BRSR 2.0 – Latest Recommendations From SEBI

BRSR 2.0 – Latest Recommendations From SEBI

- Authors

- Last Updated

- Tags

- Last Updated

- Authors

- Last Updated

- Tags

Environmental Social Governance (ESG) reporting is gaining momentum in India, with the Securities and Exchange Board of India (SEBI) making it mandatory for the top listed entities to report their Business Responsibility and Sustainability Report (BRSR) as part of their listing disclosure requirements. In addition, SEBI has also imposed regulations for ESG-labelled Mutual Funds, requiring them to invest predominantly in companies that publish BRSR reports. Recently, SEBI updated the regulatory guidelines for issuers of green bonds mandating them to adopt the abridged version of the BRSR report. SEBI is also currently working on a regulatory framework for ESG Rating Providers (ERPs).

As India’s top 1000 companies are gearing to adopt and publish the first set of mandatory BRSR reports, SEBI on 20th February 2023 released its ESG Committee’s recommendations on streamlining the ESG disclosures, ESG Ratings, and ESG Investments in India.

The recommendations put a strong emphasis on improving the quality of BRSR disclosures such that stakeholders can have a stronger reliance on the information disclosed. The top 6 highlights of the recommendations of SEBI’s ESG Committee which increase the scope, utilitarian value, and quality of BRSR are as follows:

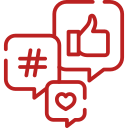

A: BRSR Core Assurance:

The simplest way to build reliance on BRSR disclosures is by a third-party assurance. BRSR currently covers a wide range of disclosures, hence, to limit the cost of compliance the committee has proposed rolling out assurance in a phased manner. The said assurance is only applicable to the most critical disclosures of BRSR, named as BRSR Core by the consultation paper. BRSR Core covers the assurance of GHG footprint, water consumption and discharge, R&D and capex expenditure in reducing environmental footprint, addressing waste disposal, employee wellbeing, and safety, gender diversity, POSH complaints, purchases from MSME and small producers, job creation in tier-3 towns, percentage of negative media sentiment and average days of payment to vendors and openness of business.

B: Upgrade to BRSR Comprehensive Framework:

Many KPIs suggested in the BRSR core are currently not in BRSR comprehensive framework. Hence the committee has proposed to amend BRSR comprehensive framework and include additional KPIs. Reasonable assurance is required from an assurance provider for such KPIs mentioned under the BRSR core option.

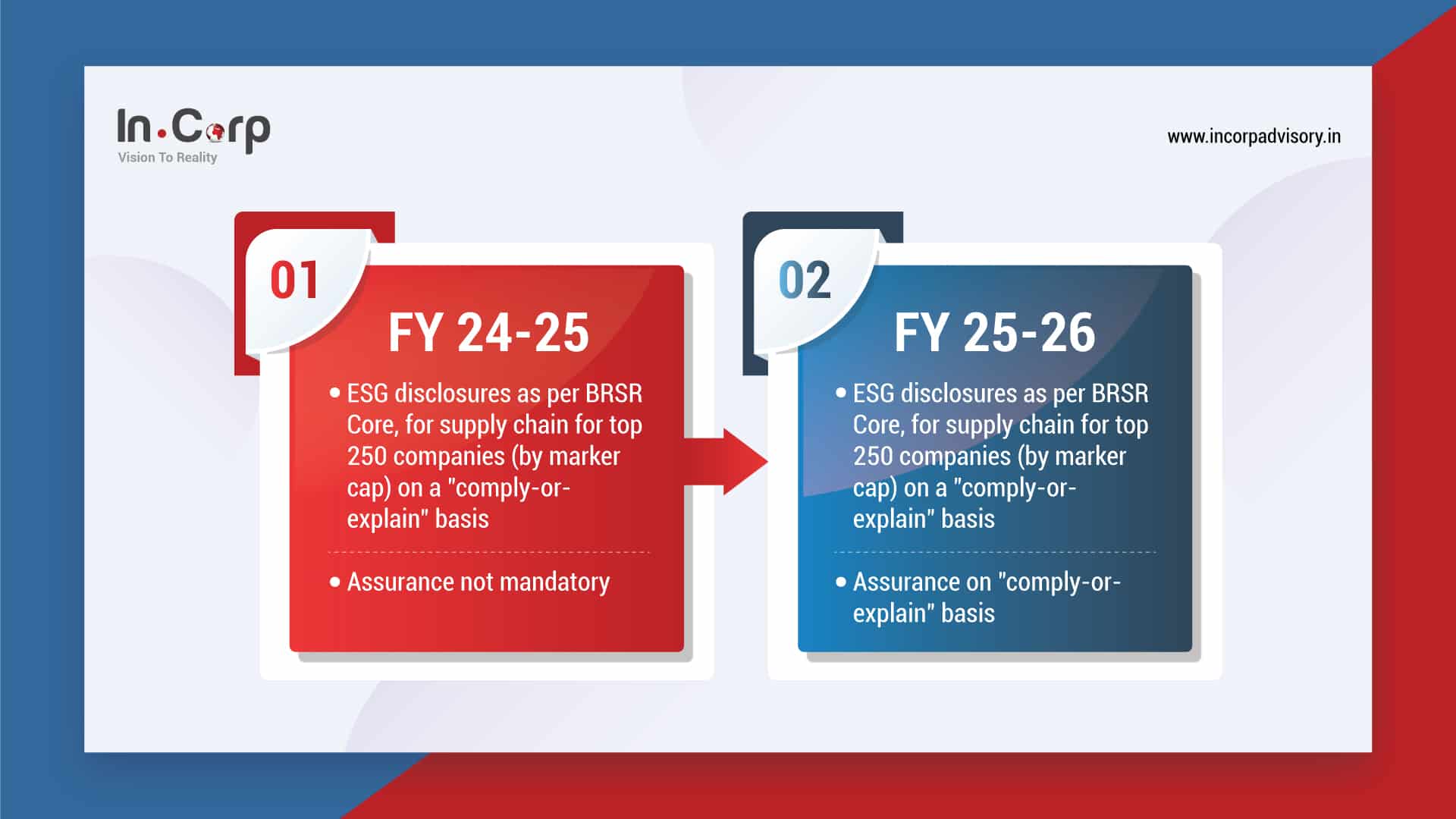

C: Essential Supply Chain Disclosures:

For the current financial year, the BRSR disclosure requirements buckets supply chain indicators under leadership indicators. However, for certain companies, significant GHG emissions may be captured in the supply chain and hence it becomes essential for them to report the same. Keeping the complexity of getting the relevant data for the companies in the initial year, the ESG committee recommends making it an essential indicator in the coming years under the BRSR disclosure requirements. The disclosure shall be on a “comply-basis and will be rolled out in a phased manner.

D: Indianized ESG Ratings Scores:

Related Read: Linking MSCI ESG Ratings with BRSR Framework

Apart from working on regulations framework on how ESG Rating Providers (ERPs) shall operate, the ESG committee also believes that emerging markets like India present a unique set of environmental and social challenges and therefore there is a need for a distinct set of metrics to be considered when assigning ESG ratings. In the context of India, for instance, issues such as employment creation in smaller towns, gender diversity at the employee level, and inclusive development are much more pertinent than in developed markets. Hence the committee has identified relevant 15 ESG parameters that have an Indian context.

E: ESG Core Rating based on BRSR:

SEBI Committee believes that in general ESG ratings are based on self-disclosed data. The Committee has already proposed that the BRSR core indicator shall be subject to assurance. The Committee further proposes that in addition to their general ESG ratings, ERPs shall also provide a Core ESG rating, which shall be based on assured BRSR Core parameters.

F: Mitigation of investment risks:

To mitigate the risk of greenwashing and safeguard investors SEBI committee has proposed an ESG scheme to invest at least 65% of its AUM in companies that are reporting the BRSR comprehensive version and also providing assurance on BRSR Core disclosures. The same shall come into effect on Oct 01, 2024. Additionally, third-party assurance for the ESG funds regarding compliance shall be introduced from April 01, 2023, on a ”comply-or-explain” basis.

Conclusion

Adoption of BRSR reporting is not just run-of-the-mill compliance but has a larger impact and a much wider audience. SEBI’s ESG committee with this consultation paper has redrawn the attention of listed companies who shall be releasing their first BRSR report for FY 22-23.

Why Choose InCorp?

InCorp Advisory provides a complete ecosystem and support for your BRSR needs. Our team of experts conducts a 360-degree assessment to identify and highlight potential risks and opportunities which can arise with BRSR reporting. Our clients range from listed companies to investors as we help them not only improve their ESG reports but also help create valuable investments.

FAQs

BRSR Core Assurance which needs to be undertaken by a third-party assurance provider for critical disclosures in the ‘BRSR Core’ framework aims to build reliance on the disclosed information by the companies.

The committee believes that emerging markets such as India have unique environmental and social challenges. This suggests the need for distinct metrics for ESG ratings that consider the Indian context, addressing issues such as creation of employment in smaller towns, gender diversity and inclusive development.

SEBI's ESG Committee envisions BRSR reporting as a tool that can drive positive change within listed companies in India. This will lead to enhanced transparency, accountability and value creation for all stakeholders. The recommendations aim to make BRSR reports more reliable and valuable by focusing on improving the quality of disclosures thus contributing to sustainable business practices.

Companies adhering to the recommendations can gain increased investor confidence, improved stakeholder trust, a positive reputation for sustainable and responsible business practices and attract socially conscious investors.

The introduction of a Core ESG rating, backed by BRSR Core parameters, aims to mitigate investment risks by ensuring the reliability of ESG disclosures. This could lead to an increase in investments in companies that adhere to sustainable practices, fostering a culture of responsible investing and potentially influencing corporate behaviour towards greater ESG compliance.

Have you started collecting your BRSR data yet?

Share

Share