Place of Effective Management Under IT Act: Implications of POEM

Place of Effective Management Under IT Act: Implications of POEM

POEM Under IT Act of India: Know about ABOI, how to determine POEM, its implications for foreign company

- Home

- »

- Assessment

- »

- Place of Effective Management Under IT Act: Implications of POEM

- Last Updated

The Finance Bill, 2015 introduced the concept “Place of Effective Management” (POEM) to determine foreign companies’ residential status. This resulted in an amendment in the Income Tax Act, the word “control and management” was replaced with “POEM.”

Accordingly, Indian companies started setting-up subsidiaries in tax havens jurisdictions and vested superficial control of their international operations to continue paying taxes only on Indian operations and avoid paying taxes on overseas operations. To curb such malpractices and avoid erosion of profits from India, the concept of Place of Effective Management (POEM) was introduced by Finance Act, 2015 w.e.f. 1st April 2016.

What is POEM?

POEM refers to a place where the key management and commercial decisions necessary for conducting a company’s business activities are made. Since the residential status of any entity is to be determined every year, POEM is also required to be determined yearly. Under Income Tax law, the residential status of a company shall be determined as – It is an Indian company; or Its POEM is in India.

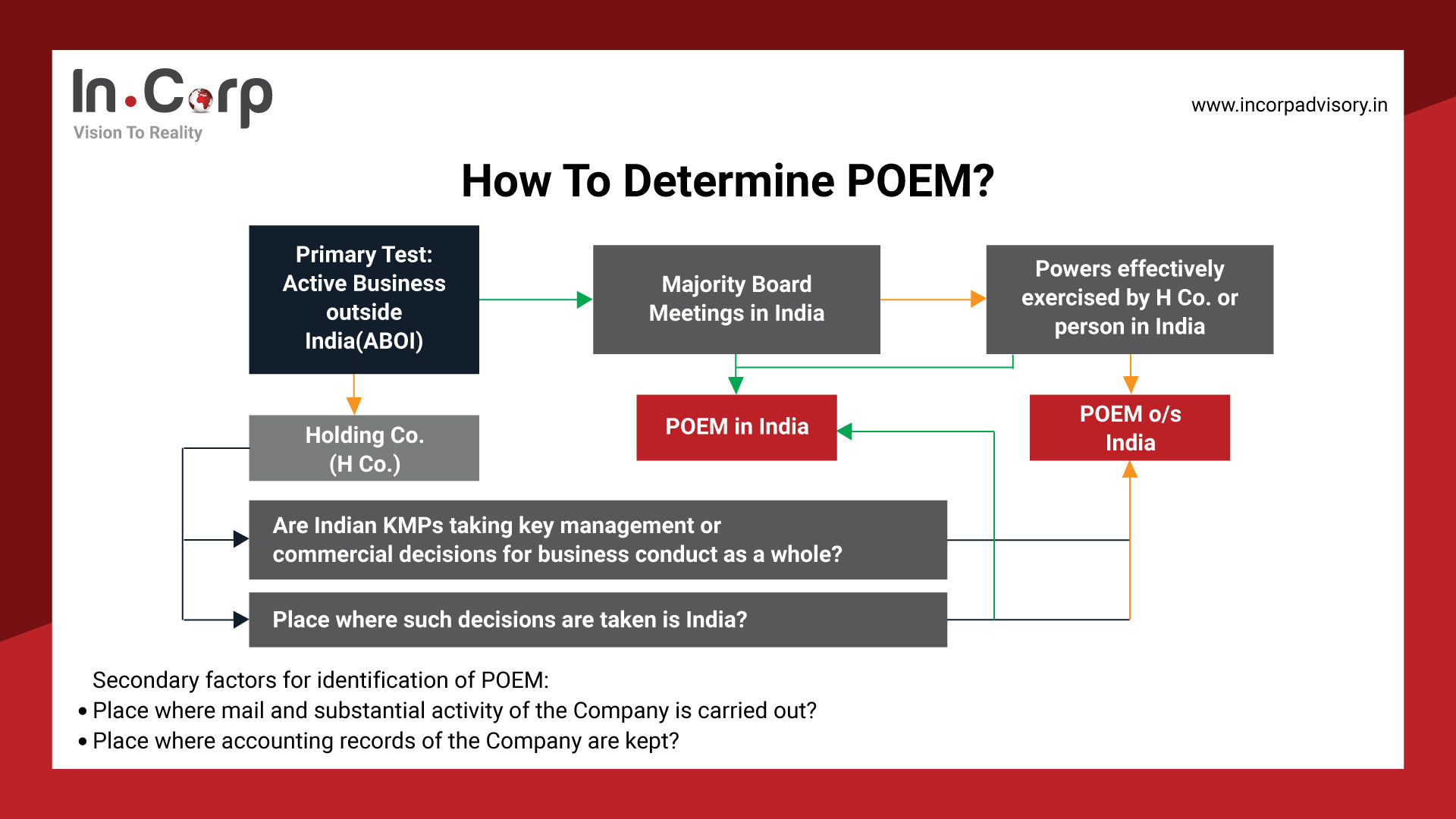

How to Determine POEM?

There are primary and secondary tests that help determine the POEM of any entity. Both the tests have been explained in the table below:

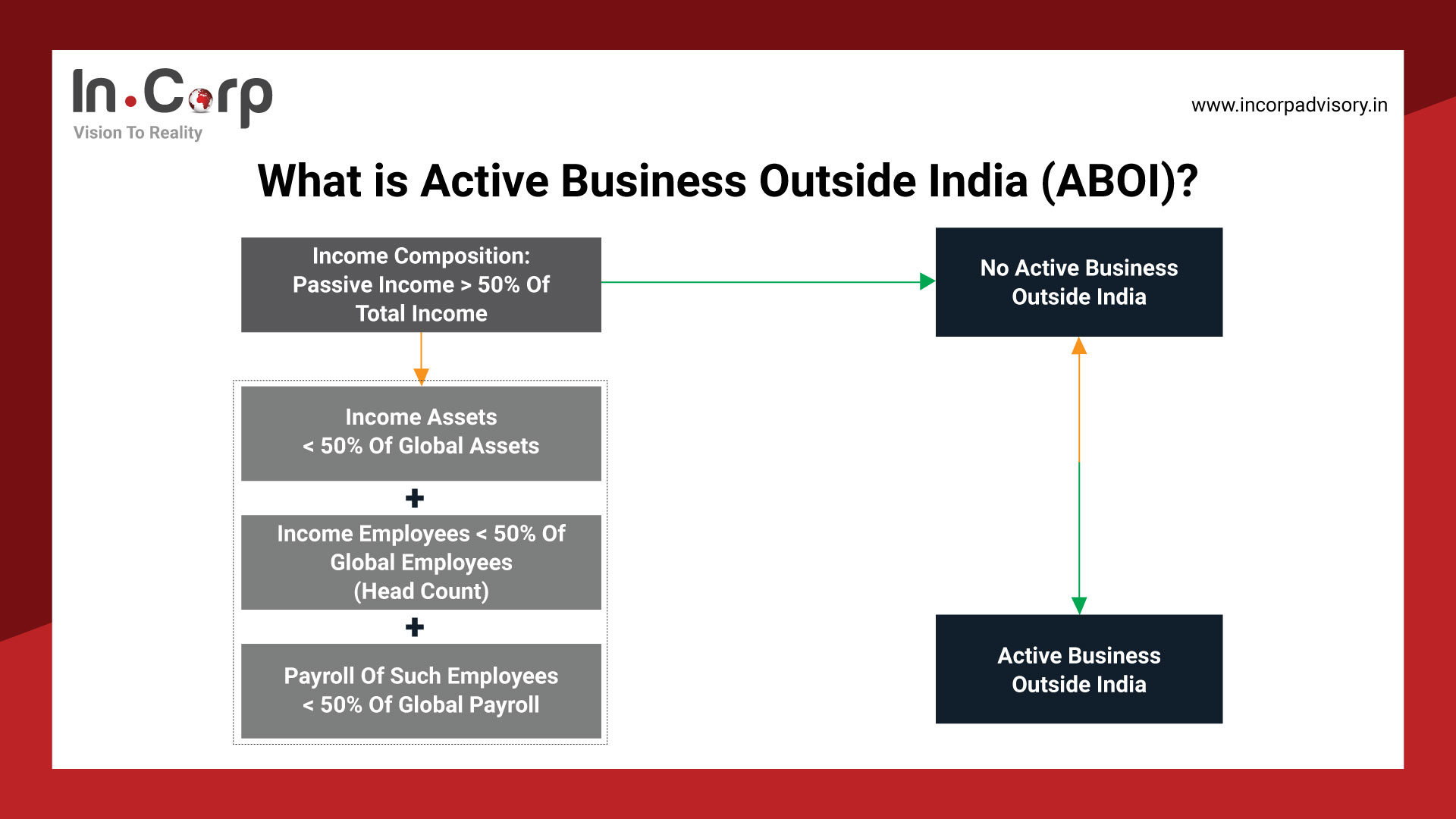

What Is Active Business Outside India (ABOI)?

Key terms which help to determine ABOI

1. What is Passive Income?

Passive income of a company shall be aggregate of-

-

- Income from the transaction where both the purchases and sale of goods is from/to its associated enterprise, and

- Income by way of royalty interest capital gains dividend or rental income

Note: If an entity is engaged in the business of banking or is a public financial institution, income by way of interest shall not be considered passive income.

2. How to compute the Value of Assets for tax purposes?

It shall be the average of the value of the assets in the country of incorporation of the company at the beginning and the end of each year.

3. How to determine the number of Employees in an entity?

The number of employees shall be the average of the number of employees of the entity at the beginning and the end of the financial year.

4. What does the term ‘Payroll’ mean?

The term ‘payroll’ has been defined inclusively to include the cost of salaries, wages, bonuses, and all other employee compensation, including the employer’s related pension and social cost.

5. Is there any exemption for the applicability of POEM to any entity?

Provision of POEM does not apply to a company whose turnover is less than or equal to INR 50 Crores.

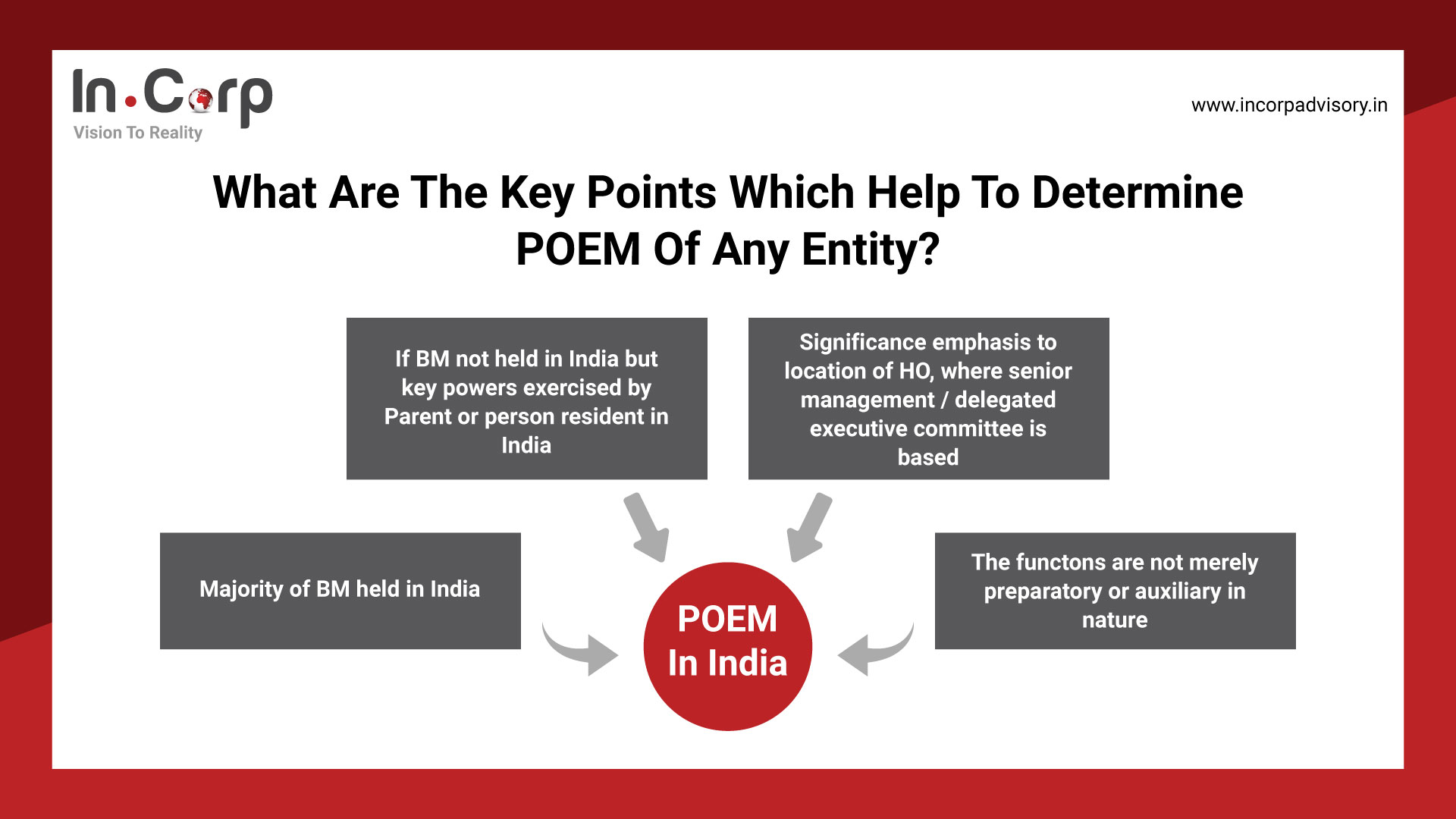

What are the Key Points that help to Determine POEM of any Entity?

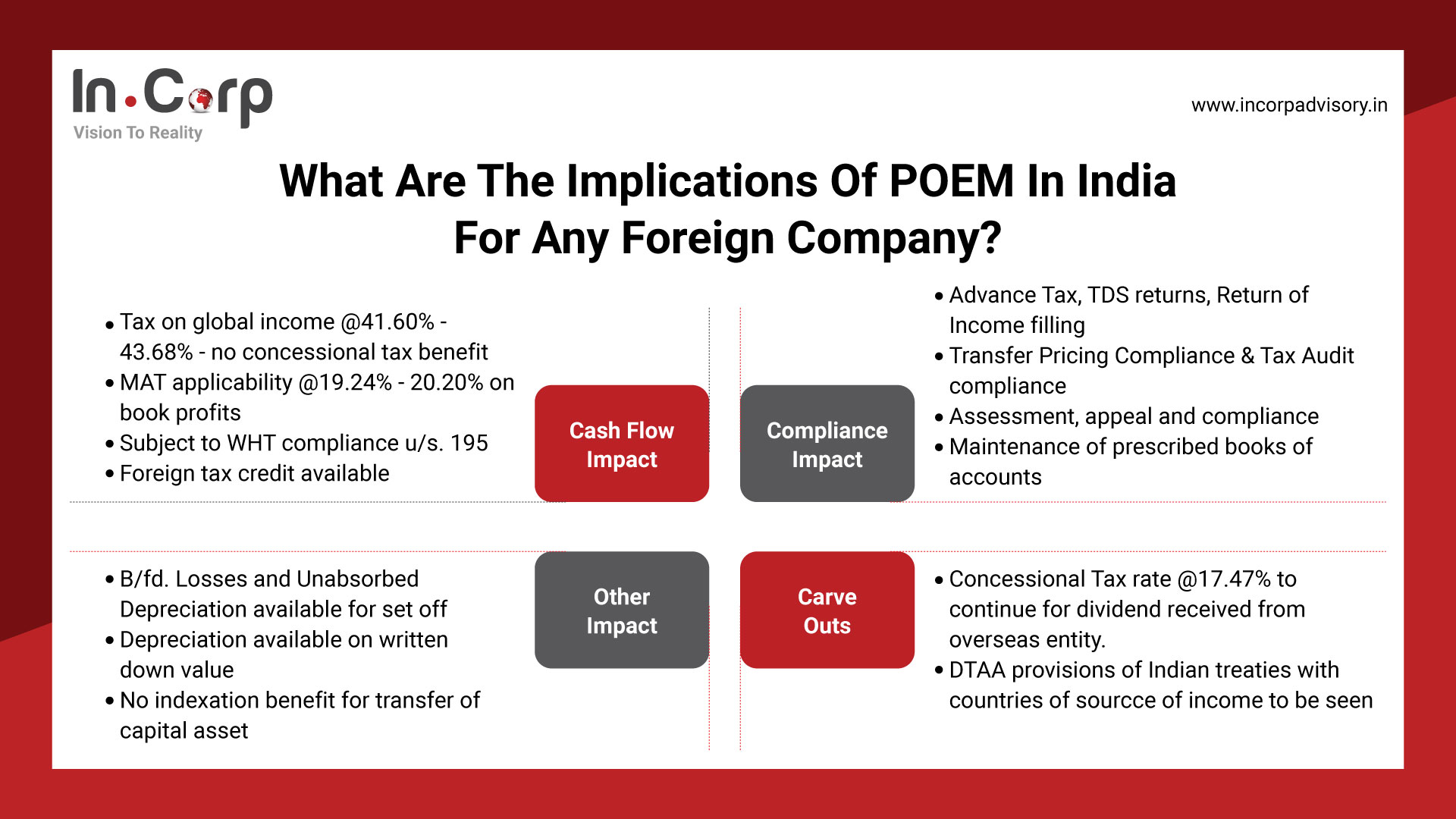

What are the Implications of POEM in India for any Foreign Company?

Conclusion

POEM is a dual-purpose concept. From the perspective of domestic laws, it may be used to determine the residential status. The principles established by Circular No 6 dated 24th January 2017 for the determination of POEM are not decisive in themselves.

Thus, the lack of any definite established legal factors for the determination of POEM may lead to several tax disputes. If POEM exists in India for any company, it would be a subject matter of litigation in various other cases and tax laws.

Moreover, the appointment of Indian directors on the board of foreign companies and participation of directors residing in India in meetings via telephone or video facility would be susceptible to the applicability of POEM in India.

How Can InCorp Help You?

At InCorp, we have a team of professionals and experts who have the expertise and skills to guide through the entire domestic and international tax planning and structuring for any company that may attract provisions of POEM. We are here to assist you in setting up your company either in India or outside India, managing related compliances, and filing your taxes on time with ease. To learn more about our services, you can write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

InCorp Advisory

Frequently Asked Questions

POEM refers to a place where the key management and commercial decisions necessary for conducting a company’s business activities are made.

- Any foreign company whose place of effective management is in India would be treated as a resident for tax purposes and liable for all income tax compliances in India.

- However, from a global point of view, POEM for the foreign companies will be the country where such key managerial decision necessary for conducting business activity as a whole are taken. Then the foreign company is liable for tax compliances of the jurisdiction where POEM is established.

Foreign companies or entities whose POEM is deemed to be in India may not have complied with all tax compliance requirements like Income tax, TDS, GST etc under Indian tax law, hence, penalty & interest provisions may be applicable.

The term ‘payroll’ has been defined inclusively to include the cost of salaries, wages, bonuses, and all other employee compensation, including the employer’s related pension and social cost.

Share

Share