ESOPs Beyond Boundaries: Tax Implications of ESOPs at MNCs

ESOPs Beyond Boundaries: Tax Implications of ESOPs at MNCs

Enhance global workforce retention and profitability with cross-border ESOP strategies

- Last Updated

Employee Stock Option Plans (ESOPs) have proven to be effective in retaining a talented workforce, preserving cash flows, increasing productivity and achieving enhanced profitability globally. Cross-border ESOP structures may be explored by various global businesses already established in India, as well as by investors intending to establish a greenfield presence or acquire operating businesses in the country. Furthermore, Indian companies have the flexibility to extend ESOPs to employees at their international holding companies, subsidiaries, or joint venture firms. This article discusses various cross-border ESOP structures and identifies key considerations arising under Indian corporate, foreign exchange, and taxation laws.

Know How Residential Status Impacts the Taxability of ESOP

Residential status is the first stage to determine the taxability of ESOP. The status of the employee can be Resident and Ordinarily Resident (ROR), Resident but not Ordinarily Resident (RNOR), and Non-Resident (NR).

- The period to be considered for taxing the ESOP scheme for non-resident employees is when benefits were granted not when the scheme was realized.

- Capital Gain (CG) on the sale of ESOP will be taxed when the income is realized, but it will be done on the terms for the period when it was granted that is based on the source rule of income i.e. income that arises in India has to be taxed in India.

ESOP Taxability Scenarios based on Varying Situations

Taxability of global income is dependent on the residential status of the individual. So, if the individual is ROR, then any income accrued from ESOPs of foreign entities will be taxed in India. The tax treatment of ESOPs of Indian entities closely aligns with the tax treatment of ESOPs of foreign entities.

The table below explains taxability in the hands of ESOP holders based on their residential status.

| Residential status of company providing the ESOP (employer) | Residential status of Employee vis a vis taxability | |||

|---|---|---|---|---|

| Residential Status at the time of Vesting to Exercise (#) | Perquisite Taxability in India | Residential Status at the time of Sale | Capital Gain taxation in India | |

| Indian or Foreign company | ROR | Taxable | ROR | LTCG/STCG |

| Indian company | ROR/RNOR/NR | Taxable (Source rule) | ROR/RNOR/NR | LTCG/STCG |

| Foreign Company | ROR | Taxable | RNOR | LTCG/STCG |

| Foreign Company | RNOR | Not taxable | ROR | LTCG/STCG |

| Foreign Company | RNOR/NR | Not taxable | RNOR/NR | Not taxable |

(Assumption: Residential Status of the employee is the same throughout the period from vesting to the exercise of ESOPs.)

Scenarios of employment and taxability of cross-border ESOPs

(Mentioned below are the assumptions under all scenarios)

Let us look at varying scenarios of employment and taxability of cross-border ESOPs received in the hands of employer and employee, taxation, and foreign exchange laws.

- Indian company is resident in India (I. Co.) and the foreign company is a non-resident company (F Co.) and they both are holding and subsidiary companies

- Resident status of employee is same during vesting/exercise and sale of ESOPs

- Necessary employment visas have been obtained by the employer

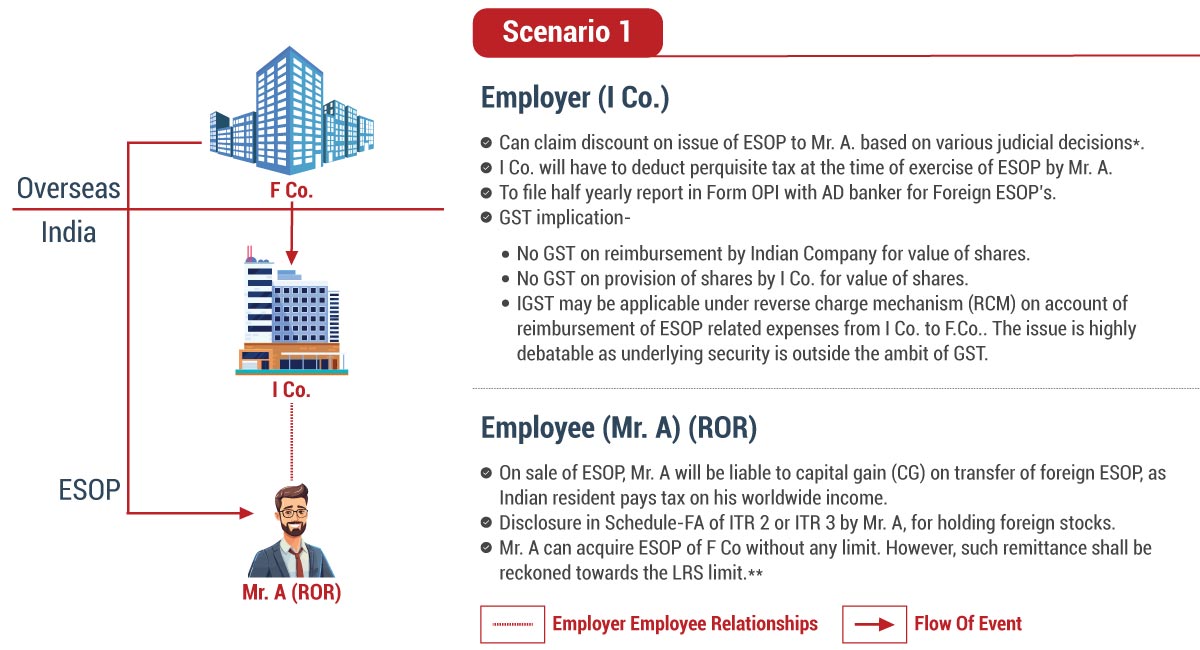

Scenario I: The representation illustrates Mr. A, an employee of the Indian subsidiary company (I. Co.) receives ESOPs from a Foreign parent company (F. Co.) in India

*Flipkart India (P.) Ltd. Vs. ACIT (Bang ITAT) (2023) (150 Taxmann.com 272), Northern Operating Services (P.) Ltd. Vs. JCIT (Bang ITAT) (2023) (149 Taxmann.com 52), Novo Nordisk India (P.) Ltd. Vs DCIT (Bang ITAT) (2014) (42 taxmann.com 168),

**LRS limit of USD 250,000 per financial year per person without any approval. Any remittance beyond this limit is subject to RBI approval.

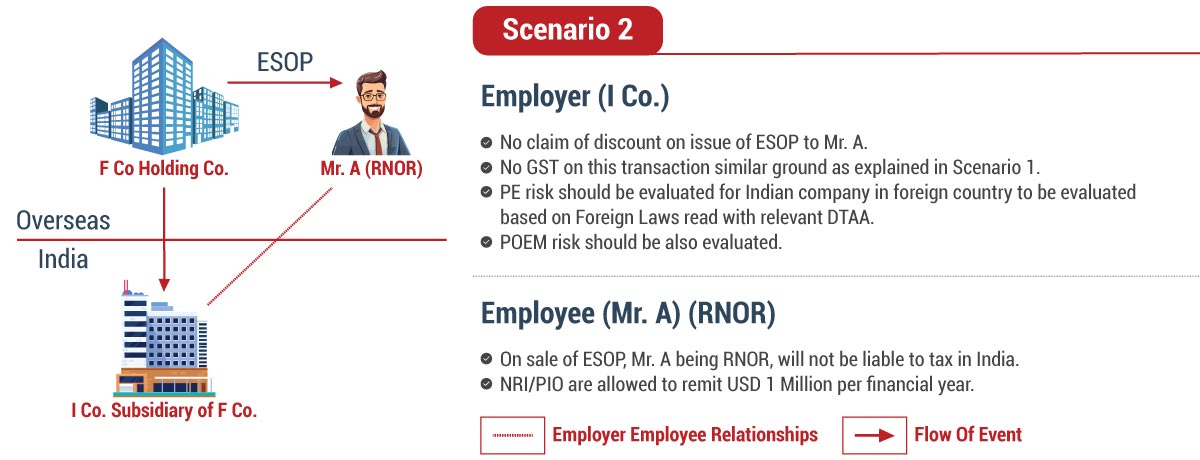

Scenario II: Employee of Indian subsidiary company is seconded to holding company F. Co. outside India and receives ESOPs of F. Co.

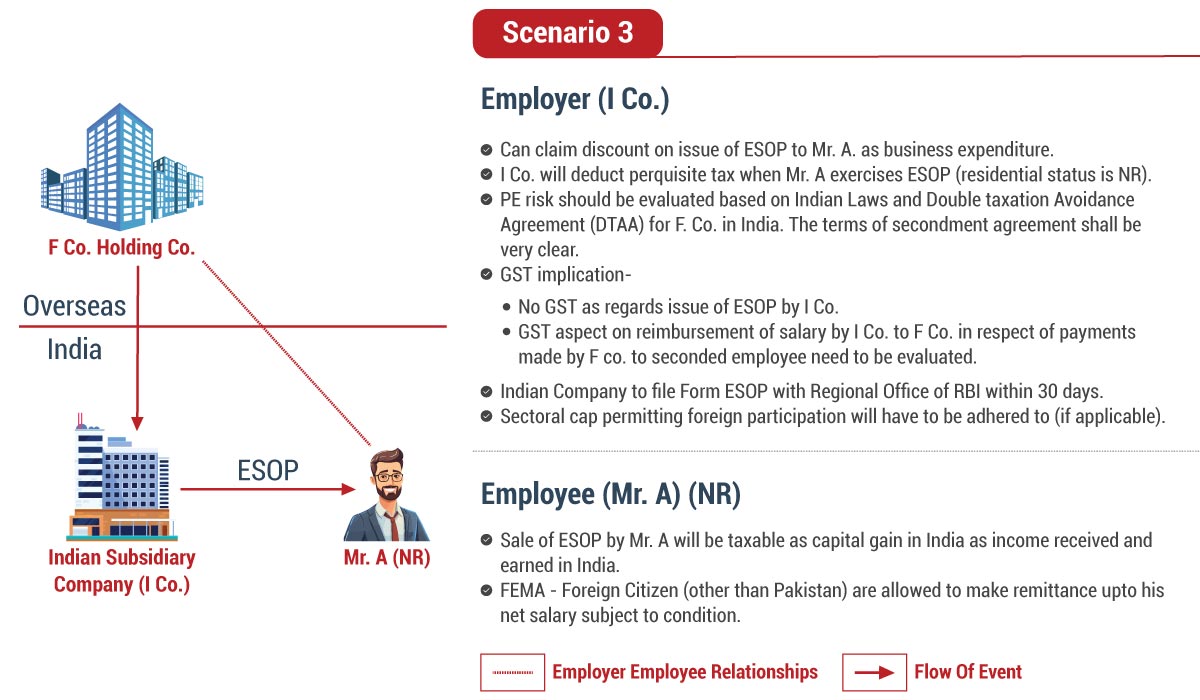

Scenario III: Tax implication when an employee of (F. Co. is seconded to I. Co. and he receives ESOPs of an I Co.

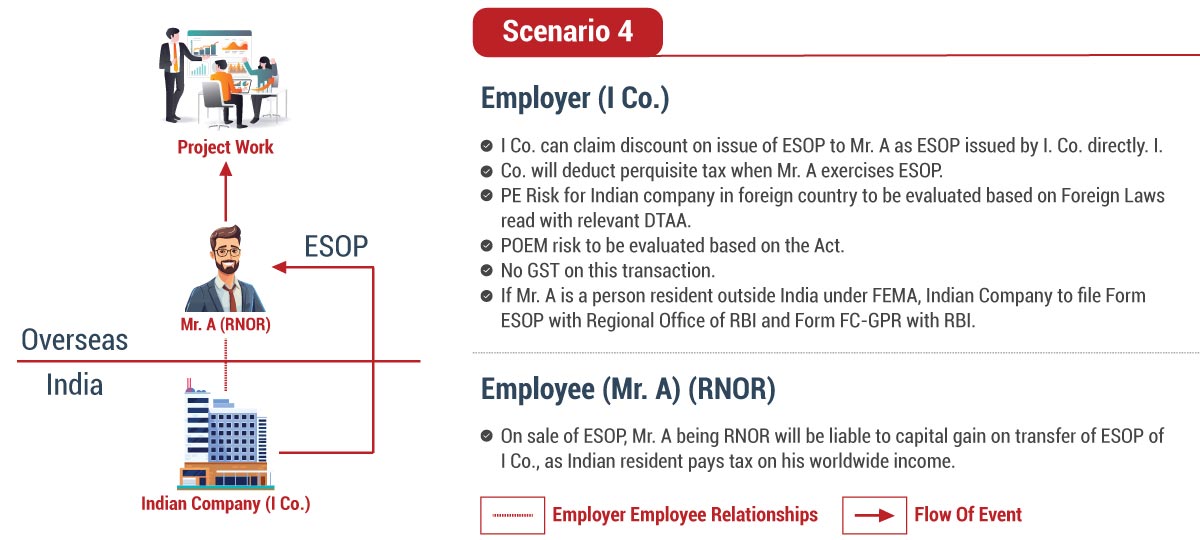

Scenario IV: Employee of I. Co. goes out of India for an independent work project and receives ESOP of I. Co. outside India

Double Taxation Avoidance Agreements (DTAA)

If the overseas/foreign company has a presence in a country with which India has a DTAA, the provisions of the DTAA may impact the tax treatment of ESOPs. The purpose of DTAA is to eliminate or reduce double taxation on income arising in one country and received by residents of another country. It is important for both the overseas/foreign company and the employee to comply with the applicable laws, regulations, and tax obligations.

Employee Migrates to Another Country by Way of Deputation

In the context of multinational corporations with a global footprint, employees may undergo international assignments, relocating to work in various countries for secondment or deputation purposes. There could be a situation where the country of service at the time ESOP was granted is different from the country where the vesting and exercise of ESOP takes place. This could give rise to conflict for apportionment of taxing rights between the countries. The first step is to determine the residential status of an employee for a given financial year. In case the employees become residents of more than one country in a particular year, then the ultimate residential status needs to be examined by applying a tie-breaker test as per the tax treaty. ESOP perquisites are taxable in a country based on the number of days services are rendered in the country. However, we need to analyze the facts of each case to determine the tax liability under ESOP.

Reporting in Income Tax Return Form

If an Indian resident employee is granted shares in a foreign parent company, they are considered the owner of the corresponding foreign assets. It is imperative for the employee to declare this ownership in their Indian tax return (ITR). As per Income-tax Act, 1961, it is mandatory for every taxpayer holding foreign stocks or earning income from a foreign company to file an ITR in India, regardless of the basic exemption limit.

In ITR, the taxpayer must disclose all foreign investments with overseas entities in Schedule FA of either ITR 2 or ITR 3, depending on the income. This includes providing details of foreign company shares in Appendix FA-Details of foreign assets. Failure to make such disclosures may result in the imposition of penal actions.

Currency Exchange

Foreign companies may issue stock options in a currency different from the employee’s home currency. The fluctuation in currency exchange rates can affect not only the options’ value but also the exercise price and potential gains or losses during the exercise and sale of shares. Employees should assess the potential impact of currency fluctuations on the value of their stock options (ESOPs).

Conclusion

As businesses continue to globalize and expand their operations across borders, multinational companies issue ESOPs to employees in various countries. Taxation of ESOPs issued by foreign companies can be complex. The tax treatment depends on the laws of the employee’s home country, where the company is based, and any tax treaties between the two countries. Employees may face the prospect of dual taxation, wherein they are liable to be taxed in both their home country and foreign country, potentially resulting in double taxation. However, it is advisable to thoroughly consider the tax implications of cross-border taxation before choosing to opt for ESOPs.

While evaluating an investment in foreign stocks or overseas entities, it is essential to go beyond evaluating potential returns based solely on income, capital appreciation, or fluctuation of foreign exchange rates. Consideration should also be given to the after-tax yield from such investment.

Why Choose InCorp Advisory?

Choose Incorp Advisory for expert guidance on cross-border ESOP tax treatment. Our team specializes in handling the complexities of Indian corporates, foreign exchange and taxation laws of different countries, ensuring optimized tax solutions for MNCs and investors. To learn more about our Taxation services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Share

Share