Payment Service Providers (PSPs) in GIFT IFSC

Payment Service Providers (PSPs) in GIFT IFSC

Everything You Need to Know About Setting Up Payment Service Providers under IFSCA Guidelines

- Last Updated

The modern world economy cannot exist without Payment Service Providers (PSPs), whose role is to facilitate seamless and secure cross-border transactions. PSPs are at the heart of digital wallet solutions, remittance services and payment settlements within the ambit of GIFT IFSC. This enables companies to function smoothly across different geographies. With the solid regulatory framework of the International Financial Services Centres Authority (IFSCA) in place, GIFT IFSC is positioning itself to be a global hub for online PSPs and a formidable competitive advantage in the global financial market.

PSPs or Payment Service Providers are entities that offer payment services in terms of payment account, money transfer (especially across countries), and provision of e-money. PSPs simplify the process of transferring money between buyers and sellers and are often involved in cross-border transactions and e-commerce. Some examples of Payment service providers are Amazon Pay, PayPal Braintree, Razor pay, PayU, etc.

Main functions of Payment Service Providers include:

• Payment processing which allows businesses and merchants to receive both credit and debit card payments from their customers.

• Enabling safe, efficient, and economical global financial transactions, making GIFT City Gujarat a strong and lucrative fintech hub.

• Giving consumers prepaid cards or digital wallets with which they may carry, send, and spend virtual money.

Pre-requisites for PSPs in GIFT IFSC

Before making an application to the GIFT City authorities, following requirements should be taken care of:

1. Possess the necessary infrastructure, including adequate office space, equipment, and communication facilities in GIFT City Investment zone.

2. Satisfy the net worth requirement.

3. Financial soundness of the applicant and fit and proper requirements.

4. The applicant or its group entities must not have been refused authorization by the authority in the past.

5. Relevant persons of the Applicant possess adequate experience, including an existing authorisation to provide similar services.

Persons exempted from Authorisation Process

The following categories of entities are not required to obtain authorization from IFSCA:

1. An IFSC Banking Company (IBC) or an IFSC Banking Unit (IBU) licensed or permissioned in IFSC GIFT City.

2. A person licensed to carry on the business of issuing credit cards in GIFT IFSC.

3. Any other person or class of persons, as may be specified by the Authority.

Restricted Activities

1. Agent-Led Payments: Payments made by an agent during the sale, or purchase of goods or services are excluded—they are part of the transaction process.

2. Paper-Based Methods: Transactions involving cheques, demand drafts, and postal orders are not considered payment services.

3. Settlement Systems: Payments made between Payment Service Providers, clearing houses, and central banks within payment or securities settlement systems are excluded.

4. Securities Payments: Transactions related to securities asset servicing—like dividends and redemptions—do not count as payment services.

5. Intra-Group Transactions: Payments between a holding company and its subsidiaries, or between subsidiaries without third-party involvement, are not classified as payment services.

6. Currency Transport: Services that transport, collect, and deliver cash are excluded from the payment services definition.

7. Technical Support Services: Entities providing support for payment services, such as data processing and authentication, without handling funds, are not classified as payment service providers.

8. Limited Use Payment Instruments: Instruments that can only be used in specific locations or for a narrow range of goods and services (like store gift cards) are not considered payment services.

9. Payments Between PSPs: Transactions carried out between Payment Service Providers or their agents for their own accounts are excluded.

Types of Payment Service Providers (PSPs)

Significant Payment Service Providers (SPSPs)

Significant payment service providers are providers deemed crucial due to their size, scale, or operational impact. These entities are subject to stricter compliance and oversight standards. Regular PSPs become significant if they meet certain thresholds or conditions, which are detailed the table below:

Conditions for PSPs to be designated as a Significant PSPs:

| Criteria | Condition | Threshold |

|---|---|---|

| 1. Payment Services | The Regular Payment Service Provider must provide one or more payment services (excluding e-money account issuance service) mentioned in Part A of this schedule. | · $2 million (or equivalent in Specified Foreign Currency) for any one service.

· $4 million (or equivalent in Specified Foreign Currency) for two or more services. |

| 2. E-money Account Issuance Service | If the provider intends to carry on or is carrying on a business of providing an e-money account issuance service. | · Average daily value over a calendar year of all e-money stored must exceed $3 million (or equivalent in a specified foreign currency). |

| 3. E-money Issuance Service | If the applicant or Regular Payment Service Provider carries on a business of providing an e-money issuance service. | · Average daily value over a calendar year of total value in one day of all e-money intended to be issued or issued must exceed $3 million (or equivalent in a specified foreign currency). |

Note:

• All thresholds are measured as averages over a calendar year.

• Equivalent values are based on Specified Foreign Currency.

Regular Payment Service Providers (RPSPs)

These are payment service providers that offer designated payment services but do not meet the criteria for being classified as significant.

Eligible activities

1. Account issuance service (including e-money account issuance service)

2. E-money issuance service

3. Escrow service

4. Cross border money transfer service

5. Merchant acquisition service

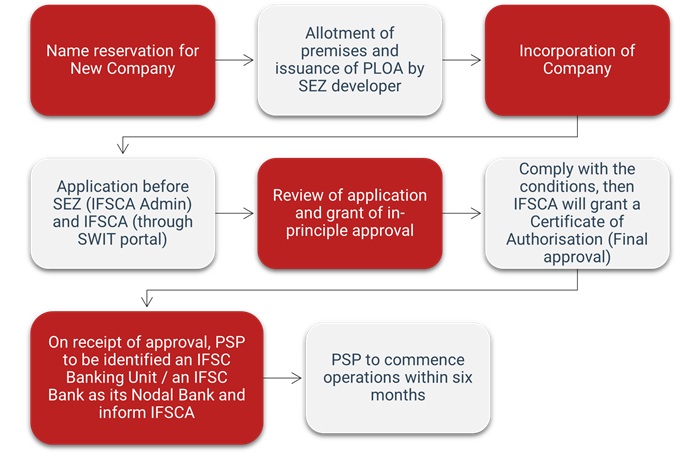

Process flow for setting up as PSPs in GIFT IFSC

Minimum Net Worth Requirements

| Category | Minimum Net Worth Requirement | Timeline |

|---|---|---|

| Regular Payment Service Provider | – USD 100,000 (on commencement) – USD 200,000 (by end of the third financial year) |

– At start of operations – By March 31 (third year) |

| Significant Payment Service Provider | – USD 250,000 (within 90 days of designation) – USD 500,000 (by end of the third financial year) |

– Within 90 days – By March 31 (third year) |

Regulatory Fees for PSPs Entities in GIFT IFSC

- IFSCA Fees

| Particulars | Regular Payment Service Provider | Significant Payment Service Provider |

|---|---|---|

| Application Fees (One-Time) | $1,000 | $1,000 |

| Authorization Fees (One-Time) | $25,000 | $25,000 |

| Recurring Fees | $5,000 | $10,000 |

- SEZ authorities’ Fees

| Particulars | Amount (in INR) |

|---|---|

| Application Fees (one-time) | 5,000 |

| Registration fees (one-time) | 25,000 |

| Recurring fees (Annual) | 5,000 |

Conclusion

With a robust regulatory structure and a clear framework for PSP operations, GIFT IFSC presents a compelling opportunity for global payment service providers. As digital transactions continue to evolve, establishing a presence in GIFT City could be a strategic move for PSPs seeking international reach and regulatory clarity.

Our team at InCorp has the expertise to offer comprehensive assistance throughout the entire process of incorporating a Payment Service Provider entity in GIFT City, Gandhinagar. Listed below are the key services offerings:

- Assistance in structuring the entity as per the regulatory requirement

- Providing advisory services on regulation and its taxation angle to ensure compliance and optimal structure

- Assistance in preparing necessary documentation required and representation before regulatory authorities for incorporation and licensing entities in GIFT IFSC

- Assistance in setting up PSP entities and post-setup requirements and compliance, if any required.

Authored by:

Kritika Raj Singh | GIFT City Service

FAQ

A nodal bank is a designated financial institution responsible for holding and managing funds on behalf of PSP entities. It maintains escrow accounts, handles security deposits, and performs other essential financial duties for the PSPs. Every PSP in the GIFT City is required to appoint a nodal bank and notify the IFSCA (International Financial Services Centres Authority) of their choice.

PSPs (Payment Service Providers) in GIFT City, Gandhinagar offer businesses and entities instant digital transactions, real-time payments, lower regulatory constraints, easier compliance, and multi-currency payment solutions, making GIFT City a prime financial hub. They leverage advanced fintech solutions, API integrations, and AI-driven fraud detection methods. In contrast, traditional banking systems tend to process transactions more slowly due to extensive compliance checks, have strict banking requirements, high capital requirements, and are generally more expensive.

The activities that are prohibited for PSPs under e-money issuance services, to be carried out in GIFT City, India are issue of e-money at a premium or discount; use of the funds collected in exchange of e-money issued to extend loans or financing; extend credit or pay interest on e-money balance; permit the e-money stored in e-wallets to be withdrawn in the form of cash; associate the e-money scheme or platform to conduct dubious or illegal activities.

An entity set up as a Payment Service Provider (PSP) in GIFT IFSC shall be considered as person resident outside India under the provision of Foreign Exchange Management Act,1999. Therefore, an Indian entity setting up a PSP in GIFT CITY as subsidiary or group company is required to comply with the provisions of Foreign Exchange Management Act,1999 before submitting its application vide ODI or OPI route subject to meeting the conditions.

A Payment Service Provider (PSP) manages online payments for merchants and facilitates transactions through various payment modes. In contrast, a Payment Gateway acts as an interface, securely transmitting transaction data between the payer and receiver. GIFT City India is rapidly emerging as a premier fintech hub, attracting major companies in GIFT City Gandhinagar. With its strong regulatory framework, GIFT IFSC offers unparalleled opportunities for Payment Service Providers and Payment Gateway Service Providers looking to scale operations globally.

Share

Share