- Home

- »

- Stressed Assets

- »

- IPE Process Advisory

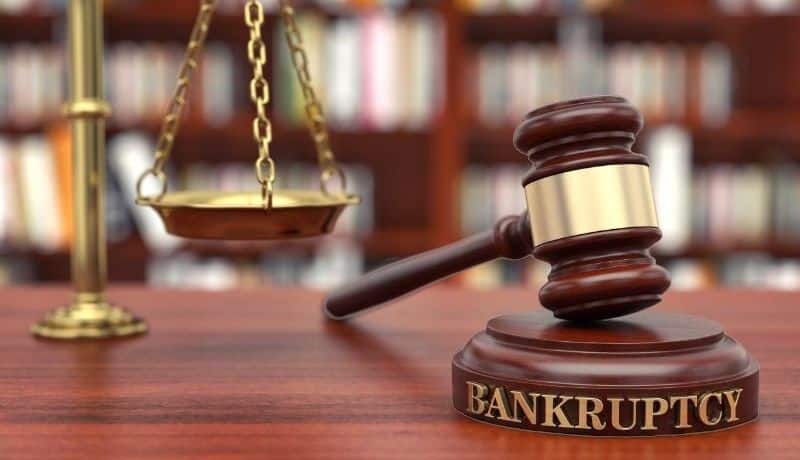

IPE Process Advisory

Expert guidance for strategic insolvency solutions

Enquiry Form

Assets

Recovered

Creditors' Asset

Recovery

Sectoral

Experts

Sectors

Covered

Assets

Recovered

Creditors' Asset

Recovery

Resolved Insolvency

Cases

Sectors

Covered

InCorp uses strategic approach to guide your business through the insolvency resolution process

Our average creditor recovery rate of 85% highlights our commitment to maximizing returns. We’ve effectively recovered over $10 million in assets, facilitating turnarounds for 15 distressed entities. Our team of 50+ sectoral experts on InCorp Advisory Board, tailor solutions to your distinct needs.

Additionally, our efforts have resulted in over $15 million in distressed asset recovery for creditors. At InCorp, our expertise ensures effective solutions that safeguard companies’ interests and financial future.

Service Areas Within IPE Process Advisory

Asset Protection and Preservation

Strategies to protect and preserve valuable assets during the insolvency process, safeguarding stakeholder interests.

Asset Recovery and Optimization

Comprehensive efforts to identify, recover, and optimize distressed assets, enhancing the potential for creditor recovery.

Debt Restructuring and Negotiation

Skillful negotiation and strategic restructuring of debts, reducing financial burdens.

Operational Streamlining and Cost Optimization

Identification of operational inefficiencies, implementation of cost-saving measures, and restructuring to enhance viability.

Customized Turnaround Strategies

Targeted strategies designed to revive distressed entities, ensuring business continuity and safeguarding stakeholders' interests.

Debt Recovery Strategies

Customized approaches to recovering outstanding debts, maximizing returns for creditors.

InCorp Insights

Time-barred Claims and the I&B Code: Decoding the RP’s Dilemma

The article tries to discuss the vexatious issue of treatment of claims which are barred under…

Navigating Real Estate Insolvency: Challenges and Strategies for Resolution Plans

Insolvency Professionals are the lifeline in the chaotic corporate insolvency situations especially in real estate. As…

Fast Track Insolvency Resolution: A Quick Overview

Why was Fast Track Corporate Insolvency Resolution Process introduced? Fast Track Corporate Insolvency Resolution Process was…

Corporate Restructuring in Insolvency: A Strategic Approach

Corporate restructuring is a complex process that requires proper planning and continuous execution. In today’s ever-changing…

Complete Overview of Corporate Insolvency and Bankruptcy

Terms like bankruptcy and corporate insolvency refer to distinct situations involving the financial stability and status…

How Restructuring Shapes Business Growth

Corporate restructuring can be an effective strategy used by a business to improve its capital structure…

Insolvency vs Bankruptcy: Difference and Legal Framework

The term ‘bankrupt’ is derived from Italian expression ‘banca rotta’, which means ‘broken bench’. Insolvency and…

Legal Aspects of Cross-Border Insolvency

An Overview To seek international exposure India seeks to attract foreign companies to set up manufacturing…

Company Liquidation Process in India: IBC Guidelines

If you are a stakeholder of a Company contemplating liquidation, it is important to understand the…

Ambiguity Over Preference of Payment to Statutory Dues Under IBC Law Continues

The Supreme Court dismisses the review petition in the case of Rainbow Papers Limited thereby legal…

clientele

Expert Team

Jayesh Sanghrajka

Co-Founder

Vinay Mruthyunjaya

Co-Founder

Direct to Your Inbox!

Stay updated with our curated newsletter content designed for you