Late Fees on GST Return: Know Consequences of Delay in Filing

Late Fees on GST Return: Know Consequences of Delay in Filing

All about GST return filing delay: Know the penalty, applicable amount and other consequences of not filing GST

- Last Updated

The efficient implementation of the indirect taxation law, known as GST, necessitates tough penalties for tax evaders. To encourage people to comply with the GST regime in India, the government has established three key strategies: interest, monetary penalties, recovery, and suspension of GSTIN. This blog discusses the penalties and prosecution when GST return is not filed on time.

What Is GST?

The Indian government passed the Goods and Service Tax Act on March 29, 2017, and it went into force on July 1, 2017. The Goods and Services Tax (GST) is a single domestic indirect tax law that applies across the country. It applies to both goods and services and is an indirect tax that has primarily replaced various other indirect taxes in India, such as VAT, service tax, excise duty, etc. This will make tax collection easier, reduce double taxation, and increase process efficiency.

Penalty for Delay in Filing GST Returns

Fortunately, there is no penalty prescribed under the GST law for late or non-filing of GST returns. Instead of a penalty, the GST registered dealer is subjected to late fees for delay in filing of returns.

Applicable Amount of Late Fees

The following table details the late fees applicable to various returns under GST law. The late fees will increase every day until it hits the capping limit. Further late fees need to be mandatorily paid by debit to the electronic cash ledger. Input Tax Credit (ITC) cannot be utilized for payment of late fees.

Return TypePAN India Turnover in Previous YearPer Day under CGST+SGST Act

Maximum Amount under CGST+SGST Act

| NIL Liability GSTR-1 / 3B | 10 + 10 = Rs 20 | 250 + 250 = Rs 500 | |

| GSTR-1 / 3B | Below 1.5 Crores | 25 + 25 = Rs 50 | 1000 + 1000 = Rs 2000 |

| Between 1.5 to 5 Crores | 25 + 25 = Rs 50 | 2500 + 2500 = Rs 5000 | |

| Above 5 Crores | 25 + 25= Rs 50 | 5000 + 5000 = Rs 10000 | |

| NIL Liability GSTR-4 Composition dealer Return | 10 + 10 = Rs 20 | 250 + 250= Rs 500 | |

| GSTR-4 Composition dealer Return | 25 + 25 = Rs 50 | 1000 + 1000 = Rs 2000 | |

| NIL Liability GSTR-5 | 10 + 10 = Rs 20 | 5000 + 5000 = Rs 10000 | |

| GSTR-5 | 25 + 25 = Rs 50 | 5000 + 5000 = Rs 10000 | |

| GSTR-6 ISD Return | 25 + 25 = Rs 50 | 5000 + 5000 = Rs 10000 | |

| GSTR-7 TDS Return | 25 + 25 = Rs 50 | 1000 + 1000 = Rs 2000 | |

| GSTR-9 Annual Return | 100 + 100 = Rs 200 | 0.25% + 0.25% of Turnover |

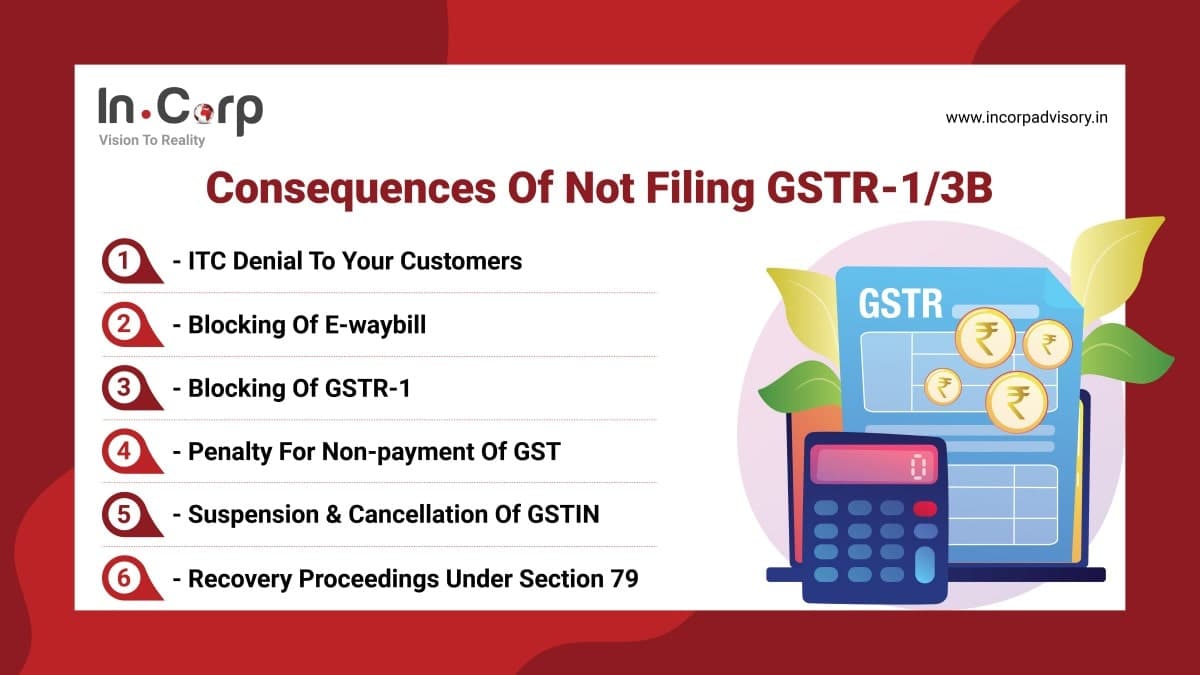

Other consequences of not filing GSTR-1/3B

Input tax credit denial to your customers

Your customer will be denied input tax credit of GST charged by you on your sales invoices.

Blocking of E-waybill

You will not be able to generate E-waybill if two consecutive GSTR 3B is not filed

Blocking of GSTR-1

You will not be able to file GSTR-1 if two consecutive GSTR 3B is not filed

Penalty for non-payment of GST

For certain specific offences, there are provisions of penalties in GST. One of such offences is not paying collected tax amount within 3 months from the due date. The Penalty will be equal to the amount of tax collected subjected to a minimum of Rs. 20,000

Suspension and then Cancellation of GSTIN

If you (a regular taxpayer) does not file a return for a continuous period of six months, then the GST Officer may cancel the GST registration of such person. Before cancellation, the officer will issue a Notice seeking your clarification. You are required to reply in 7 working days, giving reasons to the officer for not cancelling your GST registration. However, officers don’t need to initiate the cancellation immediately after the non-filing of the 6th consecutive months return. If officers choose to initiate the procedure of your GST Registration cancellation, then your GSTIN will be suspended. Until the suspension is revoked, you can not supply any Taxable Goods.

Recovery Proceedings under section 79

If you do not file your GSTR 3B despite constant reminders and notices, the department will initiate the recovery proceedings. We have detailed the entire process for your understanding as follows:

- First Reminder – 3 Days before Due Date to nudge taxpayer to file return on or before the due date

- Second Reminder – Immediately after the due date to inform that return was not filled on the due date

- Notice – 5 Days after Due date, notice in Form GSTR 3A, requiring the person to file returns in 15 Days

- Order – Any time after the lapse of 15 Days of service of notice in form GSTR 3A, provided the return is not filled. Officer may proceed for assessment.

Here the officer will compute the tax liability to the best of his/her judgment. The Officer may take into account the details of outward supply furnished by the person, inward supply is shown by his/her suppliers, e-waybill details, etc.

Order will be issued in ASMT – 13, and a summary will be uploaded in Form DRC -07 by an officer. - Initiation of proceedings: After 30 Days of serving of order in form ASMT -13, the Officer may initiate the recovery proceeding under section 78 and actual recovery under section 79. In the GST regime, officers are empowered to recover the tax payable from your debtors, refund dues, seized Goods, Property etc.

It is worthy of mentioning that officers may proceed to do an assessment. The word “may” means that it is not binding on officers that they have to compute the tax payable exactly on the expiry of the 15th Day of serving the notice in GSTR 3A. Officers may proceed on any day after the completion of 15 days. Thus the exact timeline of initiation of recovery cannot be quantified.

Consequences of Delayed Filing of GSTR-1/3B Apart from Late Fees

Related Read: Guide to ISD and Cross Charge under GST

The consequences are as follows:

- If a taxpayer is required to pay tax within the prescribed time but fails to pay, interest @18 % will be levied for the delay in payment.

- The interest will be payable only if you use the cash ledger balance to pay taxes. In other words, if you have enough input tax credit and you do not pay taxes using net banking/challan/balance already added in the cash ledger, then there won’t be any interest leviable on you.

- There is no concept of maximum capping in case of interest.

Conclusion

In India, all GST registered dealers must file their GST returns on a monthly, quarterly, or annual basis, depending on the nature of the business. A GST return is a document that comprises the details of outward and inward supplies that a registered taxpayer must file with the Indian tax authorities. A late fee and interest are imposed on the taxpayer if the GST Return is not filed on time.

How Can InCorp Advisory Help You?

At InCorp, our team has extensive expertise and experience that can assist you in complying with GST requirements and managing your taxes in a timely manner. Our service includes GST Compliances, GST Operational Assistance, GST Audit Services, GST updates on recent notifications, GST Representation and Litigation Support, other Indirect Taxes Advisory and Litigation. If you have any questions or require assistance regarding our services, please write to us at info@incorpadvisory.in or reach out to us at (+91) 77380 66622.

Authored by:

InCorp Advisory | GST

Share

Share