Finance Act 2024: Key Changes in Reopening Tax Cases

Finance Act 2024: Key Changes in Reopening Tax Cases

Finance Act (No.2) 2024: Interplay of notice under Sections 148 and 148A, applicable timelines and other amendments introduced under the new law

- Last Updated

Building trust and faith in the taxation system is crucial, and a significant step to achieve this was introduced in the Finance Act (No. 2) 2024. As per the recent amendments, the Income Tax authorities have reduced the time limit for reopening cases, effective from September 1, 2024. This article provides an in-depth analysis of the timelines introduced under the new law.

Provisions in relation to reassessment had undergone a complete change when the old law (provisions existing up to March 31, 2021) was substituted by the new law in the Finance Act 2021. From April 1, 2021, reopening was allowed for 11 years from the end of the financial year (10 years from the end of Assessment Years) where escaped income was more than 50 lakhs.

Similarly, when the escaped income was less than 50 lakhs, reopening was not permitted beyond four years from the end of the financial year. One of the saving clauses ensured that, if a case cannot be reopened under the old law, which was in effect before April 1, 2021, it cannot be reopened under the new law either, which means the amendments were applied prospectively.

Interplay of Notice under Sections 148 and 148A of the Income Tax Act, 1961 (ITA)

The shortened timelines apply to both the issuance of notices under Sections 148A and 148 of the ITA. Therefore, it is crucial to understand the circumstances under which it is mandatory to issue a notice under Section 148A and when tax authorities can proceed directly with issuing a notice under Section 148.

The requirement to issue a notice under Section 148A of ITA before issuing a notice under Section 148 became applicable from April 1, 2021. However, in cases involving searches, seized assets, or seized books of accounts, the requirement to issue a notice under Section 148A was waived, allowing the officer to directly issue a notice under Section 148 without following the procedures outlined in Section 148A.

According to the recent amendments in the Finance Act (No. 2) 2024, a notice under Section 148A need not be issued when a case is reopened based on information received from faceless authorities.

Reduced Timelines

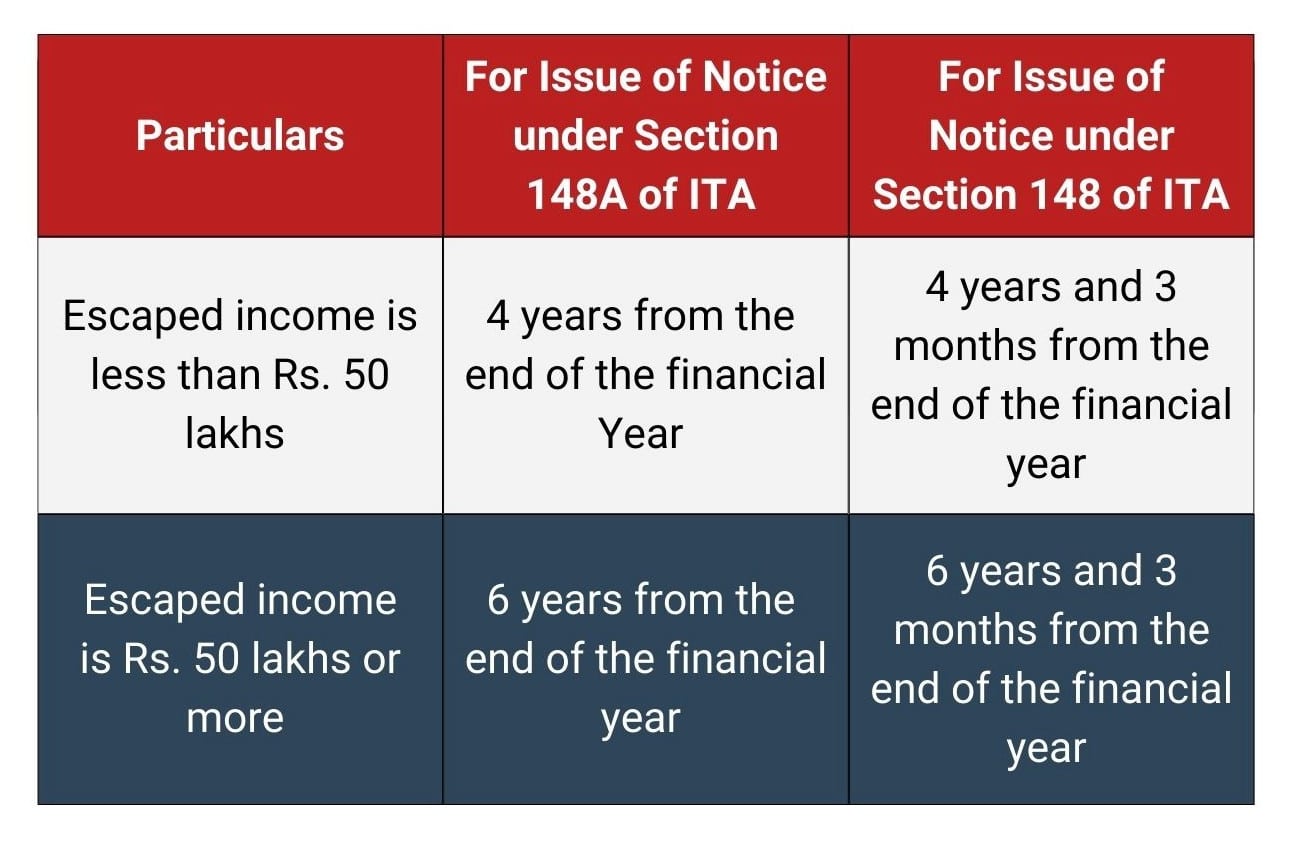

Earlier, time limits were specified solely for issuing notices under Section 148 of the ITA. However, with the amendments in the Finance Act (No.2) 2024, reduced timelines are now provided for both notices under Section 148A and Section 148 of the ITA.

The revised timelines are as follows:

As detailed above, when the assessing officer receives information from faceless authorities, they have three additional months, as a notice under Section 148A is not required in such cases. In all other cases, the assessing officer would be required to comply with both the timelines i.e. issuing notice under Section 148A, completing the process under 148A and issuing notice under Section 148.

As detailed above, when the assessing officer receives information from faceless authorities, they have three additional months, as a notice under Section 148A is not required in such cases. In all other cases, the assessing officer would be required to comply with both the timelines i.e. issuing notice under Section 148A, completing the process under 148A and issuing notice under Section 148.

Timelines as applicable – From September 1, 2024 (after amendment)

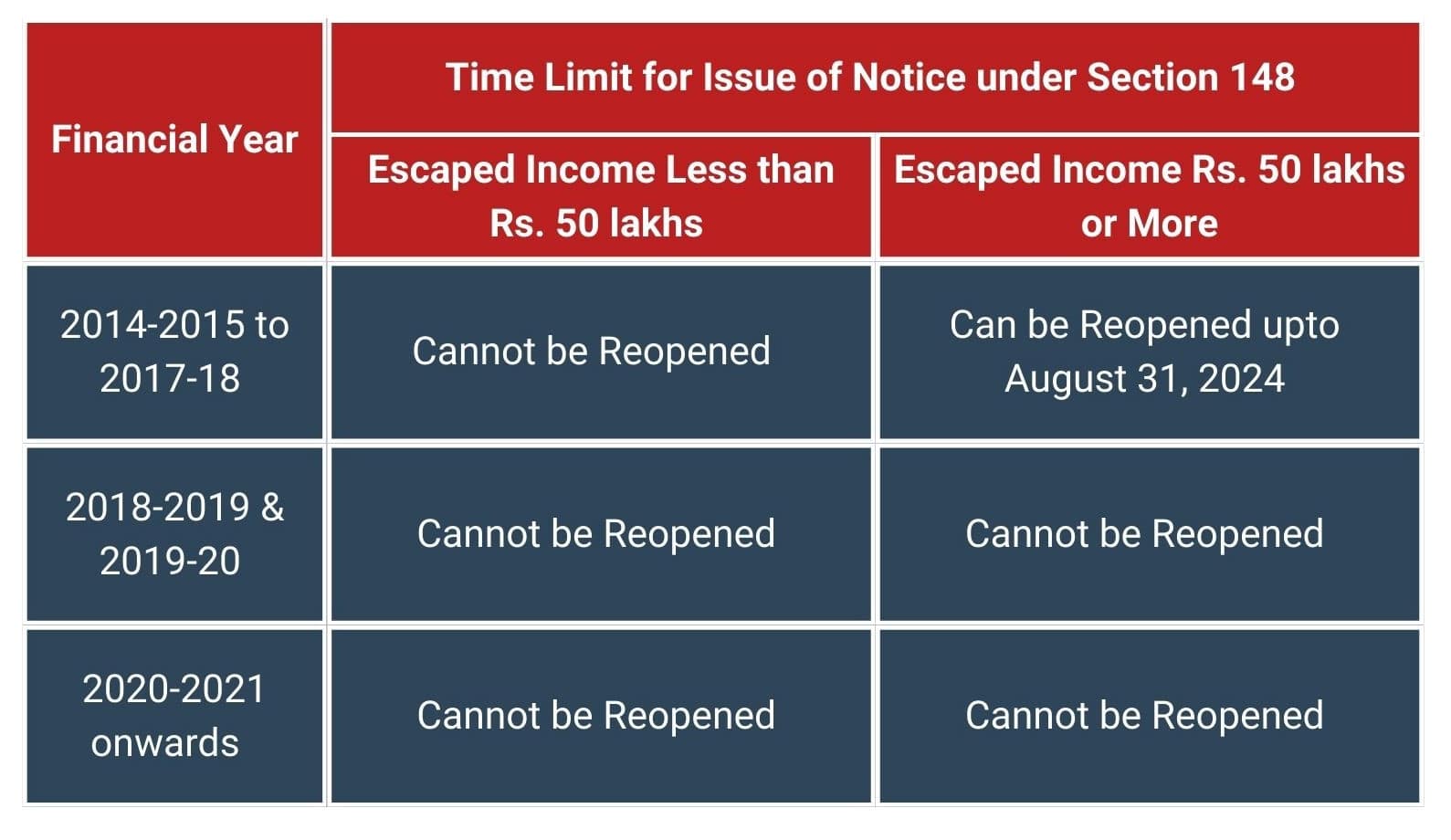

Year-wise scenarios where cases can be reopened and where it cannot be reopened

Timelines as applicable until August 31, 2024 (before amendment)

Timelines as applicable until August 31, 2024 (before amendment)

Considering it is August 2024 and the amendment as per Finance Act (No.2), 2024 for reopening cases take effect from September 1, 2024, under the current provision, the financial year that can be reopened by the tax authorities up to August 31, 2024, are as follows:

As detailed above, the tax authorities can reopen the cases pertaining to FY 2014-15 to FY 2017-18 until August 31, 2024. However, from September 1, 2024, the new provisions will take effect, introducing revised timelines of 6 years/6 years and 3 months. As a result, these financial years cannot be reopened under the amended provisions.

Given the above scenario, many reopenings by the Income Tax authorities are expected until August 31, 2024, for assessment years that will become time-barred starting September 1, 2024. Under these circumstances, it is crucial to keep track of the notices issued and ensure proper compliance if it pertains to relevant assessment years. However, if no notice is issued by August 31, 2024, the years cannot be reopened under the new law, and no adjustment to the return of income can be made by the tax authorities.

Conclusion

Until March 31, 2021, the reopening was allowed up to 7 years from the end of the financial year where escaped income could be upto Rs. 1 lakh or more, thereafter amendments were made in the Finance Act, 2021. The changes are as follows

- Increasing the time limit from 7 years to 11 years

- Increasing the threshold from Rs. 1 lakh to Rs. 50 lakhs

While the limit of escaped income was increased, the increase in time limit for reopening meant maintaining record for a longer period, uncertainty for a longer period etc.

With the amendments made in the Finance Act (No.2), 2024 the position is as under:

- Reducing the time limit from 11 years to 6 years or 6 years and 3 months.

- Keeping the threshold limit at Rs. 50 lakhs

This amendment is certainly a welcome move as reopening for above mentioned years cannot be done after August 31, 2024. Any notice received for reopening cases after August 31, 2024, would be time-barred and tax authorities would lack the jurisdiction to reopen such cases.

Authored by:

Margav Shukla | Direct Tax

FAQs

The new limit allows the Income Tax Department to reopen cases within 3 years from the end of the relevant assessment year.

It provides greater certainty and reduces prolonged tax disputes for taxpayers.

Yes, cases involving income escaping assessment exceeding ₹50 lakh can still be reopened up to 10 years.

By accurate reporting of income, timely filing, and maintaining proper documentation for all transactions.

To increase transparency, reduce litigation, and provide certainty to taxpayers on finalized assessments.

Share

Share