- Home

- »

- BRSR Services

- »

- BRSR Reporting

BRSR Reporting Made Simple

Get your Print-Ready BRSR Report and XBRL File

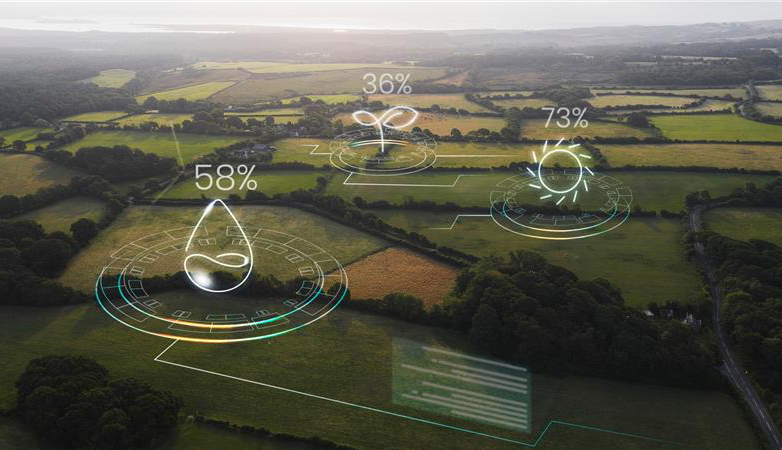

End-to-end BRSR solution covering Data Collection, Validation, XBRL Reporting, and Publishing a print-ready BRSR Report.

Enquiry Form

Professionals

BRSR Reports

Published

Sectors Covered

Leadership Indicator Reports

Professionals

BRSR Reports Published

Sectors Covered

Leadership Indicator Reports

We have published 200+ BRSR Core assurance ready reports, with 150+ reports including Leadership Indicators

We deliver comprehensive Sustainability Reporting solutions, streamlining every step from initial Data Handling to final Report Delivery. Our end-to-end services encompass multilevel Training Programs, Digital Data Collection Systems, thorough Internal Validation Processes, detailed GHG Emissions Analysis, and expert BRSR Report Preparation including Designing and XBRL Formatting. We have partnerships with leading tech companies to further enhance our capabilities. By leveraging our expertise across multiple reporting frameworks, we have optimized our clients’ BRSR reporting to align seamlessly with rating requirements, creating an efficient, unified information management system.

InCorp Global - your Trusted Partner for BRSR Reporting

With heightened ESG awareness among key stakeholders like Customers, Investors, and Bankers, the BRSR report serves as a reflection of top listed companies' ESG performance.

-

We support complete BRSR publishing journey by delivering multiple versions of BRSR Report including Board Copy, Print Version, Design Version and XBRL Version.

-

We understand the complexity of data collection and provide customised data collection templates (xls, Google Sheets), forms (Microsoft, Google Forms) and other third-party tools.

-

We empower businesses by conducting trainings at various levels including for the Board, Senior Leadership and Data Owners.

-

We provide end-to-end expertise by fulfilling the need for BRSR Experts, Greenhouse Gas (GHG) Specialists, Data Handling Experts, and Design Professionals.

Why BRSR is here to Stay

BRSR Reporting for Indian businesses is not merely a mandate. It can boost business growth across a company’s life and operations, including revenue generation and reputation management.

Climate Resilience

Companies are looking to de-risk business from the impact of climate change and aligning with national Net Zero goals. Government across the globe are pushing corporates to adopt sustainable practices.

Competitive Advantage

Brands can differentiate themselves by adopting a sustainability strategy & best practices and transparently report ESG vision for better talent acquisition and consumer attraction and retention.

Access to Funds

Investors are increasingly shifting their focus on sustainable businesses, de-risked from not just financial but also ESG risks. Companies that adopt ESG tend to perform better & carry lower default risk.

Efficient Supply Chain

From the periphery to the nub, ESG assessment of vendors is critical in factoring risk for all industries. The concept of sustainability is not limited to corporates but also to their value chain partners.

Service Areas Within BRSR Reporting

BRSR and BRSR Core

We assist our clients with preparing and improving their BRSR and BRSR Core report.

Validation and Assurance

We validate the BRSR prepared by clients and conduct detailed internal assurance enabling clients to prepare for BRSR Core.

XBRL and Designing

We assist clients in preparing the XBRL for BRSR and support in designing the BRSR report for publication as a separate Sustainability Report.

InCorp Insights

What Are the Implications and Strategies for BRSR Reporting in India?

ESG reporting originated in India as a part of CSR guidelines introduced into India in…

BRSR Reporting and Its Influence on Investor Decisions in India

A whole new Environment, Sustainability & Governance (ESG) verticals have been created by businesses across…

Best Practices for Integrating BRSR with Financial Reporting

The growing need for companies to be accountable and transparent has an implicit influence on…

SBTi Framework: Your Path to Net-Zero Emissions

With the advent of ESG and sustainable practices, businesses are ever more vigilant in reducing…

The Need for Specialized ESG Consulting in BRSR Reporting

The Sustainability Era The current regulatory landscape is not only changing globally but its effects…

Why Listed Companies Require ESG Consultants for Effective BRSR Reporting?

Introduction Today, organizations across the world are recognizing the value of incorporating Environmental, Social, and…

How Governance Structures Ensure BRSR Accountability

As India Inc progresses toward Prime Minister Narendra Modi’s net zero goal of 2070, corporates…

Social Stock Exchange India: Bridging Capital and Social Impact

The Social Stock Exchange is a platform to help Non-Profit Organizations (NPOs) raise funds from…

Enhancing ESG Credibility with BRSR Assurance

Sustainability consciousness has surged to the forefront of corporate agendas, prompting the Securities and Exchange…

How Life Cycle Assessment Impacts BRSR Reporting

In an era of fast industrialization, widespread consumerism, and expanding populations, the planet’s limited resources…

FAQs

Business Responsibility Sustainability Reporting (BRSR) is a mandatory reporting framework for the top 1,000 listed companies in India. BRSR enables clients to report their social, environmental, and economic impacts on society thus encouraging transparency and encouraging sustainable business practices.

BRSR promotes standardized disclosures on ESG parameters. It helps companies to identify and mitigate potential risks and improve their reputation. It also lets companies showcase their sustainability objectives, position, and overall performance.

BRSR is as a mandatory reporting requirement for the top 1,000 listed companies (by market capitalization) in India.

BRSR has four components: governance and ethics, social, environmental, and economic. Each component has specific disclosures that companies need to report on.

BRSR is as a mandatory reporting requirement for the top 1,000 listed companies (by market capitalization) in India. Nevertheless, other companies can voluntarily submit their BRSR report as it enhances their overall market value, particularly when seeking to raise funds.

The BRSR reporting occurs on an annual cycle between April to March of each reporting year.

There are no specific penalties for non-compliance with BRSR. However, companies that do not report under BRSR may face reputational risks and may not be able to access certain capital markets or investors who prioritize sustainable practices.

BRSR is a voluntary framework specific to Indian companies, and is designed to align with Indian laws, regulations, social and environmental priorities. BRSR also focuses on governance and ethics, which is not a component of all sustainability reporting frameworks.

Companies can prepare for BRSR reporting by understanding the framework and its components, engaging with stakeholders, conducting assessments of their social, environmental, and economic impacts, and implementing sustainable practices and policies.

BRSR reporting can benefit companies by enhancing their reputation, improving their relationship with stakeholders, identifying potential risks and opportunities, and promoting sustainable practices and policies

clientele

Expert Team

Dhaval Shah

Chief Growth Officer

Prakhar Gupta

Lead

Direct to Your Inbox!

Stay updated with our curated newsletter content designed for you