Insolvency vs Bankruptcy: Difference and Legal Framework

Insolvency vs Bankruptcy: Difference and Legal Framework

Exploring Insolvency and Bankruptcy Code 2016 for corporate and non-corporate persons: A complete overview of the legal framework

- Last Updated

The term ‘bankrupt’ is derived from Italian expression ‘banca rotta’, which means ‘broken bench’. Insolvency and bankruptcy are closely related terms often used interchangeably in discussions about debt. Insolvency is a condition that applies to both individuals and organizations. If not resolved, insolvency may evolve into bankruptcy for individuals and liquidation for corporations. Let us delve into the distinction between these commonly conflated terms, which are closely related yet subtly different.

What is Insolvency?

Insolvency refers to a situation where assets are insufficient to meet the liabilities. In simple terms, an individual or entity becomes insolvent when unable to pay back lenders on time. In such cases, there are two options – resolution and recovery/liquidation.

What is Bankruptcy?

Bankruptcy is a legal process that occurs when an individual declares inability to pay back debts to creditors. In simple terms, if a person or entity is unable to pay back even after attempting resolution, they are termed as bankrupt.

Bankruptcy is defined under Insolvency and Bankruptcy Code, 2016 (Code) which states that ‘bankruptcy’ means the state of being bankrupt.

What does bankrupt mean?

As per Section 79 (3) of the Insolvency and Bankruptcy Code, 2016 ‘bankrupt’ means as below:

(a) A debtor who has been adjudged as bankrupt by a bankruptcy order under Section 126.

(b) Each of the partners of a firm, where a bankruptcy order under Section 126 has been made against a firm.

(c) Any person adjudged as an undischarged insolvent.

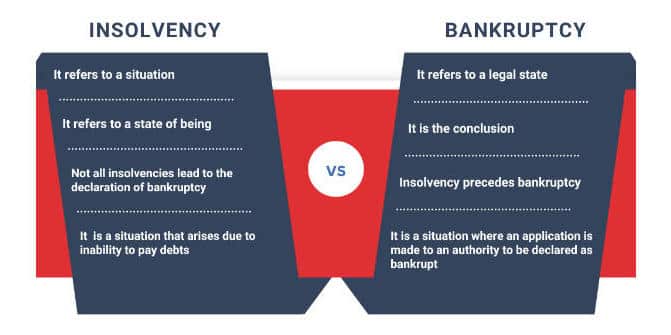

Difference Between Insolvency and Bankruptcy

As mentioned above, it is evident that insolvency is a state and bankruptcy is a conclusion. A bankrupt individual is someone who has reached a conclusive state of insolvency, but not all instances of insolvency necessarily result in bankruptcy.

The Insolvency and Bankruptcy Code, 2016 has established a structured framework wherein the Debt Recovery Tribunal adjudicates for individual and partnership firms while the National Company Law Tribunal does the same for companies and limited liability partnerships.

Let us explore how Insolvency and Bankruptcy process is dealt under Insolvency and Bankruptcy Code, 2016

Legal Framework for Insolvency and Bankruptcy

Insights from the Insolvency and Bankruptcy Code, 2016

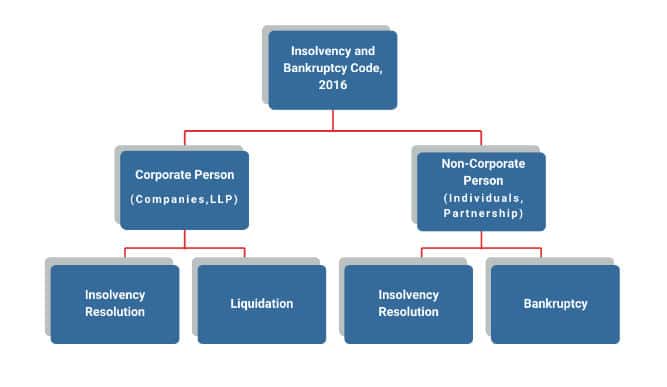

Insolvency Resolution and Liquidation for Corporate Persons

Part II of the Code covers the conduct of corporate resolution and liquidation process of the corporate person. Where any corporate debtor commits default, the corporate insolvency resolution process can be initiated by filing an application before the Adjudicating Authority in the matter as outlined in chapter II of part II of the code.

Applicability: The process of insolvency of corporate debtors under the code applies where the minimum default amount is INR 1 crore. Initially, the minimum amount of default required for initiating CIRP was INR 1 lakh. However, the government vide notification dated March 24, 2020, increased the same to INR 1 crore.

The primary objective of the Code is revival of the company from its state of insolvency and if the said object is not accomplished successfully then the corporate debtor goes into liquidation by a formal order of the Adjudicating Authority.

Insolvency Resolution and Bankruptcy for Non-corporate Persons

Part III of Code envisages two distinct processes for insolvency resolution and bankruptcy for individual and partnership firm:

- Fresh Start Process

- Insolvency Resolution Process

The Code classifies individuals in three categories as outlined below:

- Personal guarantors to corporate debtors

- Partnership firms and proprietorship firms

- Other individuals

Part III of the Code is applicable to matters concerning fresh start, insolvency, and bankruptcy of individuals and partnership firms, provided the amount of the default is not less than one thousand rupees. When the attempts to provide an individual debtor either a fresh start or an earned start fail, the last recourse left is an application for bankruptcy and the said application may be made by a creditor either individually or jointly with other creditors, or by a debtor, to the Adjudicating Authority. Insolvency is a precondition, direct application for bankruptcy is not allowed. In the final stage of the bankruptcy process, the bankrupt is released from all the bankruptcy debt.

The Insolvency Resolution Process is addressed in chapter III of part III of the Code vide notification dated November 15, 2019. The provisions relating to the insolvency resolution process for personal guarantors to corporate debtors came into force on December 01, 2019. Fresh Start Process is addressed in chapter II of part III of the Code, which is yet to be enforced. As a result, individuals and partnerships continue to be governed under the Presidency Towns Insolvency Act 1909 and Provincial Insolvency Act 1920 until the Fresh Start Process is enforced.

Conclusion

An insolvent need not be bankrupt whereas a bankrupt will always be an insolvent. There are chances that an insolvent can be saved from becoming bankrupt if dealt with in due course of time under the provisions of Insolvency and Bankruptcy Code, 2016.

Why Choose InCorp?

At InCorp, we possess the expertise and skills to guide you through every step of the Resolution Process. We have worked with both corporate and non-corporate entities, experienced Insolvency Professionals and their team. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Frequently Asked Questions

Who is the personal guarantor under the provisions of the Code?

As per Section 5(22) of the Code, a personal guarantor is an individual who is the surety in a contract of guarantee to a corporate debtor.

Who can apply for the insolvency resolution process of personal guarantors to corporate debtors?

A debtor who commits a default or a creditor can apply to the Adjudicating Authority to initiate the insolvency resolution process, either directly or through Resolution Professional.

What are the eligibility criteria for initiation of insolvency resolution process by a debtor?

The eligibility criteria for initiation of insolvency resolution process by a debtor under Section 94 of the Code are as under:

- Not an undischarged bankrupt

- Not undergoing a fresh start process

- Not undergoing an insolvency resolution process

- Not undergoing bankruptcy process

- No previous insolvency resolution process was admitted in the 12 months preceding the application.

What are the eligibility criteria for initiation of insolvency resolution process by a creditor?

The eligibility criteria for initiation of insolvency resolution process by a creditor under Section 95 of the Code are as under:

- Service of demand notice to the debtor

- Debtor’s failure to pay the debt within a period of fourteen days of the service of the notice of demand

Who adjudicates for personal guarantors to corporate debtors?

As per Section 60 of the Code, the Adjudicating Authority for insolvency resolution and liquidation for corporate persons including corporate debtors and personal guarantors thereof shall be the National Company Law Tribunal having territorial jurisdiction over the place where the registered office of the corporate person is located.

What is interim moratorium?

As per Section 96 of the Code, the interim moratorium takes effect on the date of the application. The impact of the interim moratorium under Section 96 of the Code is that a legal action or proceeding pending in respect of any debt is deemed to have been stayed and the creditors or the debtors shall not initiate any legal action or proceedings in respect of any debt. Interim moratorium ceases upon admission of the application by the Adjudicating Authority under Section 100 of the Code, and the moratorium under Section 101 of the Code then commences.

As per Section 5(22) of the Code, a personal guarantor is an individual who is the surety in a contract of guarantee to a corporate debtor.

A debtor who commits a default or a creditor can apply to the Adjudicating Authority to initiate the insolvency resolution process, either directly or through Resolution Professional.

The eligibility criteria for initiation of insolvency resolution process by a debtor under Section 94 of the Code are as under:

- Not an undischarged bankrupt

- Not undergoing a fresh start process

- Not undergoing an insolvency resolution process

- Not undergoing bankruptcy process

- No previous insolvency resolution process was admitted in the 12 months preceding the application.

The eligibility criteria for initiation of insolvency resolution process by a creditor under Section 95 of the Code are as under:

- Service of demand notice to the debtor

- Debtor’s failure to pay the debt within a period of fourteen days of the service of the notice of demand

As per Section 60 of the Code, the Adjudicating Authority for insolvency resolution and liquidation for corporate persons including corporate debtors and personal guarantors thereof shall be the National Company Law Tribunal having territorial jurisdiction over the place where the registered office of the corporate person is located.

As per Section 96 of the Code, the interim moratorium takes effect on the date of the application. The impact of the interim moratorium under Section 96 of the Code is that a legal action or proceeding pending in respect of any debt is deemed to have been stayed and the creditors or the debtors shall not initiate any legal action or proceedings in respect of any debt. Interim moratorium ceases upon admission of the application by the Adjudicating Authority under Section 100 of the Code, and the moratorium under Section 101 of the Code then commences.

Share

Share