Optimal Timing for Startups Founders to Create ESOP Pool

Optimal Timing for Startups Founders to Create ESOP Pool

Timing of rolling out ESOP is crucial, as it sets the stage to maximize the benefits of ESOP and can be effectively used to attract and retain top talent and meet investor expectations.

- Last Updated

Introduction

In the ever-evolving landscape of startup funding, there’s a growing trend where angel and seed-stage investors or venture capitalists encourage founders to establish Employee Stock Option Plans (ESOPs) before investing in them. This shift in investor demand has given rise to a common challenge for the founders to agree to create ESOP pools during fundraising. However, practically, the actual implementation, creation, and granting of ESOPs are often postponed until the next funding round. This delay was driven by both a desire of the founder to prioritize business expansion and the myth about the ESOP implementation process being complex. This becomes a prerequisite for subsequent funding. In our latest blog, we demystify the perceived complexity of setting up ESOPs by providing the right time to set up ESOP, points to be kept in mind while structuring ESOP, and the capital to be kept aside for the ESOP pool and the right stage to implement ESOP.

Startup Unicorns 2021: Size of ESOP Pools (2021 data)

| Company | ESOP Pool Size (in Crores) | Valuation (B$) | Valuation (in Crores) | % of ESOP pool |

|---|---|---|---|---|

| Flipkart | 17,000 | 37.6 | 282000 | 6.03% |

| Oyo | 7569 | 10 | 75000 | 10.09% |

| Zomato | 5639 | 13 | 97500 | 5.78% |

| Paytm | 4571 | 11 | 82500 | 5.54% |

| Nykaa | 4280 | 12.53 | 93975 | 4.55% |

| PolicyBazaar | 3836 | 6 | 45000 | 8.52% |

| CRED | 3750 | 4.01 | 30075 | 12.47% |

| Byju’s | 3092 | 18 | 135000 | 2.29% |

| Ola | 3000 | 7.3 | 54750 | 5.48% |

| Unacademy | 3000 | 3.44 | 25800 | 11.63% |

| Swiggy | 1589 | 5.5 | 41250 | 3.85% |

| PharmEasy | 592 | 6 | 45000 | 1.32% |

| Sharechat | 513 | 1.95 | 14625 | 3.51% |

| Upgrad | 427 | 1.2 | 9000 | 4.74% |

| Spinny | 336 | 0.8 | 6000 | 5.60% |

| OfBusiness | 282 | 0.8 | 6000 | 4.70% |

*Reference – https://indiatech.substack.com/

When to Structure ESOP in Startups?

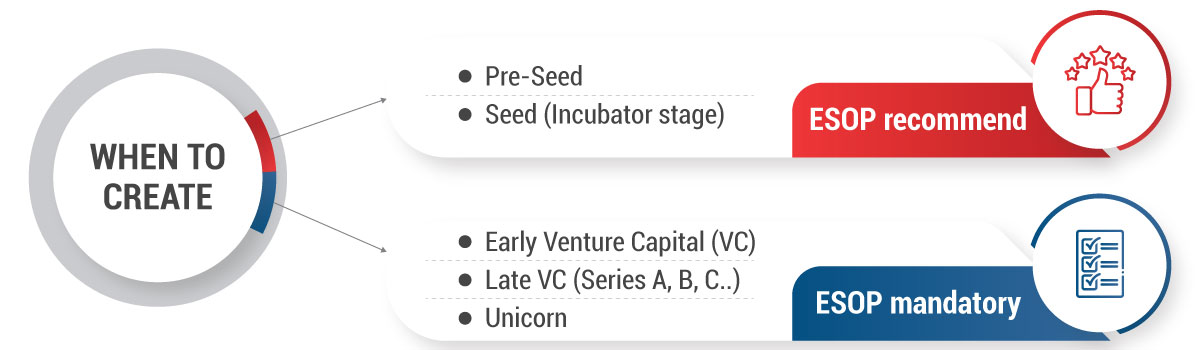

Deciding when to introduce ESOP and establish the pool is a choice founders make. Determining the correct stage involves considering several factors. While there is no one-size ESOP plan, a common recommendation is to implement ESOPs between pre-seed and early-stage venture capital stages. While this is not mandatory in the pre-seed stage, it’s prudent to evaluate the equity stock allocation for initial recruits.

Seed rounds can be concluded without ESOP setups, benefiting from shared dilution with seed investors. However, as external funding increases with angel investors and larger firms, the need for an ESOP becomes a necessity.

As the start-up grows, establishing ESOP becomes necessary upon the occurrence of first substantial Venture Capital round, as it aligns with investors’ expectation. This step is critical in meeting investor expectations and becomes a benchmark for determining the size of options to be awarded to new hires. Listed below are steps to help startups understand the right stage to introduce the subject to business dynamics.

Accurate Time for Founders to Create ESOP Pool

* ESOP is mandatory as it is required for investor satisfaction and helps them from dilution of their stake on account of ESOP

Things to be Noted While Structuring ESOP for a Startups

Once you decide the stage at which you want to introduce ESOP, an effective implementation of well-designed ESOPs will increase the company’s productivity, rates of success, and lower employee turnover rates due to the instilled sense of ownership among the workforce. Crafting a successful ESOP for startups involves careful consideration of the following key factors to ensure efficiency:

Related Read: A Complete Guide to Foreign ESOPs for Indian Employees

- Profit and tax optimization

- Probable impact on EBITDA

- Performance based vesting schedule

- Accurate valuation method

- Tailored ESOP based on individual and company’s metrics

- Legal and regulatory compliance

- Strategic exit planning

The above points collectively contribute to the creation of an ESOP plan that not only motivates employees but also aligns with the startup’s unique goals and circumstances.

How Much Equity Should Startups Allocate in ESOP

Creating and managing the ESOP pool can be challenging for founders, as they need to consider various factors and trade-offs. Below are some points to help founders navigate this process:

Understand the Dilution

To offer ESOPs, founders must dilute a portion of their equity and form an ESOP pool. ESOPs are distributed from this pool to employees. In subsequent fundraising rounds, more dilution may be required to replenish the pool. The size of the ESOP pool is inversely related to the firm’s stage of growth; as the company grows, the size of the ESOP pool shrinks.

Dilution and Retention Trade-off

Founders should be aware of the dilution and retention trade-off, which means that they need to balance the amount of equity they give away to employees and investors, and the amount of equity they retain for themselves. Diluting too much equity can reduce the founders’ control and motivation while diluting too little equity can limit the startup’s ability to attract and retain talent and capital.

Startup Framework for Calculating Size of a Startup’s ESOP Pool Size as per Common Industry Practices

| ESOP Pool should be | < 5% | < 5-10% | < 10-15% |

|---|---|---|---|

| Hiring needs (Based on Founder’s DNA) | Administrative or back-office team for mere operations | Business development, sales/marketing team for scaling up | Engineering, R&D or technical team core to business |

| Based on the stage of startup | Late VC or unicorn Stage | Early VC stage | Pre-seed or Seed Stage |

Points to be Noted While Deciding the ESOP Pool Size

- There is no one-size-fits-all formula for determining the ESOP pool size.

- The ESOP pool size depends on various factors such as the number and background of the founders, the industry and market conditions, the geographic focus, and the hiring plans and requirements of the startup.

- The founder should consider the type of role, the skill level, and the stage at which startup is, while deciding how much equity to offer to each employee.

- Safeguarding against over-dilution, as this could potentially diminish the company’s attractiveness to investors and weaken the founders’ negotiating power in future fundraising rounds.

- Mitigating the risk of operational mismanagement that may arise if ESOP holders form a cohesive group and disrupt company management.

- Identifying employees who have exercised a substantial amount of ESOPs and have subsequently left the startup may get tricky.

More than just Monetary Incentives for Employees

ESOP should represent a share in the company’s vision and future growth. Therefore, employees should be well-informed about the business goals, the key performance indicators, and the expected value of their options at the end of the vesting period. They should also have a realistic estimate of the potential wealth that can be generated when they exercise their options and sell their shares. This way, employees can appreciate the value proposition of ESOPs and align themselves with the organizational strategy and direction.

Using the ESOP Pool to Support Growth Strategy

Employee ownership and shared capitalism are relatively new concepts in India, but they have a significant impact on the startup ecosystem. ESOP shares offer various benefits to both founders and employees. For founders, they serve as a tool to retain talent and for employees, they act as a wealth creator. The advantage of ESOPs is that they enable employees to have a stake in the company, which will help in building loyalty and motivation.

Why is ESOP Valuation Necessary?

ESOP valuation is critical for startups under Indian Income Tax Law and mandates valuation from SEBI Registered (Cat-I) Merchant Bankers for accuracy. ESOP valuation is necessary for the following:

Financial Impact and Accounting Procedure

Directly influences EPS calculation, dividend declaration, MAT payment, and senior management remuneration determination. Startups must expense ESOPs diligently in their P&L statements following Ind-AS guidelines.

Equitable Value Determination

It ensures fair valuation and addresses tax implications effectively. It is essential to navigate the process effectively and mitigate potential financial risks.

Conclusion

As a startup grows and progresses beyond Series B and C rounds of funding, they need not grow ESOP pool (in terms of percentage of post-money valuation). At this stage, startups are perceived to be less risky for the employees. Therefore, the startup can allocate fewer options to new hires and need not grow the option pool so significantly—even if they are scaling. ESOP pool plays a crucial role in the startup ecosystem. Given their impact on dilution, negotiations around them can be a point of contention during negotiation. It’s crucial for both founders and investors to gain a comprehensive understanding of the implications of ESOP pool to come to common ground. An ESOP pool can help attract and retain talented employees and help align their interests with the company’s growth.

Why Choose InCorp?

InCorp will assist you in the following services:

- Assistance in structuring the ESOP as per the requirement

- Providing advisory services on regulation and taxation to ensure compliance and optimal structuring

- Assistance in preparing necessary documentation and administration required for ESOP

To learn more about our Taxation services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions About ESOPs

ESOPs appear in the cap table as separately under the total number of shares issued and are divided into allocated and unallocated.

In such event, ESOPs can be exercised, which could offer substantial monetary advantages to employees.

Yes, but increasing the ESOP Pool usually requires approval from the board and may dilute existing shareholders’ equity.

Usually, ESOPs are for employees, but some companies offer comparable advantages to contractors or advisors through different methods.

When two companies merge or one buys another, ESOPs can change into the stock of the buyer, be paid in cash, or be dealt with according to the contract.

Share

Share