Ship Leasing in GIFT IFSC: Exploring the Impact Beyond Borders

Ship Leasing in GIFT IFSC: Exploring the Impact Beyond Borders

Unveiling ship leasing dynamics in GIFT IFSC: Opportunities, challenges, and the future of maritime investment

- Authors

- Last Updated

- Tags

- Last Updated

- Tags

Share

Table of Contents

- Authors

- Last Updated

- Tags

The establishment of GIFT IFSC brought significant emphasis on the maritime sector, fostering the growth of various financial services. India, with its vast coastline and extensive global and domestic trade through the sea, has a significant strategic interest in the maritime industry. Nevertheless, many famous shipping companies prefer to operate from countries like Singapore, Dubai or Hong Kong. Therefore, the IFSCA has included ship leasing as one of the offerings that can be undertaken by a finance company that has a presence at GIFT IFSC. They can be functioning under an operating lease, finance lease, or hybrid lease. In GIFT IFSC, ship leasing allows shipping companies and operators to rent vessels to have access to various financial products.

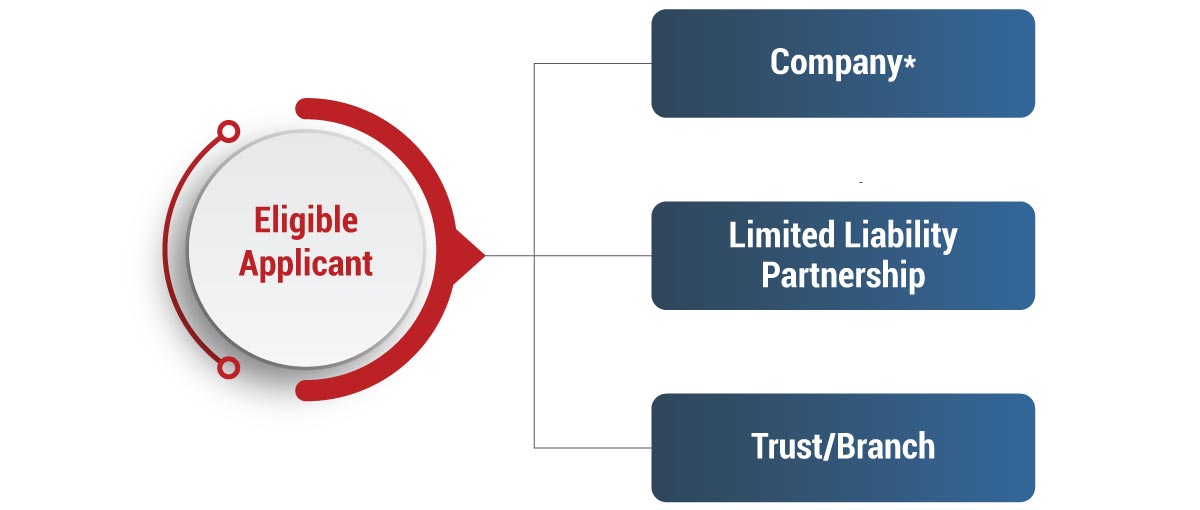

Legal Structure of Setting up Ship Leasing Entities in GIFT IFSC

*Wholly Owned Subsidiary (including subsidiary incorporated outside IFSC) of IFSC registered entity

Permissible Activities Under the Said License

The following activities are permitted under ship leasing license:

- Purchase, novation, transfer, assignment in relation to ship leasing

- Sale and leaseback

- Contracts of affreightment

- Leasing of voyage charters

- Employment in shipping pools

- Asset management support services (including third-party asset management services)

- Ship broking related to ship-leasing activities (separately covered under different licence)

Minimum Owned Funds Requirements

| Lease Type | Minimum Owned Funds |

|---|---|

| Operating Lease | USD 0.2 million |

| Finance Lease | USD 3 million |

| Hybrid Lease | USD 3 million |

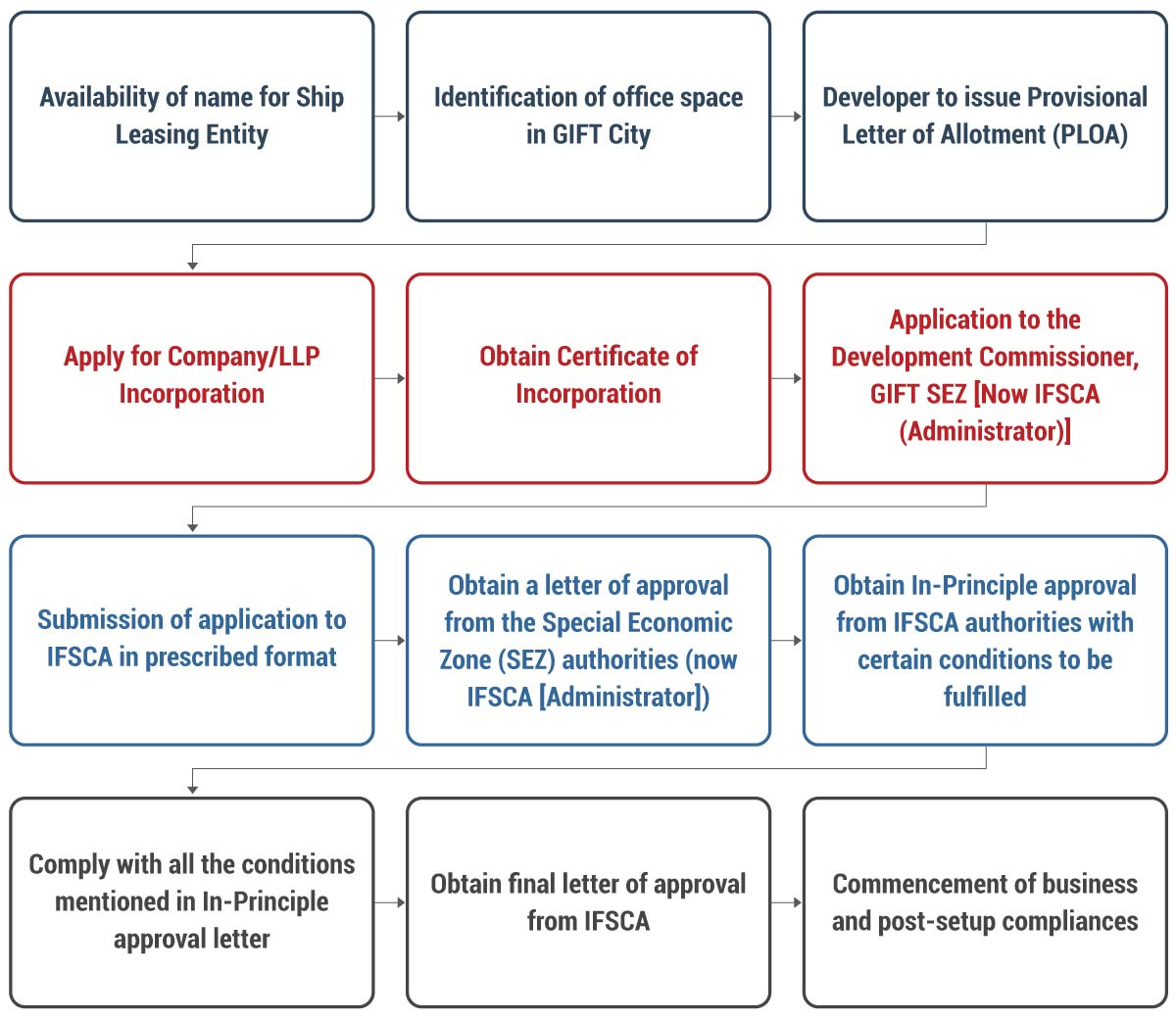

Process Flow of Setting-up Ship Leasing Entities in GIFT IFSC

Specific Conditions

Under SEZ Act, 2005, ship leasing entities are exempt from physically bringing in goods into SEZ premises as GIFT City does not have seaports. Ship leasing entities are also required to comply with the provisions of Merchant Shipping Act, 1958.

Types of Ship Leases Available at GIFT IFSC

Three major types of ship lease options are operating lease, finance lease and hybrid lease. Operating lease is a short period rental contract normally lasting a few months in which vessel is delivered for the purpose of operations. Finance leases, which are equivalent to buying credit are most suitable for those firms that have long-term fleet expansion objectives and often go over ten years. Hybrid involves elements of both operating and finance leases, thus providing tailor-made solutions in relation to ship leasing at GIFT IFSC.

GIFT IFSC offers three ship leasing options:

Operating Lease

Operating lease allows leasing of a ship for a shorter duration. This may be ideal for temporary uses where a seasonal demand is met without having to own ships on a long-term basis. For instance, a cruise line might rent an upscale yacht during summer (e.g., 4 months) with fixed monthly instalments funded by the financial institution covering maintenance.

Finance Lease

Functioning akin to buying a ship on credit, finance leases are suitable for companies looking for long-term fleet growth solutions which usually take more than a decade. Under the lease payments, part of the ship’s value is financed with an option to buy the ship at the end of the lease period. For example, a shipping company may enter into a long-term lease agreement for a new cargo vessel that would last most of its life and transfer ownership at maturity of such lease.

Hybrid Lease

At GIFT IFSC, hybrid leasing combines features from both operational and financial leases to offer tailored alternatives for ship leasing. This is in cases where traditional lease structure may not be appropriate. For instance, if a shipping firm needs a bigger boat for a particular project that lasts less than five years, then hybrid leasing could have higher initial rentals compared to normal operational leasing. However, it comes with an option to purchase at the time of maturity of the contract.

Benefits of a Ship Lessor Registered in GIFT IFSC

| Particulars | Benefits |

|---|---|

| Income Tax Act |

|

| Goods and Service Tax |

|

| Other Benefits |

|

Regulatory Fees for Ship Leasing Entities GIFT IFSC

1. IFSCA Fees

| Particulars | Ship Operating Lease | Ship Financial Lease |

|---|---|---|

| Application fees (one-time) | USD 1,000 | USD 1,000 |

| Registration fees (one-time) | USD 12,500 | USD 12,500 |

| Annual fees (recurring fee) | USD 5,000 | USD 12,500 |

2. SEZ Authorities Fees

| Particulars | Amount (in INR) |

|---|---|

| Application fees (one-time) | 5,000 |

| Registration fees (one-time) | 25,000 |

| Recurring fees (annual) | 5,000 |

Conclusion

Maritime businesses seeking flexibility and cost-effectiveness in their operations can enjoy a strategic advantage through ship leasing in the GIFT IFSC. Various types of leases are available in this region, combined with a supportive regulatory environment that includes tax incentives, streamlined governance, and others. Notably, key players such as Arcelor Mittal Nippon Steel India, Foresight Shipping, Alphard Maritime Group, Bothra Group, and ACT Group are heading to the GIFT IFSC. Against this backdrop, this framework aims to promote growth and innovation in global shipping while facilitating responsible trade.

Why Choose InCorp Advisory?

Our team at InCorp has the expertise to offer comprehensive assistance throughout the entire process of incorporating a ship leasing entity in GIFT City IFSC. Listed below are the services we offer:

- Assistance in structuring the entity as per the requirement

- Providing advisory services on regulation and taxation to ensure compliance and optimal structuring

- Assistance in preparing necessary documentation required for incorporation of ship leasing entities in GIFT City IFSC

- Assistance in setting up ship leasing entities and post-setup requirements and compliance, if any required

To learn more about our GIFT City services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions (FAQs)

Operating leases, normally last from a few months to several years, as per the want of the leaseholder; finance leases, on the other hand, may extend beyond 10 years, often lasting around 20 years or even more. Finance leases effectively cover the life of the asset. Hybrid leases offer flexibility in terms of duration, combining elements of both operating and finance models.

Under a voyage charter, a ship is rented for a single voyage or trip to move cargo between ports.

Contracts of affreightment are agreements in which the ship owner undertakes to transport a specified number of commodities over a set period for multiple journeys rather than just one.

The framework covers a wide range of watercraft: barges, lighters, mobile offshore drilling units, mobile offshore units, ships, boats, sailing vessels, fishing vessels, submersibles, semi-submersibles, hydrofoils, non-displacement crafts, amphibious crafts, wing-in-ground crafts, pleasure crafts, and any other type of watercraft used or capable of being used in navigation.

Share

Share