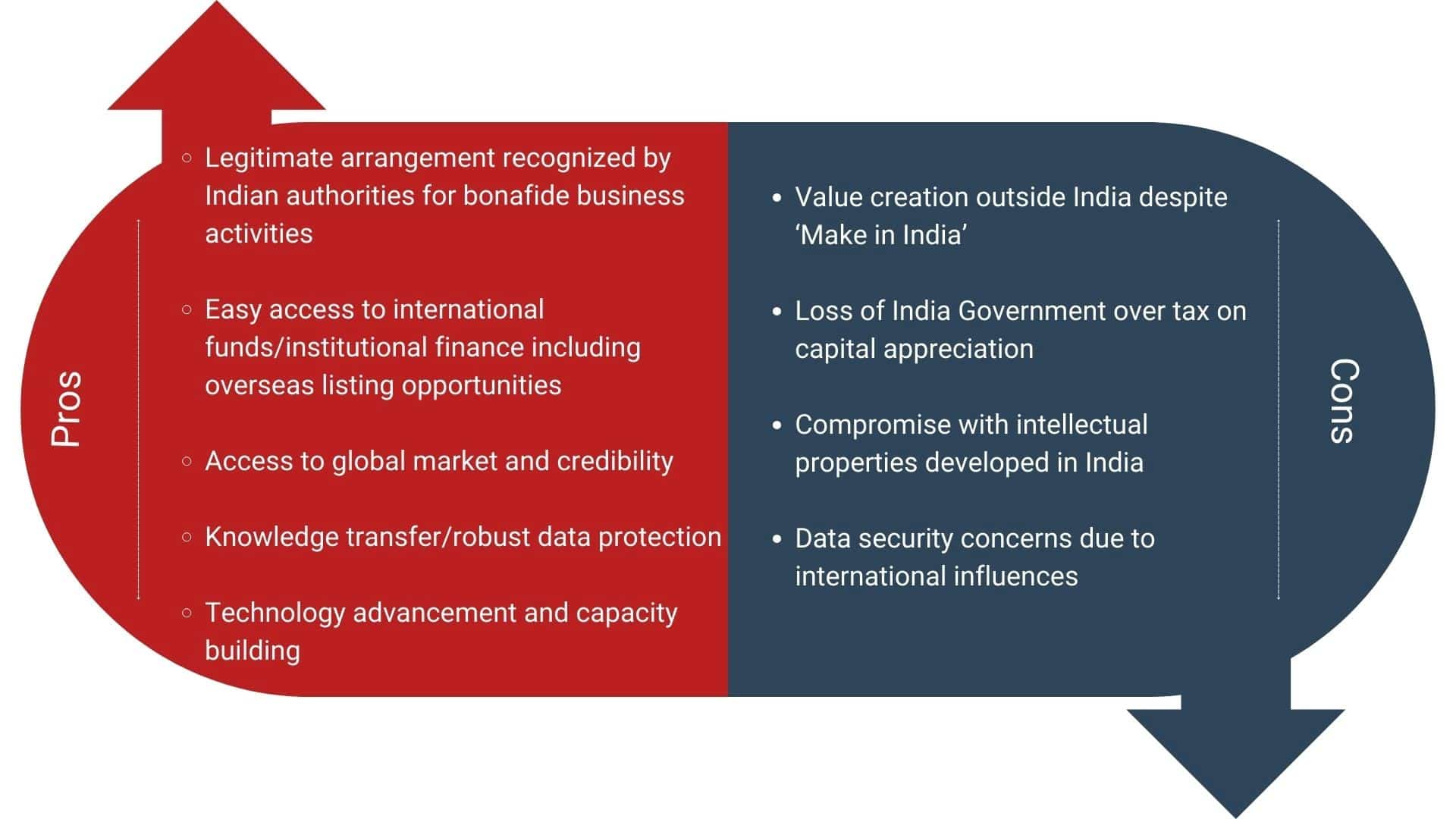

Permissible Flip Structure – Pros and Cons

Flip Structure – Issues to be Addressed

Tax planning may be one of (and not the only) the objectives behind flip strategy. Pursuing favorable tax jurisdictions has become a common strategy, leading to concerns among tax administrators about the erosion of their tax bases. Various factors apart from tax implications such as transaction compliance cost, regulatory impact on intellectual property transfers need to be considered while restructuring through a flip strategy.

Flip Structure – Case Study

Let us discuss the case study and evaluate the purpose, options, methods, challenges and tax issues based on different scenarios.

An Indian family of technocrats nurtured the idea of developing a cutting-edge, highly integrated SaaS platform with AI tools for near to accurate mental wellness assessment. This platform would provide recommended therapies/treatment from a team of experts across the globe within a fraction of seconds at a reasonable cost. They formed an Indian startup and developed inhouse technology, AI tools and registered the patent in India.

In the initial 2 years of operations, they conducted R&D, trials, and provisional patent registration. In the third year, they conducted a go-to-market strategy, established the brand, and set up business in India and overseas markets. They also set up offices in multiple locations and worked on hiring and retaining key employees. In the fourth year of operations, the startup began its final patent registration process, deep-dived into data security measures, and conducted advanced R&D initiatives, etc.

Pursuant to business exigencies and ease of specialized health-tech fundraising from the US markets, one of the opportunities explored was to set up headquarters outside India with IP registration. In return, US Health tech funds promised a huge valuation and global credentials for ease of listing in the USA.

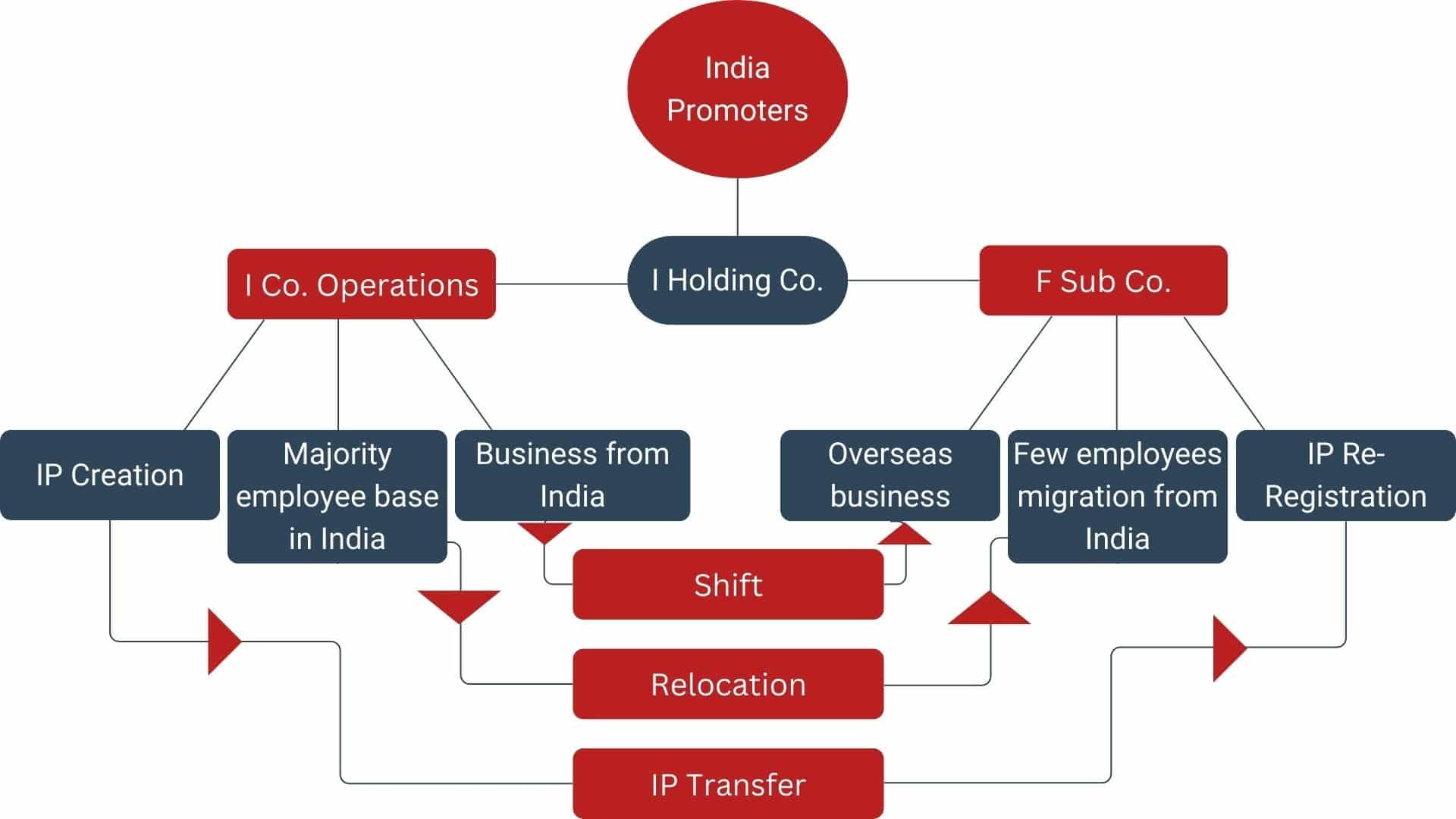

In awe of getting international access to foreign funds from recognized institutions, the promoters of I Co. explored the following scenarios to make F Co a holding company:

- Swap of shares by promoters of I Co. with F Co. and making it 100% subsidiary.

- Make F Co. as holding company and transfer of India business to new subsidiary.

Swap of shares by promoters of I Co. with F Co. and making it 100% subsidiary

One of the preferred and easy methods for implementing a ‘flip’ strategy is through a share swap. Under this exercise, the shares held by the shareholders of the I Co. are swapped with the shares of the F Co., making F Co. a holding company (F hold Co.). Therefore, the shareholders of I Co. become shareholders of the F hold Co. and indirectly hold I Co.

Foreign Exchange Laws Implications

Indian entities have the flexibility to make Overseas Investment (OI) by way of swap of securities, which is not restricted to only equity shares post August 2022. Swap of securities shall comply Foreign Direct Investment (FDI) and Overseas Direct Investment (ODI) or Overseas Portfolio Investment (OPI) with OI guidelines prescribed under Foreign Exchange Management Act (FEMA),1999. Threshold stake limits and nature of control in foreign entity are key to deciding whether transaction shall comply with ODI or OPI compliance.

Tax Implications

Any investment made by or in a startup company entails numerous tax implications, depending on the jurisdiction where the company is situated. Externalization poses as a viable solution to reduce, if not entirely circumvent, these tax implications make functioning of the company commercially viable in a cost-effective manner.

Tax planning shall be the by-product of any commercially bona-fide transaction structuring, but cash strapped startups perceive India as land imposing numerous taxes. Some include exorbitant corporate tax rates of 22%-25%, surcharge and cess; gift tax for undervaluation of capital transactions; angel tax for investment from specified global territories at premium; minimum alternative tax and ESOP tax. From an Indian perspective, the highly regulated tax regime and heavy regulatory checklist are some of the biggest reasons for Indian startups to think of flipping their structure into other luring jurisdictions like the UK, UAE or Singapore.

- Friendly corporate tax structures in Singapore (17%), UAE (9%) and UK (19%) are making tax regimes more favorable for the ease of doing business. Also, relaxation in Capital Gain Tax as well as Dividend Tax in Singapore and UAE.

- Historically, US private equity/venture capitalists have shown interest in overseas startups only if the promoters agree to ‘flip’ their corporate structure, wherein a US parent company is created with Intellectual Property (IP) rights transferred to US jurisdiction and promise to create job opportunities within the US. Over the years, global startups preferred to ‘flip’ for access to US funding and a supportive regulatory ecosystem.

However, before flipping strategy, here are some critical Indian Income Tax issues cited by Indian promoters:

- The Fair Market Value (FMV) of securities (rather than the actual commercial value involved in the transaction) swapped needs to be taken into consideration to avoid notional tax. Further, there shall be reporting obligation of foreign assets/ securities in ITR of Resident Indian shareholders from the year in which foreign securities are exchanged for Indian holding.

- The commercial substance test under the General Anti-Avoidance Rules (GAAR) is a concept which empowers refusal of tax benefit of transactions or arrangements which do not have any ‘commercial substance’ and where the only purpose of such a transaction is achieving the tax benefit. GAAR poses an imminent threat to the scheme of flip structuring.

- The Place of Effective Management (PoEM) test to determine the residence of a foreign company for taxation purposes under the Income Tax Act would bear severe implications. This test was introduced to align the domestic laws with the international standards and prevent the companies from avoiding tax liability despite being controlled and managed from India. Thus, the offshore holding company needs to keep a check on its functioning to prevent it from being taxed in India.

- Transfer pricing regulations need to be applied considering Function, Asset, Risk (FAR) Test on a yearly basis.

- Indian promoters would be taxed on capital gains at time of alienation of foreign securities in compliance with Double Tax Avoidance Agreement (DTAA) and need to repatriate the proceeds back to India.

Intellectual Property Implications

While the transfer of IP of an Indian company undergoing the flip structuring is allowed under various provisions of the FEMA, the different aspects pertaining to taxation as well as valuation need to be addressed adequately. Overall, the timing of transfer and the basis of valuation of such IP assumes greater importance to make the process of externalization cost-effective.

- The valuation must be in accordance with the FMV of the IP by employing appropriate methods of computing FMV and the rationale for selecting such method.

- Furthermore, the gains made on such transfer of the IP shall also be subjected to tax in India according to the provisions of the Income Tax Act.

Make F Co. as Holding Company and transfer of India business to new subsidiary

Key mechanics

- F Sub Co sets up a new step-down subsidiary in India (New India Sub).

- India Hold Co transfers its business to New India Sub under a Business Transfer Agreement (BTA), which would be treated as a ‘slump sale’ for tax purposes.

- India Hold Co could thereafter be wound up or merged with New India Sub, resulting in F Sub Co now being the ultimate holding company, with New India Sub as its subsidiary.

Foreign Exchange Laws Implications

Prior to August 2022, the RBI did not define ‘round tripping’ as such; however, the essence was captured in the response to FAQ 64 of the ODI FAQs which permitted an Indian party to set up the Indian subsidiary(ies) through its foreign WOS/JV under ‘approval route’ engaged in a bona genuine commercial activity.

Rule 19(3) of the OI Rules permits a round tripping structure, only if such structure is limited to two layers of subsidiaries. However, clarification sought on ‘two layers of subsidiaries’ needs to be considered from the perspective of Indian party or the foreign entity.

Tax Implication

BTA would involve taxes based on FMV principle considering the transfer of assets as per formulae, and potential stamp duties to be paid based on the situs of assets.

- Other aspects of PoEM and GAAR need to be addressed with ‘substance test’ subject to threshold criteria for applicability.

- As an alternative to a BTA, the following steps could be explored:

- Merge I Hold Co with New India Subsidiary (I Co. 2) in tax complaint manner on going concern basis.

- I Hold Co. would cease to exist, and I Co. 2 would be directly held by US Sub Co. making it US Hold Co.

- Shareholders of I Hold Co. shall get direct shares of US Hold Co. in the merger.

- This would be a tax-neutral merger between companies but may be exposed to GAAR implications.

- Transfer pricing regulations need to be applied considering FAR Test on yearly basis.

- Tax on alienation of foreign securities in hands of Indian promoters in compliance with DTAA and repatriate the tax paid proceeds back to India.

Initiatives by the Indian Government to curb Flip Strategy

- On November 1, 2023, the Ministry of Corporate Affairs (MCA), India issued a notification amending Section 23 of the Companies Act, 2020 to permit specific classes of companies to issue a class of securities for the purpose of listing on permitted stock exchanges in specific permissible foreign territories. However, the mechanism of the listing is underway and once established, we may see a decline in Flip strategy by Indian startups unless a rationale is established.

- The GIFT International Financial Services Centre (IFSC) emerges as a potential alternative for Indian tech startups, but it is in the nascent stage with a smaller and diverse investor base, which may impact newly listed companies to get necessary liquidity and trading volumes.

Concluding Thoughts

The evolution of business, driven by virtual and online models from traditional approaches, has reshaped operational paradigms and strategies across various domains. From the protection of intellectual property to global expansion and access to international funds, the technological shift has fundamentally altered business dynamics in the last decade. While focusing on efficient tax planning for sustainable profits, the rise of flip structures necessitates legislative measures to mitigate associated risks. Commercial rationale, rather than tax-saving motivations, primarily shall drive the need to flip holding structures! Consideration of exchange control regulations is also crucial to ensure regulatory compliance. Tax authorities globally are revising policies to prevent profit shifting, emphasizing the balance between growth and equitable taxation. This dynamic underscores the need to harmonize global tax regulations to foster fairness and sustainability. As businesses adapt to the digital age, strategies will likely prioritize equitable contribution to the countries where they operate.

However, recently, some Indian startups with overseas holding companies are opting for reverse flipping, relocating their headquarters to India, as seen with PhonePe, Meesho, Udaan, Groww, Pepperfry and Razorpay. This trend highlights the favorable investment climate for e-commerce, fintech and regulatory efforts by Indian lawmakers to encourage ease of operations and tax clarity. Redomicile of various companies to India demonstrates a positive shift in the Indian ecosystem, reflecting efforts to stimulate the economy and attract investment. This relocation process involves cross-country mergers and regulatory approvals to streamline operations within India. Overall, it signifies a promising trajectory for India’s startup landscape and regulatory framework.

This blog is co-authored by Megha Gala.

Why Choose InCorp Global?

Our team has expertise in managing the complexities of Indian corporates, foreign exchange, and taxation laws of different countries, including reverse flipping and optimized tax solutions for MNCs, startups, and investors. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

Samir Sanghvi | Direct Tax

Co-Authored by:

Megha Gala | Direct Tax

Frequently Asked Questions

The Reserve Bank of India (RBI) is one of the key regulatory authorities that oversee outbound mergers, ensuring compliance with foreign exchange and other legal frameworks.

According to transfer pricing regulations, under Sections 92 to 92F, all cross-border transactions between the Indian subsidiary and the foreign parent company adhere to the arm's length principle.

Outbound mergers are governed by the Companies Act of 2013, SEBI regulations, Competition Act 2002, FEMA and other relevant laws.

: Indian startups should consider the intellectual property laws of the host country, international treaties such as the Paris Convention and the Patent Cooperation Treaty, and local registration requirements to ensure their intellectual property is adequately protected in the new jurisdiction.

Yes, Indian startups can benefit from double taxation treaties, which are designed to prevent the same income from being taxed in both the home and host countries, thereby reducing their overall tax burden and avoiding double taxation.

Share

Share