The Speedy Way to Reorganize Group Companies: Understanding Fast-Track Mergers

The Speedy Way to Reorganize Group Companies: Understanding Fast-Track Mergers

Fast-track mergers: Benefits, applicability, and rationale of a fast-track merger to reorganize group companies

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

Mergers and amalgamations are popular corporate restructuring strategies that companies use to achieve their business goals by combining their resources, operations, and assets to form a larger organization. These mergers can occur through friendly negotiations or hostile takeovers. The fast-track merger is one type of merger that involves a streamlined process that is faster than regular mergers. Let’s delve deeper into the concept of fast-track mergers.

Applicability Of Fast-Track Merger

Under Section 233 of Companies Act, 2013, a scheme of merger or amalgamation may be entered into between any of the following class of companies:

- Two or more start-up companies; or

- One or more start-up company with one or more Small Company; or

- Merger between two or more Small Companies; or

- Merger between a Holding Company and its Wholly owned Subsidiary Company.

Let’s Understand The Important Definitions Relevant To Fast Track Merger

Small Companies – A “small company” is a company that is not a public company and has:

- A paid-up share capital not exceeding more than Rs.10 crores.

- A turnover not exceeding more than Rs. 100 crore.

Wholly owned subsidiary company – A wholly owned subsidiary company is a company that is incorporated under the provisions of the Companies Act, 2013, and in which holds 100 percent share capital of such company.

Start-up Company – The term ‘start-up’ or “start-up company” means a private company incorporated under the Companies Act, 2013, and recognized as a start-up in accordance with the notification issued by the Department of Industrial Policy and Promotion, Ministry of Commerce and Industry.

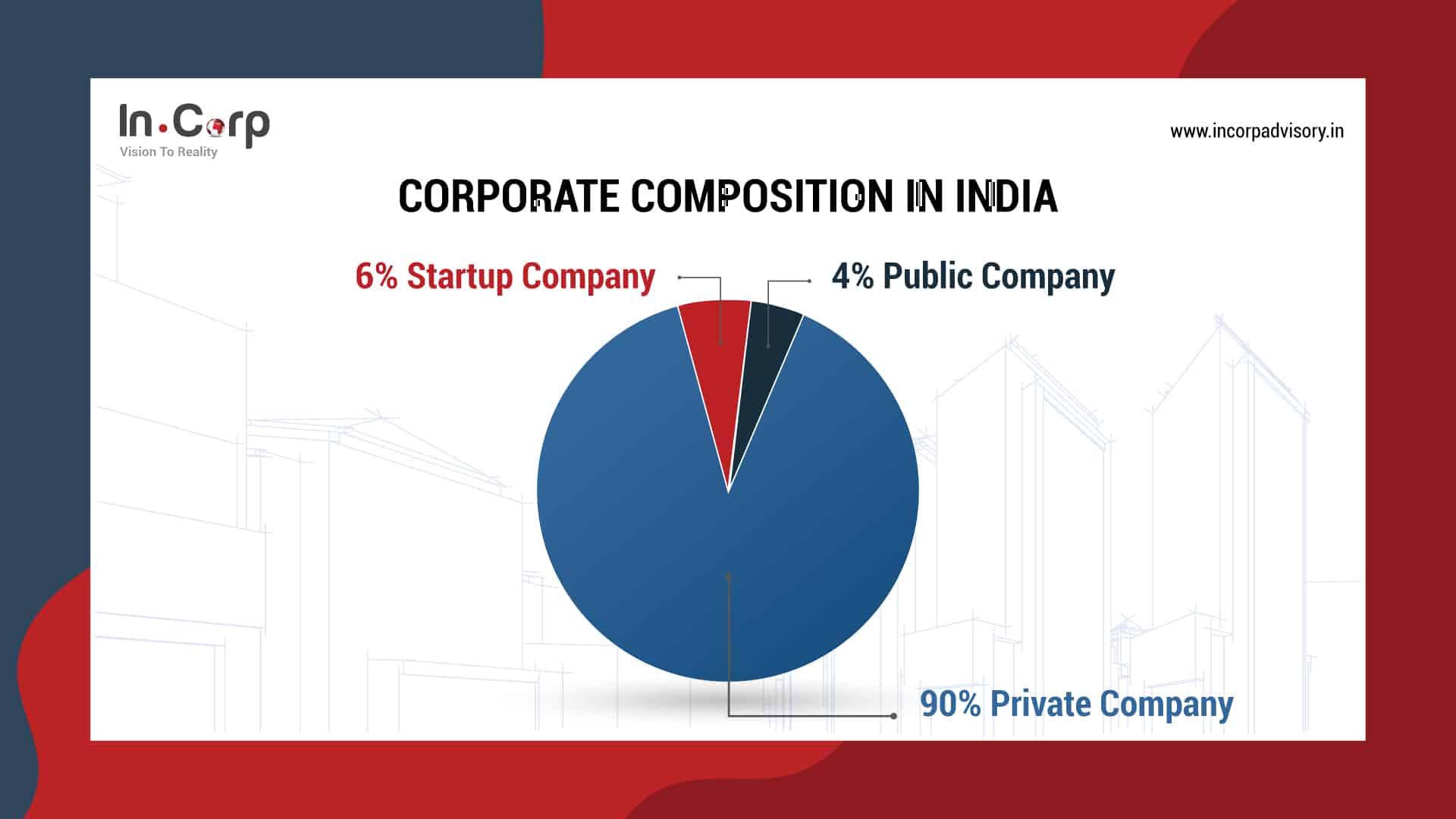

Source: Google Statistics as on 31-08-2022.

Source: Google Statistics as on 31-08-2022.

The Rationale Of Doing A Fast-Track Merger

Prior to 2017, i.e., before the introduction of GST, to take advantage of MSME status and other tax laws like VAT, service tax, and excise duty, the promoters of group companies used to incorporate multiple companies within the group with the same business objective.

However, with the introduction of the GST, and changes in other laws, these companies are finding it difficult to sustain themselves due to high compliance costs and the need to follow complex government rules and regulations. Also, the definition of MSME has been amended, and the limits have been enhanced to cover a larger chunk of companies under MSME Status. Fast-track mergers will be a great way to avoid the unwanted burden of compliance and other regulations.

Some of these group companies have accumulated huge reserves; however, now that there is minimal or no business in the company, they are on the verge of shutting down or may attract NBFC guidelines if they do investments in Group Companies. If these accumulated reserves are distributed to shareholders, Dividend Distribution Tax (DDT) or Buy-out tax may be applicable, which may turn out to be a costly exercise. In order to save taxes, a fast-track merger is a good option.

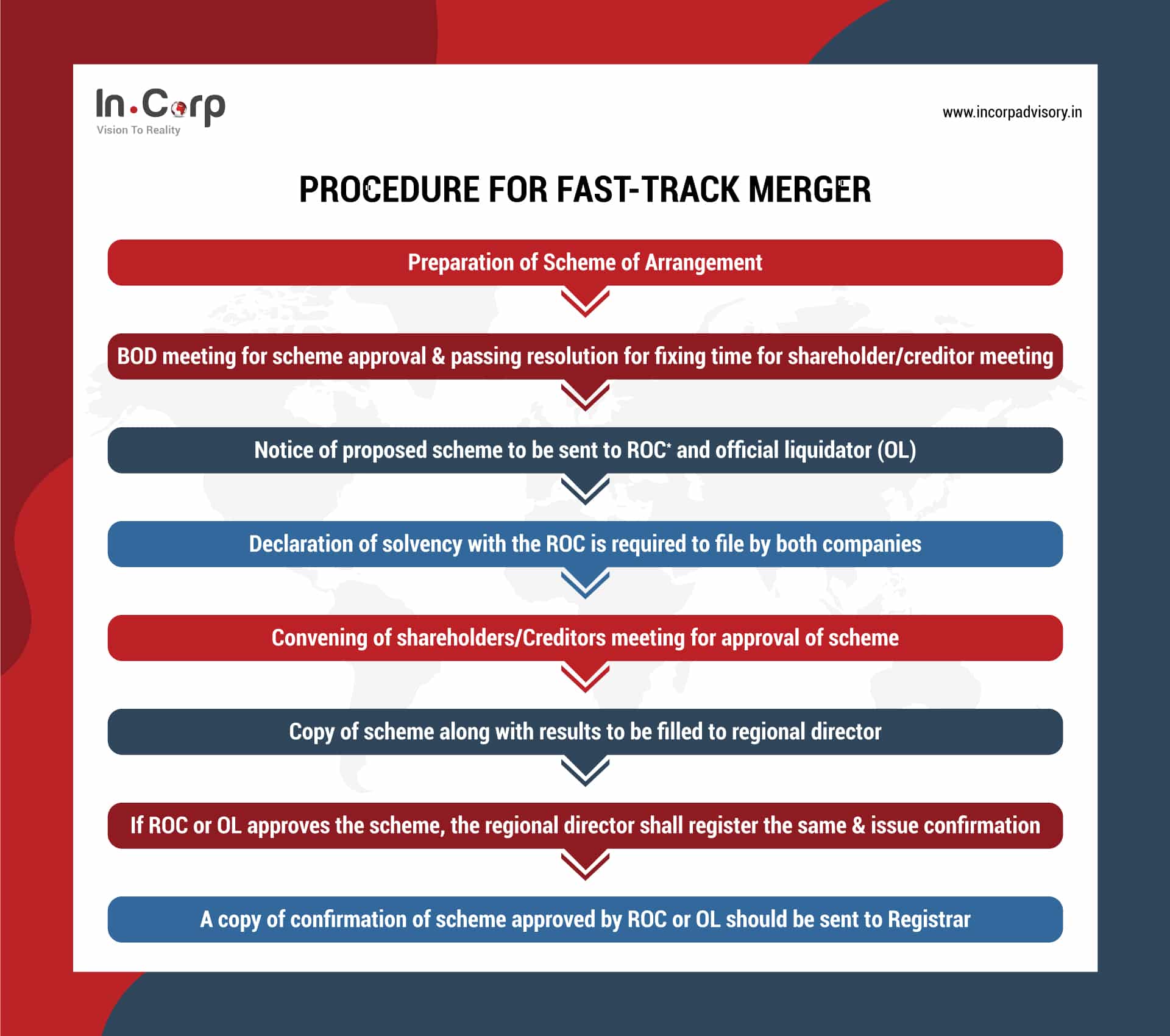

Procedure For Fast-Track Merger

Source: ROC-Registrar of Companies

Source: ROC-Registrar of Companies

Benefits Of Fast Track Merger

Quick Process: A fast-track merger can be completed more quickly than a traditional merger because it does not require the same level of shareholder approval and regulatory review. This can help companies achieve their strategic goals more quickly.

Cost savings: Because a fast-track merger requires less time and resources to complete, it can be less expensive as compared to traditional mergers.

Control: A fast-track merger can help the parent company consolidate its ownership and control over the subsidiary, which can provide greater strategic flexibility and decision-making authority.

Strategic benefits: A fast-track merger can help companies achieve their strategic objectives more quickly, such as expanding their product offerings or entering new markets. By streamlining the merger process, companies can focus more on achieving their strategic goals.

Benefit of setting off losses against profit: If the loss-making company is merged with the profit-making company, the merged company can take the tax benefit of the loss incurred by the transferee company. Overall, tax benefits can provide financial benefits to the companies involved, making a fast-track merger an efficient and attractive option for companies seeking to merge quickly.

Tax Savings: Merger results in saving of DDT and Buyback tax, which otherwise contributes to significant outflows from reserves and surplus of the closing entity (if liquidated/ strike off).

Value Consolidation: If the two companies merge, the value of the merged company will be higher than the value of the individual companies. This strategy of fast-track merger is helpful to those group entities that are planning to sell the companies to outsiders. This fast-track merger strategy would help them get good value from the merged company at a low cost.

Increased efficiency: Fast-track mergers can help improve the efficiency of the merging companies as they can quickly integrate their processes and operations.

Conclusion

Fast-track mergers are an excellent way for companies to merge quickly and efficiently. They can save a significant amount of time and money and help improve the efficiency of merging companies. However, it is essential to ensure that the process is followed correctly, and all legal requirements are met. If you are considering a fast-track merger, it is recommended that you seek the advice of a legal professional.

Why Choose InCorp?

At In.Corp, our team can provide invaluable support to companies looking to undertake a fast-track merger. With their expertise in corporate services and legal support, In. Corp can help companies navigate the complex regulatory landscape of fast-track mergers, ensuring that the merger is successful and that both companies benefit from the merger.

Need help with navigating the rules and regulations in Gift City?

Share

Share