Establishing Funds in GIFT City’s IFSCA: A Gateway to Growth

Establishing Funds in GIFT City’s IFSCA: A Gateway to Growth

Delve into the Strategic Steps and Growth Prospects for Establishing and Thriving Within the Dynamic Financial Landscape of GIFT City's IFSC

- Last Updated

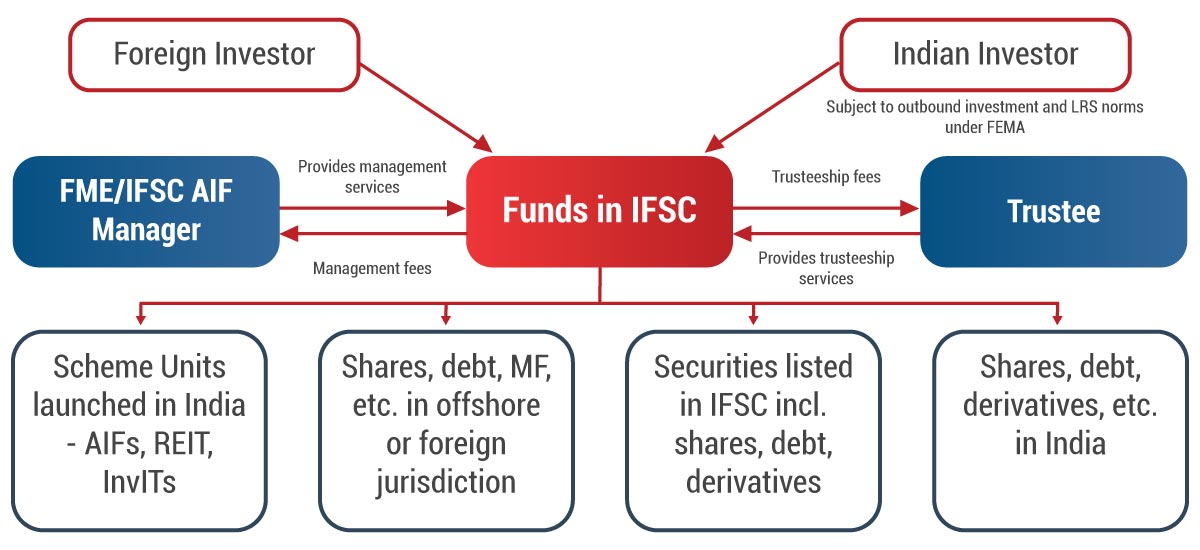

Gujarat International Fin-Tech City (GIFT City), acknowledged as an International Financial Services Centre (IFSC) since 2015, has marked a significant milestone with the introduction of the Fund Management Regulations by the International Financial Services Centres Authority (IFSCA) in April 2022.

These regulations, designed to elevate the financial landscape, focus on the meticulous oversight and regulation of fund managers within the IFSC. Unlike conventional approaches, the emphasis is on regulating the entities engaged in fund management rather than directly intervening in fund operations.

Under the comprehensive Fund Management Entity (FME) Regulations, meticulous attention is placed on establishing a secure regulatory framework. A key stipulation necessitates Fund Managers to secure registration from IFSCA, subject to specified conditions governing the launch of funds or schemes.

Legal structure

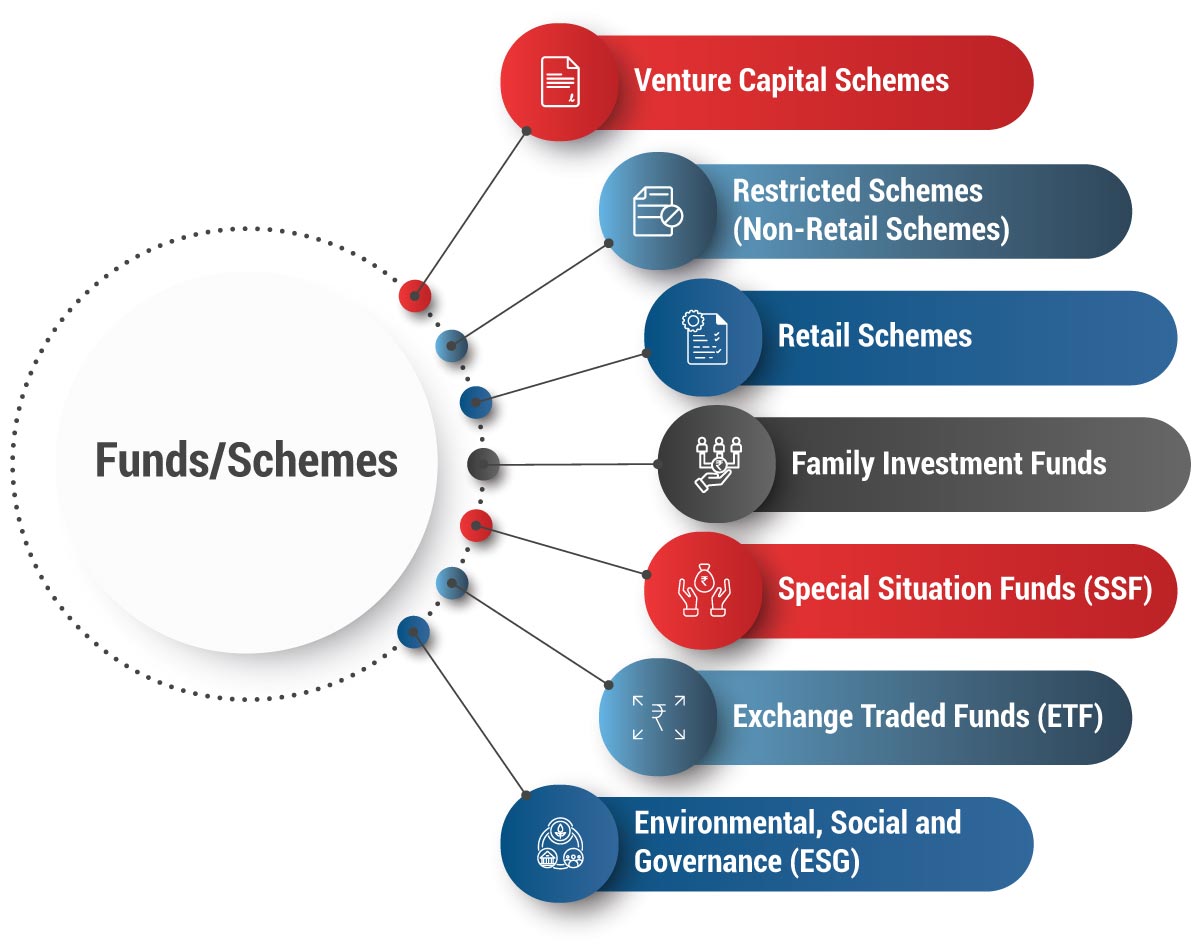

Categories of Funds/Schemes

Fund management entity(s) Regulations classify FMEs into three (3) categories

- Authorized FME

- Registered FME (Non-Retail)

- Registered FME (Retail)

Based on the license obtained, FME will be allowed to launch relevant schemes or carry out activities as described below:

| Type of Fund/Schemes | Authorized Fund Management Entity | Registered Fund Management Entity (Non-Retail Fund) | Registered Fund Management Entity (for Retail fund) |

|---|---|---|---|

| 1. Venture Capital Schemes (VCS) | √ | √ | √ |

| 2. Restricted Schemes | × | √ | √ |

| 3. Retail Schemes | × | × | √ |

| 4. Family Investment Fund (FIF) | √ | √ | √ |

| 5. Special Situation Funds (SSF) | × | √ | √ |

| 6. Exchange Traded Funds (ETF) | × | × | √ |

| 7. Environmental, Social, and Governance (ESG) | × | √ | √ |

Effectively, a registered FME (Retail) can do all the functions of an authorized FME or registered FME (non-retail), and a registered FME (Non-retail) can perform all the functions of an authorized FME. Read more about Fund Management Entities under GIFT IFSC here.

Key Points on Schemes

| Particulars | Venture Capital Scheme | Restricted Scheme (Scheme for non-retail) | Retail Scheme |

|---|---|---|---|

| Coverage of schemes |

|

|

|

| Launched by | Any FME | Registered FME | Registered FME (Retail) |

| Type of Scheme | Close-ended | Close-ended & Open-ended | Open-ended & Close-ended |

| Permissible Investment |

|

|

|

| Limitation on the number of investors | Maximum 50/scheme

Maximum 200 / portfolio scheme (AF) |

Maximum 1000 | Minimum 20 (with no single investor investing more than 25% in a scheme) |

| Minimum Investor Contribution Value |

|

No minimum contribution

|

|

| Investment Restrictions in Unlisted Entities |

|

|

|

| Custodian Requirement in Schemes | Compulsory, if Asset Under Management > USD 70 million | Compulsory, if Asset Under Management > USD 70 million | Compulsory |

| Corpus of the scheme |

(USD 1 million – AF)

|

|

|

| Valuation frequency |

|

|

|

| Constitution |

|

|

|

| Tenure of schemes |

|

|

|

| FME’s Contribution to the Schemes |

(this condition can be waived off subject to obtaining 2/3rd investor approval) |

|

|

Fund Set-up Process in GIFT City, IFSC

Ensure the Fund Management Entity (FME) is registered and operational before proceeding with the steps below.

Step 1: Availability of name for Fund (new setup)

Step 2: Identification of office space in GIFT City – Notified SEZ area

Step 3: Obtaining NOC from SEZ Developer

Step 4: Apply for company/LLP/trust incorporation

Step 5: Obtain Certificate of Incorporation

Step 6: Application to the Development Commissioner (delegated to IFSCA {Administrator})

Step 7: Application to IFSC Authorities (IFSCA)

Step 8: Obtain letter of approval from SEZ Authorities (now IFSCA {Administrator})

Step 9: Obtain letter of approval from IFSCA

Step 10: Commencement of business and focus on post-setup compliances

Benefits for Funds Registered in GIFT City, IFSC

Funds registered under IFSC regulations will have the following benefits:

1. Investor’s benefits

Funds incorporated in GIFT IFSC are permitted to invest in following securities (which may not be allowed to Funds operating out of India):

- Securities Listed in GIFT IFSC

- Securities issued by Companies incorporated in GIFT IFSC

- Securities issued by Companies incorporated in India or foreign jurisdiction.

- Units of other funds in IFSC

- Other permissible investments as per Fund Regulations (like LLP, REIT, InvIT, Derivatives, SPV etc.)

- Overseas entities (without restriction applicable for domestic Funds)

Funds registered in GIFT City IFSC can invest in India subject to FME regulations through the following modes:

- Foreign venture capital investment (FVCI) route

- Foreign portfolio investor (FPI) route

- Foreign direct investment (FDI) route.

2. Taxation benefits to funds in GIFT City, IFSC

- Exemption from Securities Transaction Tax (STT), Commodity Transaction Tax (CTT), and stamp duty for transactions conducted on IFSC exchanges.

- Units of schemes, investment trusts, and ETFs transferred by non-residents on IFSC exchanges would not be subject to Income Tax.

3. Operational benefits to funds in GIFT City, IFSC

Apart from the above tax and compliance benefits, Funds registered in IFSC have some operational benefits too which are as under:

- Availability of skilled labor

- Proximity to the onshore market

- World-class infrastructure, unparalleled connectivity, and transportation access

- Access to multiple markets from IFSC

- Operating costs will be lower due to subsidies granted by the Gujarat government

Other Fund Schemes

1. Special Situation Funds (SSF)

A scheme that invests in special situation assets in accordance with its investment objectives and may act as a resolution applicant under the Insolvency and Bankruptcy Code, 2016 (Insolvency Code). SSFs target stressed loans/assets, security receipts by asset reconstruction companies, etc. A Registered FME (non-retail) or Registered FME (Retail) may launch an SSF as a closed-ended scheme of at least 3 years to invest in special situation assets (as specified under the FM Regulations).

2. Exchange Traded Funds (ETF)

Registered FMEs (Retail) may launch an ETF. ETFs shall be mandatorily listed and traded on a recognized stock exchange and shall include:

- Equity index-based ETFs

- Debt index-based ETFs

- Commodity-based ETFs

- Gold ETFs

- Silver ETFs

- Hybrid ETFs (investing in 2 or more asset classes)

- Actively managed ETF

3. Environmental, Social and Governance (ESG)

ESG is typically intended to encourage businesses and investors to evaluate the impact of their activities on Environmental, Social, and governance factors and to evaluate sustainability related aspects.

4. Family Investment Fund (FIF)

The Family Investment Fund (FIF) refers to the self-managed fund established by a single family that operates within the regulatory framework notified. You can read more about Family Investment Fund in GIFT City IFSC here.

Regulator’s Fees for Setup in GIFT City, IFSC

1. IFSCA Fees would vary based on the category of Fund/scheme set up in GIFT IFSC. Following are the fee structures for various funds/schemes:

| S. No. | Particulars | Activity-based fees |

|---|---|---|

| i | Venture Capital Scheme | $7,500 |

| ii | Angel Fund | $3,000 |

| iii | Restricted Scheme | |

| a. Category – I AIF | $7,500 | |

| b. Category – II AIF | $15,000 | |

| c. Category – III AIF | $22,500 | |

| iv | Retail Scheme | $22,500 |

| v | Exchange-traded fund (ETF) | $22,500 |

2. All Funds/Schemes in IFSC need prior SEZ approval and hence, the SEZ authorities’ fees are as under:

| Particulars | Amount (in INR) |

|---|---|

| Application Fees (one-time) | 5,000 |

| Registration fees (one-time) | 25,000 |

| Recurring fees (Annual) | 5,000 |

Conclusion

GIFT IFSC is becoming a prominent financial destination for Global capital market players including the biggest fund houses and family offices etc. Indian regulators with the assistance of the Government of India have relaxed various regulatory compliance to facilitate the setup of Fund Management Entities (FMEs) and launch schemes.

GIFT IFSC has approx. 95 registered funds* and the number is increasing rapidly. Regulation offers advantages to both inbound and outbound investments with rea sgulatory ease.

These advantages are coupled with tax benefits for NR investors, tax holidays, and other operational efficiencies. Fund regulations make GIFT IFSC an ideal place for fund-related financial activities when completing with other Global International service centers in Dubai, Singapore, etc.

Frequently Asked Questions (FAQs)

Yes, A FME may launch multiple schemes subjects to filling of placement memorandum/draft offer documents along with the requisite fees with the IFSCA

In line with the investment valuation norms, the assets of the scheme are required to be valued by an independent third-party service provider such as a fund administrator or custodian registered with the Authority, a valuer registered with the Insolvency and Bankruptcy Board of India or such other person as may be specified by the Authority.

A Venture Capital Scheme may co-invest in permissible investments under the Regulations through a Special Purpose Vehicle (SPV) under a framework specified by the Authority or through a segregated portfolio by issuing a separate class of units

Merger/ demerger/ restructuring of schemes is permissible subject to approval by the Authority or guidelines as may be issued by the Authority

A FME that launches a scheme related to ESG, is required to make full disclosure regarding investment objective, investment policy, strategy, material risk, benchmark, etc., in the manner as may be specified by the Authority.

Share

Share