Navigating the Loan Syndication Process: A Step-by-Step Guide

Navigating the Loan Syndication Process: A Step-by-Step Guide

Loan Syndication: A Comprehensive Guide to Funding and Risk Mitigation

- Home

- »

- Debt Syndication

- »

- Navigating the Loan Syndication Process: A Step-by-Step Guide

- Last Updated

Let’s say an individual had $1 million. Would it be wise for this investor to go all-in and fund a large-scale business that wants to enter the latest Generative AI opportunity?

That’s a lot of risk — and professional lenders and financial institutions also feel the same jitters to finance large-scale borrowers. They may not have the required capital or the risk appetite that meets their investment thesis to single-handedly fund them.

It’s risky for borrowing businesses to raise large-scale funds from a single or small number of investors. That’s because lenders are not just a means to raise money. A good lender brings their vast network of other high-quality lenders and their expertise to help with the business of using the funds. Associating with them brings credibility to the borrowing business. They are not useful just for raising funds.

Thus, the more lenders the merrier for the borrower in terms of access to capital, loan terms, network, and expertise.

A loan syndication arrangement facilitates the borrower’s fundraising efforts with this arrangement. It also helps reduce the credit risk on lender/s — here, lenders group to fund a portion of required funds based on their risk appetite.

Think of it as doing teamwork to finance a large-scale borrower.

Here, the participating lender/s diversify their credit risk to tap into investment opportunities a borrowing business presents. The business also receives required funds to the best of possible conditions depending on its credit rating.

Thus, both borrowers and lenders enjoy a win-win situation such that it reduces lending and borrowing risk for both parties involved.

For businesses wanting to explore mergers, acquisitions, go-to-market, scale-up, etc — this guide helps fund such ambitions using the loan syndication route. Use the step-by-step guide to start the loan syndication process or contact InCorp to learn more.

What is loan syndication?

Loan syndication provides borrowing businesses a secure route via a single lender or collaboration between multiple lenders to secure large-scale funds. Choosing a loan syndication method for fundraising helps both borrowing businesses and lenders distribute the risk that comes with the involvement of large capital.

How is the risk worth the reward here for businesses?

Loan syndication offers a way to minimize risk by sharing the credit risk that comes with the borrowing business. Thanks to this, the borrowing business can access large-scale capital to finance their projects. Usually, such projects otherwise get deemed too risky for a single lender. Instead of taking all the risk, the lender’s liability now gets limited to the share of the total funds they have sanctioned the loan for. This makes borrowers reduce the burden on lender/s so that the opportunity meets their investment thesis.

That’s great news for the borrower too — where they acquire the required capital with endorsements from multiple lenders. This improves their credibility in the market stating multiple lender trust.

The loan syndication route is usually taken by large enterprises, governments, or promising startups. They have the required trust, thus helping them undertake large-scale projects with ease. Also, lenders expect borrowers to execute with efficiency and transparency. Loan syndication makes sure of effective risk management. Hence, borrowers can finance infrastructure projects, M&As, expansion, scale new technologies, etc.

3 Key Participants in Loan Syndication

There are 3 key players in a loan syndication process:

1. Borrower

On one side of the table is ‘The Borrower’ — these could be a government or private entity looking to raise funds for their large-scale projects. Raising large funds requires a reputation in the market and a budget to carry out the loan syndication process. Hence, usually, a medium to large-size organization adopts this route for fundraising.

For a borrowing business, here is what the loan syndication process looks like:

- The borrowing business outlines the loan amount and the fundraising purpose.

- They share their financials to help lenders understand their repayment capacity.

- Then, they invite interested lenders to negotiate loan terms with a plan for the repayment according to the agreed terms.

2. Lead Arranger or Syndicate Manager

Disbursing large amounts requires taking measures to make sure the loan syndication transaction occurs smoothly. For this, an intermediary is required – called, a ‘Lead Arranger’ or a ‘Syndicate Manager’.

A lead arranger manages and structures the loan syndication process. Usually, a bank, advisory, or other financial institution with expertise in loan syndication carries out this process.

Common tasks performed by Lead Arrangers include:

- Due diligence

- Approaching lenders

- Negotiate loan terms

- Design repayment schedules

- Provide end-to-end documentation

The lead arranger has one main job – to streamline the loan syndication process. They draft the borrowing business’s loan syndication proposal as an attractive opportunity for the lenders. Then, they must structure the deal for everyone to benefit as per their goals.

3. Participating Lenders

Related Read: SME IPO Listing Process: A Step-by-Step Guide

On the other side of the table is the ‘Lender’ — the ones who provide the loan money and are interested in striking a deal with the borrower. These are usually financial institutions, banks, independent investors, etc.

As per their risk appetite, the lenders will express their interest in participating. They review the due diligence performed by the lead arranger on the borrower’s credit profile. Then, based on their investment thesis, they will decide their participation status. They will also try to negotiate the loan terms and interest payments in their favor to maximize returns.

Why use Loan Syndication?

Loan syndication is a strategic deal. This makes it accessible for businesses to raise massive capital for large projects or transactions. A business can achieve these goals as everyone in the syndicate:

- Collaborates to realize fundraising goals.

- Maintain flexibility to make sure the deal goes through.

- Share risks as per investment thesis and appetite.

Here, borrowing businesses can undertake transformative projects. They benefit from lender/s as they pool their capital, resources, and expertise. A business is no longer being limited by funding constraints. While the investors enjoy a secure and profitable investment opportunity for their portfolio.

Loan syndication also leads to nurturing global investments and trade. This happens because such deals promote collaboration between different financial institutions for knowledge and resource sharing.

What are the three types of Loan Syndication?

Based on the risk structure designed among involved lenders and the financing situation at hand, Loan Syndication can be divided into 3 types:

- Underwritten Deal: Here, the Lead Arranger guarantees financing the loan irrespective of whether other potential lenders participate. They may hold, sell to other investors for profits, or sell it at a discount depending on the credit fundamentals of the borrower and the market conditions. For the borrower, the underwritten deal awards much-needed certainty in raising the required capital. However, they will have to pay higher fees for the additional risk the Lead Arranger bears.

- Best Efforts Syndication: In ‘Best Efforts’ syndication, the Lead Arranger does not guarantee full funding — but promises to make their ‘best efforts’ to ensure full subscription from other lenders. On failing to raise the required goal amount, the borrower receives whatever funds were managed to raise.

- Club Deal: Club deals are like ‘ready-made’ loans available for borrowers to quickly immediately choose and use. These are provided via a smaller loan syndicate who know and have a good understanding of each other very well. They typically fund with a smaller capital size — usually $25‒$150 million. With no Lead Arranger and minimal syndication efforts, club deals are faster to finalize due to fewer negotiation rounds.

InCorp brings 26 years of expertise having helped secure more than $100 million worth of term loans.

Our expertise lies in debt instruments and debt structuring — such that the borrower gets successfully financed via the debt financing route.

- Exhaustive lender network: We have spent years building strong lender relationships across banking and non-banking financial institutions. This large network makes it easy for our borrowers to access relevant lenders. A good lender-borrower match helps establish a successful loan syndicate.

- Custom debt structuring: The debt structure must be aligned with the business’s financial goals. This insight is the key at InCorp that helps us set up a successful loan syndicate. Lenders notice this alignment — hence, we always work on customized debt structuring solutions for our borrowers by understanding the business model, finances, and goals.

- Optimize debt pricing: We use our experience to structure the debt such that it minimizes the cost of borrowing for the business. We do this by finding innovative solutions to secure the best possible interest rate and loan terms from which everyone in the syndicate benefits.

- Streamline compliance: Borrowers must focus on fund utilization — we do the boring (yet very important!) documentation work to meet compliance standards.

- Post-funding support: Want to know how truly useful the lead arranger is? — check the track record of its post-fund monitoring support. At InCorp, we actively monitor debt instruments so that the business is always compliant. We implement proactive strategies to balance the syndicate throughout the loan term. This helps maintain a clean record that aligns with decided loan terms. Borrowers can then easily explore refinancing requirements in the future.

Our tools, network, and experience shape our inventive approach to debt financing. We strongly believe in optimization to help our borrowers achieve their financial goals.

Our process has led to us having helped raise $650M+ of debt for our 50+ clients — contact us to learn more.

Role of loan syndication in business expansion

Apart from accessing large-scale financing to fund growth, here are 5 ways in which following the loan syndication process helps a thriving business (borrower):

- Competitive loan terms: Lenders feel more comfortable joining a syndicate of borrowers with a stellar market reputation and solid plans to use the funds.

- Global expansion: If the business wants to increase its global footprint, having support from lenders with foreign backgrounds or international market experience makes it more feasible.

- Tailored financing: Thanks to volatile markets, especially since the 2019 Covid, businesses have had to constantly update their financial requirements. Loan syndicates are custom-designed, which brings the required agility to navigate such markets with ease.

- Avoid overleveraging: The loan syndicate makes sure the borrowing business grows sustainably. A major focus area for this is to avoid overleveraging with a single lender. For this, they invest in conducting continuous monitoring and due diligence after loan approval till repayment.

Using a recent example, let’s understand how loan syndication helps borrowing businesses.

AtlasEdge is a leading European data center provider. They recently secured a scalable €725 million facility using the loan syndication route. They intend to use this raised capital to:

- Capture the rapidly growing data center market. They plan to construct new demand-led and efficient data centers across Europe.

- Support acquisition of Datacenter One, Germany’s leading independent data center provider. It will also support more mergers and acquisitions to improve the market footprint.

- Develop a sustainable digital society, as the financing includes sustainability-linked targets focused on efficiency and renewable energy usage.

As one can observe — the above 3 goals require heavy financing to achieve the ambitious goal. They involve huge market and technological risks due to rapid innovation in data centers and the sustainability industry.

This counts for the need to adopt a loan syndication process to effectively manage the risk involved for both AtlasEdge and their potential lenders.

Hence, ING Bank took charge as the mandated lead arranger and a syndicate of other credible lenders. This included The Bank of Nova Scotia, ABN Amro, Banco Santander, Crédit Agricole CIB, UniCredit Bank AG, and National Westminster Bank Plc.

By bringing credible banks into the syndicate, AtlasEdge was able to distribute its credit risk. They can benefit from the expertise and resources of each lender to support AtlasEdge’s growth strategy.

A step-by-step guide for the loan syndication process

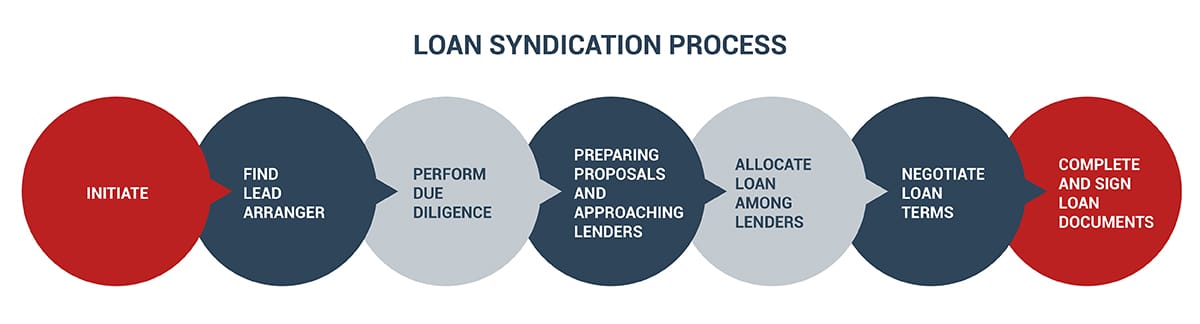

We can divide the loan syndication process into 7 key steps:

Let’s understand the above process using an example of a business ‘ABC Corp.’. They aim to raise $500 million to set up new manufacturing units via the loan syndication process.

Step 1: Deal initiation

First, the business must identify and document its capital requirements. It must consider its current cash flow and assets. In our example, ABC Corp requires $500 million — a number they arrived at by calculating project costs for manufacturing units. They have also considered timelines, supply chain volatility, and market conditions.

The business also must consider its repayment capability based on revenues generated from the manufacturing units or other available sources.

Step 2: Find a Lead Arranger

The business must find a Lead Arranger based on relevant experience working on the loan syndication process in their industry or situation.

For ABC Corp, a Lead Arranger must ideally have experience in successfully raising funds for manufacturing units via the loan syndication process. They should have the relevant lender network and advisory services available.

Of course, the Lead Arranger should fit the budget too.

Now both the business and Lead Arranger must work together to structure the loan syndication deal, which includes:

- Total loan amount required by the business.

- Loan tenure that should align with the project or business timelines for comfortable execution.

- Repayment schedule to decide the frequency and amount of payments.

- Collaterals to place guarantees like project assets, existing assets, etc.

- Restrictions like limitation on undertaking additional debts, reporting of project progress, etc.

- Tranche structure where the loan gets disbursed on certain conditions, like achieving project milestones.

- Risk mitigation for lenders to manage risks, like ‘step-in right’ where they can overtake the project if businesses fail to deliver on their obligations.

Step 3: Perform due diligence

Due diligence is a critical process for Lead Arranger and potential lenders to have clarity on the business’s financial health and agility to navigate markets. This includes conducting due diligence across:

- Financial: Study the businesses’ balance statements, profit, loss, cash flow, taxes, metrics that showcase creditworthiness, etc to understand their financial situation.

- Legal: Study businesses’ current legal obligations, compliances required and met, assess potential legal risks, any historical disputes engaged on, etc. For example, does ABC Corp have sufficient land acquisition process completed?

Role of financial advisors and legal teams

Financial advisors and legal teams ensure the accuracy of research and thoroughness of risk assessment done on the business. The idea is to make it fair, transparent, and beneficial for everyone – forming a strong foundation for a post-loan approval situation.

Both collaborate simultaneously for the loan syndication due diligence as follows:

Financial advisors flag anything suspicious in the borrower’s financials. They will share their research with the legal teams for further investigation.

Legal advisors identify past disputes, current red flags, and potential regulatory hurdles that may derail the loan syndicate structure. The financial teams then quantify their research in terms of potential cost overruns.

Once cleared, now they collaborate to draft financial reports and legal documents that outline the loan syndication structure.

Step 4: Market the syndicated loan to potential lenders

Now that the loan syndication structure is ready, the Lead Arranger will approach potential lenders to participate in the syndicate. For this purpose, it performs below key marketing tasks:

Create the Information Memorandum:

Lenders will not jump into investing with mere negotiations — the Lead Arranger has to provide a concise document detailing the deal. This will include a profile on the borrower business that educates the lender about fund utilization, loan structure, risk analysis, potential upside, and more.

Conduct Roadshows:

The next step is to attract the lenders. The Lead Arranger organizes a marketing roadshow in key investor geographies or financial hubs. They will present the investment opportunity at financial hubs. After the presentation, they will network with the lenders to explain why the syndication deal is lucrative for their portfolio. Then, they will organize a question-answer session to bring more clarity about the loan syndication process for interested lenders.

Conduct Lender Meetings:

For the interested lenders, the Lead Arranger will organize one-on-one meetings to further discuss the doubts and nitty-gritty of the loan syndication deal. Some may demand customized presentations where the Lead Arranger justifies the deal for the lender’s portfolio. It helps clarify the benefits and risks involved.

Step 5: Allocate the loan among lenders

At this stage, serious investors would want to initiate the discussion to take part in the loan syndication process.

Behind the doors, they will consider the loan amount and run numbers on how much they can allocate to get the desired return considering risks and investment thesis. The borrower’s reputation also plays a key role.

The lead arranger will organize a few rounds of negotiations with the borrower. After this, the lenders will give a final decision on their commitment to the proposed loan.

Some lenders may simply choose to participate in the loan on parts. How much this will be depends on their internal risk assessment and return targets. For example, here’s a typical scenario of senior and subordinated debt:

- Section A (senior debt): Lower risk, lower return, prioritized repayment.

- Section B (subordinated debt): Higher risk, higher return, repaid after Tranche A.

This step determines the chances of successful fundraising. One can know how keen the lenders are to participate in the syndicate and if the chosen structure meets their risk appetite. Based on this, further negotiations will be carried out.

Step 6: Negotiate loan terms and conditions

In this step, the Lead Arranger finalized the agreement terms with interested lenders. This is a critical step that clears off any misunderstandings and gives a final chance to the lenders to negotiate more favorable terms.

Of course, a good loan term agreement will benefit everyone as follows:

- Protects lenders from future unforeseen risks.

- Provides the borrower with flexibility to manage their business operations.

- Creates a framework for resolving potential disputes.

To achieve the above 3 criteria, all parties negotiate and finalize below important areas of the loan syndication process:

- Loan covenants: There are specific restrictions set by the lenders on the borrower that help them mitigate potential risk. For example, lenders may expect ABC Corp to work with their suppliers, avoid taking more debt, maintain a minimum debt-service coverage ratio, etc.

- Collateral and security requirements: A traditional way to reduce loan risk is to keep valuable collateral. The lenders in the syndicate will negotiate potential assets that they can keep as collateral.

- Interest rate and fee structure: This is important for the borrower — as it will decide how much the borrower has to pay over the principal amount to repay the loan. For lenders, it will determine the potential returns. Any additional fees like participation fees or arrangement fees will also get finalized.

- Repayment schedules: The borrower should have comfortable and realistic repayment schedules based on their financial situation and the details of the project or task the funds are used for. The lenders and borrowers may settle on several structures like quarterly payments, balloon payments at the end of the loan term, etc. For example, ABC Corp will have to consider breakeven timelines and profit forecasts for their manufacturing facilities in their repayment schedule.

Other additional areas to consider include loan disbursement schedules.

One must also prepare for any loan default triggers. The lead arranger prepares mitigation tactics for each trigger. For this, they will consider risk analysis, reporting schedules, business financials, etc.

Step 7: Finalize documentation and close the loan

In this step, the lead arranger documents agreed-upon terms. This includes legal, financial, and operational details. For future disputes or references, all parties in the loan syndicate must refer to these documents.

We can understand this process into the following 3 key parts:

1. Submissions:

It is required for borrowers to submit their:

- Financial audits

- Proof of collateral with valuation

- Any regulatory approvals

- Any insurance coverages

In our example, ABC Corp must provide regulatory approvals and insurance for the manufacturing facility project to proceed with further loan documentation.

2. Documentation:

The Lead Arranger formalizes the discussed loan terms by documenting them in legal and financial language. Some key documents include:

- Agreement: The key loan syndication contract document that drafts the loan terms and conditions between the borrower and lenders. Includes loan amount, interest rate, loan covenants, repayment schedule, and details of other custom conditions.

- Disbursement and resolution: Details out the loan disbursement, communication, monitoring, and repayment procedures. Includes scenarios of disputes and the course of action parties must take for resolution.

- Guarantees: Includes documentation for agreed-upon collaterals by borrowers and guarantees provided by both parties.

3. Sign the documents

Every stakeholder in the loan syndicate performs a final review of the documents. This is one last chance to find any anomalies, entertain requests for changes, or negotiate. Once everyone approves the final documents, they must sign the digital and physical copies.

On having every key stakeholder’s signatures, the loan is officially closed.

Now, the lead arranger proceeds with the loan disbursement process.

3 proactive post-funding support by InCorp

What makes InCorp stand out is our post-funding support.

We implement proactive strategies to ensure successful loan tenure, where everyone in the syndicate achieves their business and investment goals.

Here are 3 key services that InCorp provides after the successful execution of the loan syndicate:

1. Disburse and monitor loan

After completing documentation, the loan is disbursed as per the documented disbursement plan and conditions. Instead of giving it in all in one go, one may typically design the release in tranches or apply performance-based metrics to release the funds.

For this, the loan syndicate may have to invest in escrow account management, again done by the Lead Arranger. This helps with streamlined and controlled loan disbursement with a record kept for every transaction.

For example, payments to contractors or suppliers of ABC Corp may be released directly from this account.

Now, to track the compliance of this loan disbursement process, the Lead Arranger designs and implements monitoring systems. This includes sharing reports with the lenders, which can include

- Progress reports to show the use of funds as per decided ethics and regulations.

- Maintenance and insurance of collaterals.

- Regular review of financial statements and forecasts to identify any potential risks.

An effective loan monitoring process ensures accountability for the borrower and maintains trust among the loan syndicate.

2. Manage issues and restructuring (if needed)

The Lead Arranger must ensure all parties involved adhere to the loan syndicate terms. This helps borrowers continue their operations while protecting lender’s interests — all as per decided loan terms.

Yet, due to external factors or financial stress, issues may crop up that would raise alerts in the loan syndicate. The lead Arranger will follow the course of action to handle risks and disputes as decided during the negotiation and documentation stages.

However, sometimes the measures may prove to be insufficient, due to, maybe, scenarios that weren’t considered or market changes. The loan syndicate may have to consider restructuring the loan terms. Here are some example cases:

- Explore any extension for the loan terms in case of delays in adhering to repayment schedules.

- Adjust the interest rate that considers the borrower’s current financial and business situation.

Acquire more collaterals to safeguard investors.

3. Set up an exit strategy

What happens when the lender’s investment goals are met? Or the borrower fails with repayment schedules due to unforeseen circumstances?

The lenders must have a clear exit strategy in place, ideally during the documentation phase itself, to recoup investments irrespective of the scenario.

But sometimes, a loan syndicate may offer a lucrative opportunity, and the lender may have to play its cards smartly during the negotiation to maintain liquidity for itself.

Here are 8 examples of exit strategies to explore and consider:

- The borrower repays the loan: The lenders can simply enable the borrower to repay the loan by adjusting interest rates and rescheduling payment timelines as per their financial status. This may result in taking a hit into the potential profits and investment timelines — however, at least the lender gets to recover their money. Lenders will usually do this only if they see the borrower’s financial numbers can yield returns by implementing a recoup strategy.

- Secondary markets: The lenders may opt to sell the loan or offer strategic asset swaps in the secondary market without disrupting the loan terms. Selling is easy when the borrower has a solid reputation in the market.

- Refinance: It makes sense for lenders to fund more if the credit scenario looks favorable. For example, if the borrower successfully repays the full loan amount in the set timelines, it shows disciplined credit behavior. To get more profits, lenders may consider refinancing the borrower or increasing their share of loan exposure.

- Asset liquidation: Lenders may enforce step-in rights or liquidate the assets to salvage whatever they can. This usually happens during defaults or emergency cases.

Portfolio rebalancing: Lenders may choose to simply exit the loan syndicate irrespective of the returns due to changes in investment thesis or market scenarios. - Debt-to-equity conversion: Lenders may find the borrower’s business has high growth potential and fits with their equity investment thesis. So they offer to convert their share of the loan into equity for more returns.

Syndicate takeover: If the lender sees consistent and lucrative returns, they may opt to offer exit to other lenders by taking over their share of loans. - Performance-based exit: The lender may link their exit based on the borrower achieving certain milestones and selling their share to a new investor.

What are the advantages of loan syndication?

Loan syndication is ideal for large-scale financing, such that the financing structure makes risk manageable for everyone.

Since the amount is large, every party must trust each other — and this comes from transparency. When everyone manages to trust each other and the numbers make sense, adopting the loan syndicate process offers 5 key advantages to the borrower:

Access to large capital

Ambitious goals require substantial capital to achieve. A loan syndicate makes such capital acquisition achievable Acquire large capital from credible institutions for their projects or business goals.

Reduces efforts required to find lenders

Since the borrower works with the Lead Arranger, they do not need to approach and negotiate back and forth with lenders. This includes other tasks like documentation, negotiation, marketing, etc.

However, putting less effort comes at a cost — this means, they need to have enough budget to finance the Lead Arranger’s fee structure to carry out this work.

Diverse loan terms

A loan syndicate will have varied lenders with different investment thesis, geographical advantages, governing tax laws, funds availability, and risk appetite. Such diversity provides flexibility to the borrower.

For example, if an Indian borrower is looking to expand to US markets — having a US-based lender in the syndicate makes sense. They will benefit from their currency conversion with depreciating Indian Rupee value, meaning more money to spend within domestic borders.

Enhanced credibility

The number game plays out here too. Support from multiple lenders in the syndicate, especially if they have a respectable reputation, is great news for the borrower. They too get blessed with the lender’s image in the market — thus, enhancing their reputation.

When the borrower repays the current loan successfully, it makes it easier to secure syndicated loans in the future.

Lengthening of maturities

Being on time always helps, and that’s the case in borrowing loans too. A disciplined borrower who is known to pay on time can secure long-term loans with longer commitment cycles. Some lenders may feel comfortable to refinance or restructure terms.

This ensures continuity, certainty, and flexibility for the borrower.

This is ideal for projects with lengthy timelines like infrastructure development that shows promising returns due to usage revenues, like toll booths on highways.

Case studies of successful loan syndication by InCorp

| Case | Case A | Case B | Case C |

|---|---|---|---|

| Sector | Industrial (polymer manufacturing) | Defense Aerospace | Shipping and Industrial |

| Revenue | $40M | $40M | c.$130M |

| Type of deal | M&A | Structured Debt | Debt |

| Debt Raised | $17M | $55M | $60M |

| How InCorp helped close the loan syndication deal | Facilitated a legally compliant, tax-efficient debt structuring within 3 months to support shareholder settlement and fund arrangement during a company demerger. | Refinanced existing debt with a $25Mn enhancement and arranged a moratorium to improve cash flow.

Conducted a thorough asset analysis to secure available collateral while protecting existing lenders’ interests to ensure continued working capital support. |

Secured $100M in term sheets from four major private banks to finance $160M in export orders, achieving competitive pricing and reducing collateral coverage from 100% to 35%.

Negotiated successfully to waive promoter personal guarantees. |

Conclusion

Loan syndication offers a strategic solution for businesses seeking large-scale funding, particularly for ambitious projects like expansion, acquisitions, and technological advancements. By pooling resources and expertise from single or multiple lenders, businesses can access substantial capital while mitigating individual lender risk. This collaborative approach enhances a borrower’s credibility, improves access to diverse loan terms, and facilitates sustainable growth.

Why Choose InCorp?

At InCorp, our experts have a lot of experience assisting businesses to achieve their financial goals by customizing their debt structure. We have a team of more than 25 experts who have enabled businesses to raise a whopping $175 Mn+ in the last few years. Our experience of serving 10+ sectors and our big network of 70+ lenders will allow you to get the funding you require for boosting your business growth. To know more about our debt syndication process, contact us at (+91) 77380 66622 or email us at info@incorpadvisory.in.

Frequently Asked Questions (FAQs)

Project finance focuses on funding long-term projects based on future cash flows, whereas working capital finance supports short-term operational needs.

There is a diverse lender base which typically includes banks, NBFCs (Non-Banking Financial Companies), AIFs (Alternate Investment Funds), Private Debt / Venture Debt, etc.

Foreign currency funding involves borrowing or financing in a currency other than the domestic one, often used for managing currency risk or meeting foreign obligations. Normal banking limits refer to standard credit facilities in the domestic currency, used for general business purposes within the country's banking regulations.

The solution varies based on multiple factors including company history, credit rating, scale of operations, promoter background, industry presence, funding type (fund-based or non-fund-based), tenure, deployment location (domestic or international), intended use of funds, expected return on investment, collateral availability, and repayment cash flows. Our debt advisory team specializes in crafting customized debt solutions that align with these considerations effectively.

Equipment loans can be used to finance various business assets, including machinery, vehicles, IT hardware, and specialized equipment essential for operations.

Debt financing involves borrowing money that must be repaid with interest, retaining ownership of the company but with repayment obligations and potential default risk. Equity financing involves raising capital by selling shares, diluting ownership but without repayment pressure and sharing profits with investors.

Share

Share