Navigating Fundraising Instruments and Mechanisms

Navigating Fundraising Instruments and Mechanisms

Understanding the Tools and Strategies for Effective Fundraising

- Last Updated

Companies in India have an option to issue various investment instruments to its investors in order to meet their capital requirements from time to time. As per the Company law in India, the term for instruments issued by companies to investors is ‘securities’. Depending upon the Company’s requirements and the investor’s preference there are various options available with the Company for fundraising.

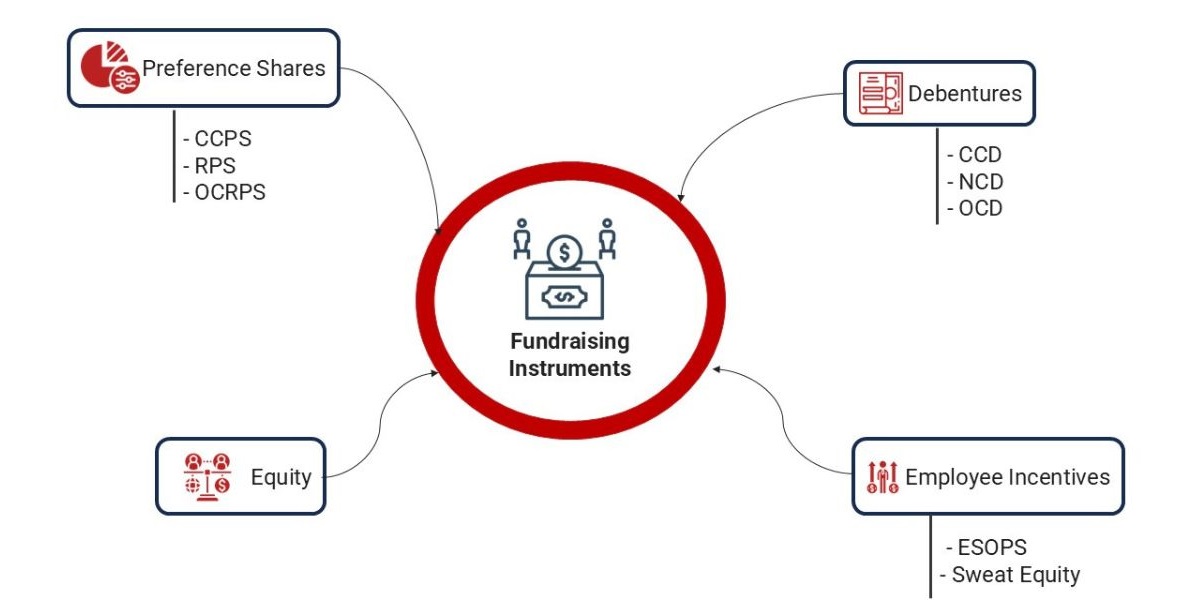

Fundraising Instruments:

The instruments commonly issued by companies at the time of fundraising are equity-based instruments, debt-based instruments or hybrid instruments (containing a combination of features of both equity and debt-based instruments).

The primary difference between the issue of equity and debt-based instruments is the dilution of shareholding of the existing shareholders of the company.

Types of Fundraising Instruments:

Equity:

Companies can raise capital through Equity Financing without incurring debt, aligning investor interests with the company’s success.

CCPS (Compulsory Convertible Preference Shares):

The CCPS are anti-dilution instrument or hybrid instrument combining fixed dividends with potential equity conversion. Conversion of the instrument can be linked to the performance of the company which is to the advantage of the investor. Conversion of the CCPS is linked to the Company accomplishing its target growth. In case the target is not laid out, the company has every right to crank up its stake.

RPS (Redeemable Preference Shares):

RPS has a fixed tenure. It enables companies to raise capital temporarily thereby providing flexibility in financial planning.

OCRPS (Optional Convertible Redeemable Preference Shares):

OCRPS provides the option to convert preference shares into equity based on mutual agreement or repayment based on an agreement. OCRPS offers flexibility for both companies and investors, aligning with performance or mutual preferences.

CCD (Compulsorily Convertible Debentures):

CCDs are hybrid instruments like CCPS which would convert into equity within a stipulated period. CCDs serve as a debt instrument until conversion, allowing the flexibility to the Company for a structured capital raising.

NCD (Non-Convertible Debentures):

NCDs are debt instruments attracting investors seeking fixed returns. NCDs have a fixed interest and principal repayment without conversion into equity.

OCD (Optionally Convertible Debentures):

In case of OCDs, there is an option to convert debentures into equity or repayment based on agreed-upon terms. These instruments blend debt financing with flexibility, catering to diverse investor preferences.

Employees Stock Option Plans (ESOPs):

Stock options give employees the right to buy shares of the company at a pre-determined price. The stock options are often granted to the employees as a tool to attract and retain talent and are also used by the companies to incentivize the employees to align their interests with the company’s success.

Sweat Equity Shares:

Sweat Equity Shares are issued by the company to its founders, directors or employees at a discounted price or for consideration other than cash in recognition of their work. The Company can issue sweat equity shares to retain the employees by rewarding them for their services.

Compliances for Issuance of the Financial Instruments:

The equity shares could be issued to the existing shareholders by way of a rights issuance by receiving the approval of the board of directors. Post receipt of the board approval, the company can issue offer letters to the existing shareholders communicating the offer period for rights issuance. The company will need to file the board resolution with the Registrar of Companies. Upon receipt of the funds towards the rights issuance, the board shall approve the allotment of the equity shares to the shareholders and the return of allotment shall be filed with the Registrar of Companies. The Company cannot utilize the funds received from the rights issuance unless and until the shares are allotted and the return of allotment is filed with the Registrar of Companies.

Related Read: SME IPO Listing Process: A Step-by-Step Guide

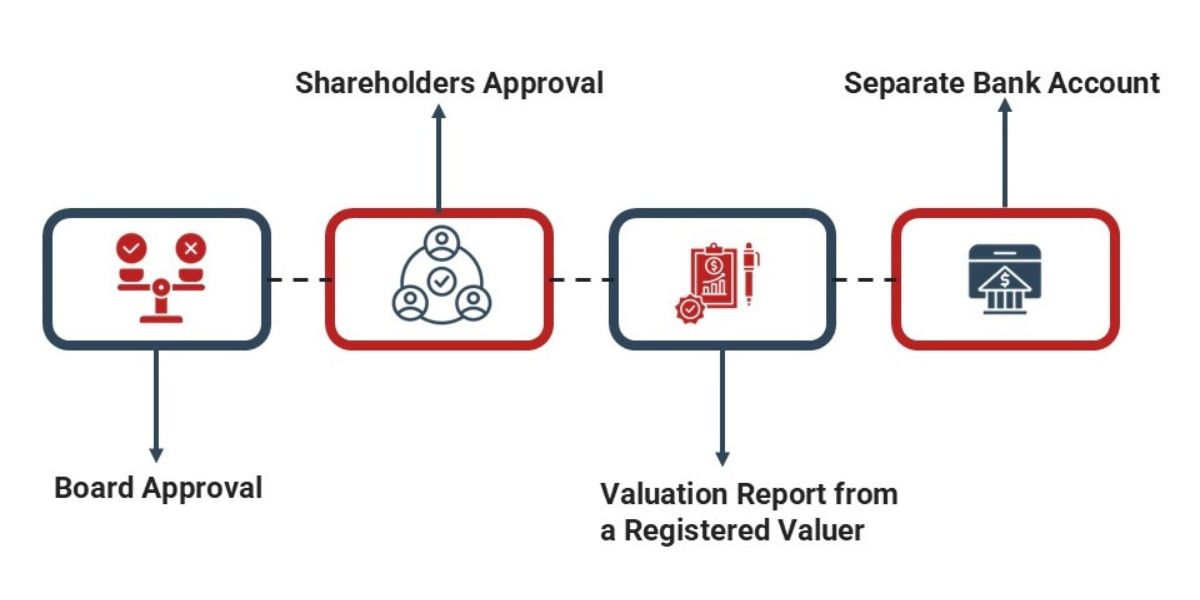

In case of preferential offer where the instruments are being issued to the new investors, the process shall be as under:

- Obtain the Valuation Report from a Registered Valuer.

- Approval of the Board of Directors needs to be sought for the preferential issue.

- Approval of the shareholders of the company by way of a special resolution needs to be sought for the preferential issue.

- Company needs to open a separate bank account, and the funds should be remitted by the investors from their account to this bank account.

- The special resolution needs to be filed with the Registrar of Companies.

- The offer letter needs to be sent to the investors.

- Once the amount is received in the bank account, the Board of Directors can allot the shares, and the return of allotment is to be filed with the Registrar of Companies.

- Once the return of allotment is filed, the company can utilize the funds.

- In case the instruments issued are equity and preference shares, the corporate actions need to be filed with the Depository Participants for crediting the instruments in the demat account of the investors. In case the instruments issued are CCDs/OCDs, the share certificates can be issued to the investors.

In case of issue of Employee Stock Options (ESOPs), the process shall be as under:

- Approval of the Board of Directors needs to be sought for the issue of ESOPs.

- Approval of the shareholders of the company by way of a special resolution needs to be sought.

- The special resolution needs to be filed with the Registrar of Companies.

- Necessary entries in the Register of Employee Stock Option.

- The options can be granted to the employees.

- After the ESOPs are vested, the options can be exercised.

- Once the options are exercised, the Board of Directors can allot the shares, and the return of allotment is to be filed with the Registrar of Companies.

- The corporate actions need to be filed with the Depository Participants for crediting the instruments in the demat account of the investors.

- Necessary disclosure is required to form a part of the boards’ report.

- Once the options are exercised, the Board of Directors can allot the shares, and the return of allotment is to be filed with the Registrar of Companies.

- The corporate actions need to be filed with the Depository Participants for crediting the instruments in the demat account of the investors.

- Necessary disclosure is required to form a part of the boards’ report.

In case of issue of Sweat Equity Shares, the process shall be as under:

- Obtain the Valuation Report from a Registered Valuer.

- Approval of the Board of Directors needs to be sought for the issue of sweat equity shares.

- Approval of the shareholders of the company by way of a special resolution needs to be sought.

- The special resolution needs to be filed with the Registrar of Companies.

- Once the special resolution is sought the Board of Directors can allot the shares and the return of allotment is to be filed with the Registrar of Companies.

- Necessary entries in the Register of Sweat Equity Shares.

- Necessary disclosure is required to form a part of the boards’ report in the year in which the Sweat Equity Shares are issued.

In case of issuance of NCDs, the company can only issue secured NCDs. In case of issuance of unsecured NCDs, it shall be mandatory for listing of these NCDs on the recognized stock exchange so that same does not come under the purview of deposits. Further, for issuance of secured NCDs, the below conditions need to be fulfilled:

- The date of redemption shall not exceed ten (10) years from the date of issue. However, in case of Infrastructure finance companies, companies engaged in Infrastructure projects, Infrastructure Debt Fund Non-Banking Financial companies and companies permitted by Ministry or Department of Central Government or by RBI the NCDs can be issued beyond a period of 10 years but up to 30 years.

- NCDs should be secured by creation of charge having value for the due payment of the debenture and the interest thereon.

- Appointment of a Debenture Trustee and the charge shall be created in favor of the Debenture Trustee.

Qualification and Role of Debenture Trustee must be clearly set out. - Debenture Redemption Reserve (DRR) needs to be created by the company on or before the 30th day of April. The amount of DRI should be 15% percent of the amount of debentures maturing during the year, ending on the 31st day of March of the next year. Such amount can be deposited in scheduled banks or securities in the Central or State Government. The amount so invested shall only be used for redemption of debentures maturing during the year.

Apart from the secretarial compliances, if the instruments are being issued to a person resident outside India, the company will have to comply with the FEMA compliances. For the FEMA compliances, the company will have to check the sectoral cap, initial acquisition as per the FEMA rules and pricing guidelines. Once the above compliance is met, the company will need to file the Form FC-GPR within 30 days from the date on which the instruments are issued to the person resident outside India.

The subscription of NCDs by foreign parties other than Foreign Portfolio Investors (FPIs) is considered an External Commercial Borrowing (ECB) and is regulated under FEMA regulations.

External Commercial Borrowings (ECB) are commercial loans taken out by Indian entities from non-resident lenders in foreign currency. ECBs can be raised only for a specific period called Minimum Average Maturity Period.

Key Takeaway for Preference/Equity/ OCD/CCD/Sweat Equity

In case of the Right issuance of Equity shares, only Board approval shall be required.

Conclusion:

The complicated nature of financial instruments emphasizes the need for a customized strategy in capital raising and ownership management. To navigate this complexity effectively, seeking advice from experts is crucial.

Why Choose InCorp Global?

At InCorp, our experts have years of experience raising funds through various instruments. To know more about our services and how we help with raising funds through issuance of various instruments, you can contact us at (+91)77380 66622 or email us at info@incorpadvisory.in.

Authored by:

Priya Vishwanathan | India Entry

FAQ:

The most effective way for a company to raise funds depends on several factors, including the company's current financial health, business objectives, the stage of growth, risk appetite, and the preferences of the investors.

- External Commercial Borrowings (ECBs) are loans taken by Indian companies from foreign lenders in foreign currency, primarily used for large capital expenditures or project financing, with fixed repayment schedules and no equity conversion. In contrast, Convertible Debentures (CDs) are hybrid instruments that combine debt and equity features, offering investors the option to convert their debt into equity shares of the company after a certain period. ECBs are regulated by FEMA and RBI, while CDs are governed by the Companies Act and SEBI. The key distinction lies in ECBs being traditional loans with fixed repayments, while CDs provide the potential for equity participation, resulting in possible dilution of the company’s ownership.

It depends upon the requirement and circumstances of the company as to which mode is most suitable. However, External Commercial Borrowing might be the most effective mode of financing as the compliances for the same under FEMA are streamlined and regulated.

- Hybrid instruments can be a good option to raise funds depending upon the requirements of the company. It includes combined features of both equity and debt, giving more flexibility to the investors as well as the company.

- Unlike Sweat Equity Shares, ESPOs cannot be issued for consideration other than cash as they are typically granted as a right to employees to purchase shares at a predetermined price. Issuing securities like ESOPs and Sweat Equity shares helps to boost the morale of the employees and other members in the company, thereby resulting in improved efficiency and increased contributions to the company.

Companies can issue NCD to NRIs provided that all the secretarial compliances and FEMA compliances have been complied with including filing of form FC-GPR with 30 days of issue.

- ECBs are another route that a company can opt in order to raise finance, in form of commercial loans taken out by Indian entities from non-resident lenders in foreign currency. MAMP refer to the maximum time limit for the repayment or conversion of ECBs. Usually, MAMP is for 3 years, however it varies for different types of ECBs.

Share

Share