FPI Registration and Compliance in India

FPI Registration and Compliance in India

Complete guide to Foreign Portfolio Investment (FPI) in India: Eligibility, taxation, regulations, benefits, and risks.

- Last Updated

Foreign investors can invest in India through Foreign Portfolio Investment (FPI), as well as other options such as Foreign Direct Investment (FDI). They can invest in debt, equities, and other securities such as listed shares, REITs, treasury bills, exchange-traded derivatives, or commercial papers. As of October 2024, India is a significant financial market with total investments worth INR 1,79,443 crores, thanks to the push by India’s inclusion in JP Morgan’s Emerging Market Government Bond Indices.

Due to the uncertain global economy fueled by post-COVID pandemic scenes, FPIs are cautious due to high equity valuations and geopolitical concerns. However, FPIs find India a strong emerging market for long-term investments compared to its global and regional counterparts. In this blog, we will take you through the eligibility criteria, regulatory framework, and tax implications of Foreign Portfolio Investment in India.

What is Foreign Portfolio Investment in India?

When countries, institutions, or individual investors from a country invest in the financial markets or assets available in a foreign nation for a short term, they are termed as Foreign Portfolio Investors (FPI). These are passive investments that allow them to diversify in foreign markets.

To invest in Indian markets, Foreign Portfolio Investors (FPIs) must register with SEBI via a custodian bank. The SEBI (FPI) Regulations, 2019 govern Foreign Portfolio Investment in India — wherein it details the eligibility, compliance, and reporting requirements.

FPI in India are classified into two categories:

- Category I includes low-risk investors like sovereign wealth funds, pension funds, foreign government entities, or other entities regulated by their nation’s government or established under an Act.

- Category II includes all other entities that don’t fall into Category I FPI like corporations, trusts, partnership firms, and individual investors. This category of Foreign Portfolio Investment in India carries huge risks.

Permitted instruments for Foreign Portfolio Investment in India

Foreign Portfolio Investment in India can be made in the following securities:

- Listed shares on the stock exchange

- Mutual funds (both equity and debt oriented)

- Government securities

- Bonds

- REITs, InvITs, and Category III Alternative Investment Funds

- Exchange traded derivatives

- Listed/unlisted Non-convertible debentures (NCDs)

- Security Receipts (SRs) and Pass Through Certificates (PTCs) issued by Asset Reconstruction Companies

Impact of Foreign Portfolio Investment on Indian financial markets

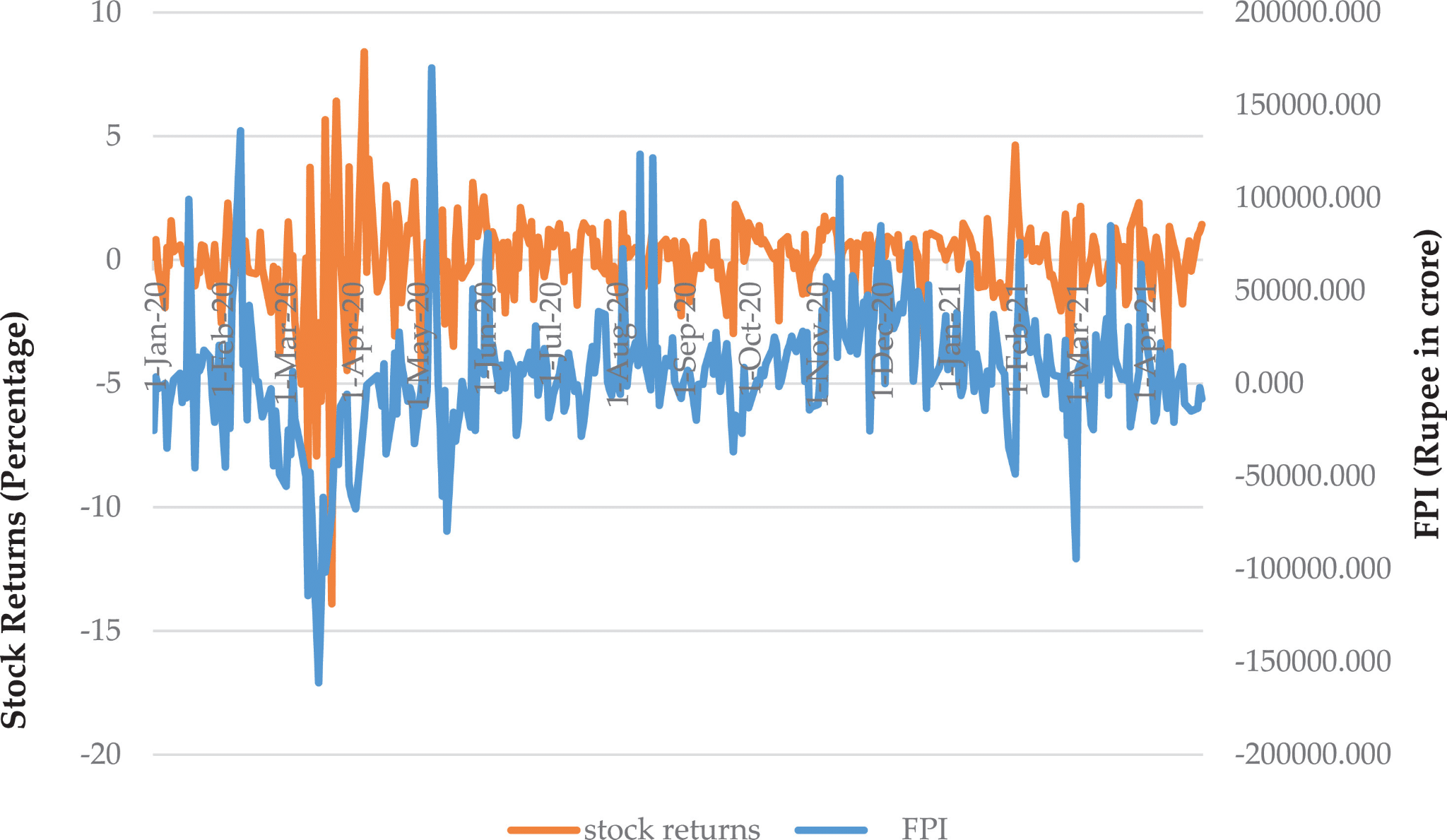

Foreign portfolio investment in India’s capital markets positively correlates with stock returns, as it helps distribute risk between domestic and foreign investors.

Image Source: ScienceDirect showcasing movements in stock price returns and Foreign Portfolio flows in India.

As you can see in the graph, the stock market returns are in tandem with foreign portfolio investment in India. One usually observes a damaging effect when FPI in India withdraws capital from Indian financial markets. However, thanks to increased retail participation post COVID-19, the Indian stock market did not witness a major movement when FPI in India withdrew funds.

Recently, in August 2024, the FPI in India withdrew money from the Indian equity market and invested in debt markets. However, in the first 15 days of August 2024, FPI in India stood as net sellers in the Indian stock markets. In July 2024, the FPI in India infused around Rs.32,000 crores in the equity market. It was thus observed that the August 2024 sell-off did not disturb the stock markets much, compared to previous occurrences. This is due to strong domestic demand and a huge investment in July 2024.

2024 Snapshot — Key Trends in Foreign Portfolio Investment in India

FPI in India is withdrawing capital from equity markets, primarily due to the unwinding of the Yen carry trade in August 2024, primarily impacting the financial services sector. Other affected sectors due to this sell-off include automobiles, metals, and construction. However, FPI in India continues to invest in FMCG, healthcare, and other defensive stocks. Thus, one expects a sector rotation after a major bull rally in Indian markets as of 2024, especially after US FED rate cuts.

FDI vs FPI in India — how are they different?

| Category | Foreign Portfolio Investment in India | Foreign Direct Investment in India |

| Nature of Investment | Investments are made to earn quick returns. | Investments are made to acquire control over the company. |

| Investment Horizon | Short-term | Long-term |

| Regulatory Framework | Governed by SEBI to protect artificial price movements in the market. | Subject to DPIIT (Department for Promotion of Industry and Internal Trade) guidelines. The goal is to put sectoral caps and manage control. |

| Risk Exposure | Subject to high volatility | Comparatively less volatile |

| Liquidity | High liquidity | Low liquidity |

| Sensitivity | Funds are withdrawn due to unfavorable macroeconomic factors. | Funds are withdrawn when the business becomes unprofitable. |

How to get started with Foreign Portfolio Investment in India?

To improve the ease of doing business in India, SEBI streamlined the registration process in 2023 for Foreign Portfolio Investment in India. These changes favor Foreign Portfolio Investment in India, wherein they streamlined the registration process and simplified the reporting requirements.

View any forthcoming changes on the SEBI website for FPI in India — in their News Listing section.

Related Read: FDI in India: Legal Framework and Impact on Growth

Based on the latest regulatory information as of 2024, we have simplified how FPI in India can get registered in a 7-step process:

1. Identify Your FPI Category

Based on the definition of Foreign Portfolio Investment in India categories, determine whether the Foreign Portfolio Investor (FPI) falls under Category I or II.

2. Complete the Common Application Form (CAF)

Submit the CAF form along with certified supporting documents to the Designated Depository Participants (DDP) for registration. You will receive a Unique Client Code (UCC).

3. Submit KYC Documents

Submit scanned copies of KYC documents. It should include proof of existence (e.g., Certificate of Incorporation, financial statements, Tax Identification Number). Also, provide a declaration of compliance with anti-money laundering laws.

4. Obtain a PAN

Once the CAF and KYC get approved, the DDP will forward the FPI application to the income tax department. Now, FPIs must process the documents to get a Permanent Account Number (PAN) in India for tax purposes.

5. Submit Physical Documents for Trading Permission

Although registration gets approved with scanned documents, for trading, original physical documents need to be submitted. The DDP further verifies for authenticity and compliance for Foreign Portfolio Investment in India.

6. Use Digital Signatures and SWIFT Mechanism

FPI in India can use digital signatures for application submission. For faster verification, they may also use the SWIFT mechanism. Here, SEBI-authorized banks send digital and original documents to the DDPs. Now, the banks are responsible for checking the authenticity of the submissions.

7. Declare Investor Group Details

FPIs must disclose details of other FPIs in the same investor group. This includes FPIs across Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs) that have common ownership of more than 50% or have common control.

Foreign Portfolio Investors must now declare a unique investor group ID. They also need to declare the Ultimate Beneficial Owners (UBOs) based on ownership and control to the local custodian.

Note: The holdings of an FPI in the Indian company must not exceed 10% of the total paid-up capital on a total basis.

Regulatory Framework Governing FPI in India

Since the Hindenburg fiasco, SEBI has introduced cautionary measures to prevent stock market manipulation by foreign portfolio investors in India. This is especially amid growing interest in FPI in India with the below measures:

- Legal Entity Identifier (LEI) Mandate: SEBI now requires non-individual FPIs to provide a 20-character LEI code, necessary for entities involved in global financial markets. If the LEI is expired or invalid, the Foreign Portfolio Investment accounts in India will be blocked by DDPs.

- Defined Categories for Additional Disclosures: SEBI has specified categories of FPI in India that must comply with extra disclosures as follows:

- FPIs hold 50% of their total equity investments in a single Indian corporation or group.

- FPIs with more than INR 25,000 crores in equity stakes in India, individually or with their investor group.

- Standard Operating Procedures (SOPs): SEBI has introduced SOPs for specific Foreign Portfolio Investment in India categories to clarify compliance requirements.

- Structural Improvements and Market Access: SEBI has streamlined timelines and processes for Foreign Portfolio Investment in India and allowed Direct Market Access to Exchange Traded Commodity Derivatives. FPI in India can now trade directly via brokers’ platforms, improving order execution speed without requiring manual intervention.

Types of Investors for FPI in India

| Foreign Institutional Investors | Sovereign Wealth Funds | Family Offic6es | |

|---|---|---|---|

| Who are they? | A foreign entity or individual investing in the financial markets of another country. | Investment fund owned by the government. It is a type of FII. | An unlisted company is established to manage the wealth of a particular family. |

| Restrictions in India | Have to register with SEBI and invest through PIS (Portfolio Investment Scheme) | Cannot engage in commercial activity in India. | Comply with the FME regulations for foreign investment. |

| Legal Form | Individuals, companies, trusts, LLP, or any other registered foreign entity. | A separate legal entity established under the law. | Company, Trust, or LLP |

Taxation of Foreign Portfolio Investment in India

The investments held by FPI in India are ‘Capital Assets’ for Income Tax purposes. Any profit earned from such investments will be subject to capital gains tax. Income Tax Laws classify gain/loss from capital assets based on the holding period.

Here is the taxation of the Foreign Portfolio Investments in India:

| Asset Class | Period of Holding | Classification | Tax Rate |

|---|---|---|---|

| Listed Equity Investments, units of REITs/InVITs | 12 months or less | Short-term | 20% Tax + Cess |

| Listed Equity Investments, units of REITs/InVITs | More than 12 months | Long-term | 12.5% rax above Rs. 1.25 lakhs |

| Unlisted Bond/Debenture | 24 months or less | Short-term | 30% |

The above tax rates are effective from July 23, 2024. For all the other asset classes, the holding period is 24 months for classification. Capital assets having a holding period of 24 months or less are short-term capital assets. Otherwise, they are long-term capital assets.

The corporate tax rate is 35%, which was reduced from 40%. This new rate is applicable from FY 2024-25 to boost Foreign Portfolio Investment in India. The FPI in India enjoys tax exemption on certain investments. For example, a Sovereign Wealth Fund or a Notified Pension Fund enjoys tax exemptions. This is for investing in the infrastructure sector. The income in the form of interest, dividend, and capital gains enjoy exemptions. However, tax exemptions are for investments that will be done up to March 31, 2025.

3 Key Benefits of Investing via Foreign Portfolio Investment in India

Here are some benefits of investing through the FPI route for foreign investors:

Related Read: India-Mauritius Amend Tax Treaty, Introduces PPT

- High Liquidity: FPIs invest in a company and do not buy a stake for ownership. This makes it highly liquid.

- Safe Withdrawal: FPIs generally withdraw their investments when the economy is uncertain.

- Tax Exemptions: FPI in India enjoy tax exemptions if a tax treaty is signed. India has tax treaties with various countries.

3 Key Risks Associated with FPI in India

Foreign Portfolio Investment in India has to go through certain risks as well:

- Volatility: Since FPIs invest in the short term, investments are prone to market fluctuations.

- Political Instability: FPIs are directly affected by the changes in government and regulatory framework.

- Exchange Rate: FPI in India could experience big movements in their portfolio due to currency appreciation and depreciation.

Future Outlook for FPI in India — #bullish

The registration process for Foreign Portfolio Investment in India is already streamlined, making the country an attractive destination for foreign investments due to its relatively stable currency. The Indian Rupee was the least volatile among emerging economies, depreciating by only 3% against the US dollar in FY 2024.

However, Budget 2024 brought some tax-related setbacks, such as the removal of indexation on capital asset sales and no extension of the tax exemption for Sovereign Wealth Funds beyond March 31, 2025.

Despite this, the government’s push for increased Foreign Portfolio Investment in India suggests a more favorable landscape for FPIs in the future. For example, the government liberalized FDI regulations in satellite manufacturing and operations which are considered to be a sensitive sector from a national security perspective.

Why Choose InCorp Global?

We have expertise in advising and structuring under the FPI route. Our team specializes in the computation of tax liability in income earned on securities considering provisions of the Indian Income Tax Act and the treaty, along with the applicability of multi-lateral instruments. Our services also include:

- Coordination with the custodian for obtaining information on periodic transactions and maintaining necessary records of the same.

- Issuance of certificate for repatriation of funds out of India as per the requirements of the Income Tax Act and RBI guidelines.

- Preparing and filing Annual Income Tax Return

- Appearing before the tax authorities in any proceedings.

To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

InCorp Global

Frequently Asked Questions on FPI in India

FPI refers to investments by foreign entities in Indian stocks, bonds, and other securities without direct control over companies.

Eligible investors include foreign institutional investors, sovereign wealth funds, pension funds, insurance companies, and other regulated foreign entities.

Investors must comply with SEBI regulations, provide KYC documentation, and be regulated in their home country to register as FPIs.

FPIs are classified as Category I, II, or III based on risk profile, investment restrictions, and regulatory oversight. Each category has specific investment limits and compliance norms.

FPIs must maintain registration, submit KYC and transaction reports, comply with SEBI regulations, and follow tax and reporting norms.

Share

Share