Buyback Tax Reforms: Implications for Companies and Shareholders

Buyback Tax Reforms: Implications for Companies and Shareholders

Tax implications on share buybacks undergo significant changes after amendments in the Finance Act (No. 2), 2024: Complete overview

- Last Updated

A buyback of shares is a financial plan where a company repurchases its own shares from shareholders, reducing the number of outstanding shares of the company. This measure can increase the value of the remaining shares and enhance the company’s financial ratios. Buyback shares of the company are used to rationalize the capital of the company, and, in today’s business environment, it also serves as a crucial avenue to offer an exit option to the investors.

According to the Companies Act, 2013, buybacks must be financed through (i) free reserves, (ii) issuance of new shares (different from the ones repurchased), or (iii) the securities premium account of the company.

As per the Finance Act (No. 2) 2024 from October 1, 2024, new regulations on tax for buybacks of shares will be implemented, transferring the income tax liability from companies to shareholders. These changes will now impact companies’ pattern of allocating capital and the investment plans of companies. Let us examine who stands to gain from these changes and analyze them.

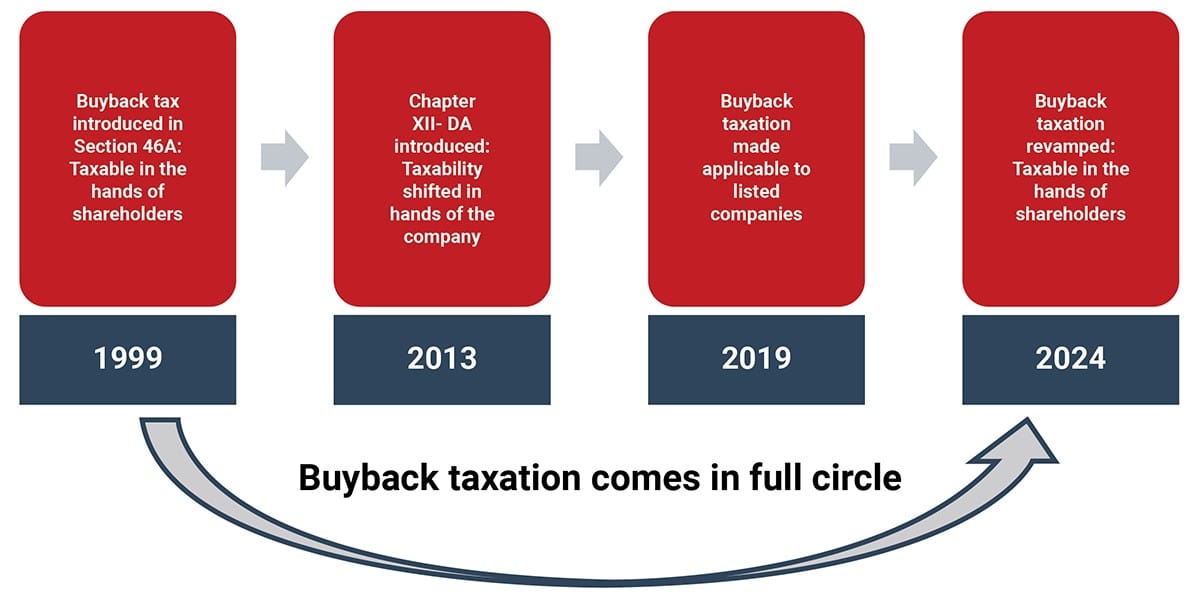

Evolution of Buyback

The tax landscape surrounding buybacks has undergone significant transformation over the years. Currently, an Indian company undertaking buyback before October 1, 2024, is required to pay income tax on the amount of ‘distributed income’ (i.e. difference between the consideration paid to the shareholder in the buyback and the amount received by the company for the issuance of such shares) at an effective tax rate of 23.30% (including surcharge and cess). Further, income tax provides for an exemption to the shareholders in respect of the consideration received by them towards the buyback from the company.

From October 1, 2024, according to an amendment in buyback tax introduced by the Finance Act (No.2) 2024, there have been substantial changes in the taxation system for buybacks wherein the tax obligation has been switched from the hands of the company to the hands of the shareholders, altering the existing system entirely.

Evolution of Buyback Tax Overtime

Buyback Taxation Post Finance Act 2024

- Buyback undertaken on or after October 1, 2024, to be taxed in the hands of shareholders as dividend.

- No deduction of cost base against such income is allowed i.e. no deduction is allowed for issue price, gross amount of buyback consideration payable to the shareholders is considered deemed dividend.

- Such a cost base shall be treated as a loss arising on buyback eligible for carry forward as capital loss and can be set off against any other capital gain income.

- TDS on dividend on buyback consideration (deemed dividend) provisions introduced at 10% for resident shareholders and at 20% for non-resident shareholders, subject to treaty relief.

In the current regime, the dividend is taxable in the hands of the recipient as per the applicable tax rates, which may go as high as ~36% as compared to buyback tax which is taxed ~23%. Also, the surcharge rate on buyback tax was restricted to 12% as compared to 15% for dividend income. Further, under the existing regime, buyback tax is levied on the distribution amount as reduced by the consideration received for shares issued, whereas in the amendment such amount is deferred as carry forward losses.

The tentative tax outflow for domestic investor pre and post amendment scenarios has been tabulated below

| Particular | Existing law upto 30 September 2024 | Buyback law as applicable from 1 October 2024 |

|---|---|---|

| Tax incidence in hands of | Company (exempt in hands of shareholders) | Shareholders |

| The rate of tax deducted by the company on buyback income | 23.92% | Not applicable |

| Maximum rate of tax at which the buyback income is taxable in the hands of resident shareholders | Exempt | 35.88% |

| Whether any withholding tax to be deducted by the company at the time of buyback in case of resident shareholders | No | At 10% |

| Maximum rate of tax at which the buyback income is taxable in the hands of non-resident shareholders | Exempt | 23.92% (subject to treaty benefits, if any) |

| Head of income under which buyback proceeds are taxable | Exempt | Income from other source |

| Treatment of cost of acquiring shares tendered in buyback under the Income Tax Act | Not allowed as capital loss | Treated as capital loss which can be set off against any other capital gain income. |

For an individual promoter subject to the highest slab rate, net cash flow will significantly decrease due to the proposed amendment. Meanwhile, for a company taxed at approximately 25% or 29%, the difference between pre and post amendment, though smaller, remains considerable with respect to cash flow.

Impact Analysis

Resident investors

Related Read: How Section 194T Impacts Partner Payments

- The Companies Act, 2013, permits buybacks out of free reserves or securities premiums, or the proceeds from any shares. As per the revised provisions of the buyback, the total amount received by shareholders from a buyback will now be taxed as a dividend, irrespective of whether the buyback is financed by accumulated profits or not.

- There may be genuine cases where the shareholder might have incurred certain expenses like commission / fees / interest in relation to shares which are bought back by the company. However, the amended provisions provide for gross taxation basis as dividend without any deductions.

- Also, we need to evaluate in detail after the revised buyback provisions come into effect whether an intermediate company, which receives buyback proceeds from another company and correspondingly distributes dividends itself, would be eligible for deduction under Section 80M of the Income Tax Act (available to the resident corporate shareholder).

Non-resident investors

- For non-resident shareholders, dividend income is taxed at flat 20% (plus applicable surcharge and cess) subject to rate under the respective tax treaty wherein the same may be considered as dividend or capital gain or other income.

- Now with the amendment, the buyback transaction is to be considered as deemed dividend. Non-resident shareholders stand to benefit from these changes, primarily due to the ability to claim lower tax rates on ‘dividend income’ under respective tax treaties, typically rates ranging from 5% to 15%. This is based on the assumption that NRIs opt for pick and choose method wherein the NRIs opt for definition of dividends under the act and rate of tax as per the tax treaty based on various case laws.

- Additionally, they can now claim credits for taxes paid in India in their home countries—a benefit not available under the previous regime, as previously the buyback tax was levied on Indian companies, and the shareholders were exempt. However, the extent of this benefit may vary depending on the jurisdiction of the non-resident shareholder and the specific provisions related to ‘dividend’, ‘capital gains’, and ’other income’ applicable in their respective tax treaties. Let us explore the tentative treatment of dividend under India-UK and India-Mauritius tax treaties:

- Under India UK Tax Treaty – A UK investor in an Indian firm would gain from the India-UK tax treaty, which considers any income deemed a dividend under Indian law as a dividend for treaty purposes. Additionally, the treatment of capital gains under the India-UK tax treaty is consistent with the respective domestic tax laws. In such cases, a lower tax rate of 10% or 15% on dividend income, as specified by the India-UK tax treaty, should apply since the buyback proceeds are now considered as dividends.

-

- Under India-Mauritius Tax Treaty – On the contrary, under the India-Mauritius Tax Treaty, while the dividend article is similarly structured, a buyback leads to an ‘extinguishment of rights’ in the shares, which falls under the capital gains article. Therefore, the applicability of treaty benefits requires careful interpretation of treaties. Notably, capital gains on shares acquired before April 1, 2017, are exempted under the India-Mauritius tax treaty, whereas dividends are taxable at a reduced rate of 5% or 15% under this treaty.

Additionally, if the shares bought back by a non-resident shareholder are held by them as ‘stock-in-trade’, the proceeds from the buyback may be treated as ‘business profits’. The taxability of business profits depends on whether the non-resident shareholder has a Permanent Establishment (PE) in accordance with the relevant tax treaty provisions and Place of Effective Management (PoEM) under the Income Tax.

Who Benefits from the Changes?

Related Read: Strategic Moves for IPO-Bound SMEs

Interestingly, changes in the buyback tax regime presents distinct advantages for certain groups.

- Mutual funds, which benefit from various tax exemptions, may find the new regulations particularly favorable as it has its own set of beneficiaries within this amendment.

- NRIs could benefit from the lower tax rates as stipulated for dividend income in the tax treaties, typically ranging between 5% to 15%. They can also credit for taxes paid in India against their liabilities in their home countries, thereby reducing the overall tax impact.

Conclusion

In conclusion, while the legislative amendments are intended to equalize the taxation on dividends and buybacks, their practical implementation may lead to considerable challenges. The increased tax rate on buyback proceeds in the year of receipt and the potential for capital loss set offs against any capital gains may reduce the appeal of buybacks. Companies often utilize share buybacks to reward shareholders and provide an exit for minority shareholders without engaging in the NCLT process. However, with the new amendments, these provisions have become less appealing. These unintended outcomes highlight the necessity for a re-evaluation and possibly redesign the buyback tax regulations. Proactively addressing these concerns is crucial for ensuring that the legislative intent is achieved without adding extra burden on the taxpayers. Making the buyback provision more attractive from a tax standpoint would benefit all stakeholders.

Authored by:

Megha Gala | Direct Tax

Frequently Asked Questions (FAQs) on Buyback Tax Reforms

The reforms shift the buyback tax from the company to the shareholder, taxing buyback proceeds directly in the hands of recipients.

Companies no longer pay buyback tax, simplifying compliance and reducing upfront tax liabilities.

Shareholders must pay tax on buyback gains, typically as capital gains, depending on the holding period and type of shares.

Companies should evaluate shareholder tax liabilities and structure buybacks considering holding periods, share types, and timing to minimize tax impact.

Certain exemptions exist for unlisted shares or small shareholders, and transactions under employee stock options may follow separate provisions.

Share

Share